Summary:

- Beyond Meat has distressing amounts of debt for a company losing money.

- Beyond Meat has little ability to pay off their debt.

- A restructuring of debt would put the shares at half their current value.

D-Keine

Introduction

Beyond Meat (NASDAQ:BYND) has been producing plant-based meat alternatives since the launch of their first products in 2012. They offer alternatives to burgers, sausages, meatballs, and jerky, all with the intent of capturing the attention of vegetarians and vegans who don’t want to completely give up meat. A solid idea, but the financials simply don’t support the long-term implementation of their vision. Beyond Meat has lost money on their operations every quarter for the last 2 years, and has been building up a huge liability in the form of 1,150MM in debt, publicly traded bonds to be paid back in March 2027, which themselves are trading for just 18% of their face value.

Clearly, the market doesn’t believe in Beyond Meat’s chances of success, but why is the stock price not reflecting this? Yes, it is down, almost 50% over the last year, and 94% over the last 5 years, but not as much as it should be. For a company with over 1,150MM of debt to pay back in 27 months, a negative book value, and negative operating income, Beyond Meat’s share price should, by most metrics, be much lower, but there is a less talked about reason for its inflated value, one that bearish investors can take advantage of. Throughout this article, I’ll discuss my opinion as to Beyond Meat’s true value, the hidden reason it’s trading at a considerably higher price, the meat alternatives market, and the potential outcomes of its debt situation.

Since my extremely bearish April coverage of Beyond Meat, encouraging investors to exit their long positions, the stock has fallen over 33%, from $7.25 a share, to under $5.00. I decided to cover Beyond Meat again to encourage investors once more to cut ties with their long positions and consider a bearish position on the company, due to the poor quality of Beyond Meat’s financials.

Thesis and Peer Comparison

So what’s the deal? Why is Beyond Meat, a company with debt expiring in under 27 months, trading for a valuation I believe to be extremely unreasonable? Well, the answer lies in something that I believe to be a major catalyst for inefficiencies in the market; the existence of short interest. When borrowing stock to short, investors typically pay 3-5% annually, even lower on large caps with significant liquidity, however Beyond Meat requires investors to pay over 40% annually to short the stock, a significant hamper on the absolute flood of short selling I believe Beyond Meat would see if not for this fact, thus leading to the company’s fundamentally outrageous valuation.

For a company losing money, trading below $5.00 a share, and with a negative book value, price to sales is the best measure of Beyond Meats value, allowing an investor to take into account the potential value in the event of a positive profit margin, adjusted for the likeness, and Beyond Meat trades at a price to sales of about 0.90x. The market is typically harsh on companies that are as consistent with their losses as Beyond Meat. A stock with similarly high short interest is AMC Theatres (AMC), a dissimilar company, but one trading for just half its sales, even though they’ve shown more potential for profitability than Beyond Meat.

While difficult to find a similarly situated company that focuses as heavily on plant-based meat alternatives as Beyond, companies Ingredion (INGR) and Nomad Foods (NOMD), trade for price to sales ratios of 1.32x and 0.85x respectively, concerningly similar, and even lower than Beyond Meat’s 0.90x, especially when considering the fact that both Ingredion and Nomad Foods make a profit.

Considering all the factors that companies in similar markets (INGR and NOMD) trade for similar price/sales ratios, and companies in similar financial situations (AMC) trade for a fraction of the price/sales multiplier, investors in Beyond Meat are either dramatically overestimating the chance for a sudden reversal in the strong trend of losses, or, my personal opinion, Beyond Meat’s astronomical short interest is preventing the markets from effectively valuing the company, leading me to the belief that Beyond Meat is quite overvalued relative to its true risk/return ratio.

Meat Alternatives Market

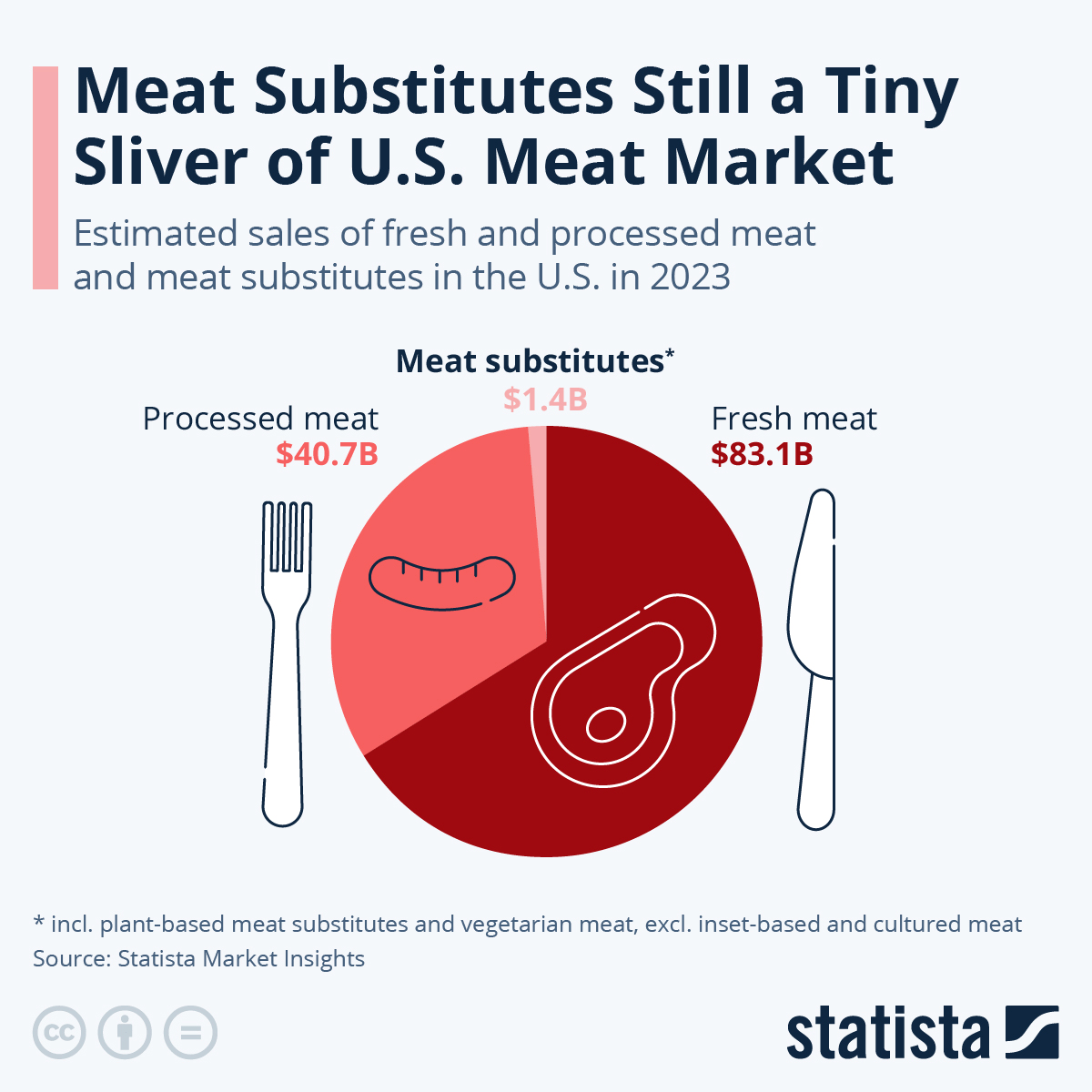

While the argument remains that the meat market has dramatic room to grow, given that meat substitutes make up just 1.4BB in the 120BB+ meat market, meat alternatives are simply lacking a catalyst for the rise in sales clearly needed to allow for Beyond Meat to pay off their debt, due in just 27 months.

Meat Substitutes as a % of the U.S. Meat Market 2023 (Statista)

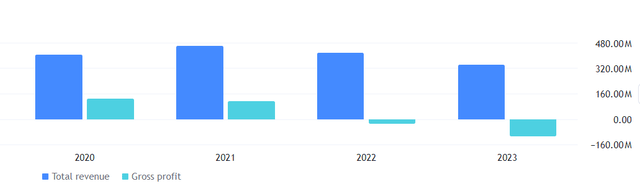

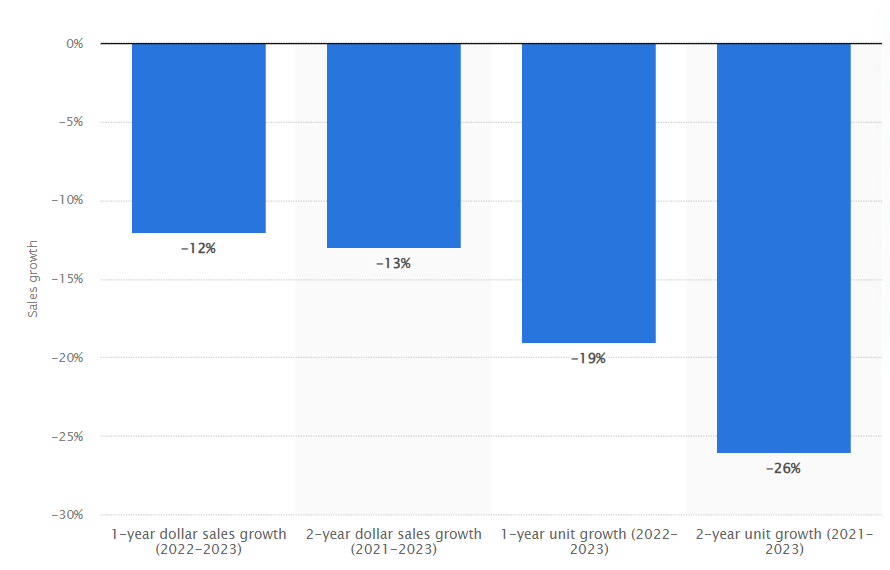

Over the last year, Statista reports a decline in meat sales, both in $ amount and units sold, while Beyond Meat specifically, has seen dramatic declines in revenue over the last 2 years, from over 460MM in 2021, to a TTM revenue of just over 320MM, down 30% over the time period. Over the same time period, gross profit has dramatically declined, even flipping negative.

Beyond Meat Revenue and Gross Profit (TradingView)

Sales growth meat substitutes in the U.S. 2021 to 2023, by value and volume (Statista)

With 1,115MM in debt coming due in March of 2027, it’s evident that without considerable support from growth in alternative meat markets boosting net income, Beyond Meat may not survive. To make matters worse, while alternative meats markets are growing rapidly, considering Beyond Meat is a company that loses money through operating, it’s quite a stretch to claim that higher demand for alternative meats will alone solve their issues.

Debt Analysis

Beyond Meat’s sole debt, in the form of publicly traded bonds, goes for 18% of their par value. Clearly, the market lacks almost any confidence in Beyond Meat’s ability to actually pay their almost 1,150MM in debt, a level of confidence I can get behind. Considering that this would represent almost 2x the company’s assets, I’m of the opinion that this debt is simply not going to be paid by Beyond Meat in the form of cash, but rather, the remaining value of the bonds is pricing in an equity conversion. Beyond Meat sits on less than 200MM in cash, almost a sixth of the value needed to pay off the 1,150MM in outstanding debt, due Q1 2027, the clock is ticking on the chances of a repayment, instead of an equity conversion.

I personally think there is next to no chance of BYND repaying their debt, as the financials simply don’t support that happening, and it’s extremely unlikely they’ll be able to roll their debt out further, as the markets clearly don’t value BYND debt very highly. This leaves us with the potential of a conversion of bondholders’ debt to equity, something that would crater the stock price. Let’s go over the possibility. Beyond Meat has 1,150MM in outstanding debt, with a market cap of less than 300MM. That alone should end the conversation, but for the sake of thoroughness, what would a Beyond Meat debt conversion look like?

While finding the actual result would be reliant on the actual conversion ratio agreed to by creditors, we can start with the obvious; the removal of the storm cloud overhead that is Beyond Meat’s debt would certainly boost the stock price. The balance sheet we’d be left with would be about 500MM in equity, subtracting whatever losses Beyond Meat incurs over the next 2 years, split across however many outstanding shares there are, a number which will probably be between 175,000,000, and 300,000,000, admittedly not a very tight range, but without the actual knowledge of the future movement of the stock price, and thus the conversion ratio, is the best guesstimate we can achieve. Using the company’s average equity decline of 58MM over the last 8 quarters to estimate earnings over the next 10 quarters, until their debt is potentially converted, Beyond Meat would lose 580MM in equity, putting its equity value, given a removal of their debt, at almost exactly 0.

This assumes many things, such as Beyond Meat’s ability to sell their fixed assets at a reasonable price, Beyond Meat managing to slow the recent increase in the rate of losses, and of course, Beyond Meat’s creditors actually agreeing to a conversion, and the company opting to do so. However, this final “simulation” does make critical points. It cements my personal belief that Beyond Meat doesn’t have the ability to pay its debt off, will have to liquidate assets to fund their continued losses, has lost the ability to raise capital without a share issuance, and all signs point to a further devaluation of existing shares.

Risks to the Short Thesis

As always, when shorting a stock down almost 99% from an all-time high, there is the risk that the company returns to its prior valuation, causing significant losses to short sellers. The potential for Beyond Meat to return to an all-time high is low, but how likely is it that it bounces back even a couple of months in price? I think low. Beyond Meat has fallen out of favor with investors, and will likely continue on a downward trend, both due to sentiment, and poor fundamentals.

A reversal of the price movement seen over the last year would require a catalyst. So, which ones am I concerned about? Frankly, I can’t see Beyond Meat recovering unless it becomes profitable, as there is little likelihood of a capital raise without proving to investors that they can actually turn that money into more money.

I think that for the stock to change direction, and pose a risk to my short thesis, a profitable quarter is necessary, and I don’t just mean an uptick in equity. In order for me to pivot from my stance, I’d want to see Beyond Meat have both positive net income, and free cash flow in the same quarter, and of a sizable amount relative to its losses.

For Beyond Meat to recover in the long run, it must start making money, and while that suddenly occurring does pose a risk to short sellers, I can’t envision a spontaneous reversal of a half-decade-long trend of excessive losses in retained earnings.

Sentiment and Investment Opportunity

Beyond Meat’s price has cratered from a high by over 98%, down from almost $240 a share in 2019, and is showing no signs of stopping. It’s clear that the market doesn’t place a high value on Beyond Meat’s billion dollars of debt, negative 600MM in equity, earnings that aren’t only negative, but continuing to decline, and inability to even make an operating profit. This sentiment is placed into measurable numbers in the form of short interest on the stock. It now costs over 40% to borrow shares to short Beyond Meat, a vote of confidence in its demise rarely seen in companies that end up turning around. But one thing must be discussed, that there is a reason for the opportunity provided by Beyond Meat’s elevated share price, and that is the risks that come inherent with taking short positions.

The potential for unlimited losses exists when shorting calls or stock without hedges, and thus investors looking to capitalize on this opportunity must be careful, but when reviewing the fundamentals of the business, Beyond Meat’s share price is likely not going to sustain the value it’s currently trading at. This leads me to the opinion that shorting calls to capture elevated returns on risk, due to short sellers purchasing hedges, and high valuations placed on puts driving up values on call counterparts, is a brilliant idea throughout the next year, as Beyond Meat continues to revert to its true value, a fraction of its current one.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of BYND either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.