Summary:

- Beyond Meat’s shares dropped 13.10% since May, but the company is showing fundamental improvements, particularly in gross margins and cost-cutting measures.

- Despite initial hopes tied to a bird flu outbreak, Beyond Meat’s turnaround is driven by better pricing strategies and a loyal consumer base.

- The company remains high-risk with ongoing net losses and potential need for equity raises, but improved margins suggest a more stable future.

- Beyond Meat’s forward P/S ratio is undervalued; a successful turnaround could see a 41.46% price increase, trading at a premium above the sector median.

Sundry Photography

Investment Thesis

Beyond Meat (NASDAQ:BYND) shares have dropped by 13.10% since I covered the plant-based meat firm in May. As I talked about in my write-up in May, a big reason I was bullish on the stock was the bird-flu outbreak. Since then, I think the market has punished shares to reflect the original high-risk, low-probability investment thesis not coming to fruition.

According to the CDC, the bird flu has not shown widespread human transmission, with the r0 value of the H5N1 strain likely being close to 1 in humans.

What’s changed since May, however, is that Beyond Meat is actually now showing signs of fundamental improvement.

The company has realized they have a dedicated consumer base for their product, and they have started to adjust their pricing strategy accordingly. Recent price hikes, along with scaled-back promotions, have had a positive impact on their gross margins on a year-on-year basis. Cost-cutting measures also have helped reduce their net losses, although revenues have continued to face pressure, with volumes dropping by 14%.

The company’s management has expressed optimism about gross margin expansion through further price adjustments. While the company is still incredibly high risk, the fundamental story is improving, and I want to note that. I expect that this could lead to a more plausible asymmetric risk-reward scenario, as opposed to the previously low odds asymmetric bird flu-driven thesis.

Beyond Meat’s margins are improving. I think the stock remains a strong buy.

Why I’m Doing Follow-up Coverage

When I last covered Beyond Meat, my focus centered on the potential impact of a bird flu outbreak on meat and poultry supplies. At the time, I saw this as a possible catalyst that could drive demand for plant-based alternatives as people shied away from affected types of meats.

However, while bird flu remains a significant issue in the US, with outbreaks reported in poultry, dairy cows, and even wild birds, it’s not materially affected the US meat market like I expected it to in the spring.

Public health agencies, such as the CDC, maintain that the risk of widespread human transmission remains low, which helped ease my personal concerns and thesis about a bird flu-driven shift in consumer demand toward plant-based products.

The purpose of this follow-up coverage is to highlight Beyond Meat’s potential for asymmetric upside, even in the absence of a major bird flu outbreak. While the Bird-Flu is not as big of a concern, the company’s improved margins could begin to provide a more stable foundation for future growth. Margins are far stronger. That’s a big deal.

Where I’m Seeing a Turnaround

Beyond Meat has improved their gross margins, expanding to 14.7% in Q2 from just 2.2% a year ago. Almost a 7x increase! As their CEO Ethan Brown noted on their call:

Q2 provides a very clear proof point that our operations are making progress toward getting leaner and more efficient. This quarter, compared with the year ago period, we realized $11.4 million more in gross profit despite lower revenue and $8.4 million less in operating expenses. Furthermore, inventory and cash consumption were both down on a year-over-year and sequential basis. Throughout the first half of 2024, we realized a reduction in operating expenses of $22.6 million, excluding the $7.5 million class action settlement accrued in Q1 2024. As reflected in our updated guidance, we are targeting a reduction in operating expenses in the remainder of 2024 compared to the equivalent period in 2023 -Q2 Call.

It’s clear the company is getting lean and mean. With this, Beyond Meat still has a unique opportunity.

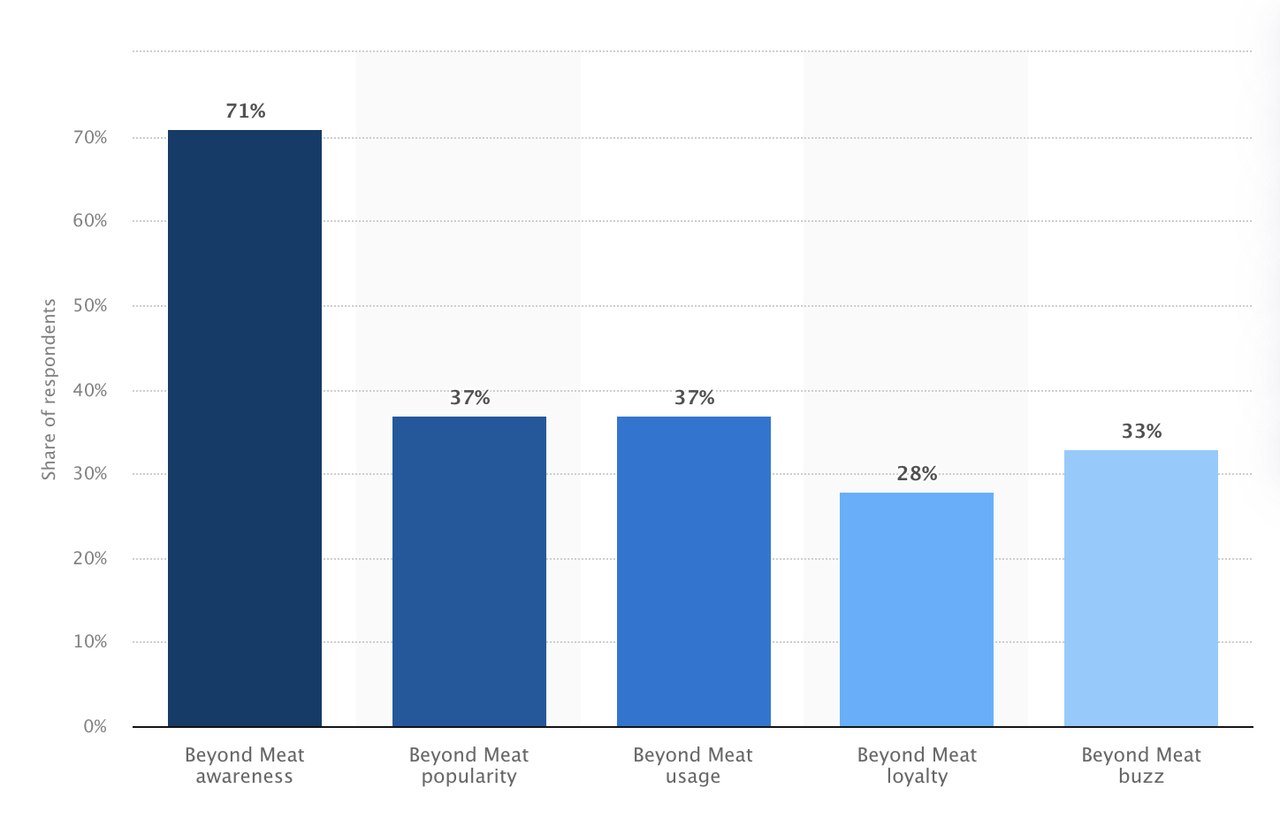

The alternative meat brand has built brand awareness over their seven years on the market and in stores, particularly at major supermarkets.

However, the conversion rate remains relatively low. Despite the high level of discovery, Beyond Meat’s loyal customer base only comprises around 28% of meat substitutes consumers in the country. As arguably the industry-leading brand, there’s room to grow here.

This small but dedicated group continues to purchase their products, even as others may have tried it once but not returned. Recognizing this, Beyond Meat is adjusting their strategy by focusing on their core audience to command more pricing power.

While the market remains cautious, as reflected in its mixed outlooks after earnings, I believe this turnaround in gross margins actually suggests the company may be slightly underpriced. There’s really more room to improve from here. And I think it’s clear there is another part of the meat substitutes market they can capture.

Valuation

While the margin story is starting to improve, the market is still discounting the future of the meat-substitute company.

Beyond Meat’s forward price-to-sales multiple of 1.23 is lower than the sector median of 1.34 by an -8.69% discount.

What matters here is the turnaround story.

I really think Beyond Meat is starting to execute a successful turnaround, driven first by improving gross margins, and then capitalizing on their niche but highly loyal consumer base plus expanding market share in this corner of the meat/poultry market. At this point, the company should actually trade at a valuation premium above the sector median.

What’s nice is the embedded brand awareness, so their first major marketing expense around informing consumers what they sell is already solved.

With a successful turnaround, I think we could see their stock trade at a premium 30% above the sector median on a forward price to sales basis.

Assuming the current P/S ratio is 1.23 and the sector median is 1.34, a 30% premium above the sector median would push Beyond Meat’s forward P/S multiple to around 1.74. If we saw this rerating, this would generate a share price increase of roughly 41.46% above the current P/S multiple the company is trading at.

Risks

True margins are getting better, and the company still has a large opportunity in the meat substitutes market. But the elephant in the room remains: Beyond Meat continues to lose money at a concerning rate, with their Q2 financial results showing a net loss of $34.5 million. This loss was actually less than the loss of $53.5 million from a year earlier, but still in the red.

The company’s operations remain unprofitable, with an operating loss of $33.9 million, representing an operating margin of -36.4%, but this was also an improvement from the year-ago period (-52.7% margin). Cash on the balance sheet was $144.9 million at the end of Q2. This implies about 4 quarters of runway at the current burn rate.

In my opinion, Beyond Meat can address this with three main options: become profitable, issuing more stock, or taking on additional debt. Profitability is the most favorable outcome (of course) but is really unlikely in the short term. To be clear, the story is better than it was before. But it’s not yet a no-brainer. This thesis assumes a bit of risk.

This leaves you with more debt, or more equity.

Issuing more stock presents a real risk to shareholders as, at this market cap, an offering would really dilute, which would be likely unpopular. More debt would damage their balance sheet, which already sports $1.1 billion in long-term outstanding debt.

I think the right answer will be equity, but this will be a tough pill to swallow. An equity raise will need to come as the market buys into their story once again. These better margins are the right start.

The market has no issue funding private (and public) money losing companies. The stories just have to be right, however.

Bottom Line

Beyond Meat remains in a tight financial position, but is starting to see some light with improving gross margins. Their Q2 net loss of $34.5 million and a decrease in net revenues show that they are not out of the woods yet.

Given the high-risk nature of Beyond Meat, this is not a stock that many investors would want to hold in their portfolios. Beyond Meat may still be a strong buy, but patience here is going to be everything.

Beyond Meat shares jumped 25% on the day after the last earnings report came out (and management unveiled the good news on better margins). The market likes where the company is going, and it may be willing to fund the company if the conditions are right. For now, all eyes are on growing their market, and further expanding their margins.

I’ll leave you with a quote from management:

We’re quite pleased [to see growth in certain accounts] given we instituted a significant price increase, [and] pulled back on trade -Q2 Call.

I’m pleased as well. The first part of moving in the right direction is taking the first step.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.