Summary:

- Nvidia Corporation’s current success is largely due to its efficient software, CUDA, which supports only Nvidia chips and has a broader developer base than competitors.

- The company’s “moat” could be eroded by competitors like Amazon, Alphabet, and Microsoft investing in open-source alternatives to CUDA, potentially reducing Nvidia’s hardware margins.

- Investors should remain alert to potential challenges and focus on Nvidia’s ability to maintain its innovative edge and deliver superior chipsets in the market.

Nikada

NVIDIA Corporation (NASDAQ:NVDA) is undeniably experiencing a noteworthy surge. However, the question of how long this upswing can be sustained merits consideration.

At first glance, it might appear that Nvidia’s momentum could carry on indefinitely, given the seemingly impregnable moat the company has built around itself. This article aims to delve into what this “moat” signifies and explore the possible factors that could gradually erode it over time.

The Nvidia Moat Explained

To grasp why Nvidia is experiencing such an upswing, it’s crucial to first comprehend the nature of the company’s operations.

For almost three decades, Nvidia has specialized in the sale of Graphics Processing Units (GPUs) or graphic cards. Primarily, and for the greater part of its history, these graphic cards were employed to generate graphics in video games. However, it was gradually realized that these units could be effectively utilized for complex mathematical calculations.

Coincidentally, intensive mathematical computation is precisely what AI development demands. GPUs are uniquely designed to distribute a problem among multiple “workers.” Central Processing Units (CPUs) can perform similar tasks, but lack the expansive pool of ‘workers’ to scale things to the level GPUs can.

While Nvidia is a prominent name in the GPU manufacturing industry, it isn’t alone. Another notable contender is Advanced Micro Devices, Inc. (AMD). AMD’s chips can potentially be utilized similarly to Nvidia’s, if developers are willing to invest the necessary effort. This brings us to the essence of Nvidia’s ‘moat’ – the considerable effort that goes into development.

Setting aside the fact that Nvidia arguably creates the best GPUs money can buy, another question arises: “What else does Nvidia do?” The answer is software, specifically, the CUDA framework.

CUDA, which stands for Compute Unified Device Architecture, is a framework developed by Nvidia that enables software engineers to construct accelerated computing applications. This platform is easier to use, better supported, and has a broader developer base than its competitors. However, the real game-changer for Nvidia investors is that CUDA only supports Nvidia chips.

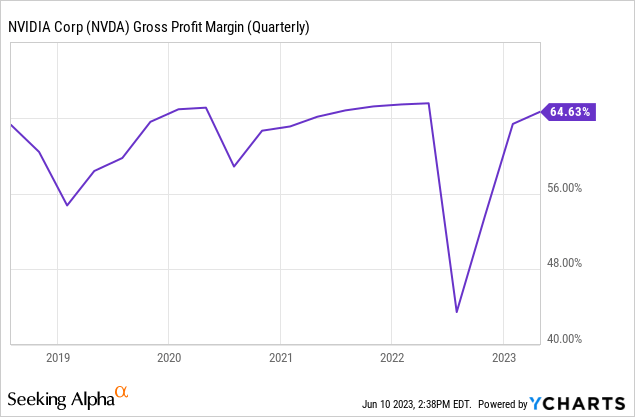

Thus, the “moat” Nvidia has built is essentially software, software so efficient that the company manages to sell its accompanying hardware at nearly 75% margins (data center). It just so happens that this hardware is arguably the best in the market, and Nvidia continues to invest considerable effort to maintain this status quo.

How To Erode The Moat

Eroding Nvidia’s “moat” is a process that will undoubtedly take time. It’s improbable that a single sudden event will cause Nvidia stock to plummet. Instead, the erosion is likely to be gradual, fueled by the consistent efforts of Nvidia’s competitors, which just so happen to be the company’s largest customers.

Nvidia’s primary customers are “data centers.” They contributed roughly $15B to the company’s revenues in the fiscal year 2023, driving much of the current Nvidia hype. These data centers are primarily operated by industry titans such as Amazon.com, Inc. (AMZN), Alphabet Inc. (GOOGL) aka Google, and Microsoft Corporation (MSFT).

Consider Jeff Bezos’s words, “your margin is my opportunity.” This sentiment is particularly relevant in the context of Nvidia. AWS, Azure, and Google Cloud are heavily reliant on Nvidia’s chipsets. If there is a viable way to sidestep a 70% margin, rest assured they will pursue it.

The critical question then arises – will they succeed? The answer is complex and far from straightforward.

Each year, over $200B is allocated for upgrading and maintaining data centers, with much of this budget being spent on traditional components like CPUs and memory. As this expenditure shifts towards accelerated computing, Nvidia stands to reap substantial benefits, unless the industry’s hyperscalers decide to enter the field.

This isn’t mere speculation. Google already has its range of Tensor Processing Units (TPUs) that compete with Nvidia’s GPUs. In a recent announcement, Google claimed that its fourth-generation TPUs outperform Nvidia’s A100 GPU by being 1.7 times faster and 1.9 times more efficient. This competitive dynamic could lead to the commoditization of hardware, with software emerging as the key differentiator.

Here, CUDA makes all the difference. Without CUDA, Nvidia’s “moat” wouldn’t exist. So, while discussing the erosion of this “moat,” it’s worth delving into the potential erosion of CUDA. Our hyperscalers – Amazon, Google, and Microsoft – are awash with cash. They could invest in competing open-source alternatives to CUDA.

Names like OpenCL, OpenGL, PyTorch, and Triton could potentially challenge CUDA in the near future. If these platforms garner substantial support from cash-rich tech firms reluctant to pay hefty margins, the timeline for this potential transition could be significantly expedited.

What This Means For Investors

Investors should remain alert to the potential challenges Nvidia could encounter in this space a few years from now. It would be imprudent for investors to solely rely on Nvidia’s current gross margins and project them unaltered into the future, as they are likely to diminish.

Rather, investors should look forward to the company maintaining its innovative edge and continuing to deliver the most superior chipsets in the market. If Nvidia can sustain this, it will undoubtedly remain one of the world’s largest companies and could potentially validate its current valuation.

Investors should also expect the company to persistently advocate for accelerated computing in the near term. As the current uncontested leader in this domain, Nvidia is well-positioned to reap the benefits from investments in a future where hardware margins are more likely to range between 30-50%, rather than exceeding 65%.

Long-Term Vision

Nvidia’s future viability as a successful enterprise a decade from now is undeniable. Backed by what many perceive as a passing trend, it’s set to become one of the world’s largest companies. However, the question of “how large?” is one that warrants exploration. Let’s consider two potential scenarios.

The following scenarios focus exclusively on Nvidia’s “Data Center” division, rather than the entire company. If other areas such as gaming, virtualization, automotive, or yet undiscovered industries also see substantial growth, Nvidia investors could be poised for significant returns.

Scenario 1 – The Super Bull

In a hyper-bullish scenario, CUDA would maintain its supremacy as the primary platform for interfacing with GPUs. Although companies like Google may develop Tensor Processing Units (TPUs) and other enhancements, GPUs would still hold sway.

Hyperscalers would continue to populate their server racks with Nvidia-manufactured hardware. Although margins might be leaner than they are today, a dominant 60% margin seems probable.

Accounting for global data center growth and a shift towards more accelerated computing, it isn’t far-fetched to predict that accelerated computing could burgeon into a $150-200B market by the end of the decade. This might seem exaggerated, but remember that the data center market is projected to surpass $600B by 2030.

In this super bull scenario, with CUDA reigning supreme, Nvidia would likely capture the lion’s share of this market, leading to top line revenues of $150B, or $90B in gross income at a 60% margin.

Applying margins comparable to Nvidia’s current levels, the company could generate roughly $32B in net income from the data center division alone. With a monopolistic premium of 25-30x sales, Nvidia’s data center segment could be valued between $800B and $960B.

Scenario 2 – The Meh!

In a more “meh” scenario, Nvidia would still be considered a dominant player. However, the game changes as the hyperscalers themselves decide to participate. In this scenario, Nvidia represents the “premium” product.

Greater competition inevitably leads to squeezed margins, likely around 35%.

Despite the reduced margins, the market size remains significant. However, Nvidia is likely to secure only a smaller portion of it. If it captures 60% of the market, Nvidia could see revenues of $90B. The considerably trimmed margin would yield the company a gross of $31.5B, and approximately $10B in net income.

In this scenario, Nvidia’s data center business would be valued in the ballpark of $200B-$300B.

Closing Thoughts

The above scenarios paint quite divergent paths for Nvidia Corporation’s future. Unfortunately for Nvidia, the more modest “Meh” scenario appears more likely at this time.

As I’ve previously mentioned, it seems unlikely that data centers will indefinitely tolerate paying a premium, and this is one of the most significant risks facing Nvidia.

So why maintain a “hold” position? There’s a chance Nvidia Corporation could successfully navigate these challenges. By making the right investments to preserve its software supremacy, Nvidia could continue to present itself as the optimal long-term solution. If it succeeds, a $2-3T valuation in the long term doesn’t seem too outlandish. The “hold” recommendation takes into account the possibility that things may not unfold as smoothly.

Deeper Dive?

I recently released this breakdown on Nvidia to YouTube. It covers the basics, why Nvidia is perfect for AI, and more.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.