Summary:

- My main thesis is to explain why AbbVie Inc. remains my top 2023 dividend stock in the healthcare space despite its near-record stock prices.

- The thesis is best illustrated by comparison and contrast against another dividend champ, Johnson & Johnson.

- Such comparison better accentuates AbbVie’s key advantages as a dividend pick.

- These advantages include a thicker dividend cushion, lower valuation, and better return potential better supported by current dividends.

- And finally, Johnson & Johnson’s ongoing spinoff plan adds an element of uncertainty.

Galeanu Mihai/iStock via Getty Images

Thesis

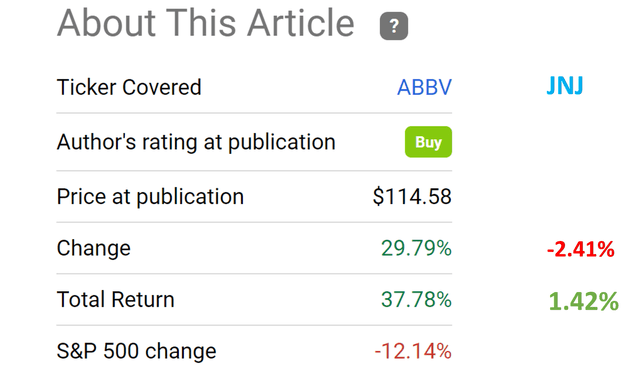

I first wrote about AbbVie Inc. (NYSE:ABBV) back in Aug 2021. At that time, the stock was trading at $114 per share, or only about 8x times its earnings before taxes (“EBT”). And my core argument then was that under Warren Buffett’s 10x Pretax Rule, ABBV was similar to an equity bond with a 12.5% yield.

Fast forward to 2023, AbbVie Inc. stock has returned a total of 38% including dividends. While in the meantime, the S&P 500 Index (SP500) has lost 12%. Currently, ABBV stock price hovers around a record high. And some of our members and readers have asked for an updated assessment of the stock.

Source: Author based on Seeking Alpha data

This article, therefore, compiles our exchanges with our members and readers in a more coherent way. And the core thesis is quite simple: I remain bullish, and AbbVie Inc. stock remains my top 2023 dividend stock in the healthcare space.

In the remainder of this article, I will explain a few key considerations. And I felt these considerations are best illustrated by comparison and contrast against another dividend champ, Johnson & Johnson (NYSE:JNJ). This comparison will illustrate why ABBV displays all the key traits I look for in a dividend stock: thicker dividend cushion, lower valuation despite essentially identical profitability, and also solid total return potential.

Before going any further, let me clarify up front that I am not bearish on JNJ. It is a solid dividend stock in its own right. I just felt a comparison and contrast between two dividend stalwarts is the best way to illustrate my thinking.

ABBV and JNJ: profitability and dividend safety

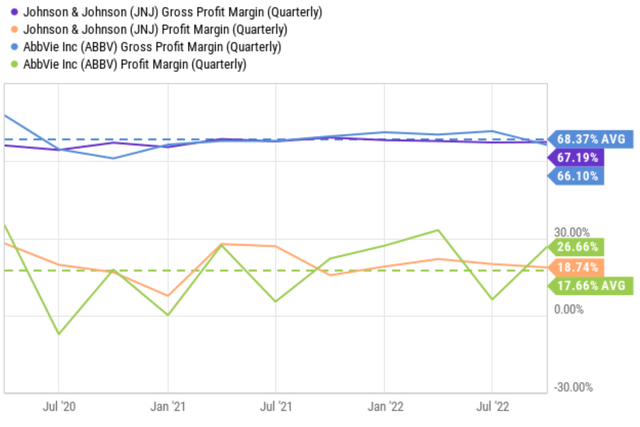

As textbook dividend stalwarts, the dividends at both places are supported by superb profitability as shown by the results below. To wit, both have been maintaining almost identical gross profit margins (“GPM”) in the long term as you can see from the data. The GPM of both companies fluctuated in a very narrow range around an average of 68%. In terms of net profit margin (“NPM”), the picture is equally strong. As seen, both companies have been maintaining an average NPM of ~18% over the years and again, with superb consistency. To put such NPM under a broader perspective, the average NPM for the overall economy is only about 8% in the long term.

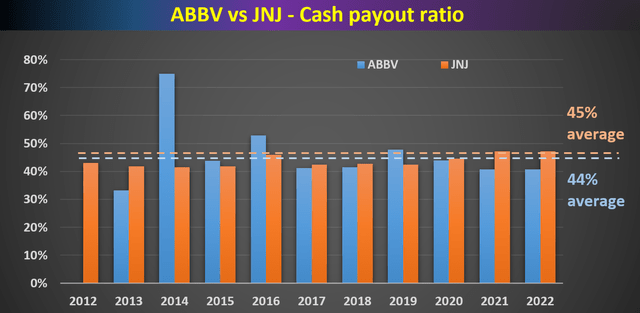

Supported by the above robust and consistent profitability, both companies have been also managing their dividend consistently in the past – something you must already know. To wit, their payout ratios are almost identical – with an average of 44%~45% in the long term as seen in the second chart below.

Source: Seeking Alpha data Source: Author based on Seeking Alpha data

ABBV vs. JNJ: ABBV offers better dividend cushion ratios

Readers familiar with our approach to picking dividend stocks know that we also go a step further beyond the above simple payout ratio. As detailed in our earlier articles, these simple ratios are limited in the following ways:

- These simple payout ratios (either in terms of earnings of cash flow) ignore the current asset that a firm has on its balance sheet. Obviously, for two firms with the same earning power, the one with more cash sitting on its balance sheet should have a higher level of dividend safety.

- These simple payout ratios also ignore the upcoming financial obligations. Again, obviously, for two firms with the same earning power, the one with a lower level of obligations (pension, debt, CAPEX expenses, et al) should have a higher level of dividend safety.

And we’d always like a more holistic assessment of a stock’s dividend safety. The dividend cushion ratio, detailed in Brian M. Nelson’s book entitled Value Trap, serves this purpose. A brief recap of the concept is quoted below:

The Dividend Cushion measure is a ratio that sums the existing net cash (total cash less total long-term debt) a company has on hand (on its balance sheet) plus its expected future free cash flows (cash from operations less all capital expenditures) over the next five years and divides that sum by future expected cash dividends (including expected growth in them, where applicable) over the same time period. If the ratio is significantly above 1, the company generally has sufficient financial capacity to pay out its expected future dividends, by our estimates. The higher the ratio, the better, all else equal.

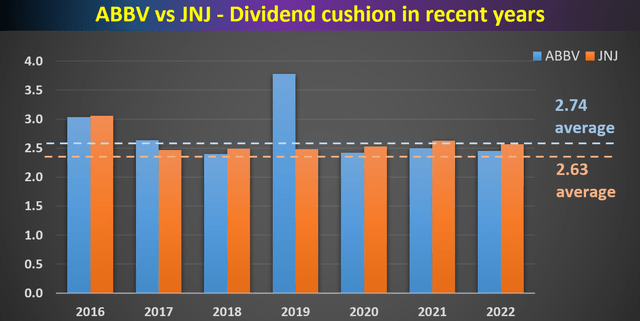

The results of ABBV and JNJ’s dividend cushion ratios (“DCR”) are analyzed using the above method and plotted in the chart below in the past 6 years since 2006. As seen, both JNJ and ABBV have been maintaining an average DCR way above the threshold of 1.0x, which provides another reassurance of their dividend safety. To be more specific, JNJ’s average DCR dialed in at 2.63x since 2006, and ABBV’s DCR is even higher with an average of 2.74x.

Source: Author based on Seeking Alpha data

ABBV vs. JNJ: valuation and return profile

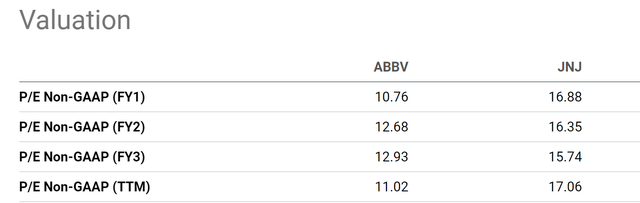

Despite their essentially identical profitability and ABBV’s thicker cushion ratio, ABBV is trading at a substantial valuation discount relative to JNJ as you can see from the following chart. In terms of FY1 P/E multiples, ABBV trades at about 10.7x, translating into a discount of more than one-third (37% to be more exact) compared to JNJ’s 16.8x.

Risks and other considerations

Admittedly, investors have good reasons to be concerned with AbbVie’s post-Humira growth plans. Increased biosimilar competition against Humira could result in significant sales erosion when the patent expires. However, I see a multitude of replacement drugs at ABBV to make up for the void left by Humira. For example, I see Skyrizi and Rinvoq are the headliners on the immunology side and they both continue to gain momentum in recent quarters. Take the recent Q3 2022 results as an example, its core immunology segment posted a sales increase of 15% YoY, largely driven by Skyrizi (+75% YOY growth) and Rinvoq (+54% YOY growth). In other segments, I see great promise in Botox Therapeutic and Vraylar to fuel future growth in neuroscience.

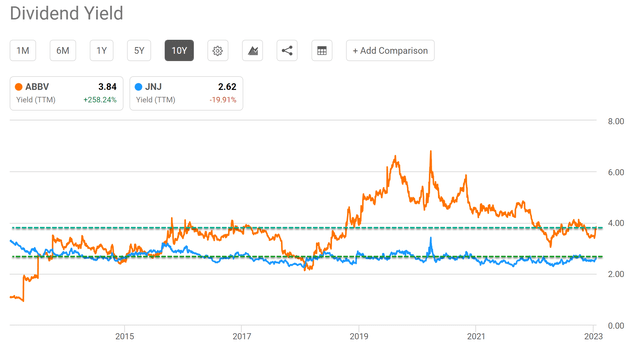

Overall, I view the above large valuation discount relative to JNJ and other peers as overblown and ABBV’s growth potential mispriced. Due to such mispricing, I anticipate a better total return potential from ABBV compared to JNJ and other healthcare peers. Finally, ABBV’s return profile is also better supported by its higher current dividends (3.8% vs JNJ’s 2.6% as seen from the chart below).

Although there will surely be some macroscopic headwinds in the near future for both ABBV, JNJ, and also the general healthcare sector. Cost control, inflationary pressure, and also currency headwinds are likely to persist and impact them all. In JNJ’s case, its ongoing efforts to spin off the Consumer Health segment add another element of uncertainty.

Source: Author based on Seeking Alpha data

Conclusion and final thoughts

To recap, the core thesis is to explain why I remain bullish on AbbVie Inc. The stock remains my top 2023 dividend stock in the healthcare space despite near-record stock prices.

My considerations are best illustrated by contrast against JNJ. This contrast illustrates that ABBV shows all the hallmarks of a solid dividend stock in my book. ABBV features a safer dividend in terms of dividend cushion ratio and also a lower valuation despite identical profitability. As a result, I expect AbbVie Inc. to post better total returns in the years to come, which is also better supported by its higher current dividend yield.

Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.