Summary:

- Bank of America released its second-quarter earnings yesterday, easily beating the Street’s estimates.

- The release showed high growth in investment banking fees.

- Other parts of the release weren’t as good. For example, net interest income declined 3%.

- I’ve begun taking small amounts of profit on BAC stock and will probably trim the position again if we see $50 soon.

Bank of America Times Square video display CribbVisuals

Bank of America (NYSE:BAC) released its earnings on Tuesday. When I checked the stock after the release came out, I was pleasantly surprised to see that it gained 5.5% in early trading. It ended up holding the gains for the better part of the day. Although Bank of America’s release beat expectations on both revenue and earnings per share (“EPS”), the company delivered no growth in the quarter. The nature of these earnings was the reason why the post-ER rally surprised me: although earnings beat expectations, the “absolute” performance wasn’t great.

To be sure, there were some good points in BAC’s second quarter release. Investment Banking fees increased 29%, 278,000 net new checking accounts were added, and trading revenue increased 9%. These were all unambiguous positives. However, net interest income, the biggest single part of BAC’s net income, declined 3%. There was also a large reserve build: $1.1 billion in provisions for loan losses were added. Charge-offs nearly doubled, so the reserves were needed, but the reserve build is the type of “cost” that can easily reverse in later periods, in this case if consumer credit improves.

I began the process of selling my BAC stock long before the second quarter release came out, trimming 10% at $38 and another 10% at $40. If the stock hits $50 in the near future (let’s say, before the end of the year), I plan to sell 20% at that level.

The most positive development at Bank of America this year is the rise in investment banking fees. They increased 29% year-over-year in Q2 and were 17.3% of net income for the period, so if they keep growing at their recent pace, they will become ever larger contributors to the bottom line.

When I last covered Bank of America stock, I rated it a hold. The reasons for this rating were several. First, it was the rating most consistent with my own trading in Bank of America at the time; which is to say holding the majority of my position while trimming small amounts. Second, the company had very poor growth metrics at the time, but good profitability metrics. Third and finally, the company’s unrealized losses were not meaningfully shrinking, but were not getting worse.

This time around, the picture is materially better. Revenue, while certainly not ripping, is at least going up (it shrank 2% last time). Investment banking fees are soaring. The unrealized loss is getting smaller. Much is better with Bank of America now than the last time I wrote about it. However, the stock price and multiples are also much higher, so my rating is still “hold.” In this article, I explain why I am maintaining my BAC rating after its second quarter earnings release, albeit for different reasons than before.

Earnings Recap

Bank of America’s most recent earnings release was a beat, although a beat with lesser growth than was seen at peer companies like JPMorgan Chase (JPM). Some highlight metrics were:

-

$25.4 billion in revenue, up 1% (beat by $173 million).

-

$6.9 billion in net income, down 6.75% (beat).

-

$13.7 billion in net interest income, down 3%.

-

$1.91 trillion in deposits, up 2%.

-

$1.6 billion in investment banking fees, up 29%.

-

$0.83 in earnings per share (“EPS”), down 5.6% (beat by $0.03).

-

A 10% return on equity (“ROE”).

-

A 27% net income margin.

Overall, Bank of America was very profitable in Q2, which impressed the markets, as did the rosy sounding guidance for the third and fourth quarters.

Personally, I was less impressed by the release and earnings call than the investing public was. It’s not that the results were “bad” or anything, just that they were a lot worse than those JPMorgan put out in the same quarter. In the same quarter that BAC just reported, JPM delivered 22% revenue growth and 29% earnings growth. One area where BAC came out on top was in liquidity: even after adjusting for the unrealized loss, its highly liquid assets were 56% of deposits, while JPM’s liquid assets were 46% of deposits. So, Bank of America has more firepower with which to withstand an unexpected loss of deposits. Nevertheless, after reading BAC and JPM’s second quarter releases, I felt the latter did better overall.

Valuation

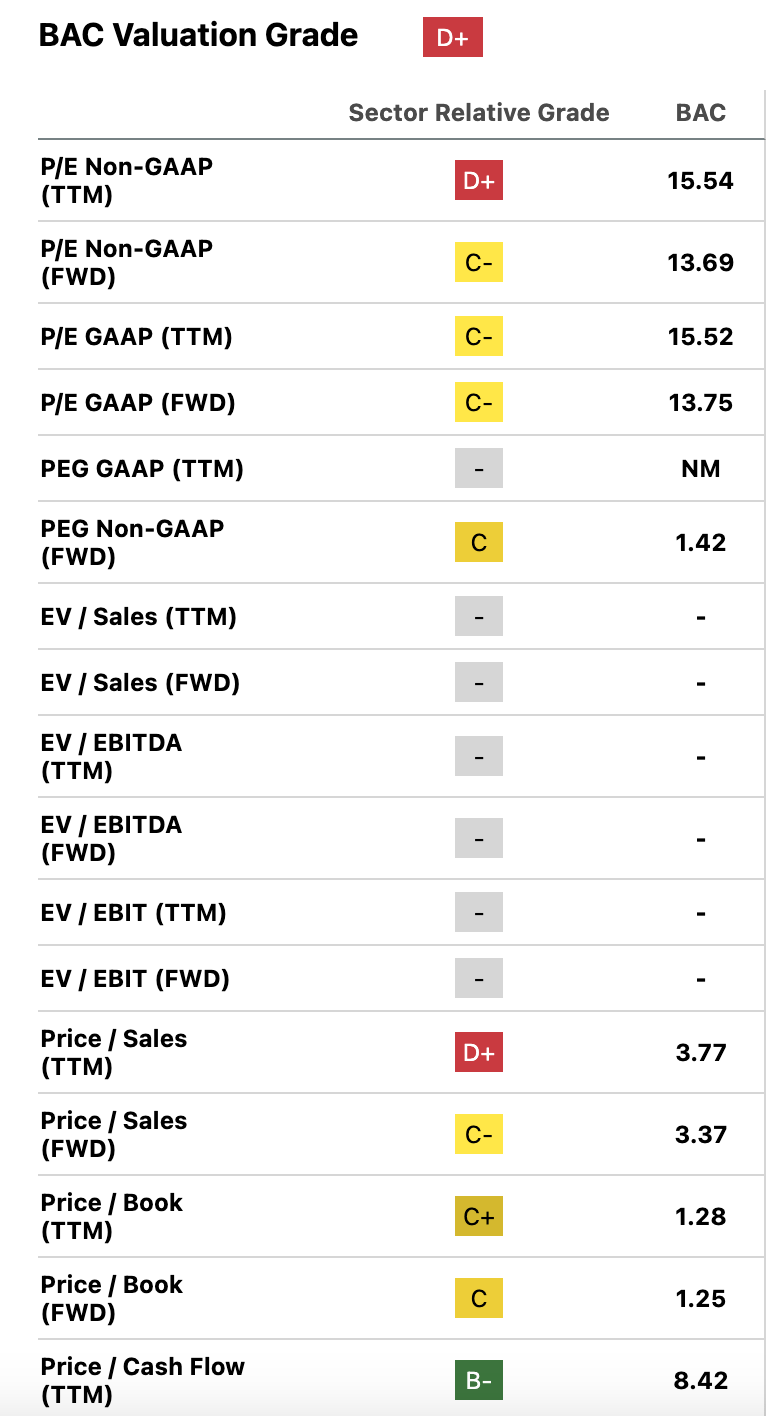

Basically, what we saw in Bank of America’s second quarter release was no growth, high profitability and rosy guidance. How do we make sense of such mixed signals? One way is to compare the release against how Bank of America is being valued in the markets. Below you’ll see some select valuation metrics for Bank of America, contrasted with the same ones for the S&P Banks Index.

| BAC multiples | Bank multiples |

BAC multiples (Seeking Alpha Quant) |

Banking Sector Multiples courtesy of S&P Global (SPGI) P/E: 13.99. Forward P/E: 10.9. P/B: 1.09. P/sales: 2.35. P/cashflow: 8.66. |

As you can see, Bank of America’s multiples are higher than comparable ones for the S&P banks index. Now, this isn’t an Apples to Apples comparison, because the S&P banks index is mostly regional banks. The larger S&P Financials Index includes the large banks, credit card companies, and insurance companies–so this seems like an even worse basis for comparison than the Banking Index, which is at least based on the same industry that Bank of America operates in. Going by that standard, Bank of America is relatively pricey for its sector.

What Has Changed Since My Last Article

Since I’m maintaining my rating, I should explain what exactly is different with Bank of America this time around. Although my rating is unchanged, the reason for it is very different than it was last time. The last time I covered Bank of America, I said that it was cheap and not growing. Today, it is relatively expensive (at least on a sector relative basis), growing a little on the top line, and expected to grow substantially in the third and fourth quarters. This rosy outlook for Q3 and Q4 is definitely a positive, but it’s hard to say what the exact numbers will be. So today my opinion is that Bank of America has definite growth prospects while being a little pricey, whereas in the past it was that the bank had a cheap valuation but was shrinking. So, same rating, but very different reasons for it.

How I Plan on Trading Bank of America

Despite the large 5.5% run-up after earnings, I did not sell any Bank of America shares on earnings day. I had sold very small amounts earlier at $38 and $40 (about 10% of my position in each sale). My current plan for the stock is to sell 20% at $50–I expect that price level to be hit late this year if Bank of America delivers on its rosy guidance. Beyond that, I have no sales planned, as I don’t expect us to visit $60 within the year–though it’s certainly possible for next year.

Conclusion

Bank of America in mid-2024 is a tale of mixed signals. The growth still isn’t there, but is expected in coming quarters. The valuation is cheaper than that of the S&P 500, but more expensive than that of the banking sector. The company has great liquidity, but a large unrealized loss. Overall, this stock is a hold, with my expectation being that it market-performs.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.