Summary:

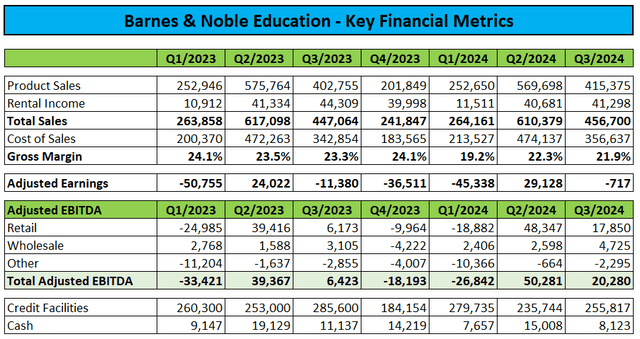

- Last month, Barnes & Noble Education reported better-than-expected Q3/FY2024 results and reiterated expectations for full-year Adjusted EBITDA of $40 million.

- Unfortunately, the company also warned investors of a potential equity offering “at a substantial discount to the current market price” thus causing a 15% selloff in the shares.

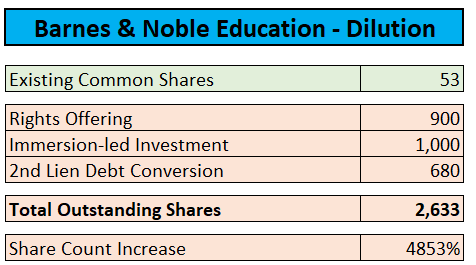

- On Tuesday, the company announced a number of transactions to strengthen the balance sheet and enhance liquidity. In aggregate, the company will issue 2.58 billion (!) new common shares.

- Existing shareholders should consider participating in the rights offering in order to significantly reduce their average purchase price and bet on the market assigning a higher valuation to the recapitalized company.

- However, given the massive risks associated with the recently proposed end to automatic text book fees, at least in my opinion, Barnes & Noble Education remains a highly speculative investment.

aimintang/iStock Unreleased via Getty Images

Last month, Barnes & Noble Education (NYSE:BNED) reported better-than-expected Q3/FY2024 results and reiterated expectations for full-year Adjusted EBITDA of $40 million.

Regulatory Filings and Press Releases

But despite the company’s operational turnaround seemingly progressing well, the stock sold off by more than 15% as market participants were scared off by a warning in the press release (emphasis added by author):

The Company is engaged in advanced and ongoing discussions with third parties to evaluate a range of options to strengthen its liquidity and financial position. The potential options under consideration include among other things, a refinancing, in whole or in part, of the Company’s obligations under the Credit Agreements, as well as a potential equity offering, which would likely be conducted at a substantial discount to the current market price of the Company’s common stock. There can be no assurance that any refinancing, equity offering, or other transaction will occur or, if any transaction occurs, that it will ultimately be consummated, or that the Company’s effort to strengthen its liquidity and financial position will be achieved.

Remember that the company has been at the mercy of its lenders for quite some time already. Last year, Barnes & Noble Education agreed to appoint a Chief Restructuring Officer and effect a “Specified Liquidity Transaction” until January 31, 2024 in exchange for an extension of its $380 million credit facility and some much-needed covenant relief.

As the company failed to comply with the deadline, a $3.8 million penalty had to be paid on January 31.

In addition, lenders imposed certain milestones for “liquidity and refinancing contingency plans” with respect to which the company was required to execute a binding commitment no later than April 10. The deadline was subsequently extended to April 15.

On Tuesday, the company finally announced the milestone transactions:

(…) Barnes & Noble Education, Inc. (…), a leading solutions provider for the education industry, today announced that it has entered into a definitive agreement with Immersion Corporation (…), and certain of the Company’s existing shareholders and strategic partners, on the terms of new equity and refinancing transactions that will significantly strengthen BNED’s long-term financial position. The proposed transactions, which are subject to shareholder approval and other closing conditions, will enable the Company to substantially deleverage its balance sheet, continue to strategically invest in innovation, and operate from a position of strength.

Upon close, which is expected in June 2024:

BNED will receive gross proceeds of $95 million of new equity capital through a $50 million new equity investment (the “Private Investment”) led by Immersion and a $45 million fully backstopped equity rights offering (the “Rights Offering”); the transactions are expected to infuse approximately $75 million of net cash proceeds after transaction costs;

The Company’s existing second lien lenders, affiliates of Fanatics, Lids, and VitalSource Technologies (“VitalSource”) (collectively, the “Second Lien Lenders”), will convert approximately $34 million of outstanding principal and any accrued and unpaid interest into BNED Common Stock; and

The Company has received commitments to refinance its existing asset backed loan facility, pursuant to an agreement with its first lien holders, providing the Company with access to a $325 million facility (the “ABL Facility”) maturing in 2028. The refinanced ABL Facility will meaningfully enhance BNED’s financial flexibility and reduce its annual interest expense.

In layman’s terms:

The company will issue 2.58 billion (!) new shares in exchange for $75 million in net cash proceeds and $34 million in second lien debt conversions.

The equity raise will be paving the way for refinancing the company’s existing credit facility with a new $325 million asset-based lending facility.

Even with existing shareholders being provided the chance to take part in the rights offering, the $50 million investment led by Immersion Corporation or “Immersion” (IMMR) and the $34 million second lien debt conversion will result in very substantial dilution:

Company Press Release / Regulatory Filings

Investors should also note the ugly terms of the rights offering and the Immersion-led investment as the company will be required to use more than 20% of gross cash proceeds to cover transaction-related costs including the backstop commitment.

From an investor perspective, the most important part of the transaction will be the rights offering (emphasis added by author):

Through the Rights Offering, BNED plans to issue up to 900,000,000 shares of its Common Stock at a cash subscription price (the “Subscription Price”) of $0.05 per share.

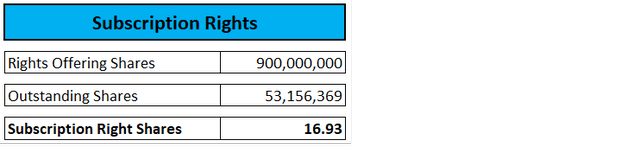

In the Rights Offering, BNED will distribute to each holder of its Common Stock on the record date one non-transferable Right, for every share of Common Stock owned by such holder on the record date, and each Subscription Right will entitle the holder to purchase the number of shares of Common Stock determined by dividing 900,000,000 by the total number of shares of Common Stock outstanding on the record date.

Each holder that fully exercises their Subscription Rights will be entitled to Over-Subscription Rights to subscribe for additional shares of Common Stock that remain unsubscribed as a result of any unexercised Subscription Rights, which allows such holder to subscribe for additional shares of Common Stock up to the number of shares purchased under such holder’s basic Subscription Right at $0.05 per share.

Pursuant to the terms and conditions of the Purchase Agreement, if any Subscription Rights remain unexercised upon the expiration of the Rights Offering after accounting for all Over-Subscription Rights exercised, the standby purchasers will collectively purchase, at the Subscription Price, up to $45 million in shares of Common Stock not subscribed for by the Company’s stockholders (the “Backstop Commitment”).

With 900 million shares being issued in the rights offering and approximately 53.2 million shares outstanding as of today, each right will entitle the holder to purchase approximately 17 new shares at a price of $0.05 per share:

Press Release / Regulatory Filings

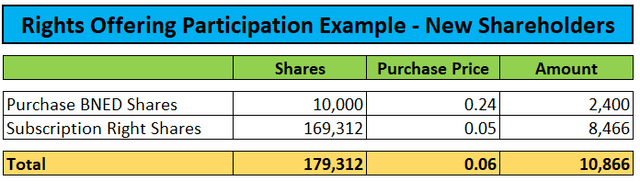

To provide an example:

Purchasing 10,000 shares at today’s price of $0.24 would include the right to subscribe to another 169,312 shares at a price of $0.05 for a total average purchase price of $0.06:

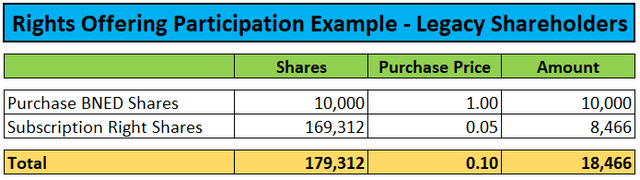

Should the post-transaction share price move above $0.06, participation in the rights offering would result in a gain for current buyers. However, legacy shareholders would require a much higher share price to break-even.

For instance, a legacy position with an average purchase price of $1.00 would require a post-transaction share price of $0.10 to break even:

For shareholders who decide against exercising their subscription rights, dilution would amount to 98%. Exercising the rights would limit dilution from the Immersion-led investment and the second lien debt conversion to approximately 64%.

On the flip side, the transaction will improve the company’s capital structure and liquidity quite meaningfully.

Before Tuesday’s announcement, the company’s enterprise value was slightly below $300 million or approximately 7x projected FY2024 Adjusted EBITDA of $40 million.

With current debt and liquidity issues soon behind the company, one can certainly make the case for assigning a higher multiple – however, with the business facing severe headwinds from a proposed near-term end to automatic book fees, Barnes & Noble Education’s prospects have worsened considerably as of late.

Given this all-important issue, it is difficult to assign a reasonable forward valuation to the company but at 8x EV/Adjusted EBITDA, the post-transaction price target would calculate to $0.07.

While I shorted the shares after last month’s disclosures, I decided to cover my position as staying short would have resulted in also being short the subscription shares. Moreover, with many brokers imposing sky-high margin requirements on the shares, I would strongly advise against shorting the stock here.

Bottom Line

Barnes & Noble Education successfully addressed its long-standing debt issues but, as usual, common equity holders will be paying the price.

However, shareholders will be able to limit dilution by participating in the rights offering.

While the proposed transaction will improve Barnes & Noble Education’s balance sheet and liquidity, the potential end of automatic book fees imposes a major risk to the business.

With severe share price damage done already, existing shareholders should consider participating in the rights offering in order to significantly reduce their average purchase price and bet on the market assigning a higher valuation to the recapitalized company.

But given the massive risks associated with the proposed end to automatic text book fees, at least in my opinion, Barnes & Noble Education remains a highly speculative investment.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.