Summary:

- Both Home Depot and Lowe’s are high-quality businesses that saw their sales decline in Q3.

- This led both company management teams to trim fiscal year guidance.

- Both offer safe, and growing dividends allowing investors in search of dividends to sleep well at night.

- With the higher for longer environment and expected recession, both companies will likely continue to face downward pressures going into 2024.

- Value seeking customers also continue to affect both companies, but one company in particular seems to be taking advantage.

hapabapa

Introduction

Both Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) operate similar businesses and recently reported Q3 earnings earlier this month. Both saw sales decline in the quarter, leading both to trim their guidance. LOW and HD are both safe, high-quality businesses with LOW being a dividend king and HD a dividend aristocrat. 2023 is coming to an end soon but it has shaped up to be an uneventful and challenging year for many stocks. With the macro environment continuing to place pressure on these going into 2024, next year could see more of the same as a result of the higher for longer environment. While many stocks are still overvalued, some now offer investors good entry prices, especially those with a long-term outlook. In this article, I get into why both stocks have disappointed this year, remain strong investments, and which one is currently the better buy.

Recent Earnings

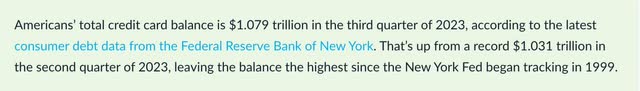

Home Depot reported Q3 earnings about a week earlier than their peer on November 14th. Both sales and EPS were down from the year prior. Sales of $37.7 billion were down 3%, or $1.2 billion from Q3 ’22. EPS was also down more than 11% from $4.24 year-over-year at $3.81. It’s obvious the current macro environment is taking a toll on the sector as consumer spending is tighter due to high interest rates and credit card debt. U.S. stores had negative comp sales of 3.5%.

Lumber, copper, and wire deflation all negatively impacted results. This caused management to lower guidance and they now expect fiscal year sales to decline 3% to 4%. Management stated that in the quarter customers continued to focus on smaller projects instead of larger ones. This caused big-ticket transactions over $1k to drop 5.2%. Like I previously mentioned, the macro environment is starting to have a larger effect on consumers.

Coupled with the surging credit card debt, consumers are being more selective with their spending. Both management teams are aware of these changing consumer spending habits and addressed this in Q3 earnings, and expects this to continue going into 2024. A little later in the article I talk about how both plan to take advantage of this. But in my opinion, I don’t see this changing until interest rates start to come down, which is likely in the second half of next year. Until then, I see HD continuing to face pressures over these next few quarters.

lendingtree

Their peer, Lowe’s, also experienced a sales decline in Q3. Like HD, during Q3 the company beat EPS estimates by $0.04 at $3.06 but missed on revenue by $390 million. Sales decreased 7.4% due to lower discretionary spending. This caused management to trim their sales forecast and EPS. Sales are now expected to be $86 billion for the year vs the prior range of $87-$89 billion. EPS is also expected to be slightly lower at $13.00 vs the prior range of $13.20 to $13.60. Like their peer they also saw increased pressure on big ticket purchases.

LOW actually saw a much larger decrease in sales as 75% of their revenue is driven by DIY customers, who purchase big ticket items like appliances, flooring, etc needed for home renovations. Management expects this to continue into the new year as well. Both companies may have disappointed on earnings due to the decline in sales, but I don’t think it was all that bad everything considered. As you can see below, both are down over the last year roughly the same, 5%. Unlike their peer whose gross margins declined by 20 basis points in Q3, Lowe’s was actually up by 36 basis points, benefiting from ongoing merchandising PPI initiatives, as well as favorable product mix and lower transportation costs.

Seeking Alpha

Growth Outlook

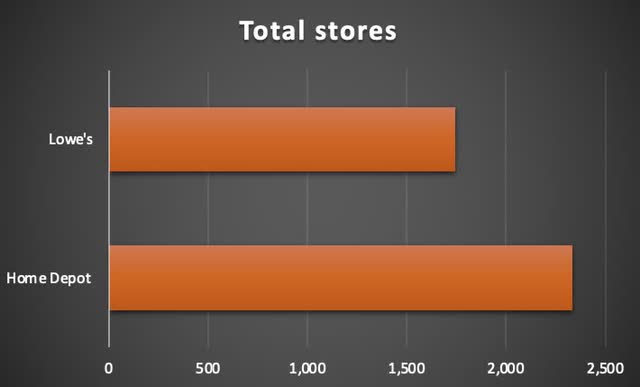

During the third quarter both opened new stores to continue on the path of unlocking new growth. New stores = increased growth opportunities. HD opened 7 new stores bringing their total to 2,333. LOW only opened one new store, but took advantage opening 15 additional outlet stores bringing their total to 1,746. While HD opened more stores, LOW opened smaller, format stores. Reason being is to leverage the lower cost of real estate in trade areas closer to their core customers without cannibalizing nearby, larger Lowe’s stores.

I think opening smaller stores is a smart move by the company as consumer spending habits are changing. More customers are seeking value as the cost of goods & services are continuing to rise exponentially, and these stores are expected to take advantage of this going forward. These stores sell damaged, discontinued, and slightly used items.

This allows customers to save between 25% to 70% off on these items. In today’s environment, imagine your washer or dryer breaking. Would you want to spend over $700 for a new one? Or get a slightly used one for cheaper at a quality company like Lowe’s? Most customers right now will take the number 2 option. This will also suit the company well if the economy enters into a recession in my opinion. HD stated in Q3 how they plan to shift focus away from DIY customers because of the decline in the quarter to professionals as the segment has an addressable market of $475 billion, in which they have little market share.

Author

With both companies’ fiscal years ending and sales expecting to continue facing downward pressures in Q4 and into next year, we take a look at both companies’ financial growth over the next two years. Both companies are conservative, and their financial growth is expected to reflect that in the near future. Home Depot is the larger of the two so it’s no surprise they are expected to post more growth in their financial metrics.

Author

Free cash flow is expected to decline in the next two years by nearly 4% while revenue & earnings are expected to grow 5% and 6%, respectively. LOW is expected to post single-digit growth in all three metrics. Their FCF is expected to increase the most at 8.7% while revenue & earnings are expected to post near identical growth of 3.5% and 3.4%, respectively. So, even though HD is the larger of the two, LOW is expected to outperform the latter in free cash flow growth over the next two years.

While I suspect both companies will faces pressures going forward from the macro environment, I remain confident in both ability to maneuver through tough environments as seen by long histories. I expect conservative, single-digit growth numbers from both and also expect them to exceed analysts’ expectations on earnings and revenue. HD reported a growth of 5% in online sales while LOW reported a decline of 4%.

But I expect this to pick up as consumers shop for sales to include Black Friday, Cyber Monday, and the Christmas holiday. Furthermore, as both companies shift focus towards changing spending habits, I see both companies capturing growth in this area for the foreseeable future.

Dividend Safety & Growth

Speaking of cash flow, cash is king in my book. But not when it comes to holding it; it’s when a company can generate a significant amount to cover its dividend. As most know, the more cash, the more likely for a lower FCF payout ratio. Which in turn means a safer dividend, more cash to reinvest back into the business, and a higher chance for sustained dividend growth. As a dividend investor, growth and safety are my priorities when looking to invest.

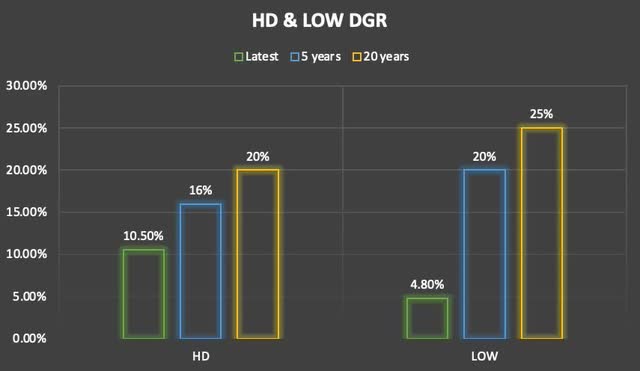

Yield is important as well, but having a well-rounded, diversified portfolio is key. Both of these are dividend growers and offer some nice growth for the long-term. When it comes to this, HD has the edge with 10.5% DGR in the last year compared to nearly 5% for LOW. But over the long-term, LOW beats out its peer with 20% and 25% over 5 & 10-year periods. In comparison, HD is close at 16% and 20% over the same time frame.

Author

Seeking Alpha’s Quant system gives HD a dividend safety grade of C- and LOW a grade of D. Since 2020, LOW has had a lower FCF payout ratio with an average of 33.5%, compared to HD’s roughly 53%. In the next 12 months, HD’s is expected to increase while LOW’s is expected to decline slightly.

For the record both dividend payouts are well-covered by earnings & free cash flow, and although they face downward pressures going into 2024, I see both dividends continuing to be safely covered. Even with Home Depot’s FCF expected to drop in the next two years, I expect them to safely cover it for the foreseeable future. If anything the company can just ease up or pause repurchasing shares.

Are Both A Buy, Hold, Or Sell?

As previously mentioned, both are down nearly 5% in the past year. At the time of writing, Lowe’s is trading roughly $30 lower than back in September while HD roughly $20 cheaper. Home Depot’s forward P/E is trading roughly in-line with its 5-year average while their peer is trading slightly lower than theirs. They also offer more upside to their price target of $226 than HD’s price target of $330.50

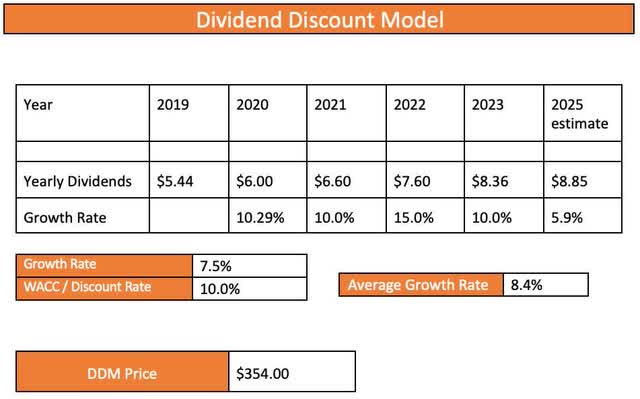

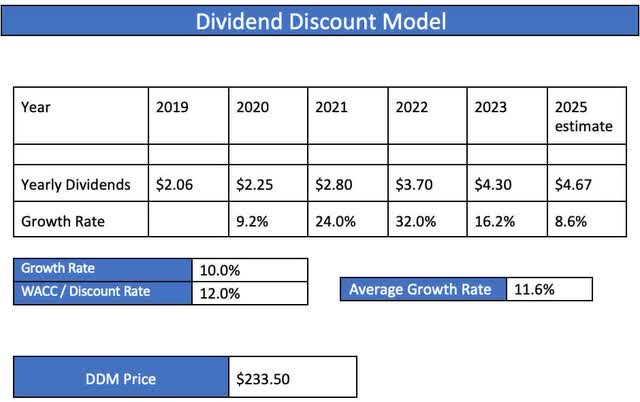

In my opinion, both are great stocks that offer long-term investors a safe, and growing dividend. Additionally, these are both sleep well at night stocks but like the great Warren Buffett believes, price is what you pay, value is what you get. And right now, LOW is the better bargain. Using the dividend discount model for HD brings me to a price target of $354 using January 2025’s estimates.

Author

Both HD & LOW are quality stocks, so instead of my usual 8% WACC being a conservative investor, I instead use 10% and 12%. Reason being is the higher-quality business models and long-term DGR’s. I also decided to be more conservative with the decline in sales due to tighter consumer spending and an expected recession. It’s always better to be more conservative and manage expectations than to get too overly optimistic. For Lowe’s, I have a price target of $223.50, slightly below SA’s price target of $226. Using the DDM, HD offers more upside at nearly 14% compared to Lowe’s near 12%.

Author

Risk Factors

With home sale prices increasing because of the rise in interest rates, I think both companies will face some significant headwinds for the foreseeable future. As previously mentioned, both companies reported a decline in sales during Q3. This is apparent because of the macro environment as consumers are feeling the effects of higher rates. The surge in home prices along with consumer goods also restrain consumers from spending more at stores like Home Depot and Lowe’s.

And then there’s also credit card debt that’s continuing to rise as well. But both management teams are expecting this as seen by their trimmed guidance during their last earnings calls. Until rates start to decline, I see both companies dealing with this over the next few quarters. And if a recession happens, it could impact sales even further, likely affecting both stocks’ valuations negatively going forward.

Bottom Line

Both Lowe’s and Home Depot are high-quality, lower risk businesses that have experienced some headwinds because of the current macro environment. And I expect these to continue going forward. If so, these will likely have an effect on both companies’ valuations, offering investors better entry prices into both. Both beat analysts’ estimates on EPS but disappointed on sales as both experienced declines. Additionally, LOW saw their margins increase 36 basis points while HD’s declined by 20.

Although both companies continue to grow their store counts, LOW continues to focus on opening outlet stores to capture growth from value-seeking customers, which is a smart move in my opinion. Both are safe, high-quality dividend stocks that offers investors growth for the long-term. But due to LOW’s higher dividend growth rate and lower FCF payout ratio, this makes them the stronger buy at this time in my opinion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.