Summary:

- Berkshire Hathaway and Apple are both great stocks that should do well in the next economic recovery.

- For the average investor, Berkshire Hathaway is the safer bet.

- It includes a lot of Apple stock, as well as energy and financial bets that are uncorrelated with Apple.

- In many ways, Berkshire is like an S&P fund, but one that carefully avoids bubble stocks and fraudulent companies.

- In this way, it can serve as an S&P 500 alternative for passive investors who wish to avoid the S&P 500’s worst names.

Conference On Issues Affecting U.S. Capital Markets Competitiveness Chip Somodevilla

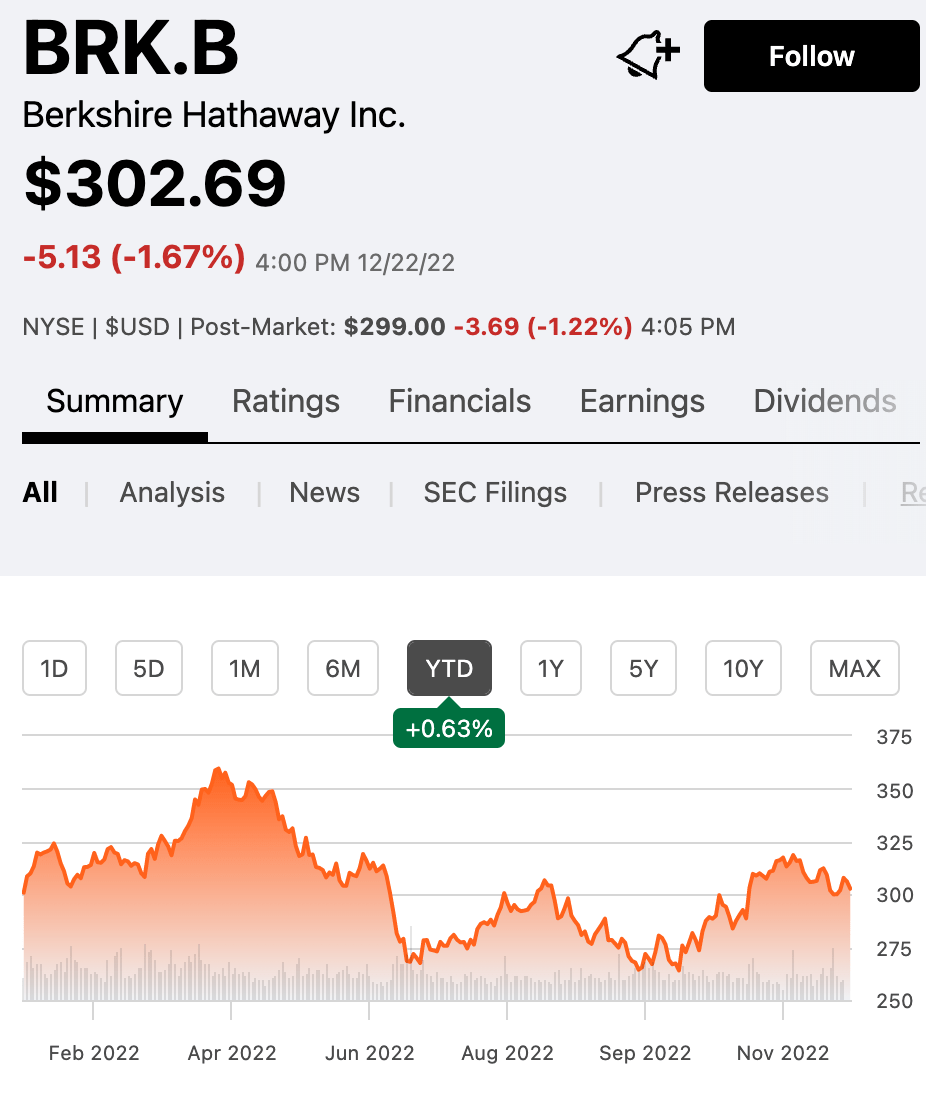

Berkshire Hathaway (BRK.B) has been one of this year’s top performing large cap stocks. Up 0.63% for the year (as of Thursday’s close), it has crushed the S&P 500.

Berkshire Hathaway: positive return year to date (Seeking Alpha Quant)

It’s not hard to see why Berkshire has done well this year:

Value stocks in general have done well. The S&P 500 value index is down 7% for the year, compared with -20% for the S&P 500. Berkshire has out-performed the average value stock (perhaps due to Buffett’s extensive oil investments), but it has also benefitted from its entire strategy being in favor this year.

How is Berkshire likely to do in the year ahead?

Potentially, it could do well yet again.

Berkshire’s emphasis on quality has paid dividends this year. The company’s value names have done extremely well, and its handful of tech stocks have avoided the worst catastrophes that have taken place in the tech sector.

Which brings us to another stock: Apple (NASDAQ:AAPL).

Apple is Berkshire’s single biggest holding and the one most likely to give Berkshire some alpha if tech companies come back into favor again. If traditional value sectors lose their sheen next year and tech stocks rally, then Berkshire could once again outperform.

However, this raises a question:

Why not just buy AAPL directly?

Warren Buffett has famously called Apple the “best business I know in the world.” Touting its brand loyalty and economic moat, he has made the stock his #1 position. It’s clear that Buffett likes Apple more than any other stock, including other stocks Berkshire owns. However, there are valid reasons why a person might prefer Berkshire to direct ownership of Apple. In fact, for those who aren’t professional investors, Berkshire may even be a better bet.

Textbook Finance Theory Suggests Berkshire is Better

Textbook finance theory (i.e. the material they teach in finance courses at universities) implies that Berkshire Hathaway is a better bet than Apple is. In most college finance courses, the curriculum teaches that the best portfolio is essentially the most diversified portfolio, with varying weightings of treasuries and equity index funds depending on the investor’s risk tolerance. Berkshire Hathaway is more diversified than Apple is (as it’s a combination of Apple plus other stocks plus operating businesses), so Berkshire is better than Apple alone going by what’s taught in most college finance courses

The theory behind this is called ‘Modern Portfolio Theory.’ In general, it runs contrary to the entire premise of active stock picking; Buffett & Munger think it’s wrong. However, Buffett says that retail investors should buy index funds, so it seems he thinks that academic investing approaches are preferable for non-professionals. If that’s the case, then both Buffett and academics would seem to agree that retail investors should own diversified portfolios rather than concentrated ones. This perspective would favor Berkshire over Apple for retail investors.

However, such a view is not exactly a ringing endorsement for Berkshire Hathaway stock. If diversification is all there is to the game, then the SPDR S&P 500 Fund (SPY) is better than Berkshire, and the iShares MSCI World ETF (URTH) is better than SPY. In a world where there’s nothing more to investing than diversifying as much as possible, why bother holding Berkshire or Apple directly at all? In the next section, I will explore one reason why Berkshire may be an attractive buy for defensive investors, above and beyond even index funds.

Buffett is Good at Spotting and Avoiding Low Quality Assets

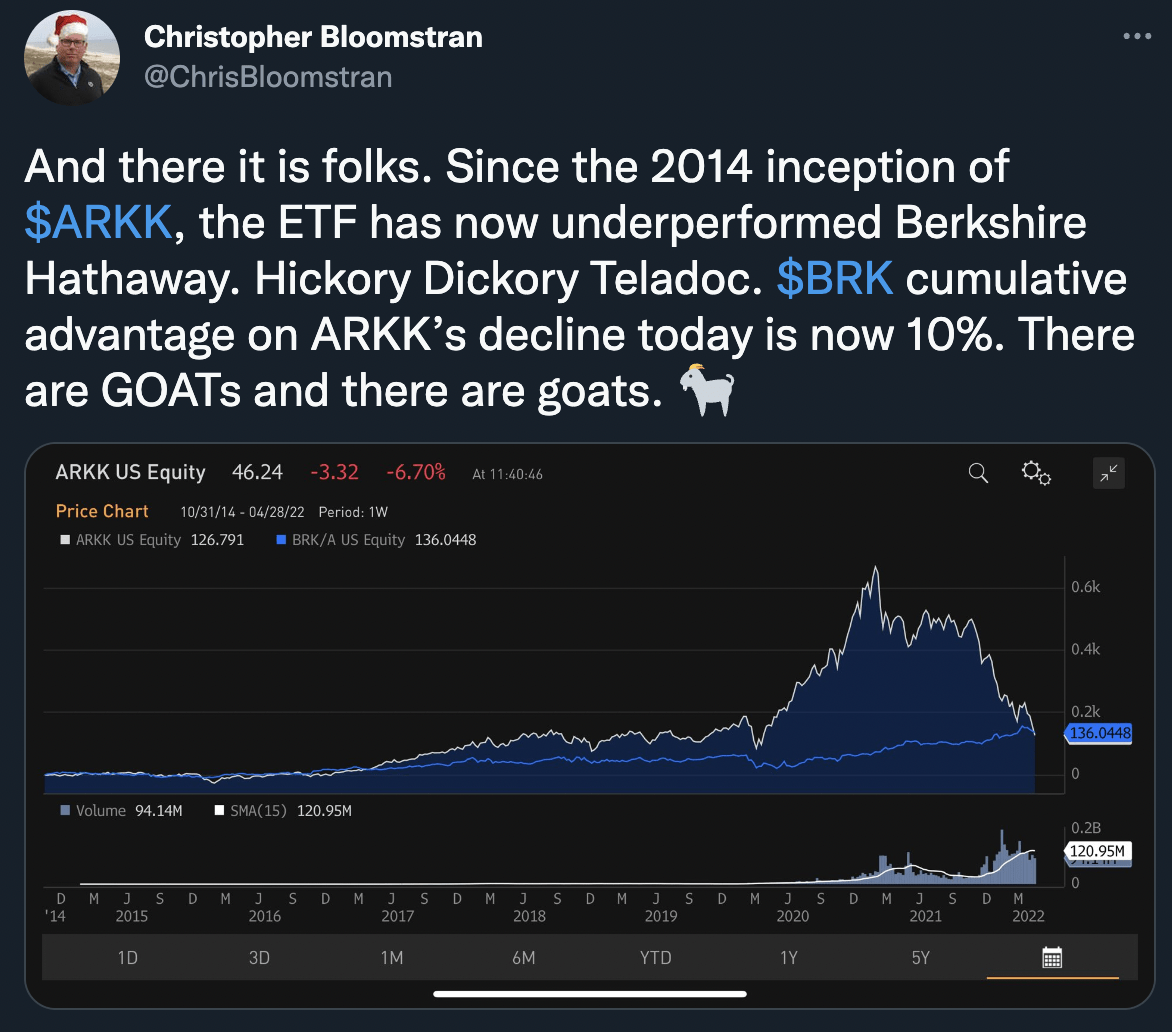

One reason why Berkshire may continue to outperform the S&P 500, even with its large market cap, is because Buffett seeks to avoid low quality assets and buy high quality ones. This strategy can result in underperformance while bubbles are going strong, but it tends to outperform after they burst. Right now, Buffett is ahead of the S&P 500 over one year, and ahead of the Ark Innovation ETF (ARKK) over five years, so it looks like Buffett’s avoidance of speculative assets is paying off.

Berkshire outperforms ARKK since inception (Christopher Bloomstran via Twitter)

If we set aside the assumptions of strong form efficient market hypothesis, it would seem that what Buffett is doing makes sense. Few would dispute that many stocks in the big indexes are bubble stocks. At the height of the 2021 bubble, there were many tech stocks trading at 50 times sales. It does not require insider information to figure out that such stocks will fall when interest rates rise-I myself predicted continued weakness in such stocks at the beginning of the year. A big part of why I saw tech stocks falling at the start of the year is because the Fed had announced it was going to be hiking interest rates all year long. The more risk free return is available, the less sense it makes to gamble on growth. Predictably, overpriced tech stocks fell when interest rates went up, their later poor earnings releases added to the selling.

If it’s possible to spot bubble stocks, then a portfolio similar to the S&P 500 but minus bubble stocks should outperform the S&P 500. That’s pretty much what Berkshire Hathaway is. It has broad exposure to basically every sector-tech, energy, banking, you name it. However, it deliberately avoids notably low quality assets, which sometimes end up having significant index weighting-it’s not the nature of an index publisher to say “this stock is a bubble, we’re not going to include it.” So, despite its large size, Berkshire could still outperform, mainly by surviving in periods like 2022 when collapsing bubbles drag down the S&P 500.

For Enterprising Investors, Apple Could be Worth It

Having looked at reasons why Berkshire is a great play for retail/defensive investors, we can now explore why Apple is a good bet for enterprising investors.

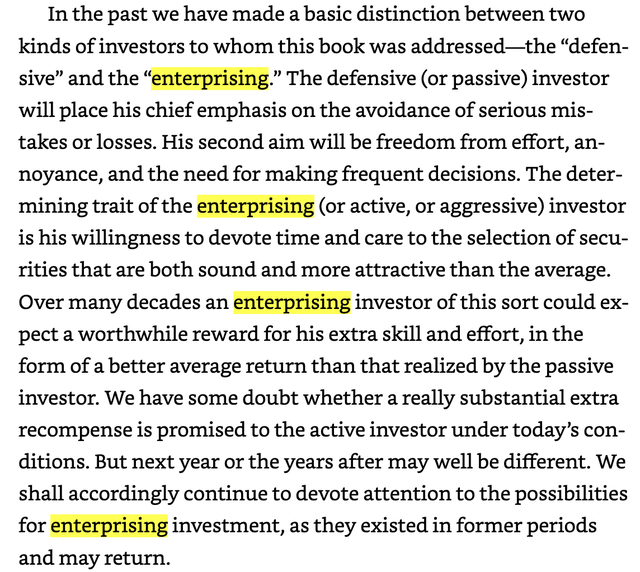

In Ben Graham’s book “The Intelligent Investor,” the author describes enterprising investors as those who invest full time, much like how entrepreneurs run their businesses full time. Key to being an enterprising investor is having copious amounts of time to research investments. If you work a regular 9-5 job (apart from being a fund manager), this likely isn’t you, but if you’re someone who manages investments all day long, you may meet the definition of an enterprising investor.

If you are such a person (that is, someone who manages investments full time), then Apple may be worth overweighting compared to Berkshire and related entities like mutual funds.

Ben Graham defines the enterprising investor (Ben Graham, The Intelligent Investor)

At today’s prices, Apple is only three dollars above its 52-week low. This is interesting because, in its most recent quarter, AAPL’s revenue and earnings both increased. As a result, the stock has gotten much cheaper than it was before, trading at:

-

22 times earnings.

-

5.5 times sales.

-

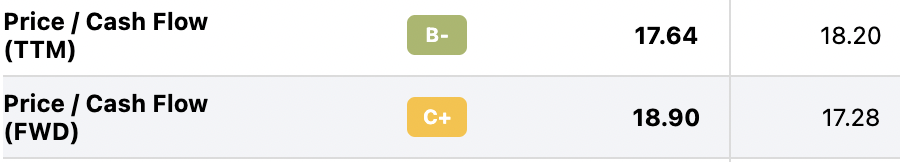

17.6 times operating cash flows.

The earnings and sales multiples here are not exactly “cheap,” though they are cheaper than Apple’s multiples at earlier points in history. The operating cash flow multiple is actually below the industry average, as the table below from Seeking Alpha Quant illustrates.

Apple price/cash flow vs industry price/cash flow (Seeking Alpha Quant)

So we’ve got Apple stock getting progressively cheaper over the year, both in terms of the stock price, and the ratio of the stock price to earnings. Nevertheless, the company still has plenty of advantages, including:

-

The world’s most valuable brand (according to Visual Capitalist).

-

An integrated ecosystem that encourages buying multiple Apple products (rather than having a smartphone, a tablet and a laptop all from different companies, as is common in the Windows/Android world).

-

Being one of two companies in the smartphone operating system duopoly.

-

A 25% profit margin.

-

A 175% return on equity.

-

Strong historical growth.

That last item on the list is just a description of how Apple has performed historically. It doesn’t mean a whole lot in itself, but when combined with Apple’s brand strength and ecosystem, it suggests a solid company with a good track record.

In light of all this, how much is Apple stock worth?

In past articles, I’ve done discounted cash flow models for Apple which valued it at anywhere from $123 to $149. The higher estimates come from using lower discount rates. In any model I tried that incorporated a risk premium, Apple came out to be worth less than its current stock price. Basically, this is one of those stocks that demonstrates why investors are so obsessed with interest rates. The stock has a bit of upside if you simply discount its cash flows at the current treasury yield, but if you include a risk premium, or assume that the treasury yield goes higher in the future, it stops being worth it. This is yet another reason why Apple stock is best suited to experienced investors.

The Final Verdict

Having reviewed Apple and Berkshire side by side, it’s time to determine which is the better buy.

Ultimately, it depends on what kind of investor you are.

If you’re a retail investor who does not research investments full time, Berkshire is likely the safer bet. The stock tends to perform well in down markets and therefore provides a ‘smooth ride’ which lessens the likelihood of panic selling.

If you’re a professional, there’s a strong case to be made for buying Apple. The stock is currently the cheapest it’s been in a year, yet its brand loyalty, economic moat and moderately above-average growth aren’t going anywhere. It also offers some dividend income, which provides a slight buffer against market volatility. Berkshire doesn’t have that.

As for me personally, I’m content to own both Berkshire and Apple, though I have a much heavier weighting in the latter.

Disclosure: I/we have a beneficial long position in the shares of BRK.B, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.