Summary:

- Bank of America remains a well-managed, well-capitalized, shareholder-friendly institution, making it a relatively safe, long-term investment for conservative investors.

- In this article, after a brief business recap, we will dive into BAC common stock valuation.

- I do not believe Warren Buffett’s recent sales of BAC shares reflect him seeing a boogeyman. To the contrary: it’s just business.

J. Michael Jones

I last wrote about Bank of America Corporation (NYSE:BAC) a little over two years ago. In this article, we will review the current business outlook and take a dive into share valuation.

In addition, I will offer you my take on recent events around Warren Buffett/Berkshire Hathaway Inc. (BRK.A) (BRK.B) and his Bank of America holdings.

General Investment Thesis

My Bank of America investment thesis remains unchanged.

-

Bank of America is a well-managed, well-capitalized, shareholder-friendly banking institution.

-

The bank represents a proxy for the overall growth and well-being of the United States economy, and to a lesser degree, the world economy. As a general investment optimist, BAC stock is aligned with my view that America remains a nation for business growth.

-

BAC stock is a relatively safe, long-term security; making it a good core investment for conservative investors. Management focuses the bank on responsible growth. The dividend is well-covered and has increased for 11 consecutive years.

A Brief Current Synopsis

Note: data in this section is found via the BAC investor website.

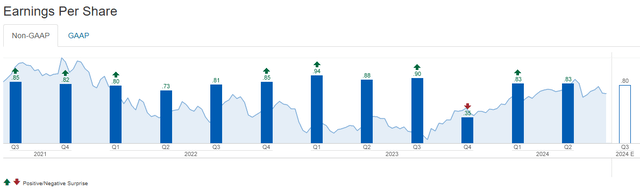

Bank of America last reported earnings on July 16 for the quarter ending June 30. Management recorded a top and bottom-line beat. Earnings were $0.83 per share, slightly above analysts’ $0.80 consensus estimates.

This is consistent with the longer-term historical record. Over the past twelve quarters, Bank of America EPS beat Street estimates seven times, met expectations four times, and missed just once.

Growth

For the past year, loan growth has been sluggish; essentially flat. This may be expected during periods of economic stagnation. Deposits are growing, albeit in the low single digits. Year-of-over-year bank revenue, net of interest expense, shows a modest uplift.

Capital

BoA remains well-capitalized. As of June 30, the CET1 ratio was 11.9, comfortably above the October 1, 2024, regulatory minimum.

Asset Quality

Bank of America’s asset quality is acceptable, despite pressure on the CRE loan book. The NCO% (net charge-off ratio) for total assets, consumer assets, and CRE flattened out in 2024. All appear to have peaked.

Total non-performing loans and leases as a function of total loans and leases also appear to have crested in 1Q2024.

Looking at credit metrics in 2019 versus 2024, the total NCO% was about 0.40 then versus 0.60 today. However, the Allowance % for commercial loans and leases was 1.0% in 2019 versus 0.8% in 2024; it’s better today than pre-pandemic.

Efficiency

The bank efficiency ratio, measured by total non-interest expense as a function of net revenue, remains in the mid-60 percent range. This is acceptable.

Dividends

Over the past five years, Bank of America boosted dividends by an average of 11.2 percent per annum. The current dividend yield is 2.69 percent. This compares favorably with large banking peers.

Book Value

Since December 31, 2023, BAC’s book value has grown 3.1 percent to $34.39 per share. For the full year 2023, book value improved 8.9 percent. Increasing net book indicates management is creating shareholder value.

Conclusion

Rattling off these recent bank results indicates Bank of America was able to maintain stability while the Fed was tightening credit.

No drama here.

Looking Forward

On September 10, bank management provided investor commentary at Barclay’s Global Financial Services Conference. CEO Brian Moynihan attended on behalf of Bank of America.

Summarizing parts of the Q&A session, I seek to paint a picture through my review of the transcript, coupled with specific quotes by Mr. Moynihan.

-

Overall, corporate accounts exhibit stable loan balances. Small businesses indicate modest loan growth. Businesses are not employing more people or reinvesting aggressively. Indeed, many businesses appear to be waiting for rates to ease and the election season to end.

-

Mr. Moynihan appears to believe there is a good growth runway ahead for the bank’s wealth management and retail banking segments. Here’s a short excerpt:

So, there’s a big opportunity to just continue to grow that core business. We’re adding one million new checking accounts a year… Those are the customers of the future. If we’re adding those in ’20, ’21, ’22, ’23, or ’24, what happens in ’26, ’27, and ’28 is some of those customers who are in college are out and working. And so they start to mature and [become] great customers.

-

Management sees lending improving as interest rates come down. Nothing drastic, just a little at a time as the Fed eases. This is aligned with previous economic business cycles.

-

Bank charge-offs are normalizing at pre-pandemic levels. CRE loans remain under pressure, but BoA expects to work through it in an orderly fashion. Another excerpt:

So, we feel good that we’ve sort of normalized the charge-off level back to where [we] were pre-pandemic, and it’s sitting around a charge-off level absent the commercial real estate, which has come down each quarter…

-

Moynihan noted bank expenses increased in 2023 due to inflationary pressure. However, in 2024, he pointed out that Bank of America has absorbed inflation. The headcount is lower by about 800. Non-interest expenses were $16.3 billion in 2Q2024; looking forward, these should remain in that range.

-

BoA assessed the pending Basel III Endgame regulations and is pleased with the expected outcome. It is unlikely to be as restrictive as feared originally. Moynihan remarked:

And now they said they could, on average, cut that back [incremental capital buffer] by half. So that means we’re fine, and we can continue to buy back stock out of all the current earnings extent don’t need it, we have excess capital. We got to wait for this proposal to really get out there. So that’s good news.

-

CEO Moynihan also sees a 15% ROTCE as sustainable. The bank achieved this for the full year 2022 and 2023. As rate compression subsides and the economic business cycle gains momentum, he suggests even higher returns are likely.

Conclusion

Compiling and sharing this data from the September investor conference reinforces the view that bank management’s forward view is constructive. Near-term pressures are expected to ease. Bank of America and its investors expect to participate fully in the subsequent economic growth phase.

Typically, such growth phases are marked by the Federal Reserve loosening credit. While it may take up to several quarters to fully gain traction, I contend the traditional investment playbook remains fully intact.

Valuation: Where the Rubber Hits the Road

Any discussion about a stock should contain a section covering valuation. Just because a business indicates solid fundamentals does not mean it is automatically a good investment.

Valuation matters.

To value BAC stock, I combined several approaches.

Price-and-Earnings

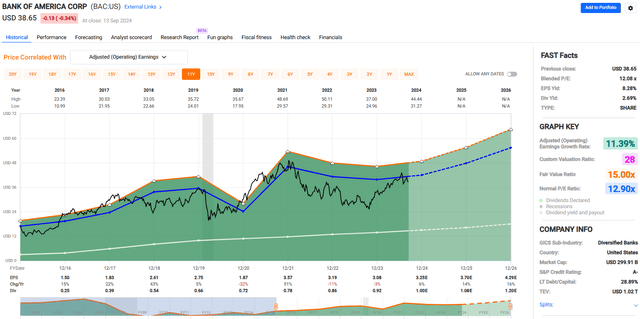

A baseline valuation may be obtained for a bank stock through a price-and-earnings exercise. For this work, I prefer to use adjusted, or operating earnings versus GAAP figures. A FAST Graphs chart offers an historical perspective:

A few remarks:

First, I chose a historical time frame that begins when BAC stock is not overvalued or undervalued. In addition, I like to approximately match the bank’s past earnings growth rate with the current consensus forward estimates. The 11-year chart accomplishes both objectives.

Second, after mid-year, I begin to project my FVE (Fair Value Estimate) using next year’s estimates.

Third, I compare the FAST Graphs forward estimates (generated by Fact Set Research Systems) with my own model and/or other sources. For BAC, my 2025 forward EPS estimate is ~$3.50.

Reviewing the data points, my BAC stock P/E valuation is:

$3.50 EPS multiplied by 12.5x historical P/E = $43 to $44

Multiple of Book Value

Another bank stock valuation methodology utilizes a historical multiple of the bank’s book value.

For Bank of America, here’s a long-term chart highlighting year-end BV:

Since 2013, the highest reasonably expected multiple of book value is about 1.1x. Currently, the BAC price-to-book is 1.1x.

However, over the past ten years, Bank of America has grown its net book by about 6 percent per year. As noted in the earlier sections of this article, I do not promise major changes in the long-term trajectory of the business. Therefore, if I multiply the current book value by 6 percent and presume Fair Value to be 1.1x price-to-book, we find

$34.39 (current BV) multiplied by 1.06 multiplied by 1.1x = $40

FVE Via Derivative of the CAPM

CAPM stands for Capital Asset Pricing Model.

The inputs for this bank valuation process combine several inputs.

Rf = Risk-Free rate (I use the 10-year Treasury note).

B = beta for the bank stock.

Eret = expected long-term market return.

R = bank RoTCE.

TBV = bank tangible book value per share.

The three-step formula looks like this:

Rf + B (Eret – Rf) = X.

R / X = Y.

Y x TBV = equity Fair Value.

The current BAC valuation inputs are:

Rf = 3.65 (as of 9/13/24).

B = 1.36.

Eret = 7.

R = 13.7 (first half 2024).

TBV = 25.37 (as of 6/30/24).

Doing the arithmetic for this model, the FVE for Bank of America stock is $42.

Conclusion

These three valuation methodologies arrive approximately at the same FVE. Simply averaging the three figures suggests a $41 to $42 Fair Value Estimate is defensible.

In recent weeks, BAC common shares have been more-or-less hanging around $40 a share (and are currently trading at $38.65). At this price, I am indifferent to accumulating shares and actually lean toward limited distribution.

However, Bank of America indicates good underlying fundamentals, a solid/safe dividend, and the shares are not overvalued.

Therefore, on balance, I suggest Bank of America stock is a soft hold.

What About Buffett, The Oracle of Omaha?

Beginning July 17, Buffett began systematically selling his 1.03 billion shares of Bank of America. From July 17 through September 10, he sold ~174 million shares. That’s about 17 percent of the original investment.

I’ve read several articles trying to explain why Mr. Buffett is offloading shares. The reasons tend to revolve around:

-

Post-election political action will force corporate tax rates to go up;

-

Fears the Fed has waited too long to lower rates, thereby ushering in a recession;

-

Future Federal Reserve policy will surprise the markets (the curveball scenario);

-

Fears of a severe stock market bubble

During the September investor conference, CEO Brian Moynihan commented on the situation:

And so, I don’t know what exactly he’s doing because, frankly, we can’t ask and we wouldn’t ask, but on the other hand, the market is absorbing the stock, and it’s a portion of the volume every day, and we’re buying the stock a portion of the stock, and so life will go on.

(That doesn’t sound like Mr. Moynihan has many answers.)

So, I will weigh in.

I contend what’s going on is straightforward. We covered it in the valuation section of this article:

BAC common stock is near its fair value. Fair value may be defined as an indifference point. If one is indifferent to owning a security, and he/she owns a lot of it, they may decide it prudent to simply “take something off the table.”

That’s what I think Warren Buffett and Berkshire Hathaway are doing. Nothing more or less.

Indeed, over the years Mr. Buffett has sold stock, with few exceptions, for only one of two reasons:

-

He lost faith in management’s ability to run the business;

-

In Buffett’s estimation, the stock became overvalued.

As to the first bullet point, CEO Brian Moynihan has been in place since the Great Recession. Through the years, Mr. Buffett has spoken well of him and his staff. I do not for a moment believe he lost faith in BoA management.

I believe he’s trimming back his large position in BAC common due to valuation. Historically, that is about the only reason he sells.

While I’m no Warren Buffett, I followed his prescription: this summer, when BAC stock rose well above $40 a share, I trimmed back, selling about 10 percent of my total shares.

My sales were based upon valuation; nothing more or less. It’s just business.

Please do your own careful due diligence before making any investment decision. This article is not a recommendation to buy or sell any stock. Good luck with all your 2024 investments.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.