Summary:

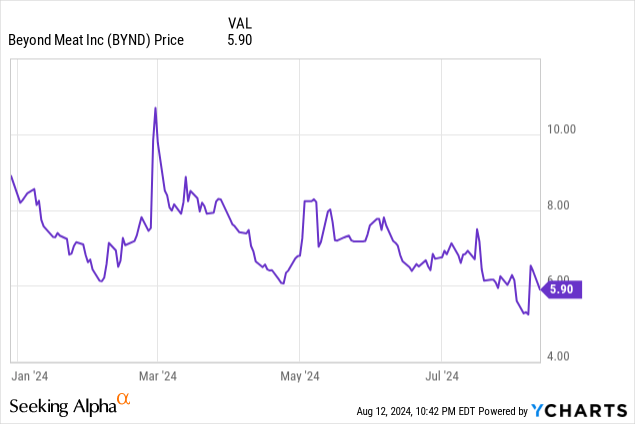

- Shares of Beyond Meat saw a brief respite after posting better-than-expected Q2 results.

- Revenue declines softened, while gross margins made a major recovery on the back of an increase in prices.

- After previously slashing prices to develop more points of sale, the company has prioritized protecting its margin. Net price per pound has increased ~20% in U.S. retail, its largest segment.

- In spite of this, Beyond Meat still faces weak end-customer demand, especially in the wake of a potential recession. I continue to recommend selling this stock.

Sundry Photography

Q2 has been an unduly strange earnings season, in which we saw shares of some of the most infallible titans correct, while underdogs that have long been abandoned by mainstream investors rallied on better-than-expected results. Beyond Meat (NASDAQ:BYND) is one of these stocks, as the plant-based meat vendor reported the benefits of price hikes in driving up the company’s long-ailing gross margins.

Despite the feeble post-earnings rally, shares of Beyond Meat remain down more than 25% year to date. To me, this is a dead-cat bounce for a company that continues to struggle to find relevance in the modern marketplace.

While acknowledging recent improvements, there’s not nearly enough here to build a buy case for Beyond Meat, especially as 2027 debt looms

I last wrote a bearish note on Beyond Meat in June, when the stock was trading at $7 per share. In spite of my bearish outlook, I’ll concede that since June and since the Q2 earnings print, a number of factors have moved in the right direction for Beyond Meat, which we’ll discuss in more detail in the next section:

- Revenue declines have softened (though this is largely a function of easing prior-year comps), and points of sale have stopped declining

- Price increases have helped the company return to a low-teens gross margin, from near-zero for much of the past year (at one point, Beyond Meat’s gross margins were negative)

- Accordingly, cash burn has also moderated, with the company additionally benefiting from huge cuts to its non-production workforce

As much as I’d like to believe Beyond Meat is on firmer footing, however, it’s difficult to not worry about this company’s future in the wake of a potential U.S. recession. Especially as Beyond Meat has turned to price hikes again (reversing its earlier policy of slashing prices to get its product into as many grocery stores and consumer refrigerators as possible), a coming recession will continue to erode the value proposition of plant-based meats (which are often more expensive than their meat-based counterparts). Furthermore, as a significant chunk of Beyond Meat’s sales happen in restaurants, we’ve already gotten warnings from companies like Yelp (YELP) that the restaurant sector, especially multi-location chains, are seeing signs of slowing consumer visits. As a result of all this, I’m reiterating my sell rating on Beyond Meat.

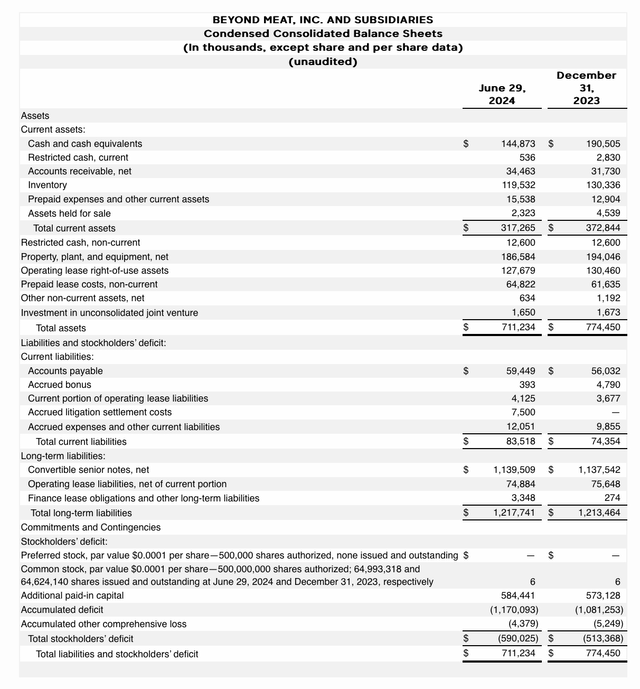

We also can’t forget a major storm cloud looming over Beyond Meat’s proverbial head: its huge debt balance. Beyond Meat’s latest balance sheet has $144.9 million of cash left on its books. Fortunately, the company has brought its burn rate down to ~$50 million over the past two quarters, so that’s more than a year left. But the concern here is the company’s mounting convertible debt, $1.14 billion worth that is due in 2027.

Beyond Meat balance sheet (Beyond Meat Q2 earnings release)

Now, there might be a light at the end of the tunnel if interest rates do come down in a recession and Beyond Meat is able to restructure its debt on favorable terms. But in my view, the core business fundamentals of Beyond Meat are so eroded that irrespective of macro credit conditions, very few creditors are going to want to touch Beyond Meat, its declining sales profile, and its still-pressing cash burn issues.

I continue to advise investors to stay away from this stock and to invest elsewhere.

Q2 recap

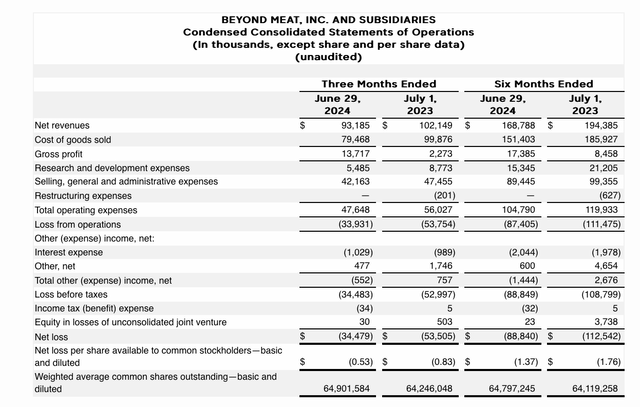

Let’s now go through Beyond Meat’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Beyond Meat Q2 results (Beyond Meat Q2 earnings release)

Revenue declined “only” -9% y/y to $93.2 million, which came in ahead of Wall Street’s weaker expectations of $88.4 million (-13% y/y). Declines also moderated somewhat from an -18% y/y decline in Q1, but again this is largely a function of prior-year comps easing as well.

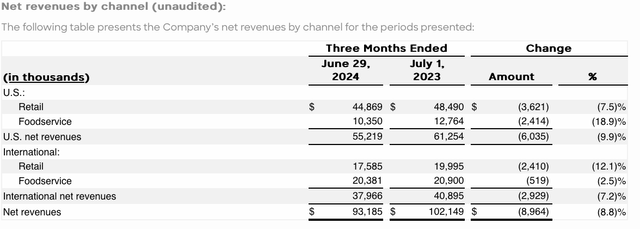

The chart below shows the breakdown of Beyond Meat’s sales by channel in the year to date. All segments, both in the U.S. and international, saw declines, but note that U.S. foodservice revenue dropped -19% y/y, much sharper than any other segment.

Beyond Meat sales by channel (Beyond Meat Q2 earnings release)

Comparatively, international foodservice held up better with a milder -2.5% y/y decline, but we note that headwinds may continue if U.S. restaurants continue to see fading visitation amid a recession.

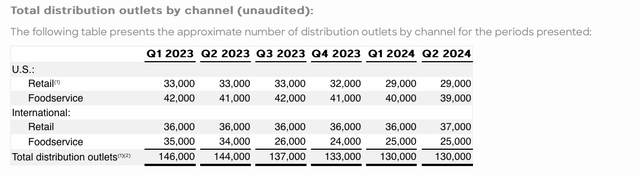

But it may not be all macro driven, either. As the chart below shows, the number of U.S. foodservice locations carrying Beyond Meat products has slimmed down to 39k, another sequential loss that the company has sustained since Q3 of 2023, and which may be a reflection of changing U.S. consumer tastes.

Beyond Meat points of sale (Beyond Meat Q2 earnings release)

Fortunately, international retail locations increased, so the total number of distribution points remained flat quarter-over-quarter at 130k: a major accomplishment for Beyond Meat. To me, it has become clear that as the plant-based meat fad is fading in the U.S., international growth has become critical for Beyond Meat. The company noted that Germany has been a core focus market, especially as it partnered with McDonald’s (MCD) to roll out McPlant Burger and McPlant Nuggets.

Importantly: Beyond Meat’s gross margin improved to 14.9% in Q2, which was a twelve-point improvement y/y and a ten-point improvement versus Q1. This was largely a result of price increases being more fully implemented across Beyond Meat’s points of sale, especially in U.S. retail, where the company has implemented a significant ~20% increase in net price per pound. Given the sharpness of these price increases, I’ll acknowledge to Beyond Meat’s credit that it’s a relief that U.S. retail points of sale have not dropped off.

Per CEO Ethan Brown’s remarks on the Q2 earnings call regarding price increases and gross margin improvements:

As discussed on prior calls, during the second quarter 2024, we scaled back on promotional trade discounts and together with the initial appearance of price increases on certain products in the US, this resulted in a 6.1% increase in our net revenue per pound compared to the year-ago period, including a 20.5% increase in our US retail channel net revenue per pound.

Gross margin rose to 14.7%, substantially higher than the 2.2% outcome in the same quarter last year and the 4.9% level achieved in the first quarter of this year. Importantly, we expect to see further gross margin progress across the balance of the year, reflecting the combined impact of more fully distributed pricing adjustments, continued moderation of promotional spending, and ongoing COGS improvements as we consolidate our network and continue on our lean management journey.

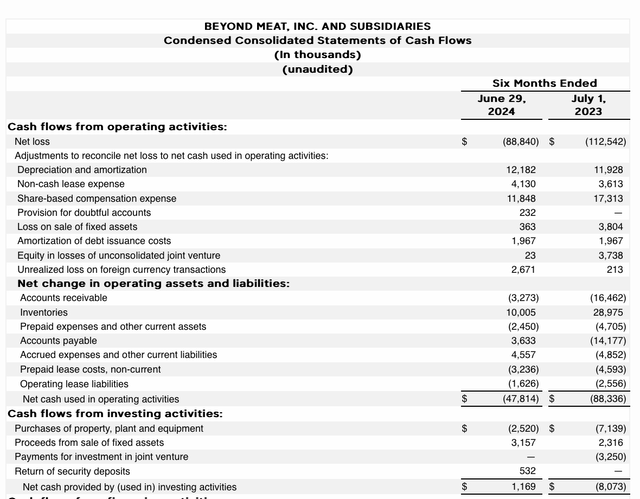

Combined with a -15% y/y reduction in operating expenses from ongoing headcount efficiencies, Beyond Meat was able to bring its YTD operating cash flow losses down to -$47.8 million, roughly half of the year-ago loss.

Beyond Meat cash flow (Beyond Meat Q2 earnings release)

Key takeaways

Despite the marginal improvements Beyond Meat is making, we have to take a step back and ask ourselves: are we really cheering a low-teens gross margin and the “achievement” of not losing any more points of sale, or of still losing cash (but just not as much as last year)? Are international growth markets going to generate enough new customers to offset sharp losses in the U.S., given both point of sale contraction and changing tastes?

In my view, the answer is no. In the long run, I still see Beyond Meat suffering through declining sales and cash burn, which will become more pressing when the company brushes up closer to its 2027 debt maturity. Continue to avoid this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.