Summary:

- Bavarian Nordic’s mpox vaccine sales have declined post-outbreak, causing reduced revenue and highlighting its reliance on outbreak-driven demand.

- The company’s Travel Health segment demonstrated strength, driven by rabies and tick-borne encephalitis vaccine sales, with a 21% revenue increase YoY.

- Bavarian is pursuing diversification, including the chikungunya vaccine launch, which targets a growing $500 million market by 2032.

- Financially, Bavarian maintains adequate liquidity with $262 million in cash and minimal long-term debt, balancing short-term liabilities well.

- Despite volatility, Bavarian’s diversification strategy and global health positioning support a continued “buy” recommendation for long-term investors.

Richard Drury

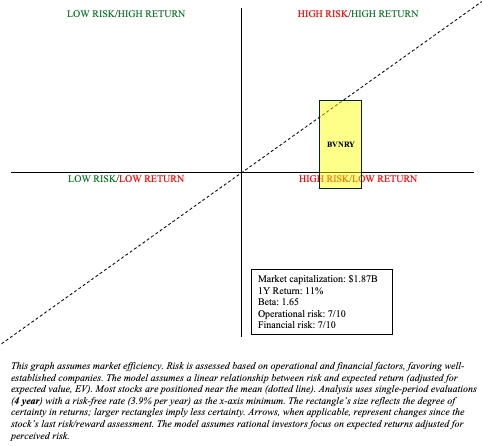

My last assessment on Bavarian Nordic (OTCPK:BVNRY), a Danish-based company, followed the World Health Organization [WHO] declaring the mpox outbreaks in Africa a “global emergency.” I posited that Bavarian, with the only FDA-approved vaccine for both smallpox and mpox, Jynneos, would be poised to benefit. Indeed, the company has since secured large U.S. and international contracts, but the outbreak has been somewhat muted (as evidenced by the CDC’s U.S. case trends). I pointed to this possibility earlier.

Whether or not anything major will come from this remains quite uncertain (e.g., how widespread the disease will become and how governments will respond to it). In addition, EU authorities see mpox as having “low impact if precautions are taken.” This is because mpox is typically transmitted via close physical contact.

Bavarian Nordic Balances Geopolitical Risks and Vaccine Market Volatility

Now that the mpox hype has settled a bit, it’s back to fundamentals, right? Wrong. It has been reported that “vaccine stocks,” like BVNRY, were particularly affected in a negative way by the news that President-elect Trump selected Robert F. Kennedy Jr. to head the U.S. Department of Health and Human Services. Mr. Kennedy is on the record as expressing anti-vaccine sentiments. For example, he promoted discredited theories linking vaccines to autism and other health issues. On the other hand, Mr. Kennedy has since taken a more mellowed stance, stating that his kids were vaccinated, and he wants vaccines to be safer. However, this does not discredit his “long record of promoting anti-vaccine views,” per the Associated Press. Subsequently, many vaccine stocks were down Friday. In fact, BVNRY closed down nearly 15%. Whether or not Mr. Kennedy, and his past anti-vaccine sentiments, will be confirmed remains to be seen. Additionally, no one knows how any of this will play out if he is confirmed. We do know that this unorthodox appointment by Mr. Trump is causing a lot of uncertainty in biotechnology and healthcare stocks. Uncertainty increases risk. Risk increases the required rate of return, resulting in a lower present value of future cash flows and decreased stock prices.

Bavarian: Transitioning Amid Declining Mpox Demand and Strategic Expansion

BVNRY may have been red Friday for other reasons as well. Bavarian reported Q3 earnings that day. Total revenue was ~$191 million (1 DKK = 0.14 USD), a 1% YoY decrease. In the first nine months of 2024, total revenue was ~$507 million, down 22% YoY due to reduced demand for mpox vaccines post-pandemic peak. Bavarian’s Travel Health segment was strong, seeing Q3 revenue increase 21% to ~$108 million. Q3 EBITDA was ~$35 million. In the last nine months, Bavarian reported an operating cash flow of ~$139 million. So, Q3 marked a transitionary period for Bavarian, characterized by strategic shifts and preparations for upcoming launches. As management elaborated:

(…) after nine months, DKK3.6 billion in revenue, 43% gross margin, total operating costs of DKK1.3 billion, R&D costs, obviously, impacted by the development of the chikungunya vaccine that we are anticipating to launch next year and SG&A costs impacted by, first of all, the acquisition from Emergent, where we took over some sales and marketing expenses, but also expansion into a few new markets, as Paul alluded to, where we are establishing ourselves this year in France and in the U.K. and Canada, we have done as well, both to take back the business we partner with Valneva, but also to prepare us for the chikungunya launch next year.

These numbers shouldn’t come as a surprise; Bavarian’s revenue is historically volatile and relies on outbreak-driven demand, which is inherently unpredictable. The company’s efforts towards enhancing manufacturing in Africa bode well for long-term demand for mpox vaccines. However, as the demand has waned, these capital investments weigh heavily on Bavarian’s ability to generate cash in the short term.

Importantly, the company has been pursuing diversification for years to mitigate reliance on outbreak-driven revenues. Take for instance, their acquisition of Rabipur/RabAvert (rabies) and Encepur (tick-borne encephalitis) vaccines from GlaxoSmithKline (GSK) in 2019. Their Travel Health segment’s encouraging performance was predominately driven by these two vaccines. The company is in the process of transferring the manufacturing of these vaccines to its own facilities. This should enable increased scale and margin improvements. Bavarian plans to launch a chikungunya vaccine candidate next year. It is currently being reviewed by authorities for approvals in the U.S. (February 14 PDUFA date) and Europe. In November 2023, Valneva’s Ixchiq became the first approved chikungunya vaccine by the U.S. FDA. This market is estimated to reach $500 million annually by 2032. Bavarian’s increased production capabilities and distribution networks could favor them in the long run to meet this demand and ensure vaccine accessibility.

Financial Health

As of September 30, Bavarian reported ~$262 million in cash, cash equivalents, and securities. Total current assets were $726 million, while total current liabilities were $431 million. Subsequently, Bavarian sports a current ratio just under 2. While not ideal, this does imply they can reasonably cover short-term obligations. Bavarian lacks significant long-term debts.

BVNRY Stock: Diversification Balances Outbreak Volatility Amid Policy Uncertainty

In conclusion, mpox has not been the tailwind that investors anticipated just a few months ago. Bavarian’s ability to generate cash is still primarily dependent on outbreak-driven demand. The company has made significant efforts to diversify its revenue by including assets with more stable demand (e.g., Rabipur/RabAvert). Furthermore, their investments in manufacturing and geographical expansion are expected to yield long-term rewards.

Given the nature of its business, Bavarian is particularly sensitive to geopolitical risks, as its portfolio heavily relies on vaccines addressing public health emergencies. The appointment of Mr. Kennedy could negatively influence public discourse and policymaking around vaccines, ultimately impacting Bavarian’s business. Shifts in public health strategies could alter the landscape for Bavarian’s government contracts and partnerships. The unorthodox Kennedy appointment is a prime example of the variety of risks involved in investing. Kennedy’s well-documented anti-vaccine stance and his appointment are “known unknown” risks because their specific impact on his role and influence on vaccine funding remain uncertain. In fact, Bavarian was asked directly about the Kennedy appointment potential risk to the vaccine market during their earnings call.

Well, the first thing I would say is that during the first turn, that Trump was President, it was — we saw the Biodefense business being heavily supported. So, I look forward again to working with the new administration. (…) And regarding vaccines in general, I mean we need to deal with that. So, I think it’s better to just wait and see what really happens with the appointment and what the policies will be.

In conclusion, I do not see any compelling reason to change my rating from “buy” despite recent stock underperformance and geopolitic uncertainty. Importantly, this recommendation is made within the context of a diversified, barbell portfolio.

Author

I believe Bavarian is well-positioned for global health emergencies, and their diversification efforts should lead to a more stable business.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.