Summary:

- PayPal is a dominant player in the rapidly expanding digital payment processing sector.

- The new management is poised to orchestrate a strategic comeback.

- The current valuation of the stock presents an excellent value proposition.

- And lastly, the robust cash flow position paves the way for ongoing opportunities for share buybacks.

- The target price is set at $114, derived from the projected earnings per share for the fiscal year 2024/25, and it incorporates a retracement based on prevailing market multiples.

Justin Sullivan

Executive Summary

PayPal stands as one of the world’s largest payment processing companies, facilitating over $1.5 trillion in transactions annually across more than 200 countries. The payment processing industry is expected to sustain growth, fueled by the development of emerging economies and advancements in technology. Over the past two decades since its IPO in 2002, PayPal has established itself as a robust player in the market.

While the stock reached its peak at above $300/share in 2021, it experienced a significant downturn, hitting a low of $50/share a few months ago-an 83% decline from its peak. Recent market activity has seen a partial recovery, with PayPal shares currently trading around $64/share.

Anticipated factors for a potential strong comeback in 2024 include the company’s historically low valuation, a new management team emphasizing profitable growth, and a consistent generation of strong free cash flow dedicated to share buybacks. With these considerations, a target price of $114/share has been set, reflecting optimism about PayPal’s potential resurgence in the coming year.

Background and History

PayPal is a leading global financial technology company based in the United States, specializing in payment processing and online money transfers. Established in 1998 as Confinity, the company underwent significant transformations, including going public through an IPO in 2002 under the name PayPal.

Initially a subsidiary of eBay after a $1.5 billion acquisition in 2002, PayPal regained its independence in 2015 when eBay spun it off. Over the years, PayPal has strategically expanded its portfolio through acquisitions, including notable entities like Braintree, Venmo, Xoom, and Paidy. The company paid $800mm for Braintree in 2013, after Braintree had paid $26mm for Venmo the year before. The most recent acquisition took place in 2021, with PayPal investing $2.7 billion to acquire Paidy.

In 2023, the company underwent a management overhaul with a renewed focus on “driving profitable growth” in its future endeavors. Historically, PayPal played a key role as eBay’s default payment method, but following the spin-off, eBay collaborated with Amsterdam-based Adyen for card payment processing.

Headquartered in the North San Jose Innovation District, California, the company’s European operations are based in Luxembourg, serving as a Luxembourg-based bank since 2007. Additionally, PayPal has operational centers in La Vista, Nebraska, with a second location established in 2007. The international headquarters is situated in Singapore.

PayPal’s global presence expanded with key locations, including a software development center in Chennai, India (2006/2007), a data service office in Austin, Texas, and customer support operations worldwide since 2011. The company further extended its reach with a global center of operations in Kuala Lumpur in 2014.

Ownership, Management and Governance

Founded in 1998 by Max Levchin, Peter Thiel, and Luke Nosek as Fieldlink, the company underwent several transformations, initially named Confinity. In March 2000, a significant development occurred when Confinity merged with x.com, a company founded in March 1999 by Elon Musk, Harris Fricker, Christopher Payne, and Ed Ho. The resulting entity was later renamed PayPal in June 2001, eventually going public in 2002.

Post-IPO, Elon Musk held the largest stake with an 11.7% ownership share, but his involvement and ownership were impacted by eBay’s acquisition shortly after the IPO. The sale to eBay, valued at $1.5 billion, resulted in Elon Musk cashing out $175 million and leaving the company.

As of October 26, 2023, PayPal has 1,078 million shares outstanding, reflecting a decrease from the beginning of the year when it stood at 1,136 million shares, representing a decline of approximately 5%. Institutional ownership now holds a significant portion, with around 70% controlled by institutions such as Vanguard, BlackRock, and State Street, possessing 8.4%, 6.7%, and 4.1% ownership, respectively.

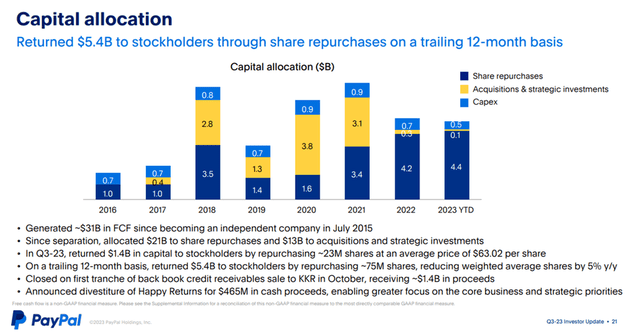

In 2022, the company executed a $4.2 billion stock buyback under its 2018 authorization program. In June 2022, the board of directors authorized an additional $15 billion for buybacks. By September 2023, the company had repurchased $4.4 billion worth of shares, totaling $5.4 billion over the last twelve months. Notably, in 3Q23, around 23 million shares were bought back at an average price of $63 per share.

While the company could potentially reduce the share count by 6-7.5% per year using free cash flow at the current market cap of approximately $66 billion, it’s essential to consider the offset from share-based compensation, which has amounted to around $1.3 billion in recent years. As the stock faced a decline since mid-2021, there has been a shift from using free cash flow for acquisitions to returning capital to shareholders.

Capital Allocation (Q3-23 Investor Update )

In a recent C-suite transition, the company welcomed Alex Chriss as the new CEO as of September 2023. Alex Chriss brings a wealth of experience, having previously held various roles at Intuit. In his most recent position, he led the Small Business and Self-Employed Group, overseeing the successful delivery of QuickBooks and Mailchimp to millions of customers.

Joining Alex Chriss in the executive leadership team is Jamie Miller, who assumed the role of CFO in November 2023. Jamie Miller brings a strong financial background, having held CFO positions at prominent companies such as Ernst & Young, Cargill, and General Electric. Notably, she also serves on the board of directors for Qualcomm.

The leadership team has undergone further changes with a clear focus on “building a high-performing organization, serving its customers, and driving profitable growth.”

The company’s board of directors comprises 12 members, with John J. Donahoe serving as the Chairman. John J. Donahoe has been on the board since 2015 and previously served as the CEO of eBay from 2008 to 2015, a pivotal period that included the spin-off of PayPal from eBay. The board, under his guidance, plays a crucial role in steering the company’s strategic direction and corporate governance.

Business Model

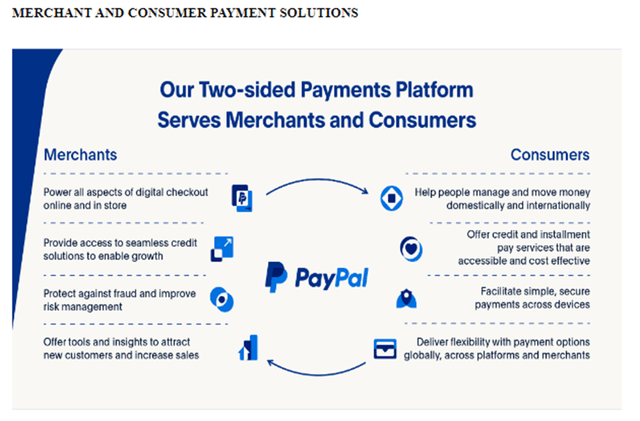

The company operates a robust technology platform, facilitating digital payments and streamlining the commerce experience for merchants and consumers worldwide. Its diverse range of payment solutions is offered under well-known names such as PayPal, PayPal Credit, Braintree, Venmo, Xoom, PayPal Zettle, Hyperwallet, PayPal Honey, and Paidy.

As of the end of 2022, the company boasted 435 million accounts, with 400 million active consumers and 35 million active merchants spanning 200 markets globally. The platform facilitated a remarkable 22.3 billion global transactions in 2022, marking a significant 16% increase from the previous year. The total payment volume reached $1.36 trillion in 2022, reflecting a robust 9% growth.

Customers benefit from the flexibility to utilize their PayPal or Venmo accounts for purchasing goods and services, along with the convenience of transferring and withdrawing funds. The company plays a crucial role in facilitating cross-border commerce, enhancing global economic interactions.

Revenue is primarily generated through transaction fees for payment completion, and additional income stems from fees related to foreign currency conversion. Notably, the company does not impose charges for funding or withdrawing funds from the account. The business also offers value-added services through strategic partnerships, generating revenue through interest and fees associated with merchant and consumer credit products. Other revenue streams include interest earned on specific assets underlying customer balances, referral fees, subscription fees, and gateway services.

PayPal’s Platform (Company’s 10-K for 2022)

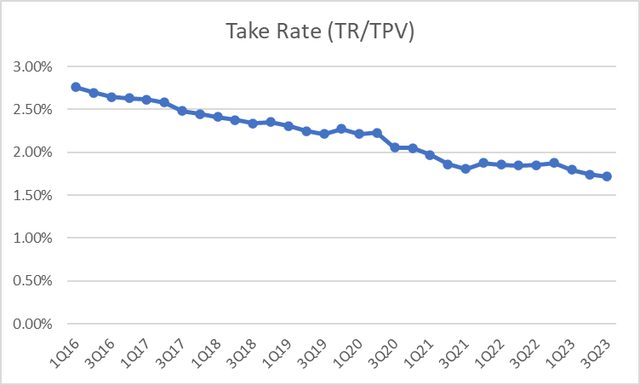

PayPal applies a 3.49% processing fee for its US commercial business, coupled with a 49-cent transaction fee. On the other hand, Braintree charges a 2.59% fee along with a 49-cent transaction fee. However, evaluating the overall cost of PayPal’s services is best understood through the “take rate,” which represents transaction revenue as a percentage of total payment volume. This metric was 1.72% in 3Q23, a decline from 2.7% in 2016. The 3Q23 figures include $6,654 million in transaction revenue and a total payment volume of $387.7 billion. The lower take rate is likely influenced by lower-priced product services between consumers, such as PayPal and Venmo, and increased market competition.

While sending money via Venmo to friends with a linked bank account is free, the company charges for instant transactions, amounting to 1.75%. For business accounts on Venmo, the charge is 1.9% plus an additional 10 cents per transaction. A notable development is the introduction of a credit card for Venmo account holders, which can be added to their phones, resembling services like Apple Pay. This initiative has the potential for significant growth in the future.

In 2022, the consumer loan and interest receivable balance experienced a remarkable 53% growth, reaching $5.9 billion. The banking partner for these services is Synchrony, and the credit card business involves substantial fees, with PayPal sharing the proceeds with Synchrony. This strategic collaboration positions PayPal to tap into the growing consumer credit market.

PayPal Take-Rate from 2016 (Company’s earnings reports)

Financial Performance

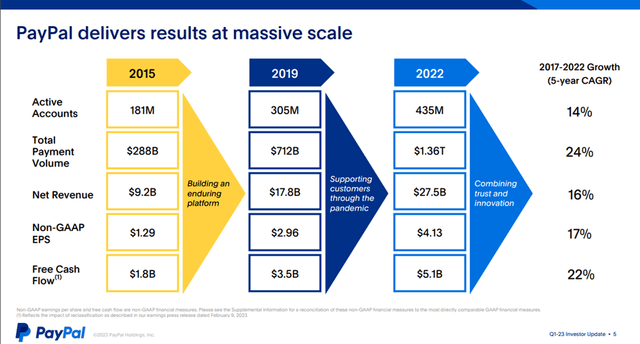

It’s evident that PayPal has experienced a robust growth period since its spin-off from eBay. The company has demonstrated impressive financial performance, with a compounded 16% revenue growth since 2017. Additionally, non-GAAP EPS, Earnings Per Share, has grown by 17%, and free cash flow has seen a remarkable increase of 22%.

This growth is attributed to the outstanding expansion in both account numbers and payment volumes. Specifically, there has been a noteworthy 14% growth in account numbers and an even more substantial 24% growth in payment volumes since 2017. These positive trends underline PayPal’s strong market presence and successful strategies in capturing the growing demand for digital payment solutions. The figures from the 1Q23 investor slide highlight the company’s continued momentum in the evolving financial landscape.

Performance Metrics since 2015 (1Q-23 Investor Update )

The company’s commitment to innovation and the launch of new products continues to yield positive results, reflected in increased payment volumes. In 3Q23, the total payment volume reached $388 billion, marking a robust 15% growth at spot and 13% on a foreign exchange-neutral basis.

Notably, while branded checkout experienced a 6% growth on a foreign exchange-neutral basis, with 5% in 2Q and 6.5% in 1Q, unbranded processing, primarily led by Braintree but also including unbranded credit and debit card processing on the PayPal platform, accelerated significantly to 32% growth, 28% in 2Q and 30% in 1Q.

While the company has not disclosed specific revenue figures for Braintree, the 4Q22 investor update included a pie chart indicating that Braintree’s volume accounted for 30% of the total payment volume in 2022. This marked an increase from the previous year, where Braintree represented 24% of the total payment volume.

One notable concern for investors could be the lower take rate, as the company expands with both Venmo and Braintree (unbranded processing). As mentioned earlier, the fee charged per transaction has gradually decreased, impacting transaction margin dollars, which declined from 51% in 3Q22 to 45.4% in 3Q23. Transaction-based expenses grew by 20.7% to $4.049 billion, offset by a 12% reduction in non-transaction operating expenses, totaling $1.722 billion.

Despite maintaining a steady number of accounts, PayPal has seen increased activity per account, contributing to the growth in volume and revenue. The figures indicate the company’s adaptability and success in navigating the evolving landscape of digital payments.

The company’s revenue and EPS growth showcase an impressive performance, particularly in the third quarter of 2023. With a topline growth of 8% at spot and 9% on a foreign exchange-neutral, FXN, basis, the company reached $7.4 billion in revenue. The non-GAAP EPS saw an even more substantial growth of 20%, reflecting the company’s financial strength and resilience.

PayPal is scheduled to disclose its fourth-quarter and full-year 2023 financial results on February 7th, 2024. The company anticipates a non-GAAP EPS of $1.36 per share, with a corresponding GAAP EPS of $1.20 per share. Revenue growth is projected to be in the range of 7-8%. Investors are advised to focus on critical performance indicators, including potential margin expansion or deterioration and the extent of share repurchases undertaken by the company.

Of particular interest is the scrutiny of margin trends to ascertain improvements or declines in profitability. Additionally, investors should closely monitor the share buyback activities, as this can influence earnings per share and serves as an indicator of management confidence. Valuable insights are expected from the management regarding the performance of the Venmo credit card business, with attention to any commentary on its growth trajectory.

The full-year revenue growth guidance for 2023 stands at 7.5% at spot and 8.5% FXN, equivalent to approximately $29.5 billion. The non-GAAP EPS guidance is $4.98/share, representing a remarkable 21% growth. It’s noteworthy that the company reports non-GAAP EPS, which was 4.13 in 2022 and is projected to be 4.98, while GAAP EPS for 2022 was 2.09. In the third quarter of 2023, GAAP EPS was 93 cents compared to the non-GAAP EPS of 1.30. Adjustments in non-GAAP figures primarily account for share-based compensation, SBC, and some restructuring and other charges.

Financially, the company has maintained robust free cash flow, FCF, consistently exceeding $1 billion per quarter. The guidance for 2023 anticipates FCF in the range of $4.5 billion to $5 billion, building on the strong performance of $5.1 billion in 2022. With over $11.5 billion in cash and short-term investments and total debt standing at $10.6 billion, the company is in a solid financial position. The positive cash flow, coupled with more cash than debt, underscores the company’s financial stability and strategic financial management.

Industry Backdrop

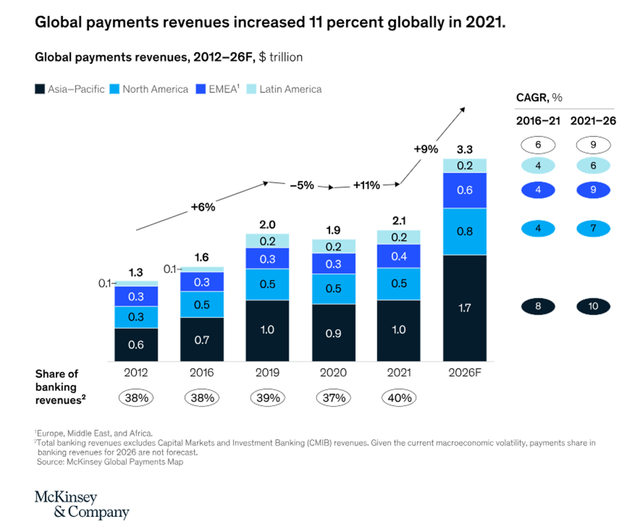

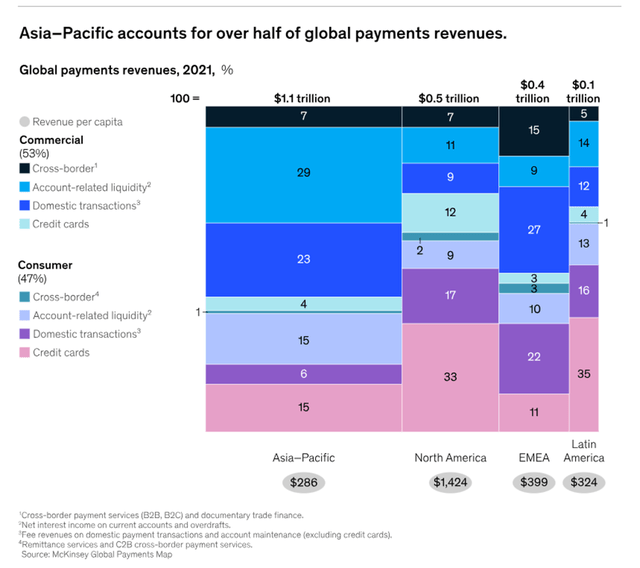

The global payment industry is indeed vast, highly competitive, and constantly evolving, encompassing banks, payment processing solutions, and money transfer services. It operates in an innovative environment and is subject to rigorous regulatory scrutiny. As of 2022, a McKinsey report indicates that the payment industry experienced substantial growth, reaching $2.1 trillion in revenues, with PayPal contributing slightly above $25 billion, securing a 1.2% market share. In 2021, PayPal exhibited impressive growth at 18%.

Global e-commerce, a significant driver for the payment industry, expanded by 17%, with China emerging as the largest contributor, now constituting over half of global retail e-commerce sales. McKinsey projects a 9% compound annual growth rate, CAGR, for the payment industry over the next five years, exceeding the historical average of 6-7%. This optimistic outlook is attributed to the higher interest rate environment.

Despite the overall positive growth trajectory, some newer entrants or high-growth companies within the industry have experienced declines in their stock or currency values. McKinsey speculates that this could lead these companies to shift from a “growth at all costs” approach to a more cost-conscious operating model. Notably, this trend aligns with observations at PayPal, suggesting a broader shift in the industry towards rational and shareholder-focused operations.

In the banking space, dominance is shared between prominent US and Chinese banks, including JPMorgan (JPM), Bank of America (BAC), Industrial and Commercial Bank of China, Agriculture Bank of China, and Bank of China. These banks lead in terms of market capitalization and total assets, underscoring the significance of both the US and Chinese financial markets in the global banking landscape.

Global Payment Size (McKinsey Report, Oct 7th 2022) Global Payment Revenues (McKinsey Report, Oct 7th 2022)

Looking at the payment processing solutions industry provides valuable insights into a dynamic and rapidly growing sector. According to Precedence Research, this industry has reached a significant milestone, currently standing at a $100 billion market and is projected to experience remarkable growth, reaching $632 billion by 2032, with an impressive 20% compound annual growth rate, CAGR. The driving forces behind this growth include the increasing global internet penetration and the rising number of smartphone users.

As of 2022, North America holds the lion’s share of the market, commanding a 47% market share. However, the report anticipates that China will exhibit the fastest growth in the forecast period. Asia-Pacific currently represents 19% of the market share. Noteworthy players in this space include ACI Worldwide, Elavon Inc, FIS, Fiserv, Global Payments, GoCardless, PayPal, Square, Stripe, and Wirecard CEE.

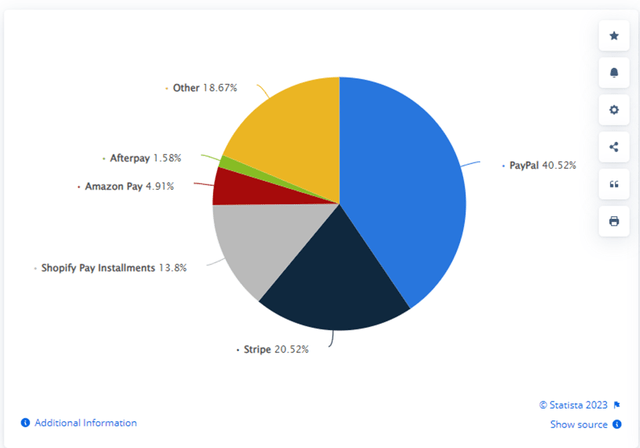

Among these players, the public companies include Fiserv (FI), Square/Block (SQ), Fidelity National Information Services (FIS), and Global Payments (GPN). Outside the traditional banking sector, PayPal stands out as the leading global online payment processing company. As of December 2023, PayPal holds a substantial 40.5% market share, positioning itself ahead of Stripe, a private company, which commands a 20.5% market share. This underscores PayPal’s strong position and influence in the evolving landscape of online payment processing.

Payment Processing Solutions Companies (Statista Report, Dec 5th, 2023)

In the money transfer and remittance industry, there are both traditional banks and specialized players. Some of the key players in this space include banks like JPMorgan, Bank of America and specialized players such as Western Union (WU), Moneygram and PayPal, through Xoom.

The remittance industry was valued at around $700 billion in 2020 and is projected to experience a compound annual growth rate (CAGR) of 5.7% from 2021 to 2030, reaching an estimated $1,227 billion. Remittance typically involves sending money across borders by foreign migrants to another person through various means, including electronic payments, drafts, and checks.

The growth in the industry is notably driven by the expansion of digital remittance services and the increasing adoption of mobile-based payment channels. PayPal, through its Xoom service, operates in this digital remittance space, capitalizing on the rise in mobile-based payments.

The company has a widespread presence in 200 markets, with its primary market being the United States, contributing to 50% of its revenue. While the company does have some exposure to China, generating approximately $700 million in revenue, this constitutes around 3% of its total revenue, which amounted to $21.5 billion in 2020.

An important development in 2022 was the reclassification of payment processing companies in the Global Industry Classification Standard (GICS) codes with start in March 2023. Payment processing companies were moved from “Data Processing & Outsourced Services” under “Information Technology” to a newly created sub-industry called “Transaction & Payment Processing Services” under the “Financials” sector. This reclassification means that PayPal is no longer classified as a technology company but as a financial company. This change could potentially have impacted the stock negatively as it lagged the technology stocks in 2023 but perhaps this could turn to a positive in 2024, especially if the financial sector becomes more favorable, potentially influenced by shifts in the fed fund rate or other market dynamics.

Value Proposition

The company’s stock performance has undergone a notable transformation, plummeting from $300/share in 2021 to $64/share currently, marking an ~80% decline. This significant shift could be attributed to diverse factors, encompassing market sentiment, sector dynamics, and broader macroeconomic conditions. Additionally, the preceding management’s extensive acquisition strategy and a controversial policy update in October 2022, where customers faced fines for spreading misinformation, might have contributed to the decline. Although the policy was retracted, the incident left a lasting impact. The company has undergone a significant shift with the introduction of new management, poised to alter the trajectory of its narrative.

In tandem with the broader financial sector, PayPal encountered challenges amid the Federal Reserve’s series of interest rate hikes. However, there is a potential for a shift in sentiment if the Federal Reserve hints at an interest rate peak and signals future cuts. Such a scenario could rekindle interest in the financial sector, aligning with expectations reflected in the treasury market. Notably, PayPal’s reclassification to the Financial sector in March 2023, from its previous categorization in the Technology sector, adds another layer to its market dynamics.

PYPL stock chart (Seeking Alpha)

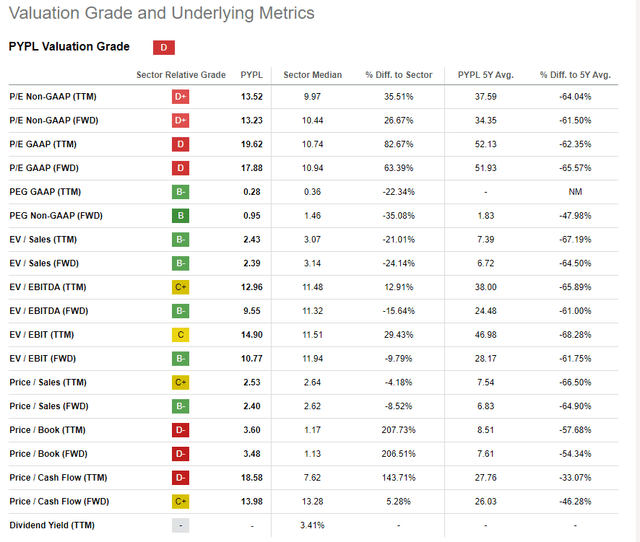

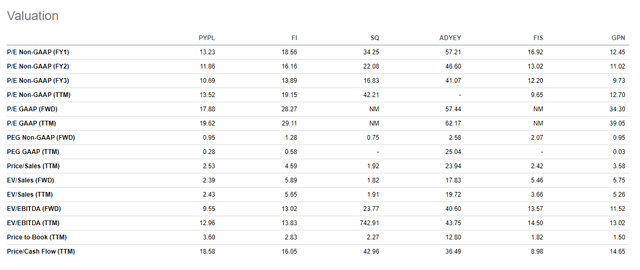

In comparison to Square and other competitors like Fidelity National Information Services, Fiserv, and Global Payments, if the company’s P/E ratio is notably lower, it could suggest that the market may not be fully reflecting the company’s earnings and growth prospects. The lower P/E ratio presents a potential opportunity for value-oriented investors, especially in the aftermath of a substantial decline in share price. Importantly, this reduction in P/E does not necessarily indicate a deterioration in business fundamentals. Currently trading at a 66% discount to its 5-year historical average and well below the current market multiple of 20 P/E, based on the average S&P500 multiple, the stock appears undervalued.

While the current multiple is slightly above the Financial Sector median may seem inconclusive, it’s essential to note that the sector predominantly comprises traditional banks, which typically trade at single-digit multiples. In contrast, PayPal’s lower P/E, when compared to its historical and market averages, underscores its potential as an attractive prospect for investors seeking value opportunities.

Valuation Metrics (Seeking Alpha) Peer Comparison (Seeking Alpha )

The company has consistently demonstrated robust cash flow generation, averaging around $4-5 billion annually in recent years and exhibiting a positive trajectory. This translates to an attractive 6-7.5% free cash flow yield on the current $70 billion market capitalization or a valuation ranging from 13.2-16.5x free cash flow.

Since 2021, the company has strategically shifted its focus from returning capital to shareholders to a more balanced approach, incorporating acquisitions into its growth strategy. There is a notable potential for a 4-5% annual reduction in share count, aligning with the new management team’s commitment to investing in profitable growth while maintaining cost consciousness. This strategic shift is anticipated to positively impact earnings per share, EPS.

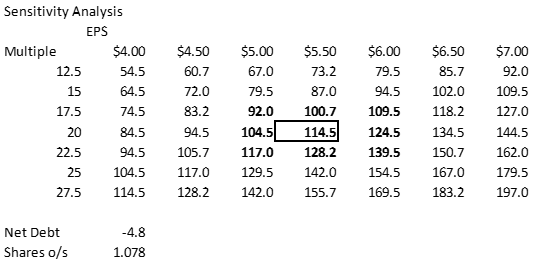

The company’s guidance for 2023 indicates a projected GAAP EPS of $3.75 and a non-GAAP EPS of $4.98, with a 4Q guidance of $1.20 and $1.36, respectively. Assuming a 15% earnings growth rate, the estimated GAAP EPS for 2024 and 2025 would be $4.30 and $4.95, and non-GAAP EPS would be $5.70 and $6.55, respectively.

The latest quarter witnessed an impressive 20% earnings growth, contributing to the company’s compounded annual growth rate of 17% since 2015. Comparatively, the S&P500 average earnings multiple stands around 20.

The initiation of the stock decline in 2021 appears to have been primarily a correction, reflective of the broader trend where speculative and highly valued stocks faced significant downturns from summer 2021 to late 2022. The earnings multiple underwent a reset, transitioning from the 5-year average multiple of nearly 40 P/E to the current 13 P/E.

Notably, PayPal’s reclassification to the Financial sector in March 2023 coincided with the technology sector’s resurgence, leaving PayPal somewhat behind. However, there is potential for a stock reemergence, particularly if the financial sector begins to trade more favorably in 2024, especially in response to a more accommodating stance from the Federal Reserve.

Considering the average S&P500 earnings multiple of 20 as the base case, our target EPS of $5.50 implies a calculated price target of $114 per share. This assessment suggests a substantial ~80% upside from the current market price, reflecting our optimistic outlook on the company’s performance and valuation.

Sensitivity P/E Valuation Analysis (Analyst Proprietary)

Catalysts

Under the stewardship of the new management, the company has demonstrated a commitment to effective cost-cutting initiatives and a proactive share buyback strategy. This strategic approach has resulted in an EPS growth trajectory that surpasses market expectations. The company’s focus on the monetization of Venmo, particularly through the credit card business, serves as a key driver for future revenue streams. The resilience of the US consumer remains steadfast, despite ongoing suggestions from financial media pundits about an imminent recession. As long as the consumer continues to weather potential challenges, the trajectory of earnings should remain intact. The ability of the consumer to withstand economic headwinds contributes to the overall stability of the earnings outlook.

Furthermore, the potential scenario of the Federal Reserve cutting rates could contribute to a market rotation into financial stocks. The company, now classified in the financial sector following industry reclassification, stands to benefit from this shift in market dynamics. Overall, these strategic measures and market conditions position the company for enhanced financial performance and increased investor confidence.

Risks

While the company has navigated challenges such as a continued lower take rate, increased competition, and the emergence of new technologies, it has faced additional headwinds, including higher costs associated with executing its business model. Moreover, the ongoing scenario of the Federal Reserve persistently hiking interest rates presents an additional layer of complexity for the company, could lead to a worsening US consumer.

Despite these challenges, the company’s resilience and adaptability will be crucial in maintaining its competitive edge. Strategic responses to address cost challenges, innovations to stay abreast of evolving technologies, and adept management of the impact of interest rate hikes will be instrumental in shaping the company’s future success. A proactive and agile approach will be key to overcoming these challenges and sustaining growth in a dynamic business environment.

Conclusion

In summary, PayPal’s report showcases a resilient company that has adeptly tackled challenges through strategic initiatives aimed at fostering growth. The firm’s commitment to cost-cutting, share buybacks, and the potential monetization of Venmo positions it favorably for strong financial performance.

The recent decline in share price has propelled PayPal into the realm of value investing, presenting a promising opportunity for significant upside in 2024, as outlined in the earlier Value Proposition section, with a target set at $114 per share.

While challenges such as a lower take rate, increased competition, and the advent of new technologies exist, the overall payment processing industry is poised for growth, and PayPal stands out as one of its largest players.

Despite these challenges, PayPal’s impressive track record, consistent cash flow generation, and commitment to profitable growth instill confidence. As market dynamics evolve, the company’s adept navigation of challenges will be crucial for sustained success. Investors are advised to vigilantly monitor how PayPal addresses these factors and adjusts to the ever-changing landscape in the financial and technology sectors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.