Summary:

- Cell tower REITs have historically been very good investments.

- But what’s the best pick of the sector?

- I compare American Tower and Crown Castle and present my top pick.

Maria Vonotna

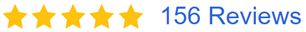

Cell tower REITs have historically been incredibly good investments.

- They are recession-resistant.

- They generate significant cash flow.

- This cash flow is highly consistent and predictable.

- It rises steadily each year according to their lease agreements.

- And since data usage is ever-growing, they can co-locate more equipment on the same towers, resulting in exceptionally attractive returns.

- Here are their historic results relative to the S&P 500 (SPY):

As a result, the market has historically priced these REITs at high valuations during most times.

American Tower (NYSE:AMT) and Crown Castle (NYSE:CCI) are the two biggest cell tower REITs, and they have commonly traded at high multiples of >25x FFO and low dividend yields of 3-4%.

But today is the exception.

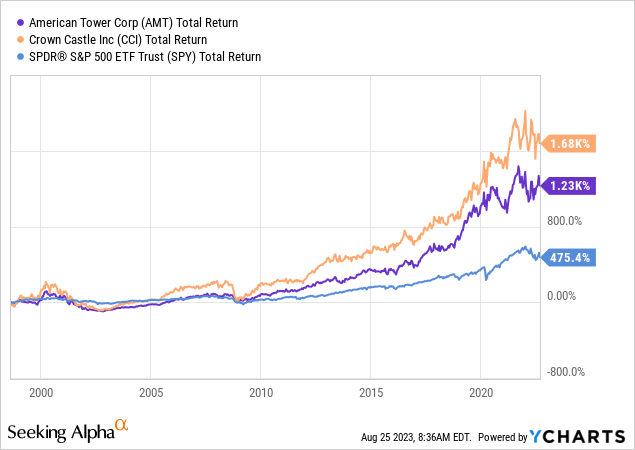

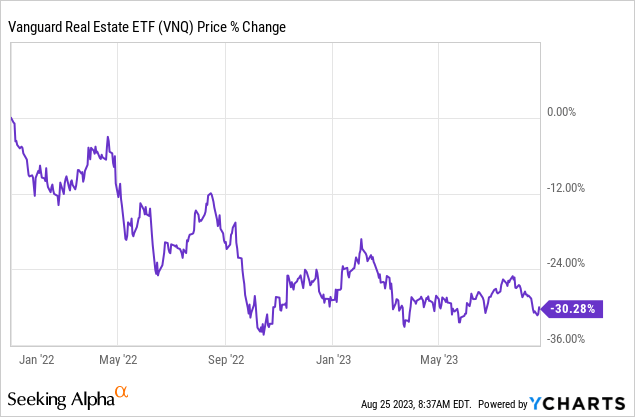

REITs (VNQ) are now out of favor and priced at historically low valuations, after dropping by about 30% since the beginning of 2022.

You would expect AMT and CCI to have performed better given that their business models are recession-resistant, cash flows keep on growing, and they have fortress investment-grade rated balance sheets that should provide superior protection against rising interest rates.

But no, none of that mattered, and these REITs have dropped even more than the average:

As a result, their valuations are now historically low, and increasingly many investors are now seeing an opportunity in cell tower REITs.

But which one is the most opportunistic today?

American Tower or Crown Castle?

That’s a question that I receive on a regular basis and in today’s article, I am going to give you two reasons why I slightly prefer CCI at this time.

Note that I am bullish on both, and my preference is not significant.

Reason #1: Materially Lower Valuation and Higher Yield

Both REITs are today discounted, but CCI is even cheaper than AMT:

| AMT | CCI | |

| FFO Multiple | 18x | 13x |

I suspect that CCI is priced at a lower valuation because it is expected to grow at a slower pace over the next two years due to some lease cancellations. T-Mobile’s (TMUS) recent acquisition of Sprint is having a greater impact on CCI in the near term, and it is depressing its valuation because the market only seems to care about the short run.

But I think that the market has overreacted to short-term news. Real estate investments should be valued based on decades of expected future cash flow, and so I see this as an opportunity to buy good real estate at a discount.

CCI also offers a materially higher dividend:

| AMT | CCI | |

| Dividend Yield | 3.5% | 6.3% |

This is in part because of its lower valuation, but it is also because it has a higher payout ratio.

In any case, I like the idea of getting a high yield in today’s market environment because it helps me to remain patient.

It makes us less reliant on capital appreciation to earn compelling returns.

Reason #2: Stronger Catalyst for Upside

As we explained earlier, CCI’s growth will be slow for the next two years and the market has now priced it accordingly as if its growth story was over.

But this also means that as its growth reaccelerates from here, the market will likely reprice it at a much higher valuation, and just recently, the management stated on their Q2 conference call that they are confident they can return to 7-8% dividend per share growth beyond 2025:

In a normal go-forward period of time over a multi-year period we’re going to see about 5% tower organic revenue growth. And it’s likely to move a little above, a little below that in certain periods. But I think generally that’s what our expectation would be and that’s what’s driving our longer term. If we think about value creation, when we talk about being able to get back to a point where we’re growing the dividend 7% to 8%, once we’re beyond the Sprint site rationalization process that we’re in the middle of once we’re past that point, returning to being able to grow the dividend at 7% to 8% over a long period of time, underlying that is our assumption around top line growth.

They even repeated this later in the call:

As a result, we believe we are positioned to return to our long-term annual dividend per share growth target of 7% to 8% beyond 2025 as we get past the remaining large Sprint cancellations.

They are so confident in this guidance because they have already today secured 75% of their 5% organic growth target through 2027.

I believe that the market is focusing too much on the 2023-2025 period of slow growth, and not looking far enough. But as we get passed this dip in growth, I expect the market to reprice CCI as a high-growth, blue-chip REIT, and with that could come significant upside potential.

Before the recent crash, it traded at 27x AFFO. Simply returning to a more conservative 20x would unlock over 50% upside potential and while you wait, you earn a 6.3% dividend yield.

AMT also has upside potential from today’s valuation, but not quite as much, and its catalyst also isn’t quite as clear to me.

Closing Note

To conclude, I would like to reiterate that I am bullish on both companies. AMT and CCI are both now priced at historically low valuations and offer some upside potential to our fair value target. However, the best pick of the two appears to be CCI given that it is materially cheaper due to “temporary” concerns, and it has a stronger catalyst to unlock value for shareholders.

It is important to be very selective when investing in high-dividend stocks if you want to maximize your returns and minimize risk. We do our best to find the best combination of yield, growth, and value, and that’s how we have managed to outperform the market averages over the long run.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Investor for a 2-week free trial

We are the #1-rated high-yield investor community on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!