Summary:

- Northrop Grumman reported stellar 2Q24 earnings with revenue and earnings growth, strong free cash flow, and successful major programs.

- The company’s high-tech capabilities and diverse portfolio contribute to strong performance, with a focus on innovation and strategic defense programs.

- Northrop Grumman expects continued growth in free cash flow, EPS, and sales, with a favorable outlook for shareholders and a promising valuation for future returns.

Elen11/iStock via Getty Images

Introduction

I have to say, although I have seen some negative outliers, I’m very happy with the way things are going so far in this earnings season. One reason is the turnaround of the defense sector, a sector that enjoys a weighting of roughly 20% in my dividend growth portfolio.

As most of my readers will know, I started to aggressively buy defense contractors when the pandemic started to fade, as I liked the mix of anti-cyclical demand, innovation-driven growth, and consistent dividend growth and buybacks.

Unfortunately, my bet on defense contractors did not immediately yield the results one may have hoped for, as a number of issues lasted. This includes supply chain headwinds, defense budget uncertainty, and struggles in some major programs.

Leo Nelissen (My Four Defense Investments)

The good news is that the defense sector has made a comeback, supported by mostly stellar 2Q24 earnings. One of the stars of this quarter is the Northrop Grumman Corporation (NYSE:NOC), a company I have discussed many times in the past.

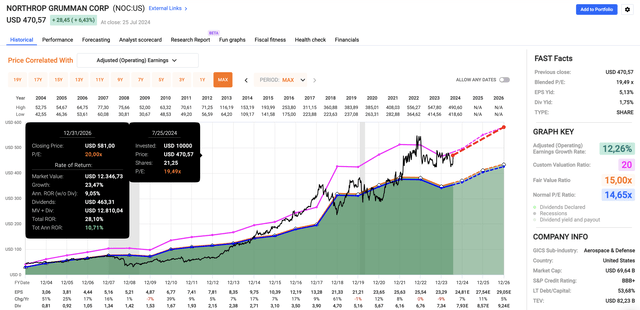

My most recent article on this giant was written on May 31, titled “Undervalued And Misunderstood: Why Northrop Grumman Is A High-Conviction Buy.”

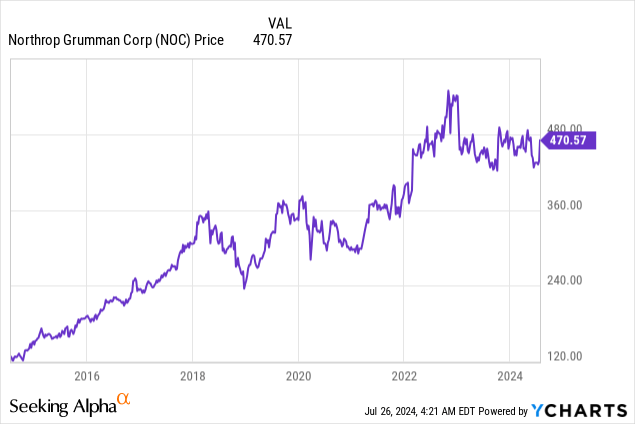

Since then, shares have returned 4.4%, beating the 2.3% gain of the S&P 500 by a slight margin.

However, what matters more is that NOC just released fantastic earnings that confirm the defense upswing. Both revenue and earnings growth have made a comeback, supported by accelerating free cash flow, successful major programs, and a guidance hike.

Although the company’s stock price still does not scream excitement, I believe the company’s numbers confirm we may be dealing with a long-term upswing, which I expect to unlock a lot of value.

So, as we have a lot to discuss, let’s dive into the details!

Northrop Grumman Is Firing On All Cylinders

The second quarter was a fantastic quarter for Northrop and many of its peers.

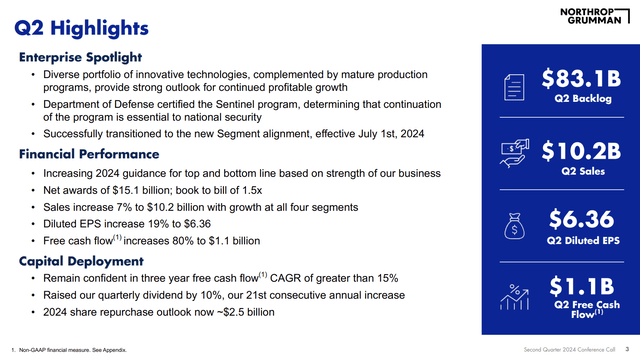

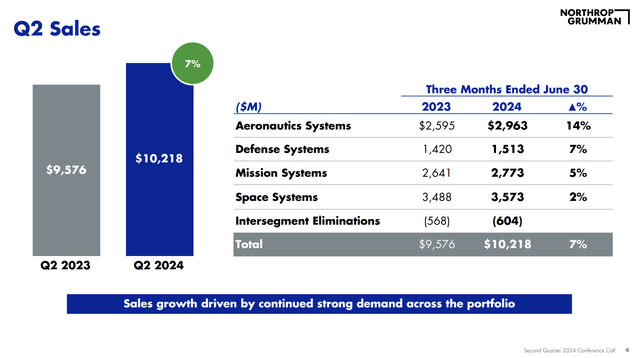

Northrop reported a 7% increase in sales on a year-over-year basis and an 8% increase in the first two quarters of this year. These numbers come with a 13% improvement in operating income, which is supported by higher margins.

Additionally, as we can see below, Northrop Grumman achieved a significant 19% growth rate in earnings per share and boosted free cash flow by more than $500 million in the first half of the year compared to the same period last year.

Even more important is the fact that the Virginia-based contractor got $15.1 billion in new orders. This resulted in a 1.5x book-to-bill ratio, indicating $1.50 in new orders for every dollar in finished work. That’s extremely favorable for future growth and one of the best book/bill profiles of the entire industry.

Moreover, as I have often said, I don’t buy defense contractors to benefit from war. I am buying defense contractors for their ability to innovate, as innovation drives defense. That has always been the case.

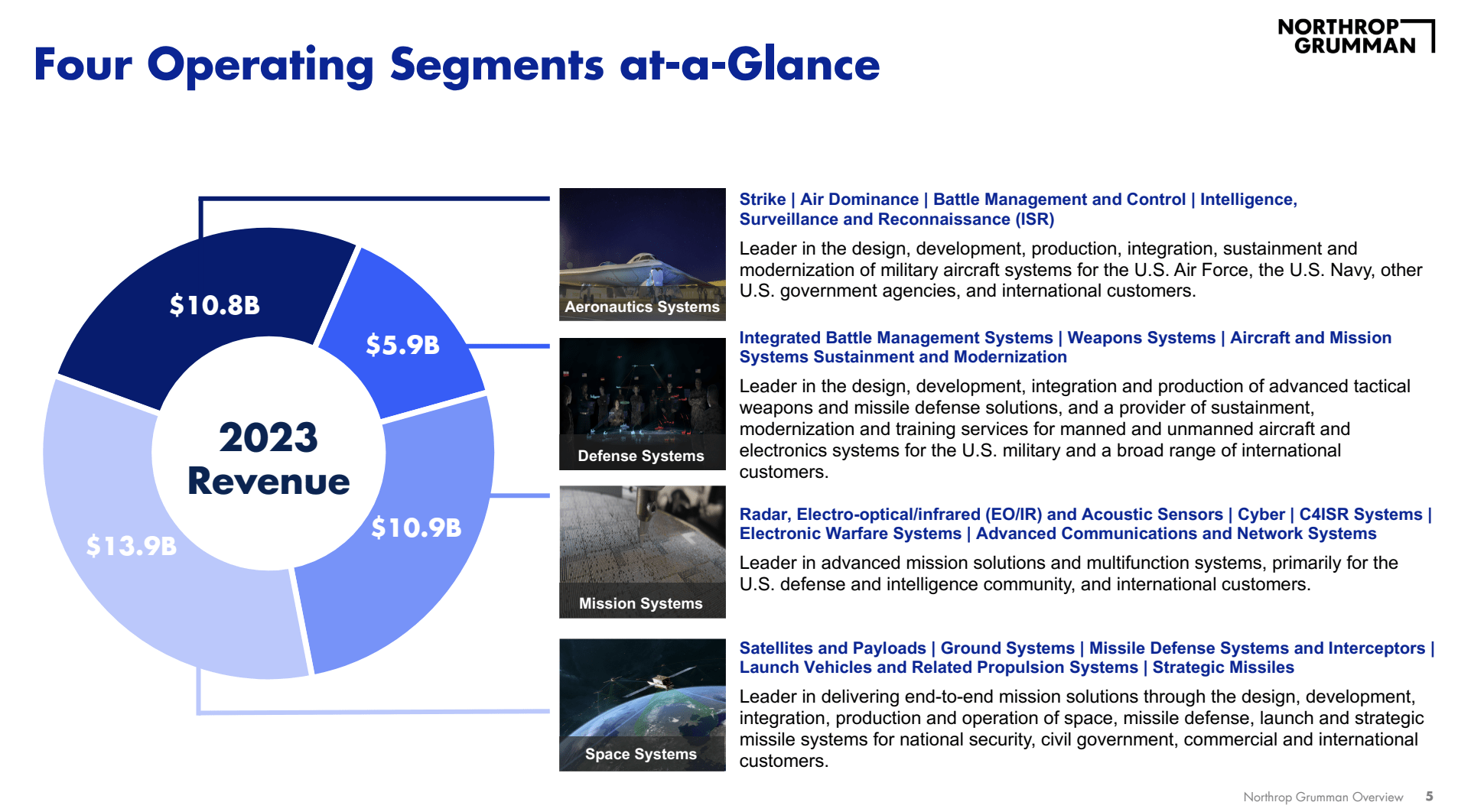

In the case of Northrop, we’re dealing with one of the most high-tech portfolios in the industry. I often say that while Northrop Grumman is officially classified as an industrial company, I believe it has more “high-tech” capabilities than almost every “technology” company on the stock market.

Northrop Grumman Corp.

I’m bringing this up because roughly 85% of Northrop’s sales come from a wide range of capabilities, including electronics, communications, crewed and uncrewed aircraft, space payloads, advanced weapons, and command and control systems.

According to the company, these capabilities are critical for the modern defense environment and give it a competitive edge.

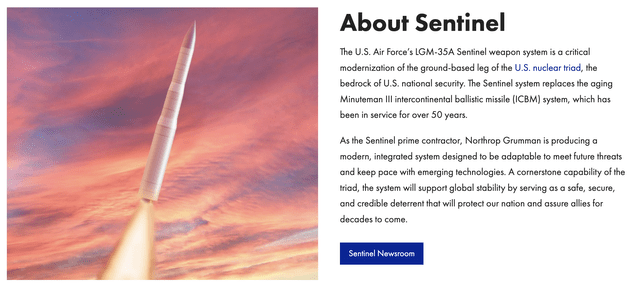

The remaining 15% of its sales come from two prime programs, the Sentinel and B-21, which are key to America’s strategic defense capabilities. The Sentinel program is the next-gen land-based intercontinental ballistic missile system. The B-21 Raider is the next strategic bomber.

Regarding critical programs, the company is involved in a number of other projects as well, including the Guided Multiple Launch Rocket System (“GMLRS”). Last year, it was reported that the company would supply rocket motors for the system which is being led by Lockheed Martin (LMT).

In its 2Q24 earnings call, the company noted it saw almost 60% year-to-date growth in this program, with more than $500 million in contracts for communication delivery, and will start deliveries in the third quarter.

With regard to the B-21 raider, the company noted the program is in low-rate initial production and performing within schedule and cost estimates. This is crucial, as cost headwinds in the company’s largest programs have led to stock price sell-offs in the past.

In general, the company’s underlying business is strong, as all four segments saw year-over-year growth, with 14% growth in Aeronautics, driven by higher volumes on key programs like B-21, F-35, and Triton.

The company builds fuselages and other supplies for the F-35. The Triton is an unmanned, high-altitude, long-endurance “drone” used for surveillance, targeting, and other operations.

In my last article, I noted it got $11.5 billion in orders to produce 65 Tritons with multi-sensor upgrades, which has helped Northrop gain a 20% market share in the North American UAV market.

Moreover, a huge part of its successful second quarter is its free cash flow. The company’s 2Q24 free cash flow was $1.1 billion, an 80% increase compared to the prior-year quarter result.

This is great news for shareholders, as the company has used free cash flow for aggressive yet sustainable cash distributions.

- Since 2014, the company has bought back almost a third of its shares.

- It also has hiked its dividend by roughly 12% per year through 2030.

- The dividend has been hiked for 20 consecutive years.

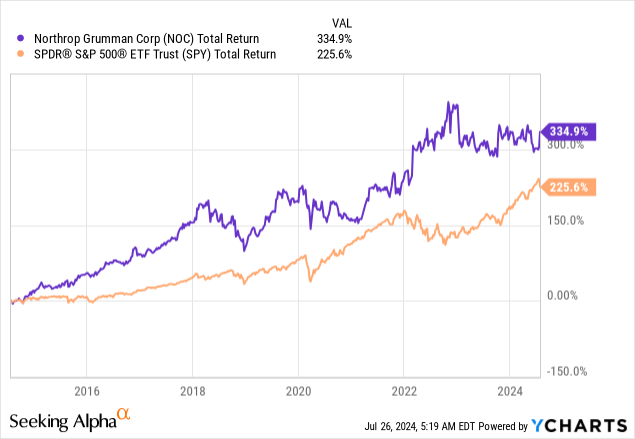

- Although its current 1.8% yield may not be breathtaking, the total return picture is fantastic and allowed NOC to return 335% over the past ten years, beating the S&P 500 by more than 100 points.

So far, so good.

What’s even better is the company’s outlook.

A Bright Future For Shareholders

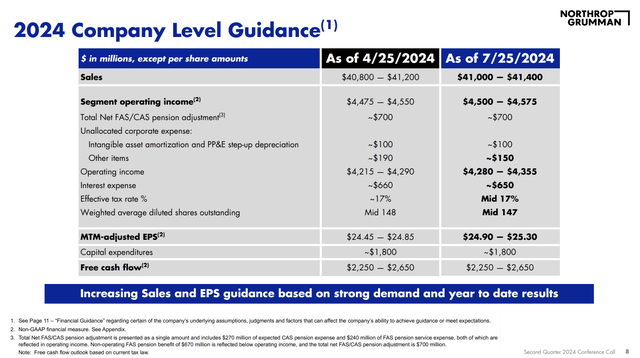

As part of its outlook, the company expects to grow its free cash flow by (at least) 15% per year. In this case, it is very important to mention that this is expected to be driven by higher margins and declining capital expenditures.

I added emphasis to the quote below:

So when we talk about a 15%-plus free cash flow CAGR from 2023 to 2026, that is not driven by further working capital efficiencies. It’s driven by the expansion of operating profits as we continue to grow the top line and we deliver on margin expansion opportunities. CapEx is at peak levels this year as it was last. That will decline going forward, both in real dollars and clearly as a percentage of sales toward our longer-term target in the 3% range. – NOC 2Q24 Earnings Call

Moreover, according to the company, the outlook for the B-21 program is promising, with production ramping up through the decade and modernization and sustainment efforts expected to generate accretive profit rates.

This is one of the drivers of a more favorable outlook, as the company expects full-year sales to be $41.0 billion to $41.4 billion, which indicates 5% midpoint growth. That’s up from the prior range of $40.8 billion to $41.2 billion.

Additionally, the company has revised its EPS guidance upward by $0.45 to the new range of $24.90 to $25.30.

Valuation

The valuation remains fantastic. Northrop is expected to accelerate EPS growth after a very volatile period in 2019-2023. This year, analysts expect 7% EPS growth, potentially followed by 11% and 5% growth in 2025 and 2026, respectively.

Using the 20x multiple I Have used in the past to incorporate stronger growth and higher margins, I’ll stick to my $580-$585 price target, 20-24% above the current price.

I even expect analyst estimates to rise substantially in the quarters ahead if the company can maintain strong order growth and keep major projects like the B-21 and Sentinel on track.

Moreover, the company expects accelerating growth in the Space segment in 2026. This, too, could have a meaningful impact on longer-term EPS estimates.

All things considered, I’ll keep adding to my NOC position on weakness, as I believe I own one of the best anti-cyclical dividend growth stocks on the market.

And yes, given how much I like my other defense stocks as well, odds are I will remain massively overweight in this sector for many more years to come.

Takeaway

My aggressive investment in defense contractors like Northrop Grumman has started to pay off despite earlier challenges.

NOC’s strong 2Q24 performance, including significant growth in sales, operating income, and free cash flow, confirms the sector’s upswing.

With strong new orders and key programs like the B-21 and Sentinel progressing well, NOC is poised for sustained growth, while the company’s promising outlook and innovative edge make it a compelling long-term investment.

Hence, I remain confident in my defense-heavy portfolio and will continue to add to my positions, expecting substantial value to be unlocked in the coming years.

Pros & Cons

Pros:

- Strong Earnings Growth: NOC’s recent earnings have been stellar, with significant increases in sales, operating income, and free cash flow.

- A Deep Order Book: The company secured $15.1 billion in new orders, and it enjoys an impressive 1.5x book-to-bill ratio.

- Innovative Edge: Northrop’s high-tech capabilities across various defense segments provide a competitive advantage.

- Dividend Growth: With a history of consistent dividend hikes and substantial buybacks, NOC is a reliable dividend growth stock.

- Positive Outlook: The company’s guidance for future growth, driven by higher margins and declining capital expenditures, is very promising.

Cons:

- Stock Price Volatility: Despite strong fundamentals, NOC’s stock price has seen volatility due to issues in major programs and external factors.

- Supply Chain Risks: Ongoing supply chain challenges can impact production and financial performance.

- Defense Budget Uncertainty: Fluctuations in defense budgets could affect future revenues and order flows.

- Dividend Yield: While dividend growth is elevated, the current yield of 1.8% might not be appealing to income-focused investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LMT, NOC, LHX, RTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.