Summary:

- Beyond Meat’s Q3 report showed decent revenue growth and margin improvement, but cash burn and a massive debt pile are major concerns.

- The company’s balance sheet continues to weaken, with cash reserves and working capital dwindling, increasing bankruptcy risk.

- Despite some operational improvements, Beyond Meat’s valuation is unattractive compared to more stable competitors in the space.

PM Images

After the bell on Wednesday, we received third quarter results from Beyond Meat (NASDAQ:BYND). The plant-based meat company has been one of the stock market’s biggest losers in recent years, as sizable revenue growth expectations have not materialized and ongoing losses have resulted in significant cash burn. The Q3 report did show some positive signs, but the company’s massive debt pile remains a major headwind.

Previous coverage of this name

I last covered the name back in August, at which point investors did receive some good news. The company reported better than expected revenues, although that was mostly a function of dramatically reduced estimates, while expenses were coming under some control. Unfortunately, the weakening balance sheet was only increasing the risk of bankruptcy here, and working capital was continuing its march towards zero.

Back then, I continued to reiterate a sell rating on the stock. The company had a very small cash balance as compared to its large debt pile, and even an open equity sales program wouldn’t be nearly enough to close the gap before the 2027 debt maturity date hit. With an unimpressive valuation, I figured either shares would go lower on their own, or management would need to dilute investors substantially just to keep things going. Since then, shares have mostly rallied with the overall US market, although they are now behind if you include the after-hours decline.

The Q3 report

For the quarter, revenues came in at $81 million, almost a million ahead of the street’s average estimate. This was more than 7% growth over the prior year period, the first top line increase in two and a half years, and the largest revenue increase in percentage terms in three years. The revenue rise was thanks to a nearly 16% increase in revenue per pound, due to lower trade discounts, a change in sales mix, and selected price increases. Unfortunately, there was a more than 7% decline in the volume of products sold.

As management has worked to reduce costs, gross margins rose by three percentage points sequentially. The operating loss was still nearly $31 million in the quarter, but that was much better than Q2 2024 and the year ago period. The GAAP net loss for the quarter still annualized out to over $106 million, but that’s a nearly two-thirds improvement from a year ago.

With another couple of months in the books, management updated its 2024 forecast on Wednesday. 2024 revenues are now expected to be in a range of $320 million to $330 million, meaning that the top end of the range was cut by $10 million from the Q2 report. The midpoint of that range was about as expected, with analysts having continued to slash their estimates over time. Just a few years ago, there were hopes for the company to do well over $1 billion in revenue this year, but now expectations don’t even top $400 million for any of the next couple of years. Margin and expense guidance was maintained, while capital expenditures are forecast to be $5 million less.

Balance sheet gets even weaker

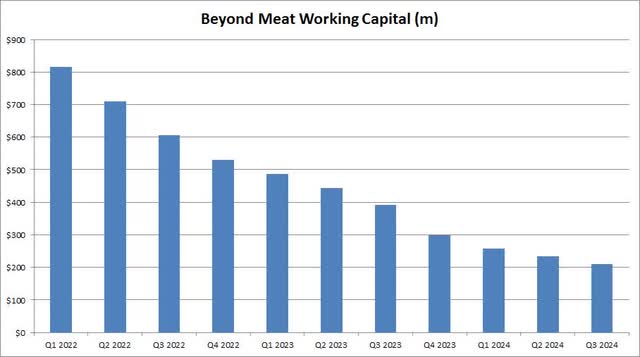

While losses are improving, cash burn remains a problem. Free cash flow was negative $24 million in the period, and is nearly $75 million through the first three quarters of the year (excluding asset sales). Cash and equivalents were about $135 million at the end of September, but debt was $1.1 billion. As the chart below shows, working capital continues to decrease by the quarter, down over $605 million in just two and a half years.

Beyond Meat Working Capital (Company Earnings Reports)

Management expects to increase its cash reserves by year-end and pursue some balance sheet restructuring efforts in 2025. This will be an extremely tall task, as the company’s market cap is only about $400 million currently. Through the end of Q3, there were no stock sales under the company’s $200 million equity sales program. Even if all that money were raised, the balance sheet would still be extremely debt heavy, and raising that amount of money would be extremely dilutive to current shareholders. With the current convertible debt having no coupon interest, a debt refinancing will likely be expensive, and interest expenses would only hamper efforts to get to annual GAAP profitability and positive cash flow.

Valuation is not impressive

As of Wednesday’s close, Beyond Meat shares were trading for 1.25 times their expected sales for 2025. If we look at some other larger players, Tyson Foods (TSN) went for just 0.39 times its expected revenues for its September 2025 fiscal year, while Hormel Foods (HRL) went for 1.38 times its October 2025 fiscal year expected revenues. It’s hard to argue investors should pay well above the average of those two names for Beyond Meat, when you can easily invest in those other two more stable companies.

As for the street, analysts saw this name as worth $5.38 going into this week’s quarterly results. That number represented considerable downside from Wednesday’s $6.58 close, and analysts have cut their average by about a third over the past year. The street average peaked about five years ago at around $165, just a little while after shares had surged past $230 a share, but it has been all downhill ever since.

Final thoughts and recommendation

On Wednesday afternoon, another somewhat mixed report from Beyond Meat has put even more pressure on the company’s long-term future. Revenues did beat street estimates and finally showed some year-over-year growth. Management was able to show solid margin and expense improvement, but losses and cash burn do remain. The balance sheet continues to weaken by the quarter, with the 2027 debt mountain remaining the biggest issue here.

With a major restructuring needed for this company, I am continuing to rate the stock a sell today. Either management is going to have to dilute investors substantially to remain afloat, or it will need a lot of help from its creditors to avoid filing for bankruptcy moving forward. While the company may be able to work with lenders to get its debt balance down, it likely will result in interest expenses that will only make the near-term financial situation worse. Every day that goes by seemingly increases the chances of bankruptcy, which could wipe out equity holders completely.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.