Summary:

- Bavarian Nordic specializes in vaccines for infectious diseases and immuno-oncology therapies, with Jynneos being a featured vaccine.

- Jynneos, Bavarian’s vaccine for smallpox and monkeypox, is the only FDA-approved option for both conditions.

- Bavarian Nordic’s 2024 revenue guidance is between $710 million and $750 million, influenced by fluctuating public health demands.

- Bavarian Nordic offers a cautious “buy” opportunity, with risks tied to the uncertain future demand for its Jynneos vaccine.

MicroStockHub/E+ via Getty Images

Bavarian Nordic: Navigating the Complexities of a Vaccine-Driven Market

Bavarian Nordic (OTCPK:BVNRY) (OTCPK:BVNKF) is a Danish biotechnology company specializing in the development, manufacturing, and commercialization of vaccines for infectious diseases and immuno-oncology therapies. Bavarian Nordic’s proprietary MVA-BN technology platform is the key asset that enables vaccine development. A featured vaccine is Jynneos. It is the only FDA-approved vaccine for both smallpox and monkeypox in the U.S., with corresponding approvals in the EU and Canada (Imvanex and Imvamune, respectively). The company also has vaccines approved for rabies (Rabipur) and tick-borne encephalitis (Encepur). MVA-BN RSV is in late-stage clinical trials for RSV, a $5.8 billion market expected to grow at a CAGR of 12.8% over the next few years.

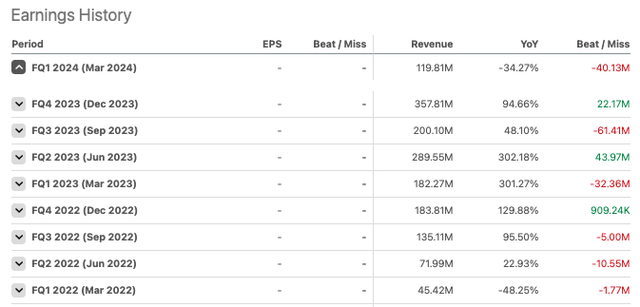

Given the markets in which Bavarian operates, it is unsurprising that revenue fluctuates, though it is noticeably higher now than in previous years. This is largely associated with recent monkeypox outbreaks.

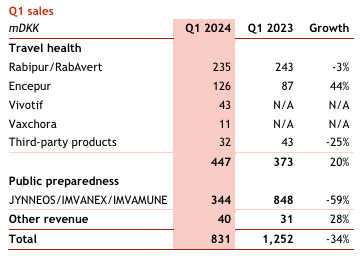

According to Seeking Alpha data, total revenue for 2023 was $1.046 billion. Gross profit was $764.3 million. Bavarian reported an operating income of $323.1 million. Bavarian recognizes revenue from two main segments: public preparedness and travel health. Recall that Bavarian Nordic acquired Emergent BioSolutions’ (EBS) travel vaccine portfolio last year for $274 million. This included Vivotif for the prevention of typhoid fever and Vaxchora for the prevention of cholera. Their public preparedness segment made up the majority of revenues for 2023, coming in at $703.78 million. The two segments were more balanced in Q1 2024 as Jynneos’ revenues waned following the 2022–2023 monkeypox outbreak.

Bavarian Nordic

Revenue for 2024 is expected to be between $710 million and $750 million, with EBITDA ranging from $154 million to $189 million. Please keep in mind that these financial numbers have been converted from DKK to USD and may differ from source to source due to exchange rates.

However, there have been significant global developments that may alter their full-year outlook. On Wednesday, the World Health Organization [WHO] declared the monkeypox outbreaks in Africa a “global emergency.” To date, “more than 14,000 cases and 524 people have died,” implying a death rate of up to 4%, or one in every 25. On Thursday, Swedish officials reported the first monkeypox case, similar to the more infectious variants out of Congo. On Friday, it had spread to Pakistan. Bavarian’s vaccine, Jynneos, is approved in the US and Europe for monkeypox. But it is not widely available, especially in places like Africa where access to healthcare is poor, which can result in outbreaks. It is typically reserved for high-risk groups, such as healthcare workers and immunocompromised individuals. Because of the declaration, health authorities may soon launch a campaign to promote monkeypox vaccinations, particularly among high-risk groups. Being that Jynneos is the only vaccine approved for monkeypox, the global emergency could develop into a significant windfall for Bavarian. On Thursday, Bavarian discussed their plans to expand their capacity for Jynneos, aiming to supply up to 2 million shots this year and 10 million by the end of 2025. Depending on the pricing structure, 10 million doses at $100 per dose, for example, could add $1 billion in revenue. Whether or not anything major will come from this remains quite uncertain (e.g., how widespread the disease will become and how governments will respond to it). In addition, EU authorities see monkeypox as having “low impact if precautions are taken.” This is because monkeypox is typically transmitted via close physical contact.

Financial Health

Turning to their balance sheet, as of March 31, Bavarian reported $331.7 in cash and short-term investments. Total current assets were $696.8 million, while total current liabilities were $424.6 million. This implies a current ratio > 1, which suggests the company can reasonably cover any short-term obligations. Bavarian is without significant long-term debts.

As Bavarian reported positive cash flow in 2023, I will not provide an estimate for cash runway. However, it should be noted that, due to the nature of their business, any changes in revenue, which would not be surprising, could significantly alter this outlook.

Risk/Reward Analysis and Investment Recommendation

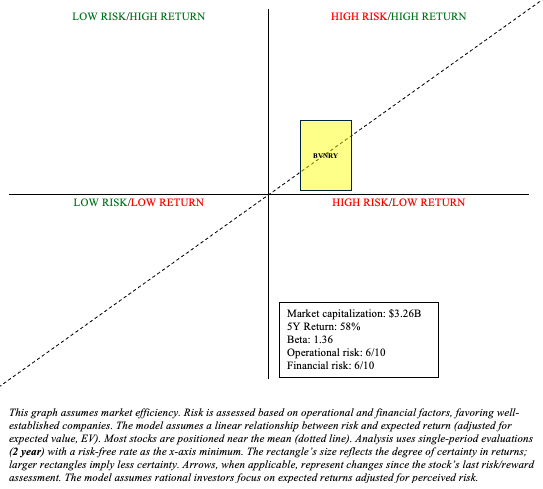

Bavarian’s stock has risen nearly 50% in the last week. So, I believe investors have already priced in a significant portion of the potential windfall from the emergency declaration. BVNRY is certainly a Quadrant 1 investment (high risk/high reward) but offers less risk compared to peers like Emergent BioSolutions, which has a total debt to equity of 226.96%, and SIGA Technologies (SIGA), which is heavily reliant on one drug and one or two customers.

Author

BVNRY has its place in a barbell portfolio (“buy“), but be aware of the risks here. The demand for Jynneos is heavily dependent on the prevalence and severity of monkeypox outbreaks. Moreover, responses from government agencies can vary significantly. Some may not prioritize large-scale vaccination programs. Importantly, expanding capacity can be a double-edged sword. If the monkeypox outbreak is contained quickly, there may not be enough demand for the vaccine, resulting in significant inventory losses. Governments could also negotiate lower prices from large contracts, limiting profitability. Also, while Jynneos is currently the only FDA-approved vaccine for monkeypox, future competitors or alternative treatments could emerge and threaten Bavarian’s market positioning. Finally, any regulatory delays (e.g., expanded label to include adolescents) or challenges in scaling production could hinder Bavarian’s ability to meet production targets.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.