Summary:

- Barnes & Noble Education reported decent Q2/FY2025 results, driven by strong growth in First Day program contributions and ongoing cost savings initiatives.

- While revenues were down slightly due to additional store closures, Adjusted EBITDA of $66 million increased by more than 30% on a year-over-year basis.

- However, persistent shareholder dilution in combination with a lack of investor communication and recent key executive resignations is keeping my from getting more constructive on the shares.

- Considering the renewed overhang from this week’s $40 million shelf registration, I am reiterating my “Hold” rating on the shares.

aimintang

Note:

I have covered Barnes & Noble Education, Inc. or “BNED” (NYSE:BNED) previously, so investors should view this as an update to my earlier articles on the company.

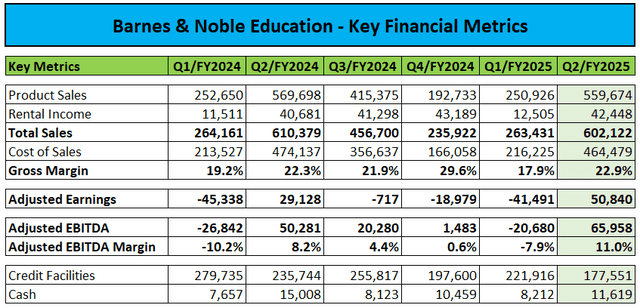

Earlier this week, Barnes & Noble Education reported Q2/FY2025 results in line with the preliminary numbers released on November 7:

Company Press Releases / Regulatory Filings

While total sales were down slightly on a year-over-year basis, mostly as a result of additional store closures, comparable store sales were up 3.8% during the quarter.

More importantly, First Day program contributions continued to increase:

Revenues from BNC First Day® programs increased by $36.2 million, or ∼18%, as First Day® Complete continues to see rapid growth in institutional adoption, with a total of 183 campus stores utilizing First Day Complete in the fall 2024 term with a total enrollment of approximately 925,000* undergraduate and graduate students, up from 800,000 in the prior year.

The company’s cost savings and productivity initiatives resulted in Adjusted EBITDA increasing by more than 30% to $66.0 million.

On the flip side, free cash flow of $41.5 million was down by more than 30% due to higher receivable levels resulting from the growth of the company’s First Day programs and timing of vendor payments.

In the press release, management celebrated the improved results and reiterated its targets for the current fiscal year:

Our second-quarter performance during the pivotal fall back-to-school season underscores the exciting progress we’re making in our business transformation. Strong adoption of our First Day affordable access programs, exceptional retail execution supporting our client institutions, and a disciplined focus on operational efficiency are reflected in our outstanding results. We are confident in our improving momentum and the opportunities ahead.

The Company’s budget goals continue to target a material improvement in fiscal year 2025 GAAP operating results and Adjusted EBITDA versus last year. Based on current estimates of capital expenditures and significantly reduced interest costs from last fiscal year, BNED believes it can drive meaningful operating free cash flow, which will be used to further de-lever its balance sheet.

While BNED’s operating performance appears to be on track for substantial year-over-year improvement, recent corporate developments and actions continue to raise eyebrows among market participants.

On September 19, the company surprisingly disclosed a $40 million open market sales agreement with BTIG which was completed last month.

In aggregate, BNED sold close to 4 million shares at an average price of approximately $10 into the open market thus increasing outstanding shares by approximately 15%.

With the recent recapitalization having improved the company’s balance sheet and liquidity considerably, there was no urgent need to dilute common shareholders even further.

However, management apparently decided to take advantage of the renewed investor interest:

The proceeds of this capital raise will reduce go-forward annual interest expense by nearly $4 million per year, reduce risk, accelerate our ability to win new customers, and enhance our strategic and balance sheet optionality. In the medium-term, management is seeking to reduce annual interest expenses to around $10 million or less.

With the last sentence already hinting to further equity sales, I wasn’t exactly surprised to see the company filing a new $40 million shelf registration on Tuesday. However, market participants appear to have been caught flat-footed as evidenced by Thursday’s trading action:

Please note that BNED has not yet disclosed a new open market sales agreement.

While persistent dilution for no real fundamental reasons certainly isn’t great news, I was far more surprised by the concurrent resignations of the company’s Chief Financial Officer and Chief Accounting Officer last week:

On December 2, 2024, Kevin Watson notified the Company of his resignation as Executive Vice President and Chief Financial Officer, effective January 4, 2025.

In connection with Mr. Watson’s resignation, the Company has entered into a Transition and Separation Agreement with Mr. Watson which provides for a lump sum cash severance payment of $270,000, subject to appropriate withholdings, and COBRA continued health care coverage at the premium level in effect prior to the resignation for Mr. Watson and his dependents for two months, in exchange for a release of claims against the Company.

On December 2, 2024, Seema Paul notified the Company of her resignation as Chief Accounting Officer, effective December 27, 2024.

However, both executives have signed this week’s quarterly report on form 10-Q, so I wouldn’t attribute the resignations to disagreements over accounting issues.

Remember, that the recapitalization transaction in June resulted in Immersion Corporation or “Immersion” (IMMR) becoming the company’s controlling shareholder. Subsequently, BNED’s long-standing CEO Michael Huseby was replaced with Jonathan Star, the President of the company’s College division.

Given this issue, the year-end resignations might just be a continuation of the company’s management reshuffling efforts.

On a final note, the outcome of the U.S. elections appears to have lifted the overhang resulting from the current administration’s plan to end automatic textbook fees, which is a major positive for the company.

Bottom Line

While Barnes & Noble Education reported decent Q2/FY2025 results driven by increased First Day program sales and ongoing cost savings initiatives, the decision to dilute shareholders even further without any real fundamental needs is perplexing.

In addition, similar to its new controlling shareholder Immersion Corporation, the company has stopped holding quarterly conference calls, thus largely limiting investor communications to press releases and regulatory filings.

While improved results and the removal of the overhang from a potential end to automatic textbook fees could justify a higher valuation, I continue to struggle with persistent dilution and lack of investor communications.

Investors looking for the bull case on Barnes & Noble Education should consider reading fellow contributor’s “The Minotaur” most recent discussion of the company which has been published earlier this month.

Considering the renewed overhang from this week’s $40 million shelf registration, I am reiterating my “Hold” rating on the shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.