Summary:

- Barnes & Noble Education, Inc. reported mixed Q1/FY2025 results, with revenues coming in slightly below expectations and GAAP profitability impacted by charges related to the recent recapitalization transaction.

- A 32% increase in First Day program revenues helped to offset sales pressure from store closures, and Adjusted EBITDA benefited from a combination of cost savings and higher productivity.

- In the earnings press release, management projected substantially increased profitability and cash flow for FY2025.

- However, momentum has faded recently, and Friday’s $40 million ATM Offering isn’t exactly suited to instill investor confidence ahead of the company’s all-important Q2/FY2025 results.

- While I am reiterating my “Hold” rating for now, investors should keep a close eye on Barnes & Noble Education’s operating performance when the company reports crucial Q2/FY2025 results in early December.

aimintang

Note:

I have covered Barnes & Noble Education, Inc. or “BNED” (NYSE:BNED) previously, so investors should view this as an update to my earlier articles on the company.

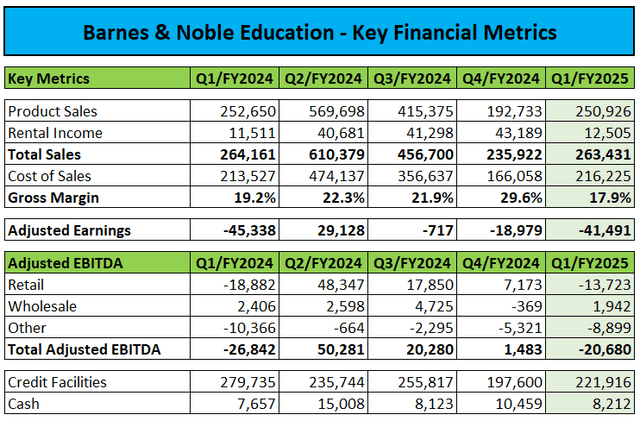

Two weeks ago, Barnes & Noble Education reported Q1/FY2025 results with revenues coming in slightly below consensus estimates and GAAP profitability impacted by charges related to the recent recapitalization transaction.

However, a 32% increase in First Day program revenues helped to offset sales pressure from store closures and a combination of cost savings and higher productivity resulted in a decreased Adjusted EBITDA loss.

Due to the recent recapitalization transaction, the company’s net debt position improved by more than 20% to $213.7 million.

On the flip side, consolidated gross margin was down by 130 basis points on a year-over-year basis. Management attributed this to several issues, including the impact of additional store closures, as also outlined in more detail in the company’s quarterly report on form 10-Q:

For the 13 weeks ended July 27, 2024, Retail Product and other gross margin decreased (160 basis points), primarily due to lower margin rates (125 basis points) for course materials due to higher markdowns, including markdowns related to closed stores and higher inventory reserves, unfavorable sales mix (100 basis points) due to lower general merchandise sales, primarily from graduation product sales and closed stores, and the shift to digital course materials, offset by lower contract costs as a percentage of sales (65 basis points) related to our college and university contracts as a result of the shift to digital and First Day models and lower performing school contracts not renewed.

In addition, cash used in operating activities increased by more than 20% year-over-year to $144.0 million as BNED was required to catch up on previously delayed vendor payments.

In the press release, management outlined expectations for improved profitability and meaningful operating cash flow in FY2025:

At this time, BNED is not providing formal guidance, but management’s budget goals target a material improvement in fiscal year 2025 GAAP operating results and Adjusted EBITDA versus last year.

Based on current estimates of capital expenditures and significantly reduced interest costs from last fiscal year, BNED believes it can drive meaningful operating free cash flow, which will be used to further de-lever its balance sheet.

With the federal government’s plan to end automatic textbook fees having been delayed by at least one year, the company’s near-term outlook has improved considerably. However, it will likely require a Trump victory for the overhang to lift.

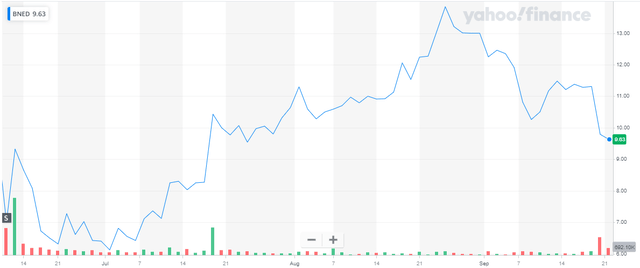

The successful recapitalization in combination with recent favorable regulatory developments had lifted the stock price to almost $14 by late August, but momentum has faded recently.

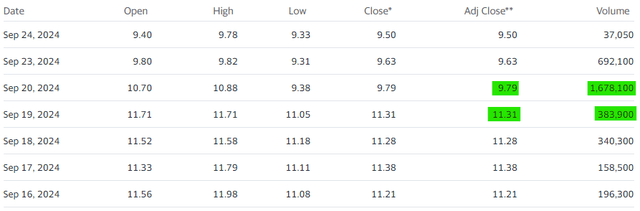

Last week, a surprise $40 million At-the-Market Sales Agreement (“ATM Agreement”) with BTIG caught market participants flat-footed as evidenced by Friday’s 13.5% selloff on much higher than average volume.

Quite frankly, with projected strong improvements in cash generation this year, why start diluting shareholders again?

While near-term sales under the ATM Agreement are not a given by any means, the timing ahead of the crucial Fall Rush seems unfortunate.

A weaker than expected operating performance in combination with open market sales would likely result in substantial selling pressure on the shares.

Given this issue, investors should keep a close eye on BNED’s sales and margins when the company reports its all-important Q2/FY2025 results in early December.

Bottom Line

Barnes & Noble Education, Inc. reported mixed Q1/FY2025 results with pressures from store closures largely offset by strong growth in the company’s First Day programs.

After favorable regulatory developments lifted the stock price to new post-recapitalization highs in late August, momentum has faded recently.

In addition, an ill-timed $40 million ATM offering in the midst of the company’s all-important second quarter has resulted in additional pressure on the shares.

As a result, investors should keep a close eye on Barnes & Noble Education’s operating performance when the company reports the all-important Q2/FY2025 results in early December.

For now, I am reiterating my “Hold” rating on the shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.