Summary:

- The banking crisis has investors lumping some of the worst banks with the best.

- Both Wells Fargo and BofA have solid financial profiles and should weather this storm.

- I provide a variety of metrics to consider while evaluating the two firms.

Henrik5000

The collapse of the Silicon Valley and Signature Banks sent shock waves through the financials sector. In tandem with other banking stocks, shares of Bank of America (NYSE:BAC) and Wells Fargo (NYSE:WFC) suffered double-digit losses over the last month.

Investors are now focused on the share of FDIC insured deposits as well as the level of held-to-maturity (HTM) securities held by banks. In the meanwhile, customers shifting deposits from smaller banks to the likes of Wells Fargo and BofA have not gone unnoticed. In a master of days, BofA took in $15 billion in deposits from customers fleeing local and regional banks.

The question is whether this calamity represents an irrational reaction by the market. And if that holds true, which banks offer the most upside over the long haul, and why.

A Few Metrics To Consider

Back in 2016, Wells Fargo’s phony-accounts scandal hit the headlines. Without the consent of customers, and at the behest of management, employees opened millions of credit-card and bank accounts. When regulators shined the light on those issues, they discovered a plethora of other scandals including improperly and illegally assessed fees and interest on mortgage and auto loans.

Fast forward to 2023, and Wells Fargo has paid billions in fines and still has nine outstanding consent orders from various banking regulators. Perhaps of greatest import to investors is that the government imposed an asset cap on the bank that will stymie growth until the issues are resolved.

However, it is ironic that a silver lining lies in the imposition of the asset cap.

A metric known as a deposit beta measures the amount banks raise deposit costs in response to increases in the Fed’s interest rates. Expressed as a percentage, the lower the number the better.

Since WFC cannot grow assets beyond a certain size, the company has the luxury of gleaning the best deposits from its prospective client pool.

And so, as we entered this period, what we said is we would have expected our deposit betas to be less than others have seen because they haven’t had those limitations, and we have seen that.

Charlie Scharf, CEO

At the end of the fourth quarter, Wells Fargo’s deposit beta stood at 15%. This compares to 21% for BofA, 31% for JPMorgan Chase (JPM), and 42% for Citigroup (C). Although BofA has a history of posting very strong deposit beta figures, Wells Fargo’s current numbers are even better.

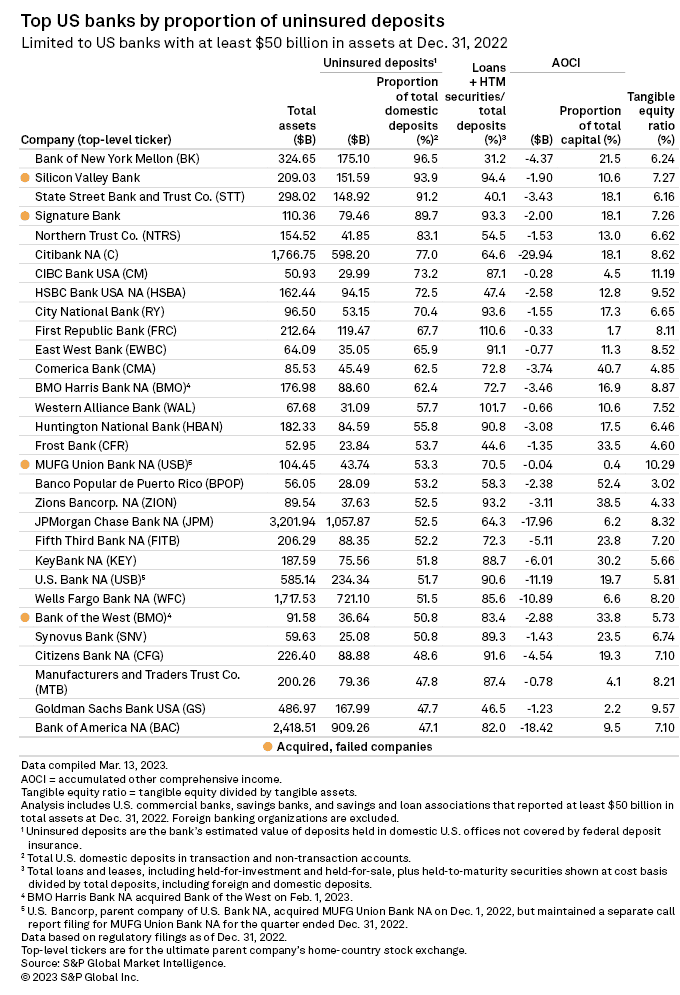

The next chart paints a picture of where the two stand in terms of the percentage of uninsured deposits each bank holds.

CROWDFUND INSIDER

While both banks rank well, BAC has the best level of insured deposits among the bunch. As of the BofA’s last filing, the bank held $1.93 trillion in customer deposits.

A metric known as an efficiency ratio is a calculation used to determine the profitability of a bank. The lower the number the better. In the first six months of 2022 BAC had an efficiency ratio of 67%, while WFC posted an efficiency ratio of 77%.

The efficiency level of Wells Fargo is worsened by the penalties paid for past transgressions. Neither of those numbers are something to brag about. I would opine that a well-run bank should have an efficiency ratio of 60 or lower. BAC did post an efficiency ratio of 63% last quarter.

At the center of the banking crisis lies the losses suffered by banks on bonds. As deposits surged following the COVID crisis, banks invested in securities. One type of bond is referred to as “held-to-maturity,” the other as “available-for-sale” (AFS). When interest rates rise, the value of bonds fall. Consequently, banks with large holdings in HTM securities also have large unrealized losses.

(The following data is derived from the respective bank’s latest 10-Ks.)

As of the end of 2022, Wells Fargo held approximately $121.7 million in AFS securities with a fair value of about $113.6 million. The loss on those bonds is $8,131 million.

WFC held just over $297 million in HTM securities with a fair value of about $255.5 million. The loss on those bonds totals $41.536 million. The combined losses for the AFS/HTM securities as of the end of 2022 totals $49,669 million.

In that same time frame, BAC held nearly $255.5 million in AFS bonds with a fair value of approximately $220.8 million. The loss on the AFS portfolio totals $5,697 million.

BAC held nearly $632.9 million in HTM bonds with a fair value of just under $524.3 million. The loss on the HTM portfolio totaled $108,596 million.

The loss per share for Wells Fargo comes to $13.09, or about 34.2% of the share price as of 4/10/23.

The loss for BAC totals $14.28, or approximately 51% of the share price as of 04/10/23.

Investors should understand that these represent paper losses and that the consensus among analysts is that neither bank will be forced to liquidate the securities. Assuming both banks hold the bonds until maturity, which is likely, neither will incur any unrealized losses.

Business Models: Where They Differ, Where They Are The Same

Both banks are one of the largest issuers of credit and debit cards, and both banks also operate solid commercial real estate (CRE) banking franchises.

The recent bank failures brought attention to CRE loans with a particular focus on office buildings. The trend to work-at-home resulted in a steep decline in demand for office space. Morgan Stanley’s chief investment officer claims the commercial real estate sector is facing an economic crash that will surpass the 2008 financial crisis.

BofA has 26% of CRE loans dedicated to offices, and WFC has 22% of CRE loans in the office space. Furthermore, Wells is the nation’s largest CRE lender.

However, the size of a bank’s CRE loan portfolio is not in itself a negative. The credit worthiness of clients is of greater importance. For example, last year Wells Fargo’s charge offs for commercial loans were a mere .01 of 1 percent of the bank’s portfolio. Now consider that the bank’s write offs on consumer loans were 39 times that figure.

While I give the edge to WFC when considering the banks’ exposure to CRE loans, there are two distinct differences in BofA’s and Wells Fargo’s business models. One lies in Bank of America’s wealth management operations via Merrill Edge and Merrill Lynch Wealth Management services. BofA is also one of the top five global investment banks and fee earner of FICC products.

An example of the difference in the two lies in the revenues each bank generated in investment banking fees through the first three quarters of 2022. WFC recorded about $1.1 billion in investment banking fees, while BofA generated $3.75 billion of investment banking fees in that time frame.

Although the longer term prospects for the bank’s global wealth management and global banking segments are a net positive, they are suffering from the current macroeconomic environment. In Q4, the Global Wealth and Investment Management net income declined by Global Banking net income fell 5%, and the Global Markets segments net income dropped 25%.

The opposite side of that coin is that Wells Fargo is more focused on consumer banking than its rivals. Last quarter, WFC garnered approximately 48% of revenue from its consumer banking and lending arm. Of the top four banks, WFC had the percentage of revenue from consumer banking and the lowest percentage of revenue from its investment banking division.

In a period of macroeconomic malaise and high interest rates, the wealth management arms will suffer while the consumer banking business will show a positive rate sensitivity that should translate into an extra earnings boost as rates rise. This ranks as a positive for WFC.

Another minor advantage in regards to the top four banks is that WFC has the lowest global systemically important bank surcharge. This will result in the bank being required to hold relatively less capital.

Debt, Dividend, And Valuations

Both banks have sound financial foundations.

As of December 31, 2022, Wells Fargo’s Tier 1 ratio was 10.6% under Basel III Advanced Approach.

Bank of America’s Tier 1 ratio under the Basel III Advanced Approach was 12.8% at the close of 2022.

Wells Fargo’s dividend currently yields 3.17%. The payout ratio is 24.7%, and the 5-year dividend growth rate is -5.80%.

BofA yields 3.16%. The payout ratio is 29.96%, and the 5-year dividend growth rate is 14.87%.

WFC has a forward P/E of 8.08x. BAC has a forward P/E of 8.20x.

Yahoo Finance estimates Wells Fargo’s 5-year PEG ratio at 0.76x.

BofA’s 5-year PEG ratio is 4.22x.

NASDAQ calculates the 12-month PEG ratio for WFC at 0.79x.

For BofA, NASDAQ estimates a 12-month PEG ratio of 1.21x.

WFC currently trades for $38.46 a share. The 12-month average price target of the 13 analysts that follow WFC is $50.56. The price target of the 7 analysts that rated the stock following the last earnings report is $53.71.

Four analysts provided a price target over the last 3 weeks. Their average target price is $45.25.

BAC currently trades for $27.92 a share. The 12-month average price target of the 13 analysts that follow BofA is $37.75. The price target of the 8 analysts that rated the stock following the last earnings report is $41.40.

Six analysts provided a price target for BofA over the last 3 weeks. Their average target price is $37.16.

Negatives To Consider

As noted earlier, both banks recorded large unrealized losses related to bond portfolios. Both banks also have large exposure to CRE. While I believe each bank will weather these negatives well, investors should nonetheless take these headwinds into consideration.

While the initial reaction to the banking crisis led to consumers moving deposits into larger banks, there is also a trend by customers to rotate deposits into higher-interest-bearing deposit accounts. This could result in lower deposits for both banks.

Last but far from least is the prospect of a recession on the horizon. Macroeconomic malaise will lead to reduced demand for bank services along with an increase in borrower defaults.

BofA And Wells Fargo: Buy, Sell, Or Hold?

On one hand, investment banking activity dropped sharply of late. That trend is likely to continue for the short to mid term. In comparing the two, that trend is a sharper headwind for BofA than WFC. At the same time, Wells Fargo’s consumer banking division gives that bank an advantage as the Fed increases rates.

An obvious and large negative for WFC lies in the asset cap imposed upon the bank. The cap, which is costing the company billions in revenue, is unlikely to be lifted in 2023. However, I would posit that once lifted, the stock may react like a coiled spring.

Readers should know that I view the banking crisis as a prime buying opportunity for the stronger banking stocks.

I rate BAC as a Buy.

I also rank WFC as a Buy.

However, I prefer WFC over BAC. Wells Fargo’s smaller CRE loan portfolio, more favorable deposit beta, and the stock’s lower one-year and five-year PEG ratios, are some of the factors that have me favoring that name.

I do not hold a position in either stock. I’ve initiated and/or added to a number of financial stocks over the last week. As outlined in this recent article, my favored investment in this space is U.S. Bancorp (USB).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have no formal training in investing. All articles are my personal perspective on a given prospective investment and should not be considered as investment advice. Due diligence should be exercised and readers should engage in additional research and analysis before making their own investment decision. All relevant risks are not covered in this article. Although I endeavor to provide accurate data, there is a possibility that I inadvertently relay inaccurate or outdated information. Readers should consider their own unique investment profile and consider seeking advice from an investment professional before making an investment decision.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.