Summary:

- Q1 2023 was particularly impressive, with every business segment experiencing organic growth in customers and accounts.

- Deposits remained robust at $1.9 trillion, and the asset quality was in top shape with a charge-off rate comfortably below pre-pandemic levels.

- Despite potential challenges such as loan growth hitting the brakes, I believe Bank of America remains well-equipped to weather economic storms and maintain long-term profitability.

Eva-Katalin/E+ via Getty Images

Thesis

This article examines Bank of America’s (NYSE:BAC) performance in a turbulent market, exploring how the banking behemoth has managed to not only preserve profitability but also thrive amidst economic uncertainty. Through an analysis of its strategic borrowings, digital transformation efforts and competitive advantages, this article seeks to determine if investing in Bank of America is a viable option for investors seeking reliable returns.

BAC’s Main Q1 2023 Bullish Points

- Bank of America strutted into Q1 with impressive results, as every business segment basked in the glory of organic growth in customers and accounts. The bank’s digital wizardry worked its charm, boosting customer engagement and satisfaction to levels that’d make its rivals green with envy.

- The consumer banking segment flexed its muscle, adding 130,000 net new checking accounts, 1.3 million credit card accounts, and bulking up investment accounts by 9%. The result? Record-shattering consumer investment flows. Meanwhile, the wealth management segment reveled in a cool $25 billion of client flows, and the global banking segment’s revenue shot up by a jaw-dropping 19% YoY to $6.2 billion.

- Global markets didn’t lag behind, either, posting a stellar quarter with earnings ballooning to almost $1.7 billion post-tax. The bank’s operating leverage streak kept its swagger for the seventh quarter, and the efficiency ratio slimmed down to a lean 62%. Despite the dwindling wealth management balances, the bank’s deposits stayed true to their course.

- Loan growth may have hit the brakes, but deposits clung to a robust $1.9 trillion. The bank even upped the rate paid, possibly luring in more customers. Bank of America’s Q1 performance was undeniably robust, boasting a net income of $8.2 billion and 13% revenue growth.

- The asset quality remained in top shape, flexing a charge-off rate of 32 basis points, comfortably below pre-pandemic levels. The bank’s organic growth in clients and accounts was nothing short of spectacular, marking the seventh consecutive quarter of operating leverage.

- Consumers found themselves on solid financial footing, basking in the light of employment and higher wages, healthy account balances, and easy access to credit. Deposits remained steadfast, towering 34% above pre-pandemic levels, and the bank wrapped up the quarter with over $900 billion in its Global Liquidity Sources arsenal.

My Bullish Take

There’s a warm and fuzzy feeling around Bank of America, thanks to its latest report card. It seems to me that the bank has struck a delicate balance between the art of risk and the science of customer selection, managing to consistently titillate its risk appetite while serenading borrowers who won’t leave it high and dry. Sure, the Fed’s rate hike party might put a damper on the bank’s loan growth, but from my perspective, it’s not because Bank of America is suddenly an uptight chaperone. Instead, they’re more like a bouncer, cautiously vetting the guests—mortgage and auto loan borrowers, for instance—to make sure they’re responsible enough to handle the elixir of credit. I imagine that it’s a classic recipe for risk management and lasting success.

Bank of America’s customers seem to be regaining their financial mojo too, with checking account balances looking healthier than pre-pandemic. In my estimation, this is backed by a 9% jump in total payments and a 6% bump in credit card and debit spending, year over year. Of course, the payment landscape looks more like a generational dance-off, with Millennials and Gen Zers owning 14% fewer credit cards than their elders. Instead, they’re grooving to the beat of mobile wallets and contactless cards, and as far as I’m concerned, the bank is set to boogie with Erica, its virtual assistant, enhancing customer service and internal processes.

With a steady and diverse deposit franchise under its belt, I believe Bank of America can turn surplus deposit growth into a value-add banquet. From my point of view, the bank’s broad platform caters to clients who don’t need daily hand-holding, making excess deposit growth and checking balance stability a solid foundation for the long haul. The bank’s trading division is no slouch either, outpacing competitors in fixed income like a Wall Street thoroughbred. As a result, I am convinced that Bank of America is well-equipped to weather economic storms and maintain long-term profitability. Financial soothsayers are eyeing a 7-8% growth in net interest income this year, thanks to the bank’s diverse assets and muscular capital position, which should keep it nimble and profitable even when the economic seas get choppy.

And as turbulence rattles the markets, I discovered that Bank of America finds itself a beneficiary of flight-to-safety deposits—crucial for keeping a sturdy deposit base in tip-top shape. A stable deposit foundation allows the bank to strike a healthy balance sheet pose and tap into capital when the time comes. In my opinion, with costs projected to hover around $62.5 billion this year, and a helpful tailwind from workforce cuts, it’s clear that cost control is an essential ingredient in the bank’s recipe for long-term growth.

Peer Evaluation

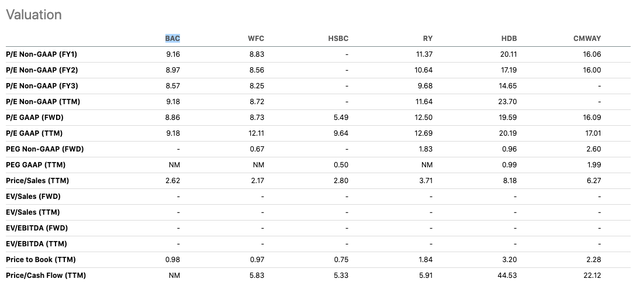

Examining Bank of America vis-à-vis its counterparts, I find that it’s unjustly undervalued in comparison. To begin with, BAC’s forward P/E ratio is notably more modest than that of the majority of its competitors, insinuating that the market has not yet fully embraced the extent of the bank’s prospective earnings. BAC’s forward P/E ratio of 9.16 pales in comparison to the industry median of 16.06 and a peer average of 12.27. Further, with a PEG ratio below the industry mean, it is evident that the market has not adequately factored in BAC’s growth potential. Moreover, when considering the price-to-book ratio, BAC again lags behind most of its peers, suggesting that the market does not value its assets as highly as it does for other banks. At 0.98, its price-to-book ratio is dwarfed by the peer average of 1.96 and the industry median of 1.98.

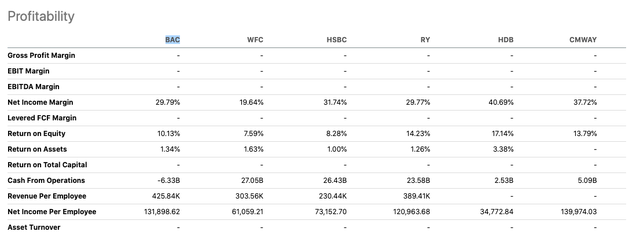

Lastly, BAC’s history of robust profitability cannot be overlooked. Boasting a net income margin of 29.79% and a return on equity of 10.13%, BAC surpasses the peer average of 8.53%. Furthermore, the bank exhibits superior revenue per employee and net income per employee metrics, alluding to its operational efficiency.

BAC’s Main Q1 2023 Bearish Points

- Bank of America’s Q1 2023 results could be seen as a financial Rorschach test, with strong numbers splotched amidst concerning patches of ink. The wealth management segment’s asset management fees found themselves on the wrong side of market swings, while the consumer segment’s expenses hinted at growing pains – a prelude to heftier costs down the line.

- As for the global markets segment, the equities took a 19% nosedive compared to last year, accompanied by a modest loss in the “all other” category, where securities sold racked up $220 million in losses. The bank’s 10% effective tax rate this quarter did get a boost from environmentally-conscious clients and savvy in-house investments.

- However, the hold-to-maturity securities book has been feeling the heat as rates rise, leaving disclosed market values of bonds deflated. Clients are also eyeing alternatives to lower-yielding sweep accounts, shuffling funds into higher-yielding preferred deposits, causing wealth management balances to wobble.

- Seasonal credit card paydowns and a lukewarm commercial demand in Q1 put the brakes on the company’s loan growth. BoA’s quarterly results faced several other gusts of headwind: lower service charges, asset management fees, and investment banking fees, to name a few.

- Meanwhile, the bank’s research team anticipates a shallow recession to begin by the third quarter of 2023. Debit and credit card spending has tapered off, yet year-over-year growth rates still show there may be energy remaining in the economy.

My Bearish Take

As the sinister storm clouds of recession loom, Bank of America finds itself gazing into a financial abyss, teetering on the edge of a potential downturn. In my estimation, the prospect of this cyclical economic maelstrom threatens to hobble the once-mighty behemoth, as commercial customers and loan demand may sputter, pummeling the firm’s revenue growth. The cruel specter of stagnating wages and inflation looms, while the very hint of a financial crisis or recession sends shivers down the spines of even the most steely-eyed investors.

An unnerving tremor ripples through the financial world as the possibility of plunging net interest income looms large. From my perspective, imagine, if you will, a $3.6 billion tumble in Bank of America’s coffers over the next year, shaking the very foundations of the corporation’s bottom line. The bank has hedged its bets against this chilling scenario, but the icy fingers of fate may yet penetrate its defenses. Stagnation in the realm of commercial loans might throttle revenue growth, and a souring of credit quality could deliver a swift kick to the institution.

But wait, there’s more. As I see it, the bank’s burgeoning short-term borrowings could signal a bittersweet boon of liquidity in these turbulent times, potentially tugging down the net interest margin (NIM) and, by extension, net interest income (NII) dollars. As the economy sags and consumers cinch their purse strings tighter, our protagonist may find itself grappling with a veritable hydra of challenges. Should the days of Q4 ’19 resurface, the transition from non-interest-bearing to interest-bearing could decelerate, and the bank’s clientele may rotate assets with all the enthusiasm of a lethargic sloth as interest rates ascend.

In the shadow of robust key performance metrics, pre-tax margins have dwindled, unnerving investors like a specter in the night. Management’s assurances of a return to pre-crisis levels ring hollow without guarantees. The regulatory bogeymen of Basel IV scenario planning and FDIC special assessments lurk, ready to pounce with additional costs. From my viewpoint, the digitalization of services may not yield the cost-cutting windfall promised, and unforeseen obstacles may spring forth like malevolent gremlins in the machinery.

After my investigation, the findings suggest that Bank of America’s deposit payments may appear anemic in comparison to its rivals, rendering it less alluring to a discerning clientele. Navigating this treacherous, competitive market of capricious interest rates and economic conditions, the bank must rely on its value proposition and sector growth to lure customers. Meanwhile, the dark cloud of unrealized losses in its held-to-maturity portfolio looms, threatening to rain on future financial performance.

Furthermore, the company’s net interest income trajectory wobbles, with the potential for three rate cuts by year’s end casting a pall over NII in the latter half of the year. Gazing into the murky crystal ball of the market, the Federal Reserve’s actions remain enigmatic, a riddle wrapped in an enigma. Faced with this conundrum, the firm refrains from full-year prognostications, and spending may yet emerge as a millstone around its neck, particularly in the waning months of the year. From my point of view, despite a strong fiscal performance, Bank of America continues to pour resources into its sales and trading operations, all while the ominous shadow of macroeconomic uncertainty looms, poised to impact future repurchase activity, especially as the June stress test results approach.

Final Takeaway

In the face of ambiguous economic risk indicators, Bank of America emerges as a compelling investment opportunity. Astutely safeguarding itself against a prospective recession, the institution has not only preserved profitability but also managed to thrive. The bank’s strategic adoption of short-term borrowings might well bolster liquidity and amplify net interest income, while its ongoing digital transformation stands to yield considerable cost-efficiency advantages. Moreover, Bank of America’s enduring status as a preeminent global financial powerhouse lends it a discernible competitive edge. As a result, investors eyeing reliable returns would be well-advised to consider adding this banking behemoth to their portfolios.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.