Summary:

- Beyond Meat improved its margins via cost cuts, lower trade discounts, and price increases.

- Beyond IV aims to change the perception that the firm’s meat isn’t healthy. The product has a shorter ingredient list and less saturated fat, but sales haven’t spiked.

- The $1.15 billion in debt due in March 2027 makes Beyond Meat too risky to buy.

- Beyond Meat faces significant competition from Impossible Foods, which has a better strategy and is gaining market share.

- I rate Beyond Meat as a hold; avoid buying shares until sales growth from Beyond IV and balance sheet clarity are achieved.

Bogdan Kurylo/iStock via Getty Images

Too Early To Bet On This Turnaround

Beyond Meat’s (NASDAQ:BYND) popularity surged from 2019 to 2021 as consumers flocked to groceries & restaurants to try its plant-based meat products which promised to be a guilt-free, healthy way to have burgers, beef, sausage, and chicken. I was one of the consumers going to restaurants to try the burgers. They generated a lot of curiosity. Furthermore, Beyond Meat’s IPO in May 2019 gave it access to capital which funded an intense ad campaign. This was part of the growth at all costs, land grab mentality of the late 2010s/early pandemic era (losses are ok if you gain market share). The difference here is Beyond Meat isn’t a software company trying to capture sticky B2B clients; instead, it is in the food industry, which sells to fickle consumers (market share changes quickly).

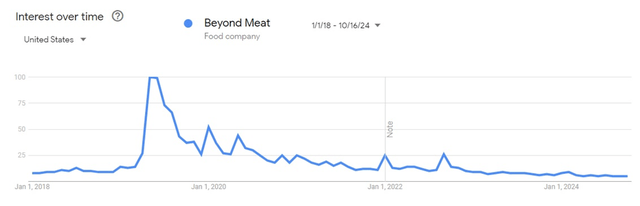

As you can see below, its popularity as measured by Google search interest waned after the initial excitement in 2019. Sales peaked after search interest, with Beyond Meat topping out at $464.7 million in 2021. If sales hit 2024 estimates, they will fall about 30% from the peak to $325.44 million. Some chains like McDonald’s in America shelved Beyond Meat’s products (McPlant). Beyond Meat’s partnership with Pepsi to create a plant-based jerky ended unsuccessfully.

Now Beyond Meat wants to reinvent itself. The goal is to change the narrative around the health of its products by launching a new platform called Beyond IV which has a shorter, healthier ingredient list and less saturated fat. Furthermore, it wants to get to profitability by raising prices in America/lowering trade discounts and cutting costs. These changes have boosted margins, but it’s too early to tell if the new platform is resonating with consumers.

So far, there is no sign of positive sales growth. Nielsen reported four-week average (ending August 10th) Beyond Meat US retail sales were down 12.8% year over year (category up 1.8%). Considering the firm’s Q2 US retail sales were down 7.5%, it looks like the trend worsened this summer. Furthermore, the company has $1.15 billion in debt due in March 2027 which puts a shot clock on its turnaround efforts.

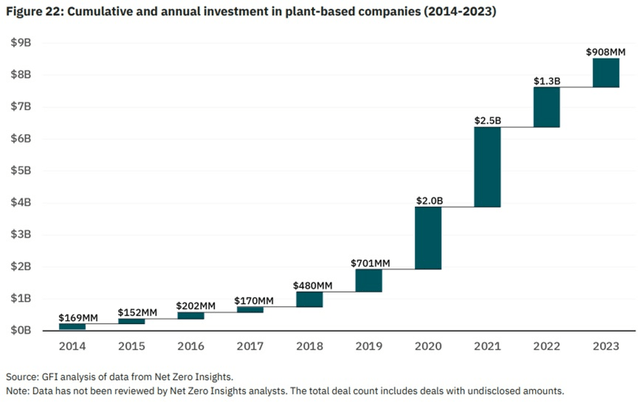

Finally, I’m concerned with competition from Impossible Foods (IMPF). The industry-wide weakness is particularly hitting the smaller, less capitalized brands, which helps the established players Beyond Meat and Impossible Foods. Specifically, investment into plant-based companies fell from $2.5 billion in 2021 to $908 million in 2023. However, I think Impossible Foods has a better strategy than Beyond Meat. It has had a “slow and steady wins the race” approach to marketing and distribution.

Anecdotally, I think Impossible burgers taste better, and everyone I’ve asked agrees. You can’t prove which burger tastes the best, but Impossible is gaining market share. Therefore, my anecdotal evidence is supported by the consumer. Impossible Foods isn’t public, so I will analyze it from a competitive perspective. Competition from just one company is an issue because the category has been declining.

I think Beyond Meat is a hold. I wouldn’t sell it if I owned a small position because margins are improving and the push to healthier products is rational. However, I wouldn’t buy it until we see Beyond IV drive sales growth, and we get clarity on the balance sheet. The CEO owns a large stake in the business, which incentivizes him to avoid bankruptcy. I wouldn’t short Beyond Meat due to sentiment potentially swinging in the opposite direction on improving sales trends. We already saw the stock pop in August on margin improvement. The stock’s elevated short interest puts shorts at risk of being squeezed (plus elevated borrowing costs).

Plant-Based Milk Shows The Path For Plant-Based Meat

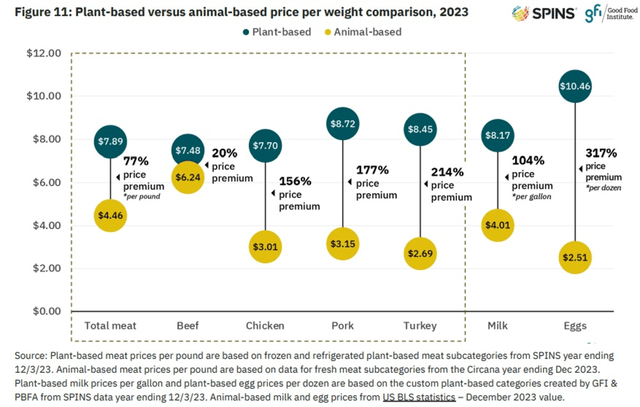

The 2019-2021 plant-based meat trial period didn’t lead to consistent sales, mostly because consumers didn’t like the taste and they started doubting its healthiness. If plant-based meat tastes slightly worse than conventional meat and consumers question its ingredients, they won’t buy it. I don’t think pricing is an issue because consumers will pay up for products they value, especially if they view them as healthy. The Impossible Foods CEO stated cutting prices didn’t increase volumes. It’s why Beyond Meat raised prices this year in the US.

In 2023, SPINS data shows plant-based beef only had a 20% price premium to animal beef (total meat had 77% premium), while plant-based milk had a 104% price premium. Despite this large price premium, milk has been the most successful plant-based category. Plant-based milk was nearly 15% of US milk retail sales in 2023 ($2.9 billion). North American sales were $4.1 billion. Globally, plant-based milk had $18.7 billion in sales as it was boosted by APAC (over 60% of Indians are lactose intolerant). In comparison, the plant-based meat & seafood category had $2.1 billion in sales in North America and $6.4 billion in sales globally.

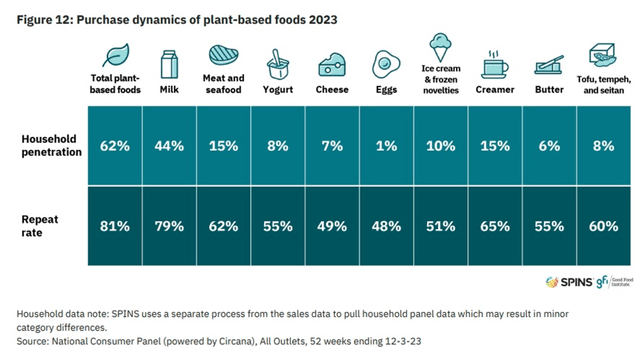

The success of plant-based milk shows plant-based meat can gain market share if the right strategies are pursued. Plant-based milk had a 79% repeat buy rate; 44% of households bought it at least once in 2023. That compares to a 62% repeat buy rate and 15% penetration for plant-based meat & seafood. On the one hand, plant-based meat & seafood had a decent repeat buy rate, which suggests more trial can generate more sales. On the other hand, the penetration rate fell from 19% in 2022 showing trial is in decline because it occurred previously. 43% of US consumers have already eaten plant-based meat.

Plant-based meat companies need to avoid going to war with the animal meat industry. The goal is to get consumers to switch some of their buying to plant-based meat. It doesn’t have to be a religious-type experience where consumers go ‘cold-turkey’ leaving animal meat entirely. The initial marketing campaigns alienated animal meat eaters who need to be attracted to the category. I think future non-political marketing pushes focused on inclusivity can boost the category.

Beyond Meat’s Health Pivot Makes Sense & Could Work

Marketing can only do so much if the product doesn’t change. That’s why Beyond Meat came out with the Beyond IV platform, which currently includes its burger, beef, and sausage. Before I get into the platform’s advantages, I’d like to note a small issue with the business. Beyond Meat’s approach is like tech companies, meaning it comes out with new advancements. The problem is while consumers expect an operating system to improve over time, their first impression of a food item lasts. If you try out a glitchy smartphone, you might expect it to get better. However, you don’t have the same patience with food. Many consumers feel they have already tasted what Beyond Meat offers. If they didn’t like the taste or thought it wasn’t healthy enough, they haven’t been expecting updates. It takes marketing to explain this concept which is costly.

With that being said, it’s marvelous Beyond Meat can use food science to respond to consumers’ desires. Since consumers had problems with the number of ingredients and their nutrition, Beyond Meat changed its products. Beyond IV burger and beef use protein from yellow peas, brown rice, red lentils and faba beans, giving each serving 21 grams of protein. The fat from avocado oil, provides taste and limits saturated fat to 2 grams, which is 75% less than 80/20 animal meat.

The Beyond IV burger/beef have 60% less saturated fat, 20% less sodium, and 1 gram more of protein than the previous Beyond III. The sausage version has 75% less saturated fat than pork and 66% less saturated fat than the previous version. It has 17 grams of protein. The ingredient list is now simpler in all three products. You can see the simplification from the older burger version on top to the newer one on the bottom.

It will take marketing money to educate consumers on the improved healthiness of the products. Instead of a huge marketing push which goes after the animal meat industry, Beyond Meat is taking a less bold, but effective approach in which it is generating a consensus of dieticians/doctors/national health organizations to recommend its products. The firm’s burger, beef, and dinner sausage are certified by the American Heart Association’s Heart-Check program, included in the American Diabetes Association’s Better Choices for Life program, and Clean Label Project certified.

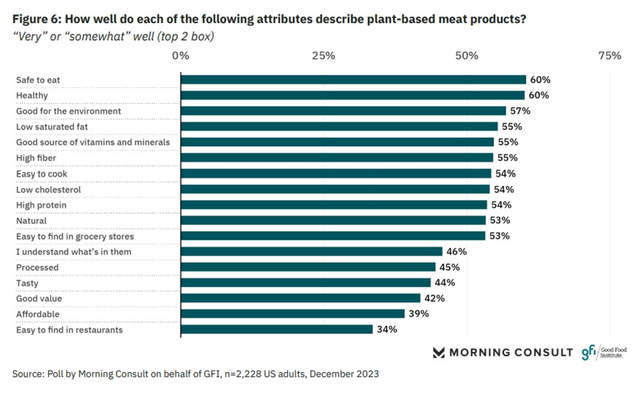

Consumers somewhat understand the potential health benefits of plant-based meat, but they struggle with the issue of viewing them as “processed” which has become a synonym of unhealthy. It’s the concept of viewing a foot item as unhealthy if it has a ton of ingredients, some of which consumers can’t pronounce. In 2022, 43% of consumers said they wanted to reduce their consumption of processed foods. Over half of Americans said it is somewhat or very important to avoid eating processed foods.

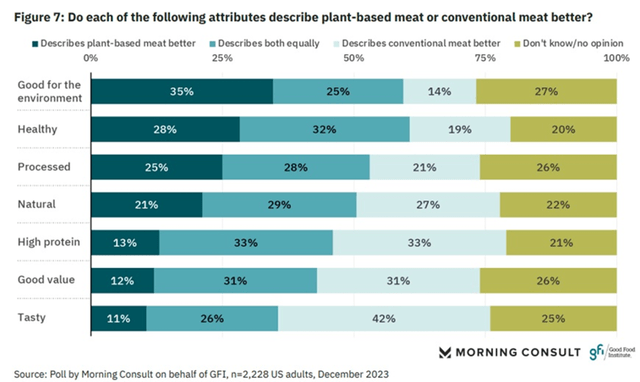

Sixty percent and 55% of consumers identified plant-based meat as either very or somewhat healthy and low in saturated fat respectively. However, only 46% selected the same for understanding what’s in them. It’s a conundrum for the category, since Beyond Meat & Impossible Foods are viewed as food-tech companies. Technology is synonymous with being highly processed. For example, a high-tech virtual reality headset has a lot of complicated components which are difficult to make.

Forty-five percent of Americans describing plant-based meat as processed is a problem. To be clear, there is a certain amount of processing involved. If there wasn’t, Beyond Meat & Impossible Foods would be making veggie burgers in which you can see the vegetables (you can see the corn, beans, & carrots in a veggie burger). It’s impossible (no pun intended) to come out with a plant-based, unprocessed burger that tastes just like conventional meat.

As you can see above, 4% more respondents described plant-based meat as processed than described conventional meat as processed. I don’t think Beyond Meat can convince consumers their products aren’t processed, but they can convince them that they are healthy, given the changes I mentioned. Beyond Meat needs plant-based meat to have more than a nine-point advantage over conventional meat when it comes to health. The problem is this education period will take time which Beyond Meat doesn’t have a lot of because of its debt due in March 2027. On this point, Beyond Meat’s CEO Ethan Brown stated,

“I do not expect consumer perception to shift quickly and certainly not overnight.”

Plant-Based Meat In Decline

Beyond Meat’s website had 304k views in September, which was 31st in the vegetarian & vegan category. This is a strong ranking because the websites with higher traffic in this category are content publishers. It was the highest ranked branded site. Furthermore, Beyond Meat has 990k Instagram followers. The problem for Beyond Meat is it is in a declining industry.

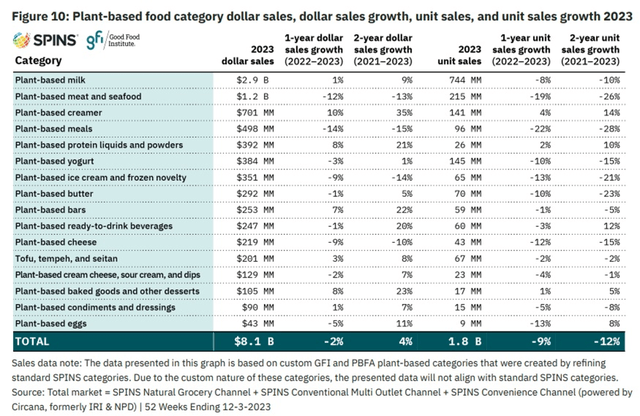

As you can see from the table below, plant-based meat & seafood US retail dollar sales were down 12% and unit sales were down 19% (implying higher prices) in 2023. The overall plant-based category fell 2% in retail, with plant-based milk sales only up 1%. Not only does Beyond Meat need to fix the consumer’s perception of its own brand, it also needs to buck the industry’s trend. I believe that’s too much of a challenge even though I think Beyond IV has promise due to its health benefits versus animal meat.

Beyond Meat Has Successfully Improved Margins

The most successful part of Beyond Meat’s turnaround so far has been its gross & operating margin improvement. Its gross margin increased from 2.2% in Q2 last year to 14.7% in Q2 this year. This was the firm’s highest gross margin since Q3 2021. Its operating margin improved from -52.7% to -36.4% in the same period. Margins are obviously critical for a firm that has lost money throughout its history and has debt due in March 2027.

First let’s look at the cost reductions. Beyond Meat completed the internalization of its production network which cut tolling & underutilization fees. Logistics & production got more efficient and quality control & inventory management improved. Beyond Meat now has better asset utilization, overhead cost absorption has increased, and it freed up working capital. Finally, the firm rationalized its warehousing network which cut transportation costs. Lower inventory provisions and manufacturing costs led to its lowest COGS per pound since Q2 2021. Gross margin will be further helped in the second half by temporarily elevated labor costs due to moving production in-house going away.

Operating margin improvement came from lower marketing expenses. The firm is moving away from splashy advertisements. It’s instead relying on its cultivated network of doctors pushing Beyond IV due to its health benefits. Operating expenses fell from $56 million in Q2 2023 to $47.6 million in Q2 2024.

Besides lower costs, Beyond Meat is benefitting from higher realized pricing. US retail’s net revenue per pound was up 20.5% yearly and 11.7% sequentially. This pushed overall net revenue per pound up 6.1% yearly. Higher pricing mostly came from lower trade discounts. The company has changed its strategy from pushing sales growth at all costs, to aiming for profitability. This is why management was pleased with its 7.5% decline in US retail sales. The channel had to overcome the large drop in promotional trade discounts.

I expect overall company net revenue per pound to further increase in Q3 because it was only up 1.4% in the US foodservice channel in Q2. This channel actually had higher trade discounts due to reconciliations and true-ups for larger customers. A true-up is when a seller adjusts the final price paid due to a discrepancy or error in calculating the discount. This is a one-time event that doesn’t reflect the firm’s strategy.

Finally, Beyond Meat raised prices. As I mentioned earlier, despite the price premium to animal meat, I don’t see pricing as an impediment to adoption. Most of the higher revenues per pound in Q2 came from less trade discounts. The firm’s price increases will further raise revenues per pound in the second half. The price increases started in April and were further phased-in in May. Full distribution will allow the firm to mostly realize price increases in 2H. The firm is only raising prices in America because it has less scale in Europe and Europe’s market is more competitive.

High Debt Makes Beyond Meat Risky

Even if you believe margins will further improve and sales will stabilize via the Beyond IV platform, you should not buy Beyond Meat stock because of its high debt load. Specifically, the firm issued $1 billion in 0% convertible senior notes in March 2021 that are due in March 2027. It exercised its option to raise $150 million more a couple weeks later. The firm got such great terms because of the 2021 stock market bubble where low rates encouraged wild speculation.

As of the end of Q2 2024, this $1.15 billion note carried a fair value of $238.6 million. The firm can’t even issue shares to buy the notes back at a discount because the entire market cap is only $415.6 million. This is why management is trying to get to profitability as quickly as it can. I don’t see profitability within the next 12 months (management doesn’t see it happening this year). If the firm reaches profitability in 2025 or 2026, it can refinance the debt. The rate would be higher, but at least the due date would be further off. The stock likely won’t rise until the balance sheet is fixed because any equity valuation increase sets investors up for dilution to pay back bondholders.

It makes sense to invest in the senior notes if you are bullish on the firm’s future. Debt holders might transition to equity investors in a restructuring. The Wall Street Journal reported Beyond Meat is engaging with bondholders and working with the law firm Akin Gump Strauss Hauer & Feld on a restructuring. In the ideal situation, bondholders would take some equity & new debt at a higher rate to avoid bankruptcy while not wiping out current shareholders. I believe management is especially motivated to avoid equity investors losing it all because the CEO has skin in the game. I’ll review this in a future section.

Competition From Impossible Foods

I would invest in Impossible Foods at a reasonable valuation if the balance sheet is healthy because I think management is great and the product tastes the best in the category. Because it will likely stay private for the next couple years, I will just review it from a competitor’s perspective. Impossible Foods has less web traffic with 133k views in September and fewer Instagram followers (331k) than Beyond Meat. However, its sales pack a more powerful punch, implying it is winning at the grocery store which is what matters.

The firm had $460 million in sales in 2022 which was up 50% from the prior year. Beyond Meat had $418.9 million in 2022 sales. More recent data is fuzzy since Impossible Foods is private. However, it seems like sales growth was positive in 2023 which far outperformed Beyond Meat’s 18% decline. As of September 2023, Nielsen data showed Impossible Foods had high single digit/low double digit retail sales growth with a 50% repeat buy rate. In May 2024, CEO Peter McGuinness was quoted as saying, Impossible Foods is the

“only growing plant-based brand in the United States, and as a consequence, the fastest growing.”

According to Peter, the firm’s

“growth alone has cut the category decline in half.”

This implies Impossible Foods is much bigger than Beyond Meat now. Winning at the grocery store and having the best taste without doing combative ads is a prudent combination. Impossible Foods doesn’t want to alienate consumers and views grocery store marketing as the way to win them over.

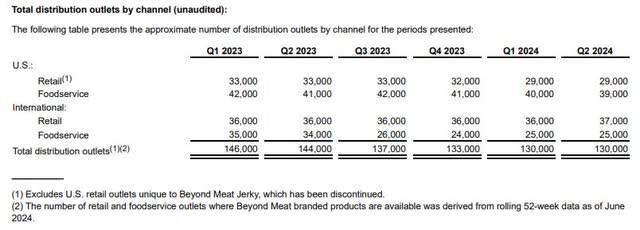

Impossible Foods is in 45k foodservice locations (unclear if this is domestic or global) such as Applebee’s, IHOP, Ruby Tuesday’s, Burger King, White Castle, and Starbucks. Beyond Meat is in 39k foodservice outlets in the US and 25k internationally. Impossible Foods has 400+ employees which compares to Beyond Meat’s 686 (plus 63 contract workers). On their respective websites, the former had three job openings and the latter had 13.

Both firms have been looking to cut costs and sure up their balance sheets. I think it’s unlikely that Impossible Foods is profitable. This might be why the firm has no plans to go public in the near-term. Beyond Meat went public at the perfect time to raise money because it was before the apex of the plant-based meat trial period when category growth was high.

If plant-based meat was a growing category where Beyond Meat & Impossible Foods had enough scale to be profitable, analysts would describe this industry as a duopoly between the two firms. However, since the industry is declining and neither have substantial scale, Impossible Foods’ strong execution is a major impediment to Beyond Meat’s turnaround plan. Impossible Foods’ BEEF LITE competes directly with Beyond IV. The former has 1g of saturated fat, 260mg of sodium, and 21g of protein, compared to the latter’s 2g of saturated fat, 310mg of sodium, and 21g of protein.

As a whole, Beyond Meat’s products don’t contain soy, while Impossible Foods’ products do. Therefore, Beyond Meat wins with the soy-free crowd, but I don’t think that’s enough to move the needle. Specifically, Impossible Foods uses soy heme which is a source of iron and helps with its meat’s look & taste as well as how it cooks. If anything, soy helps Impossible Foods.

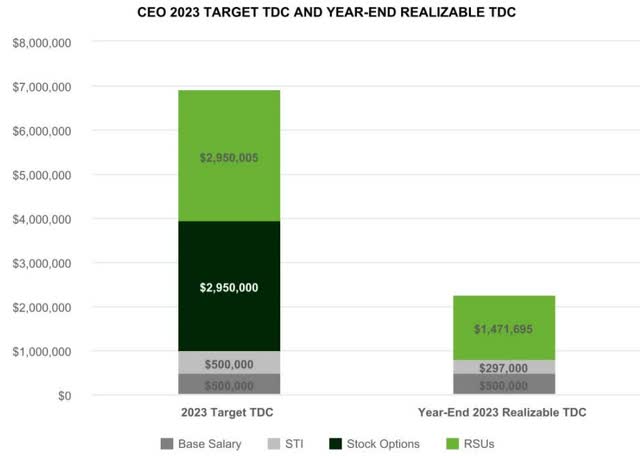

Strong Insider Ownership & Properly Incentivized Executives

The founder and CEO of Beyond Meat, Ethan Brown, has 3.85 million shares which is 5.7% of the company and worth about $24.6 million. He is financially incentivized to maintain the equity’s value in a debt restructuring. 93% of the CEO’s compensation in 2023 was performance-based. You can see his award below. The firm had declining sales and large losses in 2023, so it’s nice to see he got only 32.9% of his potential pay. Similarly, 82% of other named executive officers’ compensation was performance-based.

It’s encouraging to see the firm reach out to shareholders and make changes to its executive compensation plans after listening to requests. Specifically, in 2024 the peer group for executive pay only consists of firms in the food and beverage industry. Biotech, life-sciences, pharma, and high-growth firms have been removed. This should have already been the case since Beyond Meat is not a healthcare firm and has negative sales growth.

Beyond Meat also strengthened its long-term incentive plan design by introducing performance stock units for 50% of CEO and CFO long-term awards in 2024. They vest based on total shareholder return. The poor historic stock price performance can’t be changed, but at least the firm improved its 2024 compensation structure to better align executives with investors.

Beyond Meat Stock Is A Hold: Risks To Upside & Downside

Because I am giving Beyond Meat a hold rating, I will include risks to shorting the stock and risks to investing new capital in it. I think investors should do neither.

Beyond Meat has a 38.09% short interest which makes it expensive to borrow shares and puts shorts at risk of being squeezed. 27.77 million shares are short; shorts have 10.1 days to cover. I don’t think investors should short the stock because executives have aligned incentives with investors, the firm’s margins are improving, and management has a plausible strategy to win back consumers with its new healthier platform.

Management said on the Q2 call if you strip away promotional activity, velocity for beef and burger products under the Beyond IV platform has grown or stabilized at certain significant national grocer accounts. If sales growth resumes in 2025 due to the improved nutrition of Beyond IV, the stock can spike since the firm’s gross margin should be in the high teens. Investors love when sales growth is combined with margin expansion. Furthermore, the firm is gearing up to launch a whole muscle plant-based steak that mimics a filet. This could sell well in the fitness industry.

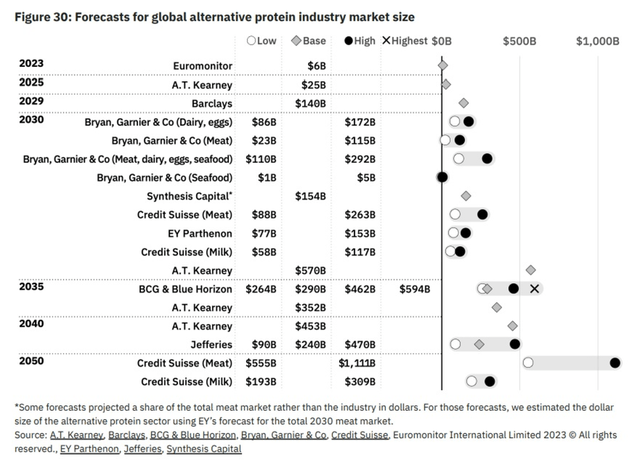

There are such high expectations for the global alternative protein industry because animal meat production is limited by its high land, energy, and water usage. Beef & lamb require about 100 times as much land as plant-based alternatives. Animal meat requires 75 times more energy than corn. Beef uses 15.5x the water as fruits and 51.7 times the water as vegetables. If the world ate as much animal meat as Americans, we could only feed 2.5 billion people. This is especially problematic as emerging markets demand more animal meat.

The animal meat industry produces a lot of methane which governments are trying to limit due to its impact on climate change. Livestock creates 37% of the methane produced in America. Methane is 80x more powerful than carbon dioxide at warming the Earth. In 2021, the US and over 100 countries agreed to lower methane emissions by 30% by 2030.

On the other hand, Beyond Meat is not a good place to invest new capital because its distribution is declining. The CEO of Impossible Foods claimed adding distribution is pivotal to growing the category. Specifically, Beyond Meat’s global distribution outlets fell from 144k in Q2 2023 to 130k in Q2 2024. As you can see below, distribution has been steadily falling in the US. The US retail decline would look worse if the discontinued jerky joint venture with Pepsi was included in the data.

Even though Beyond Meat has improved its margins, I calculated it will have negative $153 million in free cash flow in 2024 if the mid-point of its guidance ranges are all hit. Management has not guided for the firm to reach profitability this year. It’s too risky to invest new money in a business with such high debt and no plan to hit profitability in the near-term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.