Summary:

- Shares of Beyond Meat have dropped even further to a ~40% YTD loss despite a temporary return to sales growth.

- The company struggles with taste, health perceptions, and high prices, leading to reduced consumer demand and fewer points of sale.

- Despite Q3 revenue growth and improved gross margins, Beyond Meat’s limited liquidity and high debt pose significant risks.

- Investors should avoid Beyond Meat due to its weak demand, poor product-market fit, and uncertain path to recovery.

Alexander Farnsworth

Sometimes, good ideas fail at being good businesses, and tough economic times expose that harsh reality quicker than others. Amid sky-high stock markets, we have to be careful to prune these names out of our portfolios.

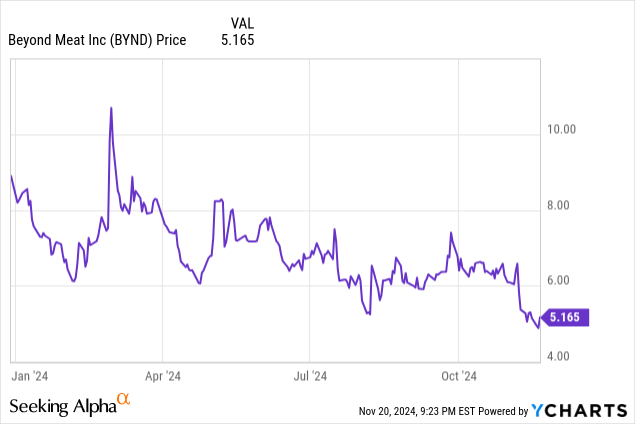

Beyond Meat (NASDAQ:BYND) is one of these names, and it has had a tough year so far. The plant-based food manufacturer has faced declining sales and profitability, and though trends have stabilized somewhat (largely on account of easing prior year comps), Beyond Meat has still lost 40% of its value year to date.

I last wrote a bearish note on Beyond Meat in August, when the stock was still trading closer to $6 per share. Since then, while the rest of the stock market has gone into overdrive and cheered interest rate cuts and Trump’s reelection, Beyond Meat was an exception to the rally and slid ~20% instead. The company’s recent Q3 results, meanwhile, show some signs of improvement, but not nearly enough to warrant buying in. As such, I’m reiterating my sell rating on Beyond Meat.

Beyond Meat, in my view, is stuck in a quagmire of taste, health, and price. On the health side, the company has long been plagued by the connotation that plant-based meats are too rich in sodium to be healthy (to mimic the taste of meat) – and at the same time, it’s also often the premium protein option. Amid an economy that’s hyper-sensitive to inflation and is trading down to cheaper substitutes, Beyond Meat is poorly positioned to regain any sales momentum.

The company is battling its profitability issues by raising prices and reducing trade discounts to its reseller partners. This has yielded growth in revenue (again, off a much-reduced prior year compare), but at the expense of sales volume and a reduction in points of sale. Over time, I fear that Beyond Meat may convert itself into a small specialty brand that isn’t broadly carried and has little room to achieve economies of scale.

As a reminder for investors who are newer to Beyond Meat, here are my core red flags that keep me concerned on this stock:

- Fewer points of sale are carrying Beyond Meat products. The fact that fewer consumers are opting for plant-based meats means that the number of restaurants and grocers carrying Beyond Meat’s products are also shrinking. This reduces the company’s brand visibility and will be a vicious cycle that terminates in Beyond Meat’s failure.

- Low gross margins. The company isn’t suffering from negative gross margins anymore, but its mid-teens gross margin doesn’t leave much room for operating leverage: especially if sales momentum continues to be weak.

- Limited liquidity. Beyond Meat hinted at a deeper balance sheet restructuring in 2025, but at the moment it barely has over $100 million in cash left on its books and is carrying debt of over $1.1 billion.

In my view, Beyond Meat’s problems are likely to keep multiplying. Though the days of sharp sales declines and negative gross margins may be behind us, the company is still fighting an uphill battle against weak overall demand and poor product-market fit. Steer clear here and invest elsewhere.

Q3 recap

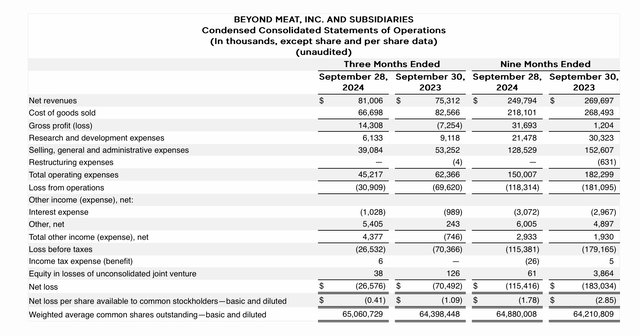

Beyond Meat posted one of the best quarters (well, at least a quarter that didn’t spark immediate alarm) in recent memory, and yet the company is still in deep red ink with no line of sight to recovery. Let’s now go through the company’s latest quarterly results in greater detail. The Q3 earnings summary is shown below:

Beyond Meat Q3 results (Beyond Meat Q3 earnings release)

Beyond Meat’s revenue grew 8% y/y to $81.0 million, slightly beating Wall Street’s expectations of $80.2 million (+7% y/y). This is a notable return to growth after Beyond Meat declined -18% y/y in Q2. Revenue also grew 7% sequentially versus Q2.

This slightly more optimistic quarter was driven by price increases and more selective distribution to Beyond Meat’s points of sale. The company reduced trade discounts and increased prices, resulting in a 16% y/y increase in the price per pound sold (partially offset by a 7% reduction in volume of pounds sold). Also worth noting is the fact that total U.S. revenue increased 15% y/y, while international (roughly 40% of overall revenue) declined -2% y/y.

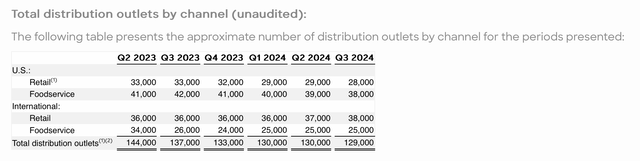

Still: what worries me is the continued pullback in Beyond Meat’s points of sale. The company lost 1k U.S. retail locations and 1k U.S. food service (restaurant) locations in Q3, as shown in the chart below:

Beyond Meat points of sale (Beyond Meat Q3 earnings release)

This is also yielding the company’s lower volume of sales by pound. To me, increased pricing and the lowering of trade discounts are not a repeatable growth lever, at least not without losing more volume. Optically, the company is benefiting now from easier prior-year comps (when sales fell harshly and gross margins were still negative), but when it laps price increases next year amid potentially softer demand, the company will still struggle to show growth.

Profitability also looked more optimistic in Q3. Gross margins of 17.7% leaped nearly 30 points versus -9.6% in the year-ago quarter. The company benefited from both higher pricing as well as lower logistics costs, and it expects to gain further savings from the installation of a new production plant in Pennsylvania. Per CFO Lubi Kutua’s remarks on the Q3 earnings call:

Gross profit in the third quarter of 2024 was $14.3 million, or gross margin of 17.7% compared to a loss of $7.3 million, or gross margin of negative 9.6% in a year ago period. As Ethan noted, this was our highest quarterly gross margin since the third quarter of 2021 and our lowest cost per pound since the second quarter of that year. In addition to the benefit from net price realization, gross margin in the third quarter of 2024 was also positively impacted by decreased cost per pound resulting from lower inventory provision, reduced logistics cost, and lower materials cost per pound. Overall, our cost of production continues to benefit from our network consolidation measures and more efficient inventory management. We are commissioning additional finished goods production capabilities at our facility in Pennsylvania, which we expect will drive further COG savings in 2025 and beyond.”

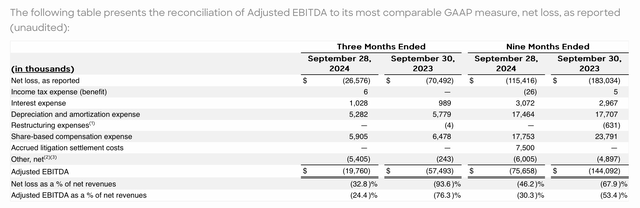

As a result, adjusted EBITDA losses also shrunk to -$19.8 million, representing a -24% adjusted EBITDA margin (much better versus -76% in the year-ago quarter).

Beyond Meat adjusted EBITDA (Beyond Meat Q3 earnings release)

Still: Beyond Meat can’t claim victory yet. Decreased pound sales means Beyond Meat is experiencing dis-economies of scale on production, despite the company installing additional capacity. If points of sale and overall shipments continue to shrink, the company’s recent streak of revenue and profitability improvements could still fade.

Key takeaways

Beyond Meat continues to be more trouble than it’s worth. In my view, the company won’t be able to sustain its return to revenue growth (driven by increased pricing) if it continues to see declines in the number of retailers carrying its product, diminishing the visibility of its brand. We note as well that the company’s ~$1 billion net debt positioning and continued negative FCF may force the company’s hand as it attempts a balance sheet restructuring next year. Maintain caution here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.