Summary:

- Google recently launched its Bing-AI competitor, Bard.

- As scrutiny from lawmakers and regulators on AI grows, we think Google’s rollout will position it as the responsible actor in the space.

- With the launch, we can confirm that Google has not fallen behind in AI.

JHVEPhoto

A Long Wait, Over

Today, Google parent Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) announced that it was launching the public version of Bard, Google’s much-hyped answer to Microsoft Corporation’s (MSFT) Bing-integrated AI collaboration with OpenAI.

In this article, we’ll cover why this matters, how Google has handled things in the run-up to the launch, and why we think this is an exciting time for Google shareholders.

Let’s dive in.

Overview

By visiting this link, users can sign up to join the waitlist for Bard. At this time, the company plans to roll out full access over time, which follows the same path that Microsoft has taken with its Bing-AI product.

We previously wrote that we were of the opinion that Google was making a calculated, cautious moves with the rollout of its Bard platform (you can read the article here), and that we believed this strategic patience would be rewarded. Given Google’s prominent place in the search ecosystem, a botched rollout could present a serious threat to Google’s golden goose. On the other hand, we believed that Microsoft–with its distant second-place search asset Bing–had far less to lose from a bumpy launch of its AI product.

We believe that, given some of guardrails that Google has placed on Bard, we were largely correct in our assessment of why a delayed launch was both practical and smart. A Bloomberg article covering the launch of Bard made a few important observations about the new product, namely that Google is limiting the duration of chats with Bard, and that Bard refused to engage with dangerous inquiries such as “how to make a bomb.”

These two guardrails alone are, we want to point out, important lessons that Google was able to learn for free from Microsoft after early iterations of its Bing-AI product quickly devolved into conversations with the sort of undertones you’d expect from a sci-fi computer overlord, not a friendly search assistant.

Bard will, importantly, also be integrated with Google’s search function and be able to draw on real-time data. Of course, Microsoft’s product can do this, too, but given that much was made about how Google had “lost ground” to Microsoft on the AI-tech front, we believe it was an important move on Google’s part to show that that is not, in fact, the case.

Who’s The Adult Here?

Google’s strategic patience has paid off in other ways, too. By delaying its launch, it has allowed Microsoft and it’s OpenAI investment to be the most prominent media example of the AI-bogeyman. The splash that was made by the Bing-AI integration has also now gotten the attention of lawmakers.

Senator Michael Bennett recently penned a letter to multiple companies (including Microsoft, Google, and Snap Inc. (SNAP)) requesting information about how they are planning to keep users safe.

Of course, this letter didn’t simply appear in a vacuum–it is presumably in response to the multiple reports of users’ bizarre interactions with ChatGPT and the fear that these sorts of experiences will only proliferate as more systems come online.

By taking the user safety lessons learned from Microsoft’s launch, we believe this will allow Google to position itself as the “adult in the room” among AI players. It can plausibly say that it did not rush to launch its Bard product specifically out of the same concerns shared by the Senator. This could prove to be a valuable card for Google to play with regulators and lawmakers when the time inevitably comes.

Still Undervalued

It is clear that search-integrated, conversational AI is likely to be a game-changer in more ways than we can appreciate today. It is also not some pie-in-the-sky tunnel visions–it is actually here with us now. We believe that we can reasonably assume, then, that platforms like Google will only further integrate themselves into users daily lives, which has the potential to enhance secular tailwinds for the company as time goes on.

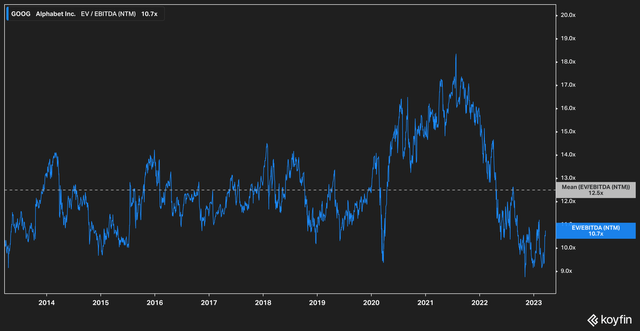

With all this in mind, the market still values Google’s stock at near-historic lows.

On most timeframes, Google is trading below historic forward EV/EBITDA averages. The current valuation of 10.7x is well below the 10-year average of 12.5x, and we point out that previous valuations do not even include a premium for what an AI-integrated Google has to offer investors.

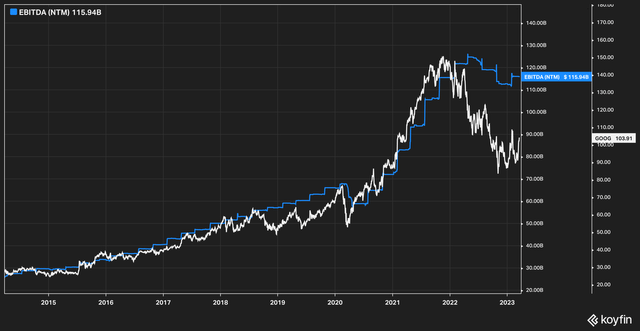

One of our favorite valuation statistics for Google also continues to show a historical disconnect, the price-to-forward-EBITDA overlay.

Over the last ten years, Google’s price has largely tracked with forward EBITDA estimates. In 2022, however, this historic relationship broke down as EBITDA estimates fell. Recently, however, analyst estimates for forward EBITDA have begun to recover. While we cannot say for certain that the historic relationship will fully restore itself, even a modest recovery to historical norms offers quite a bit of upside.

The Bottom Line

One of the biggest collective gasps from investors when Microsoft launched its AI product was due to the (unwarranted, in our view) belief that it heralded a new era where Google had been lapped technologically. What else, the thinking went, could it mean when Bing–Bing!–is the first to market in a hot new field?

We advocated our belief that that view was, for lack of a better word, silly. Google had, after all, spent significant time and resources on AI, and many of the engineers at ChatGPT were former Google employees who worked on the company’s AI projects.

We believe that the launch of Bard, then, vindicates the idea that Google has not lost a technological step when it comes to the AI race. In fact, we think that the company’s chosen rollout method positions it as the responsible player in what is largely seen as the new wild west in the technological frontier.

For all of these reasons, we continue to view Google’s stock as undervalued and worthy of strong examination from investors.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.