Summary:

- Barnes & Noble Education reported Q4 and full year earnings, showing a per-share loss for both periods.

- Revenue from BNC First Day increased 37% year over year to $474 million, a significant part of total revenue.

- The company faces risks such as heavy losses, competition in book-selling, seasonality, and potential dilution of shares.

FreshSplash/E+ via Getty Images

College bookstore giant Barnes & Noble Education (NYSE:BNED) has released its Q4 and full year earnings this week. The release shows a revenue miss and, as is common these days, a gaudy per-share loss both for the quarter and the year.

Still, not everything is bad, as we saw a shifting to the promising BNC First Day system, where course materials are included in the charge of the course itself. The total revenue for BNC First Day increased 37% year over year to $474 million.

Today we’ll be looking at Barnes & Noble Education in a more thorough way, learning what they offer as a company, how they’re unique, and whether their growth in First Day justifies the current market price.

Understanding Barnes & Noble Education

Barnes & Noble Education commands 1,245 physical and virtual bookstores for various colleges and institutes of learning. This gives them access to a market of 5.8 million students, and the textbooks for college courses tend to be expensive, which seems to be a good thing for a higher margin business.

The split includes 707 highly seasonal physical bookstores, alongside 538 virtual bookstores. According to the most recent 10-K, approximately 27% of schools operate their own bookstores, which Barnes & Noble Education is hoping to use as an opportunity to further grow their market share.

| Cash and Equivalent | $10.46 million |

| Merchandise | $344 million |

| Total Current Assets | $530.7 million |

| Total Assets | $905 million |

| Total Current Liabilities | $478.8 million |

| Long-Term Borrowings | $196 million |

| Total Liabilities | $834.5 million |

| Total Shareholder Equity | $70.6 million |

(source: 10-K from SEC)

This gives us a price/book value of about 2.53. Justifying paying that sort of premium is not hard, so long as the company’s growth is strong enough. Given Barnes & Noble Education hasn’t been profitable in recent earnings releases, and not even close, it’s going to be very difficult to justify paying such a premium to book.

The Shift to Digital Course Materials

It’s been a number of years since I went to university, but when I did, the campus had a Barnes & Noble Education-run bookstore. This was before the advent of e-books, and taking a course properly meant buying the often extremely expensive physical books.

Nowadays, at least some of the course material is available digitally, which reduces costs, though not necessarily with reduced margins, since the cost of delivering digital content is a mere fraction of the cost of buying physical printed material.

The big shift digitally is BNC First Day, which promises students to have digitally provided course materials available to them on the first day of class, and sees the fees for those materials to be added to the cost of taking the course.

BNC First Day isn’t just a growth spot in their portfolio, Barnes & Noble Education is seeing this as a substantial part of their total revenue, $474 million of their total revenue in fiscal year 2024 compared to $1.57 billion overall.

Understanding the Risks

Like any big company, Barnes & Noble Education comes with some risks. The biggest, obviously, is the fact that they’re nowhere near profitable, and not expected to be in the near-term. There are some other issues to be aware of, however.

Competition in book-selling is fierce. That’s true whether students are left to decide whether to buy physical books on Amazon or some third-party used store, or the physical campus bookstore, or online course material from the various websites like Akademos that may offer the books at a more affordable price.

That’s part of why BNC First Day is so appealing. Choice in material sources is removed from the student, and the money is just deducted from their accounts as part of the cost of taking the course. One can see why Barnes & Noble Education is emphasizing BNC First Day so heavily.

Which brings up the issue of seasonality. The textbook business is already seasonal in the extreme, as students are only buying their textbooks a few time per year. BNC First Day, ironically, shifts this season down the road a few weeks, as instead of a student buying his/her books before the classes begin, the revenue is only actually realized when the date for dropping the course ends and the student becomes locked In to taking the class, and by extension paying for the course material.

While virtual textbooks seem to be the wave of the future, it also carries a substantial risk to the 707 physical bookstores that Barnes & Noble Education owns. The less courses at these campuses that require a physical textbook, the less these stores have to sell, and the harder it is to justify their existence.

That is seemingly where the 538 virtual stores come in, and for the most part, it is. Yet, some publishers are taking the opportunity to cut out the middle-man and sell or rent their virtual textbooks directly to the students. In that scenario, there simply is no need for the retail outlet, physical or otherwise.

A shareholder amendment last month also increased the number of shares Barnes & Noble Education is authorized to release from 200 million to 10 billion. With only a bit over 26 million shares outstanding for the whole company, that would be a huge amount of dilution, and while there isn’t a specific plan to flood the market with paper, the fact that they pushed such an amendment at all is worrying, at least to me.

Growth, Such as it Is

| 2023 | 2024 | |

| Total Sales | $1.54 billion | $1.57 billion |

| Gross Profit | $349 million | $357 million |

| Net Loss | ($102 million) | ($63 million) |

| Diluted EPS | ($38.61) | ($23.75) |

(source: 10-K from SEC)

Here we can see Barnes & Noble Education’s good news and very, very bad news. The good news is the company’s total sales are relatively stable, and even growing slightly. Gross profit is also pretty stable. The bad news is that the company is hemorrhaging money, with per share losses that are many-fold greater than the share price.

This isn’t just a one-off, either. The estimates for fiscal year 2025 see another narrow growth of revenue, up to $1.62 billion, and the per-share losses dip back down to $37.00 per share. A relatively small company, Barnes & Noble Education, doesn’t have a crazy amount of coverage where we can take these estimates as absolute gospel. Still and all, the trend is for losses, and big losses at that.

Conclusion

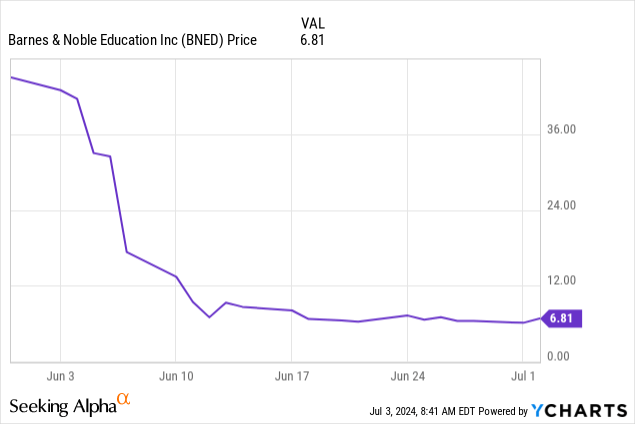

Barnes & Noble Education share prices plummeted after the huge reverse split the company went through, but have recovered a fair bit since the release of Q4 earnings. It is possible that investors saw the price decline and viewed it has having gone too far, trying to buy the shares at or near the recent lows.

And to be fair, there’s a real business here. I’m just not clear that the business is one, with all the concerns of modernization and virtual textbooks, is in a position to make any real money.

I hate to be a pessimist, which is why I almost never cover companies that aren’t buys or at least holds. From what I’ve seen in the course of researching, however, I just can’t recommend Barnes & Noble Education, even at these levels. The losses are too concerning, and there are just too many questions to say whether the company is ever going to become profitable, or return anything of value to shareholders. I’d say the recent price bump, modest though it is, is an opportunity to sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.