Summary:

- Bank of America’s stock price weakness presents a buying opportunity due to its discount to book value.

- The central bank’s potential rate hikes and inflation trends could fuel Bank of America’s net interest income growth.

- The upcoming 3Q-23 earnings release could result in a stock re-rating, and attention will be on net interest income and consumer net charge-offs.

Spencer Platt

Market weakness has translated into stock price weakness for Wall Street powerhouse Bank of America Corporation (NYSE:BAC), and taking into account that the bank’s stock is now finally selling at a discount to book value, I pulled the trigger and added Bank of America to my portfolio.

Bank of America is scheduled to release its quarterly earnings on October 17, 2023, and I think that, given recent inflation data, the central bank will continue to hike rates, adding fuel to the bank’s net interest income growth.

With 3Q-23 earnings coming up next week, a stronger-than-expected earnings release could result in a stock re-rating. Now, with a 16% discount to book value available, I think Bank of America has a reasonably large margin of safety to warrant a Buy rating.

My Rating History

Rising credit losses were one reason, besides a premium valuation, why I was cautious about investing in Bank of America in 2022 and 2023. Given that inflation trends have recently changed direction, the central bank now has a strong argument to keep hiking rates, which should fuel the Bank of America’s net interest income.

With a discount valuation improving the risk/reward ratio, the value proposition has been enhanced as Bank of America’s stock slipped last week.

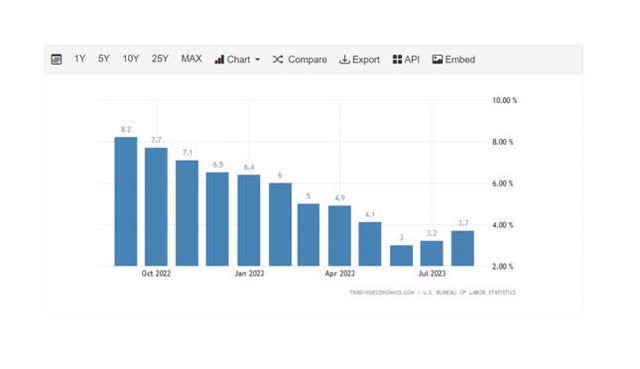

Inflation Making A Strong Argument For A Rate Hike

In November, the central bank will have to decide about a rate hike, and chances are that it will raise interest rates by 25 basis points. The reason: Inflation has been trending up in the last two months, raising concerns about a resurgence of inflation. In two consecutive quarters, in July and August, inflation re-accelerated, going as high as 3.7% in August.

Inflation (Tradingeconomics.com)

Higher inflation is a leading indicator of a coming rate hike, and Bank of America could be set to profit from an increase in key rates in its loan business. The bank’s net interest income is also potentially set to get an uplift, which could also reverse the recent downtrend in its net interest income.

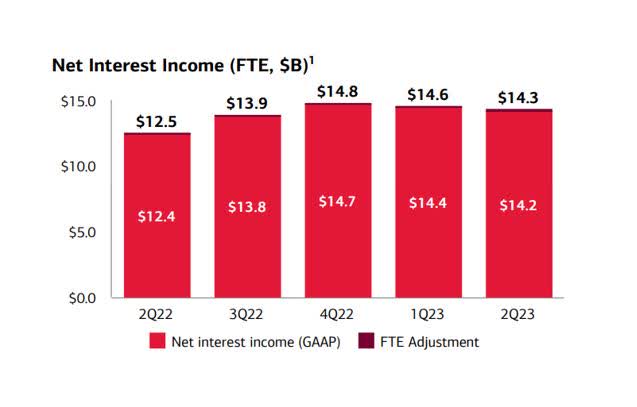

In 2Q-23, Bank of America earned $14.3 billion in net interest income, and the bank’s net interest income slid for the second consecutive quarter. If the trend reverses, investors will also have a reason to consider the stock again.

Net Interest Income (Bank Of America Corp)

Higher interest rates should allow Bank of America to charge higher costs for its large loan portfolio. Banks are notorious in exploiting rate hikes for loan rate increases and higher credit card, mortgage and personal loan costs could provide a boost to Bank of America’s bottom line in the short-term.

Though deposit costs have also risen (and should be expected to rise as long as the central bank hikes rates), banks have been traditionally slow in passing higher rates through to savers.

Bank of America’s Upcoming 3Q-23 Report

On October 17, 2023, Bank of America will release earnings for 3Q-23, and I will be taking a look into two metrics in particular:

- Net interest income; and

- Consumer net charge offs (which should indicate the overall asset quality on Bank of America’s balance sheet).

Bank of America’s net interest income has shown early signs of a cyclical contraction due to two consecutive quarters of sliding net interest income. A third QoQ decline would be a short-term negative for Bank of America, but the bank’s guidance would likely be more important than actual results.

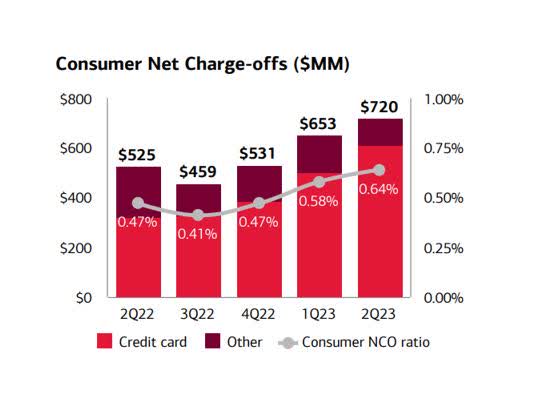

The second metric that I’m going to pay a lot of attention to is the trend in consumer net charge-offs which have risen for three quarters in a row and indicate, broadly speaking, a deterioration of credit quality on Bank of America’s balance sheet. A fourth consecutive uptick in net charge-offs would be a cause for concern and counter my bullish investment thesis.

Consumer Net Charge-Offs (Bank Of America Corp)

Positive History Of EPS Outperformance

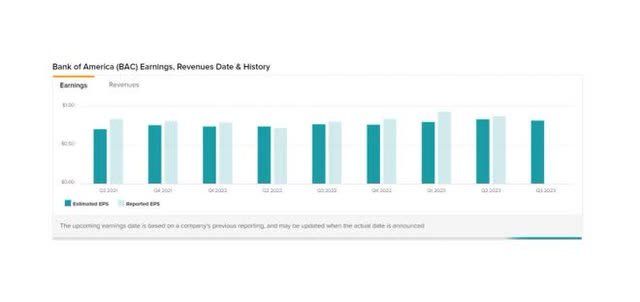

The market models $0.83 per share in earnings for Bank of America’s third quarter which would reflect 2.5% YoY growth. Bank of America has beaten consensus estimates four times in the last four quarters, resulting in an average beat of $0.07 per share. The short term EPS performance therefore favors Bank of America.

Estimated Earnings (Bank Of America Corp)

Recovery Potential

Bank of America was oversold based on the Relative Strength Index last week, which is when I bought, but technical sentiment has since normalized.

In August, Bank of America’s stock price fell through both the 50-day and 200-day moving average lines, which diminished the chart picture in the short-term.

From a technical point of view, a break of the $25.47 52-week low would clear the way all the way down to $22. On the flip side, an upsurge above $29.87 would send a bullish signal to investors.

Moving Averages (Stockcharts.com)

Bank of America: Now Selling At A Discount Valuation

In the last two years, I often cited the possibility of Bank of America returning to a discount valuation: Bank of America: Discount Valuation Ahead In 2023.

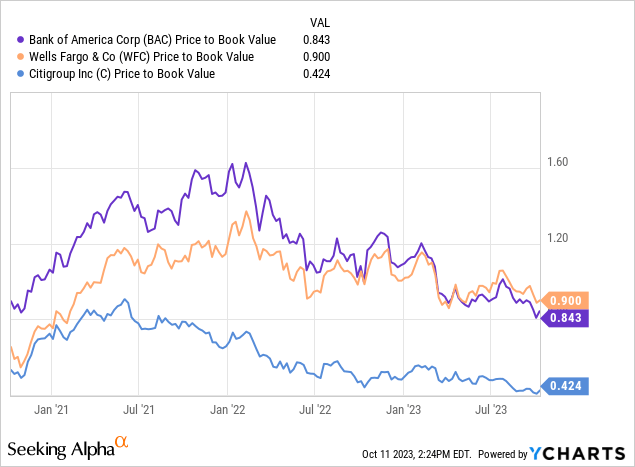

While I recommended to sell Bank of America earlier due to the premium valuation, I think the discount valuation available now creates a sufficient margin of safety for investors, particularly now that the central bank’s rate policy may be a catalyst for Bank of America’s net interest income growth moving forward. Large banks like Wells Fargo (WFC) and Citigroup (C) are also trading at substantial discounts to book value.

Large-cap banks are selling at discounts to book value, in my view, because the market is now too optimistic about rate decreases moving forward.

Inflation for September rose, YoY, to 3.7% which makes is very probable that the central bank will rate hikes again. I consider a discount valuation for Bank of America and for other banks with large deposit bases and loan portfolios appropriate during a recession, when earnings cyclically contract, loan defaults increase and the central bank lowers rates to stimulate the economy.

Since inflation has shown new signs of life in the last three months, I think that the central bank will have no other choice but to keep hiking interest rates.

Wells Fargo is probably the most comparable competitor to Bank of America as both banks have large consumer and commercial banking divisions and WFC sells for a relatively small discount to book value. Both banks are potentially interesting to investors that think that the central bank will keep pushing rates higher.

Why Bank of America Might See A Lower/Higher Valuation

Bank of America has two potential headwinds that could be problematic:

- Cyclically declining net interest income if inflation retreats and the central bank makes clear it will kick off a rate-lowering cycle; and

- A deterioration in average credit quality on Bank of America’s balance sheet.

My Conclusion

Expectations for Bank of America’s third quarter profits are not particularly high so the bank won’t have to do much to beat low earnings expectations next week in my opinion.

Given that inflation reared its ugly head again in the last two months, the odds are tilted in favor of new rate hikes in November.

Importantly, given potential net interest income tailwinds and the re-appearance of a discount valuation, I changed my tune last week and took advantage of Bank of America’s selloff.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.