Summary:

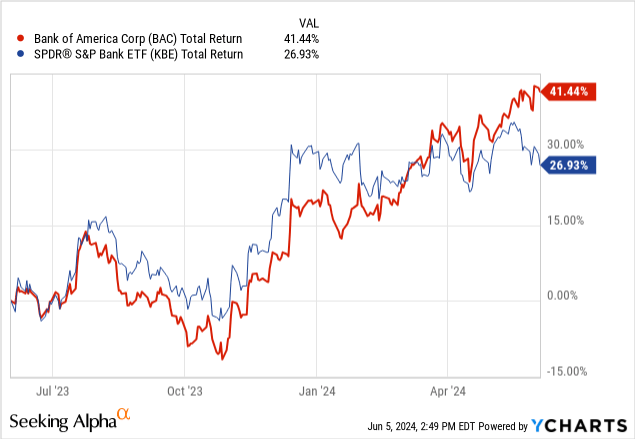

- Bank of America, together with other major retail banks, has outperformed both the S&P 500 and the S&P Banks index over the past year.

- Currently, BAC is exhibiting a trend of lower NII from a year ago, but non-interest income has picked up again, primarily due to higher S&T and IB activities.

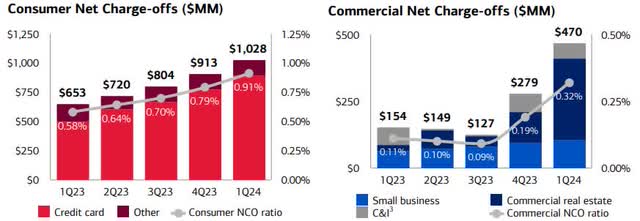

- Charge-offs have been increasing from previous quarters due to higher delinquency rates in credit cards, coupled with the credit crisis in the commercial real estate space.

- Based on a dovish monetary policy that will likely reduce the cost of funding and a DDM model with an elevated margin of safety, I assign BAC a buy rating.

ablokhin

Bank of America (NYSE:BAC) is one of the major retail banks in the US, and through their four business segments, they managed to generate $93.359 billion in TTM revenue, $25.028 billion in net income, and a consolidated amount of $293.552 billion in total equity. This resulted in a market cap of $312.50 billion and a 2.35% TTM dividend yield.

In this analysis, I will go through Bank of America’s earnings evolution, outlook, risks, and valuation to decide on a buy rating of the stock despite its impressive 18.68% YTD price increase that has outperformed the S&P 500, Nasdaq 100, and the US bank index.

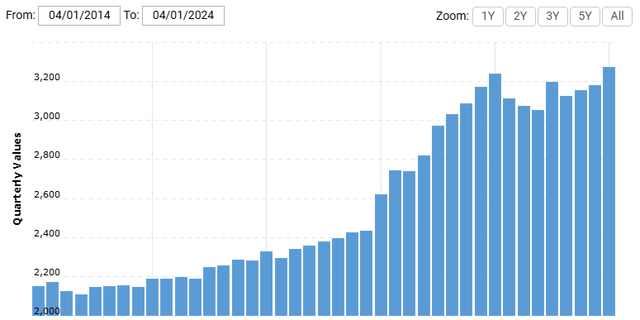

Bank of America Assets Growth

Bank Of America Total Assets (Macrotrends)

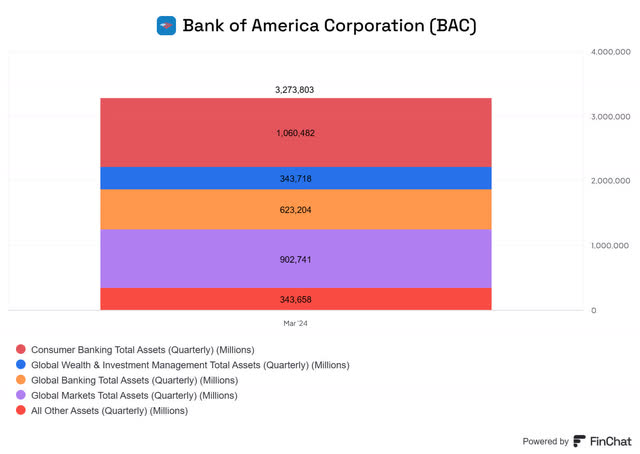

Due to quantitative easing, BAC has been able to rapidly grow its assets during the pandemic and now sits at $3.274 trillion in total assets. From there, Consumer Banking and Global Markets are the major asset holders (which doesn’t necessarily translate into revenue), followed by Global Banking and Global Wealth & Investment Management, as seen in the bar graph below.

BAC Earnings

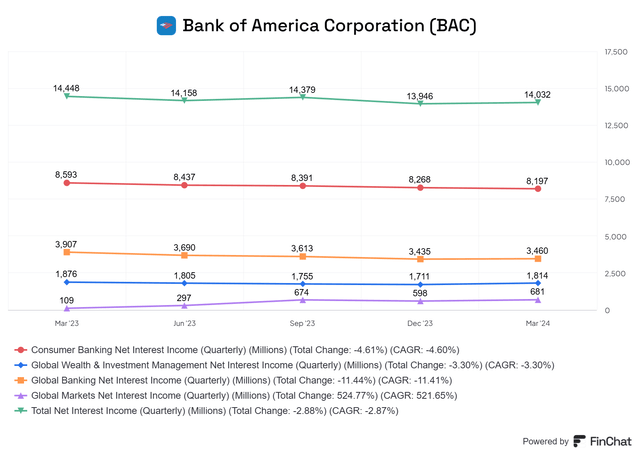

When it comes to the net interest income of BAC, generally all segments of the bank have encountered declines compared to a year ago, primarily due to higher costs of borrowing. For the case of Consumer Banking, the NII contribution has been reduced by $396 million, following a -7.2% drop in average deposits and a 358.3% increase in the rate paid on deposits, passing from 0.12% in Q1 2023 to 0.55% in Q1 2024.

At the same time, Global Banking has been exhibiting downward momentum in NII even though deposits have grown 7% from Q1. Although the major contributor to the revenue of Global Banking comes from net interest income, non-interest income from Investment Banking fees is also an important revenue contributor of that segment and partially helped to offset the -4% total revenue decline of Global Banking.

Now, when adding together all the NII of all segments, the trend has gone down every quarter over the past year. Yet, the overall decrease of -2.88% is greatly inferior to the one exhibited in the core NII segment, Consumer Banking.

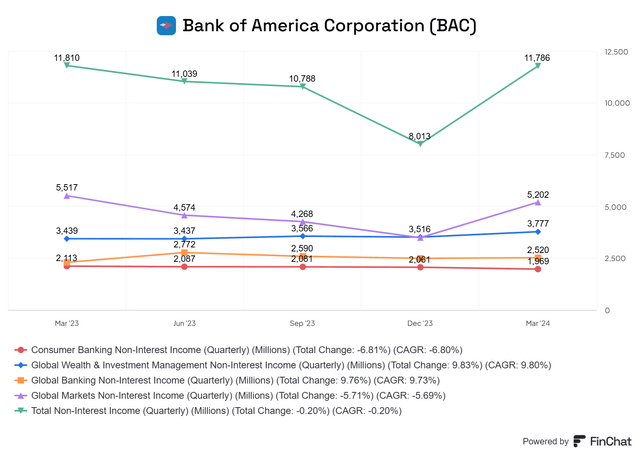

From the side of non-interest income, Global Markets saw a big jump of 48.0% from the previous quarter due to stronger sales and trading revenue, particularly within FICC sales. The segment non-interest income remains -5.7% lower than a year ago, but a reversal is more than evident based on the image above.

Global Wealth & Investment Management did see a YoY increase of 9.8% after benefiting from strong inflows and generally higher asset valuations, bringing a record revenue despite the drop in net interest income. Finally, Consumer Banking was the only segment that saw a YoY decrease in both their net interest income and their non-interest income.

Now, when adding all the segments together, the bank saw a notable improvement from the prior quarter and ended close to the level experienced a year ago. For comparison, Wells Fargo did see an important increase in non-interest income with a remarkable growth of 16.8% as commented in my last analysis of them.

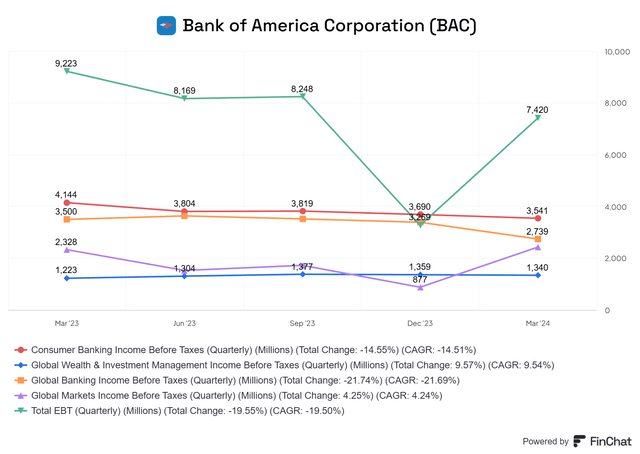

From the side of pre-tax income contribution per segment, it can be seen that the momentum in FICC revenue helped the Global Markets segment to grow its EBT QoQ at an impressive rate of 176.7%. Contrarily, the Consumer Banking and Global Baking pre-tax profits have been exhibiting some weaknesses after a decrease in almost every quarter of the past twelve months.

Overall, the total GAAP pre-tax profit of the bank saw a notable rise from the prior quarter, after increasing 101.1%. Nonetheless, this comes with a caveat, as in both Q4 and Q1 there were materially unusual expenses that affected the bank’s profitability, such as the FDIC special assessment for uninsured deposits after the failure of banks such as Silicon Valley and Signature. That assessment resulted in non-interest expenses of $2.1 billion in Q4 and $700 million in Q1. Yet, even when eliminating those expenses from the pre-tax profit, the QoQ growth stood elevated at 40.0%.

Bank of America Outlook 2024

Even though Bank of America is a well-diversified bank that has components of revenue that could mitigate NII drops, at this point, a drop in rates would allow them to generate higher loan demand, particularly in loans that have contracted significantly in the portfolio such as residential mortgages.

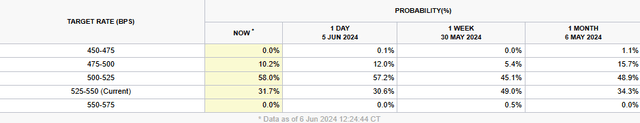

September 2024 – Target Rate Probabilities (CME FedWatch Tool)

This week both the Bank of Canada and the European Central Bank have started a dovish cycle of rate cuts after holding them at record levels for almost a year in both cases. With this, the probability for the FED to start a rate cut in September has increased based on how the interest rate futures are trading. Currently, the probability of a 25 bps down-move stands at 58.0%, when this same metric was at 45.1% one week ago. Simultaneously, the probabilities for next week’s meeting and the one at the end of July remain low at 2.5% and 20.1%.

Despite the rate cuts from the ECB, their inflation forecast for 2024 increased from 2.3% to 2.5%, which makes the market believe that even though rate cuts started they would most likely maintain a restrictive policy by sitting rates above the neutral rate.

At the same time, if things do not unfold, those rate cuts would allow the yield curve to become more steeper as short-term rates decrease and long-term rates would naturally increase from the incorporation of higher inflation expectations in the long term. A steeper yield curve is the ideal scenario for a bank as the spread from the rates at which they borrow and lend, or maturity transformation, expands. But currently, the 2y-to-10y spread has been inverted for 482 business days, and so far, it hasn’t worked as an early indicator of a recession.

BAC Stock Performance

The stock performance of Bank of America has been outstanding. Over the past year, the stock has gained 41.4% on a total return, outperforming by 14.5% its natural benchmark, the S&P Bank (KBE). This has also been the case for other major US banks such as Wells Fargo (WFC), Citi (C), and JP Morgan (JPM), with all gaining around the total return level of 40% for the past year.

All of these banks’ performances have benefited from mainly the same cause. For example, generally strong credit quality (besides CRE) in loans, helped by a low unemployment rate, and an outlook for interest rate cuts that would allow these banks to reduce their cost of funding, and boost loan demand. At the same time, these banks have gained from a rebound of non-interest activities in investment banking and asset management due to higher equity valuations and deal activity.

Bank of America Stock Valuation

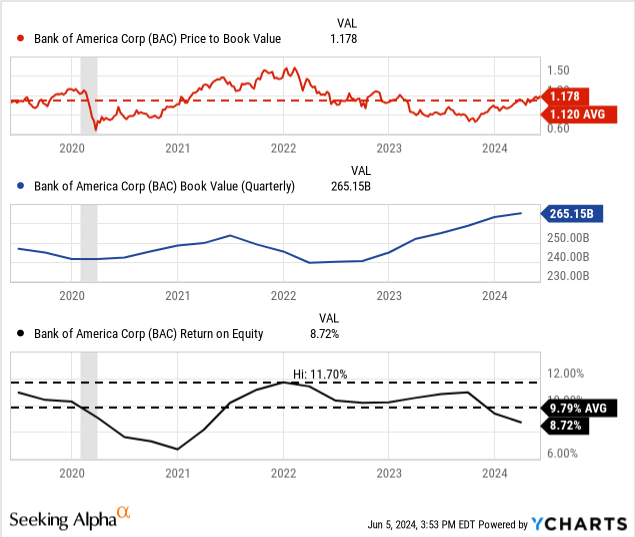

From the side of valuation, based on their five-year historical average, their price-to-book multiple sits at its historical average above book value at 1.12x. In November of last year, Bank of America even got to trade at a multiple below book value of 0.77x. Now its multiple has significantly expanded, but not to the point where one could call it overvalued.

One element that helps justify the price to book is the return on equity. From there, the company is exhibiting an ROE of 8.72%, which falls slightly below its average, making it less attractive. Nonetheless, with improving net incomes going forward from improving interest margins and higher loan demand, I see this ratio increasing going forward, which would most likely result in a PB expansion.

Last, a bank’s growth could be measured by the growth in book value, and in the case of BAC, it has grown unstoppably every quarter since Q1 of 2022, representing a 10.72% cumulative growth ever since that date becoming a positive sign to investors.

Bank of America Dividend Discount Model

| Discount Rate | Risk free rate | Beta | Equity Risk Premium |

| 8.89% | 4.28% | 1.12 | 4.12% |

| Growth Rate | ROE | Retention Ratio | |

| 6.85% | 9.79% | 70.01% | |

| Dividend 1 | E Dividend FY24 | E Dividend FY25 | |

| $1.04 | $1 | $1.07 | |

| Upside | Price | Intrinsic Value | |

| +26.93% | $39.96 | $50.72 |

Moving on with a second valuation method, based on a single-period dividend discount model, the shares of BAC appear undervalued with a 26.94% upside. For the model inputs, I calculated the cost of equity at 8.89%, a growth rate of 6.85%, and a weighted average of the forecasted dividends of FY 24 and FY 25 that resulted in a $1.04 numerator. From there, the intrinsic value stood at $50.72. Which is $10.76 higher than the current price, representing a 26.93% upside and a 21.21% margin of safety.

Risks to Investing in Bank of America

Although fundamentally, I believe BAC remains undervalued based on a pondering of the DDM and the historical PB multiple, the stock has exhibited a strong momentum since November, together with the general benchmark, and in these situations triggering a significant stock correction is normal. From a technical point of view, the entry level is not the best as it’s at its 52-week high.

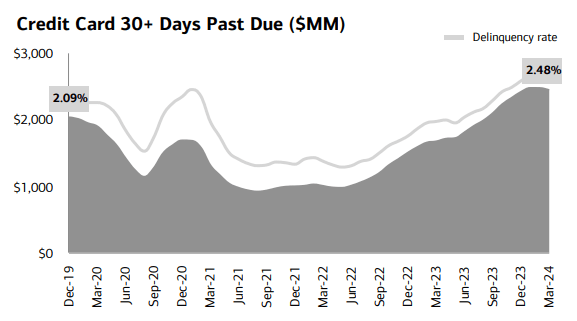

Q1 BAC Presentation

Now moving on to the recorded results, there has been an up-trend in delinquency rates on credit cards. Even though US unemployment remains low, the era of money transfers from the government during the pandemic is gone and if you couple this with higher interest rates naturally results in higher delinquency rates. From here, I expect the bank to become more restrictive in credit card limits due to the trend being exhibited.

Together, the net charge-offs in the bank have been increasing every quarter of the past year, again primarily an increase in credit card losses, but also due to their exposure to commercial real estate office loans that are being affected by secular trends and higher interest rates. Currently, the bank holds $17.4 billion in assets attributed to office real estate, and $7 billion of those are set to mature in 2024. Yet, BAC remains well capitalized with a CET1 ratio of 11.8%, which is 184 bps above the regulatory requirement from Basel III.

BAC Buy or Sell?

To conclude, this stock is unquestionably a buy. Based on the DDM model it stands undervalued, with a considerable margin of safety of 21.21% despite the recent run up in the stock price. Also, from the side of historical PB, it is at its average, providing some room for further margin expansion if ROE normalizes and helps justify a higher multiple. At the same time, rate cuts would provide higher loan demand, which would help in improving NII which has been experiencing overall declines, especially in Consumer Banking. Also, rate cuts could potentially help appreciate unrealized losses captured in long-term assets over the past years due predominantly to rate hikes.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BAC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.