Summary:

- Bank of America, a major U.S. bank, is a significant holding of Berkshire Hathaway, which recently sold 20% of its stake.

- It follows a similar move by Buffett with AAPL, showing his wish to build up a large cash position.

- His original investment in BoA, negotiated directly with CEO Brian Moynihan, shows why trimming and raising cash is attractive for BRK.

- For the average investor, however, BAC shows signs of fair valuation, with modest upside over time little risk given the bank’s healthy balance sheet.

brunocoelhopt

Bank of America (NYSE:BAC) is one of the largest banks in the U.S., and it’s also famous as one of Berkshire Hathaway’s (BRK.A)/(BRK.B) largest holdings. It’s come under more attention in recent months after Warren Buffett has decided to sell about 20% of its stake starting in July.

I recently discussed his similar moves with Apple (AAPL) and, after assessing his investment from start to finish, I concluded that Buffett’s moves make much more sense for him and not for us. BoA is a sound bank at a fair price, and it deserves a Hold rating.

Entry Point and Partial Exit

Unlike AAPL, BAC did not start as a normal transaction on the open market. Buffett called CEO Brian Moynihan directly. It was a $5 billion investment into the coffers of BoA (see 2011 Shareholder Letter). In exchange, Berkshire received preferred shares with a 6% dividend, redeemable at a 5% premium, and ten-year warrants to buy 700M common shares at $7.14 (effectively, a convertible option for the preferreds).

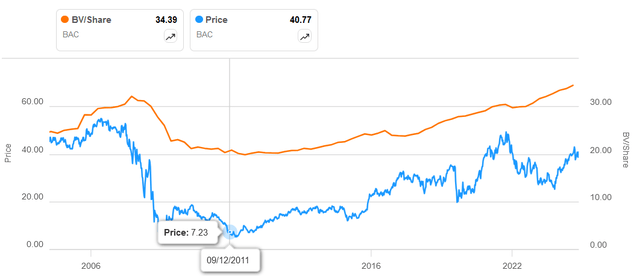

BV/Share and BAC Price History (Seeking Alpha)

Seen above, both BAC’s book value per share and share price had taken a hit during the Great Recession and had not completely bounced back. Concerns during the 2011 Debt Ceiling Crisis had soured market moods further.

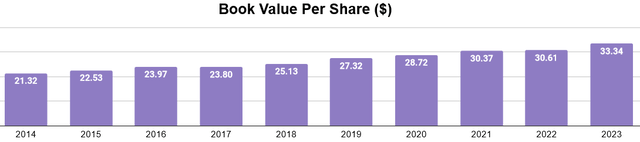

Buffett’s infusion provided liquidity to preserve confidence in the bank. The warrants would lock in the low market price, while the preferreds would receive decent dividends in the meantime. Meanwhile, Buffett was looking at a book value per share of about $20, a huge discount!

The share price eventually caught up to book value in 2017. This is also when the (growing) common dividend caught up with the yield of his preferred position. As such, Buffett exercised the warrants and swapped his preferreds for common. The capital gains on the principal were about 4x.

The Berkshire portfolio has had some additions and trims, the only other sale being about 2M shares in 2019.

Berkshire’s BAC Trades (stockcircle.com)

Since the 198M shares purchased in 2018, the sale of 197M shares in Q2 2024 is Berkshire’s largest adjustment to the position. This sale was about 20% of their total position and brought Berkshire’s stake in BoA to just over 10% of the company.

P/B 5Y History (Seeking Alpha)

Not only has BAC’s price risen to about $40 from Buffett’s initial exercise price of $7.14, but the Price/Book ratio went from a discount to a premium, even as book value per share has grown. Berkshire’s recent sales have spanned a ratio of 1.1 to 1.2.

Book Value

How should we value BAC to make sense of Buffett’s moves and to inform what we ourselves might do? I think it’s useful to focus on book value first and the complementary factors, like the buybacks and the dividends.

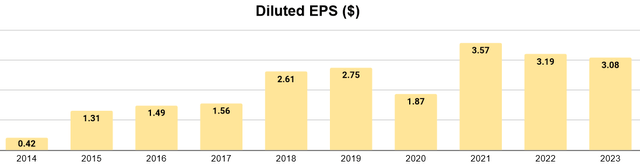

Between 2014 and 2023, book value per share has grown at about CAGR of 5%, with consistent increases (except between 2016 and 2017). As of Q2 2024, book value per share is $34.39.

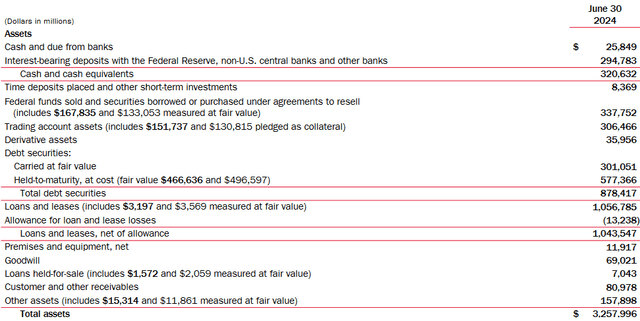

The assets that support this book value are primarily their cash cushion around $320B, $878B of debt securities, and just over $1 trillion in loans, which are primarily interest-bearing assets. Retained earnings therefore allows BoA to accumulate more of those, but as fixed-income they lack much upside over time.

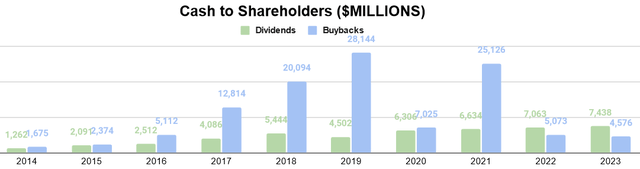

Buybacks increase book value per share when the discount on the market is bigger than the cash outflow of the buyback, which was the case early in Buffett’s investment. Put another way, they are a tool for BoA to make an equity investment in itself, as an alternative to the limits of fixed-income. As share price exceeds book value, buybacks can also slow its growth over time.

(Dividends also don’t remain on the book, but they do return to shareholders in proportion with the outflow.)

As BoA recovered from the events of 2008, a significant majority of earnings was returned to shareholders as buybacks. It is therefore not surprising that the share price eventually caught up with book value.

Over the last couple of years, buybacks were less than dividends, but YTD 2024 buybacks have returned to exceeding dividends.

Now, with a premium to book value and so much going off the balance sheet for buybacks, the same floor of value that seem guaranteed in 2011 no longer exists. The only additional upside can come from BoA’s ability to grow its earnings, as a business and per share.

Earnings

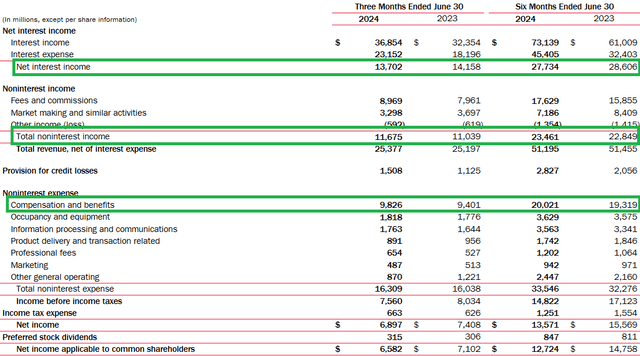

Income Statement (Q2 2024 Form 10Q)

Seen above, earnings are primarily a result of net interest income from its banking and investment segments. Noninterest income, which mostly consists of fees and commissions on its wide array of services, makes up a comparable number. Meanwhile, the largest expense is, far and away, compensation and benefits.

There are a number of things that can improve earnings and thus the ability to continue growing the dividends. They can acquire more customers, which would increase their deposits and provide capital for loans, growing net interest income. Rate cuts could even boost loan volume.

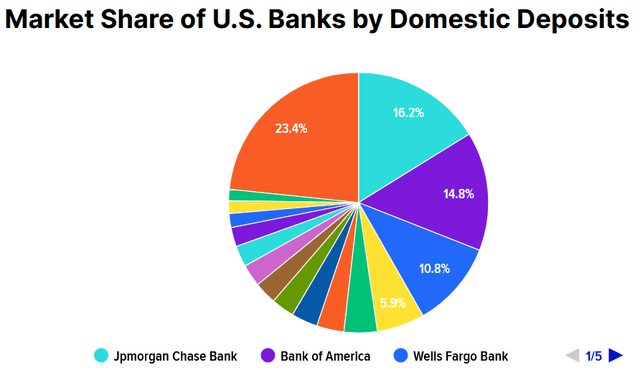

BoA is the second-largest bank by deposits. Being a highly competitive space, I personally believe that once people like their bank, they don’t hurry to change. Regional and community banks often have this “David vs. Goliath” appeal to folks when compared to big banks. I expect BoA will usually grow its deposits as the banking industry itself grows.

It did suck up $15B in deposits as SVB collapsed and many were scared out of regional banks. Its liquid position should therefore allow it to get through tough times and absorb market share from weaker banks, but this can’t happen every year.

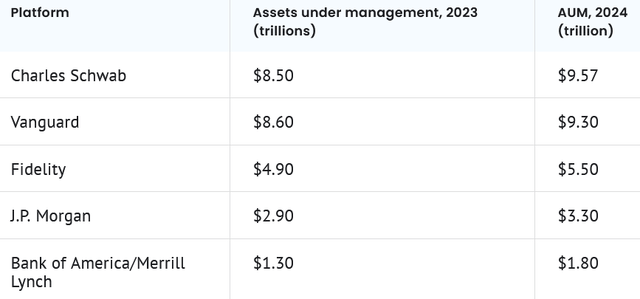

Brokerage Firm Market Share (Motley Fool)

I think a similar statement could be made about its investment services, as a broker and adviser. It should grow as this industry grows over time, essentially in line with the U.S. population/economy. Yet, it’s not quite the leader in this that it is with traditional banking. Charles Schwab (SCHW), Vanguard, and Fidelity have a tremendous lead over them.

Lastly, their next big key to growing earnings is to reduce operating expenses, the largest of which is payroll and compensation. The two tables below illustrate this approach perfectly.

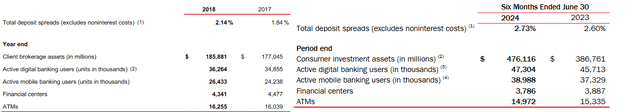

2018 Form 10K & Q2 2024 Form 10Q

BoA has been shifting toward a more tech-heavy, capital-light model. Financial centers have declined from 4,477 in 2017 to 3,786 this year. ATMs have shrunk from 16,255 to 14,972. Meanwhile, brokerage/investment assets have grown from $177B to $476B, followed by increases in digital and mobile users. These moves require less personnel to operate physical locations. In addition to modest growth, BoA can unlock new operating efficiencies.

These basic trends can explain how diluted EPS has grown over the past decade. $0.42 in 2014 to $3.08 in 2023 is a big leap, but the trend hasn’t been one of growth in the 2020s.

Valuation

If a discount to book suggests a floor of value based on the balance sheet, a premium to book should require additional upside from growth in EPS. Earnings growth can occur when they grow their deposits and AUM, allowing them to earn more net interest income and fees for their other financial services.

As some of you may already be thinking, people do not magically come up with new cash to save or invest through BoA. Market share is difficult to win and better-accomplished by patiently maintaining liquidity for during times of distress. It is therefore not surprising that BoA has returned a significant portion of its earnings to shareholders through buybacks, rather than keep that cash on the book.

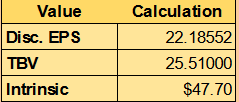

With all that said, I will do my own valuation. I will use tangible book value and add the next decade’s EPS to it. In my opinion, I risk double-counting some of future earnings by including what BoA’s accountants consider to be the enterprise value of their intangibles. Assumptions about EPS are also easier to distill and calculate.

- $2.84 as baseline EPS

- $25.51 as TBV per share

- 5% CAGR of EPS the next decade

$2.84 is diluted EPS for the trailing twelve months as of Q2, and $25.51 is also the most recently reported TBV. I believe a 5% growth rate of EPS is about as high one could reasonably expect EPS to grow based on nothing but the business fundamentals, given BoA’s size and the competitive pressures that exist across the gamut of the financial industry.

Author’s calculation

Discounting the EPS at a 10% rate (typical return of the market), a fair value of BAC appears to be $47.70 over the long run. Buffett has been trimming around $40 per share. Compared to its 2.5% dividend, these BAC proceeds can go into Treasury Bills at roughly ~4.5%, so some (like Buffett) might be content to reallocate. Yet, BAC doesn’t show signs of overvaluation, and while short-term rates have already begun to drop, this dividend still has some upside.

Conclusion

While exiting 20% of BAC seems like Buffett is sour on it, I don’t see it that way. We do not own over 10% of BAC, which would saddle us with extra federal rules. This is incentive for him to trim, not us. When he trims, he can build a pile of cash and wait for companies on his radar. Some may need financing under terms that almost guarantee strong returns (exactly as he did with BoA in the first place), and so Buffett gets more value from his cash position than most of us can.

For the average, long-term investor I think the outlook is different. The financial data and trends for Bank of America suggest a safe bank with slight upside and a decent dividend yield. In other words, it’s a reasonable Hold, and if the price were to drop sharply, it would become quite attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.