Summary:

- GM is losing market share in a stagnant industry.

- Its business fundamentals are affected by economic cycles, with limited competitive advantages.

- The financial segment adds complexity and leverage, so caution is advised for investment.

- Macro trends and peer stock performance suggest caution as well.

JHVEPhoto

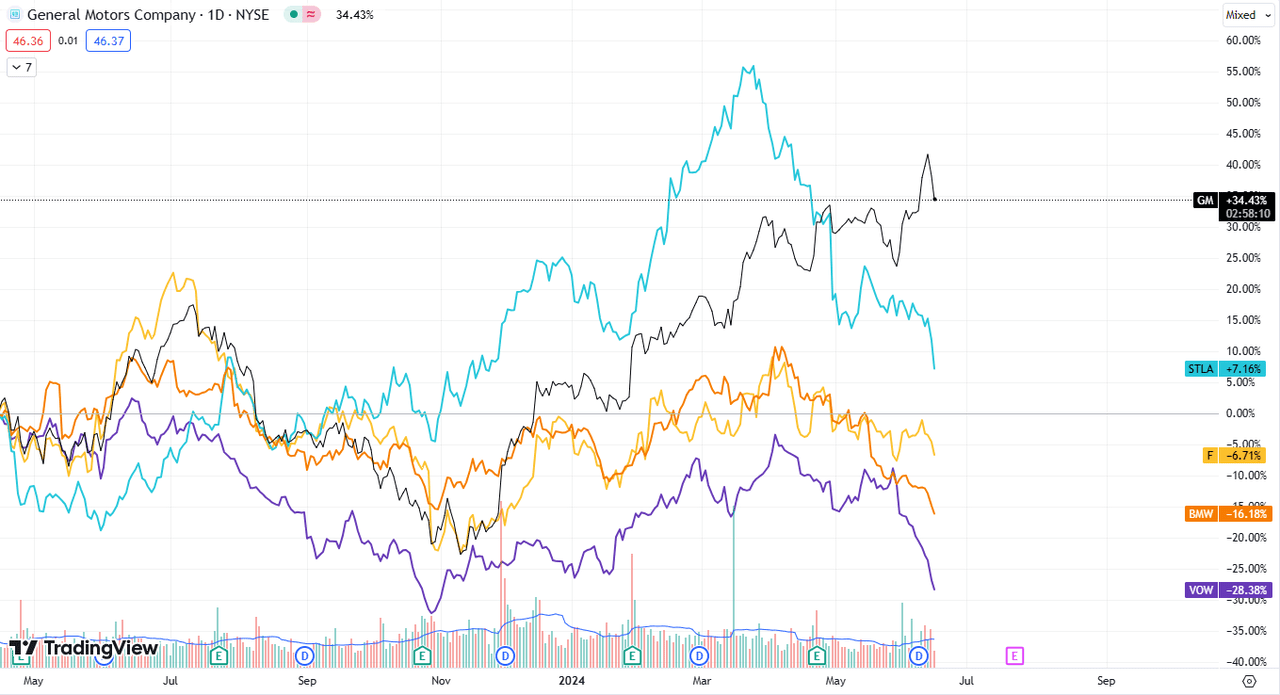

Despite the optically cheap valuation, I believe the timing for investment in GM (NYSE:GM) is not favorable. While the business is structurally losing market share in a stagnating industry, recent macro signals and peer stock performance suggest emerging weakness.

Losing share in a stagnant market

General Motors is a rather cyclical business whose fundamentals are affected by economic cycles, consumer preferences, interest rate variations and commodity volatility, among others. Despite its scale, and like many other automotive businesses, it’s difficult to identify competitive advantages that allow General Motors to deliver attractive growth or profitability. The stock has been volatile but without meaningful appreciation since the IPO in 2010. Some dividends marginally improve the total return picture but still show the stock has delivered a fraction of the total return of any major index.

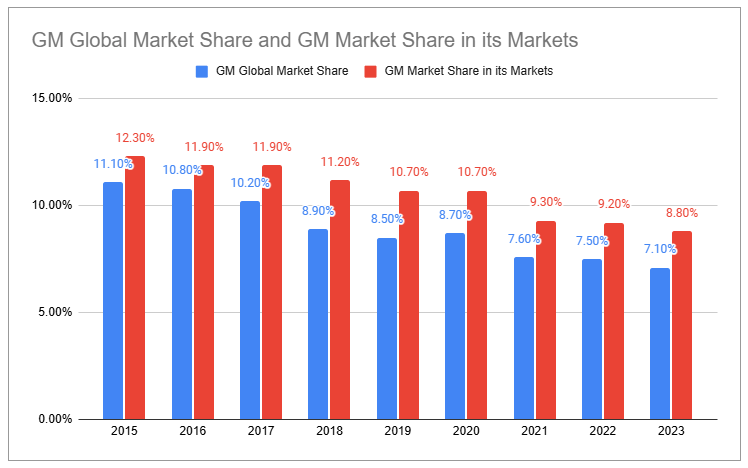

Producing and selling vehicles is a tough business. Consumer preferences vary based on multiple factors such as vehicle design, price, quality, available options, safety, reliability, fuel economy or range and functionality, among others. Market share trends are affected by product cycles as well as changes in conditions across geographies. At the global level, General Motors’ market share has been slowly declining over time, going from 11.1% in 2018 to 7.1% in 2023. Even if we exclude the markets where GM does not operate, its market share still declined from 12.3% in 2015 to 8.8% in 2023.

Company Filings, Author

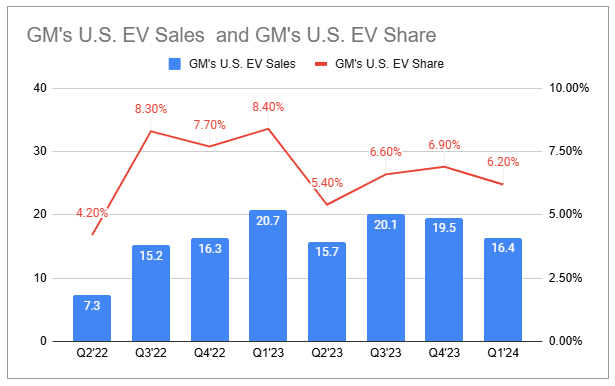

One thing worse than losing market share is losing market share in a market that struggles to generate meaningful growth. Although the market has been rebounding since the end of 2022 as chip shortage conditions improved, growth forecasts for the industry continue to be lukewarm. Passenger vehicles are expected to experience only a 0.22% CAGR, where even limited market share losses can lead to volume declines. Electric vehicles are expected to grow at nearly a 10% CAGR, which means strong positioning in the segment will be necessary to avoid significant market share loss. While GM’s performance in the ICE market has been good recently, with strong sales in trucks and SUV, GM’s EV performance continues to be lackluster. Total deliveries of Ultium EVs were up 9x YoY in Q1’24 to ~9K, while Cadillac LYRIQ is performing well in the luxury segment. However, GM’s share of the US EV market remains low at only ~6.2% in Q1’24 vs. 6.8% share in cars and 15.4% total share in vehicles.

Company Filings, Author

There are some potential catalysts to improve the trends, such as the Ultium EV ramp-up in the second half of the year, the launch of the Chevrolet Equinox and Silverado EVs, plus several launches across GMC and Cadillac. However, I believe these are unlikely to structurally change GM’s position at the group level.

Pricing and Margins

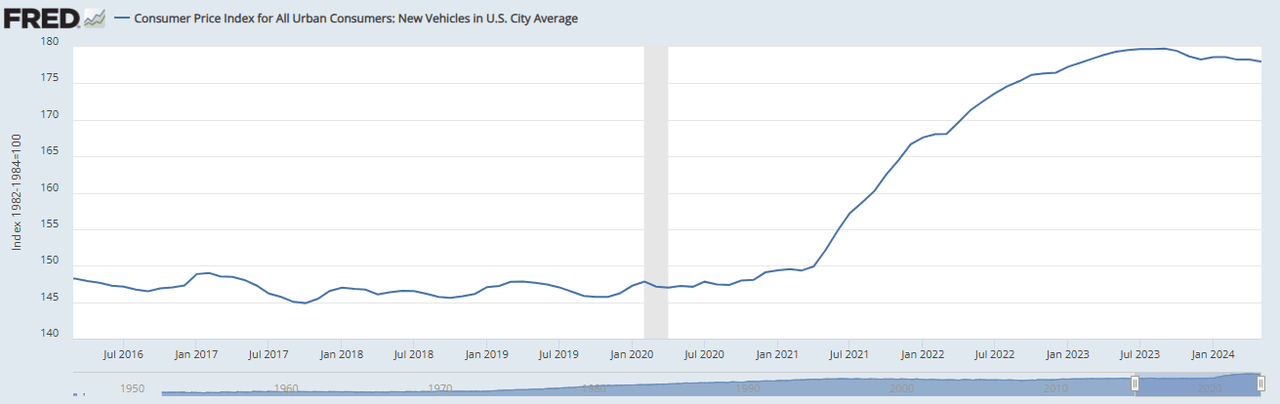

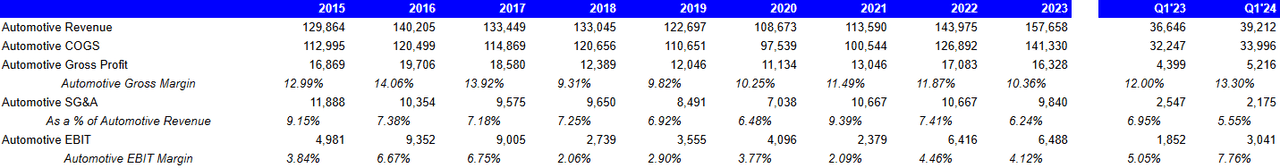

GM’s Automotive and Other segment is a capital-intensive and low profitability segment with a reported GAAP gross margin in the ~10% area and EBIT margin of just ~4% taking the full year 2023 as a reference. These margins were reported in a period of favorable pricing backdrop in the automotive industry driven by supply/demand imbalances post-COVID reopening that caused shortages of components such as chips.

However, for GM, the strong pricing in the 2022-23 period was mostly offsetting higher costs, without a big boost to profitability. Investors should be careful with extrapolating revenue growth, as this was mostly driven by pricing and offset by higher costs.

While GM’s consolidated EBIT is down from 2021 levels, adjusted EBIT margin trends at least show improvements in the international segment (up to 7.6% margin) although the core North America segment lost 150bps of adjusted EBIT margin between 2021 and 2023.

The danger of buying a business like GM is that it is a cyclical, high capital-intensive business with limited competitive advantages and mean-reverting margins.

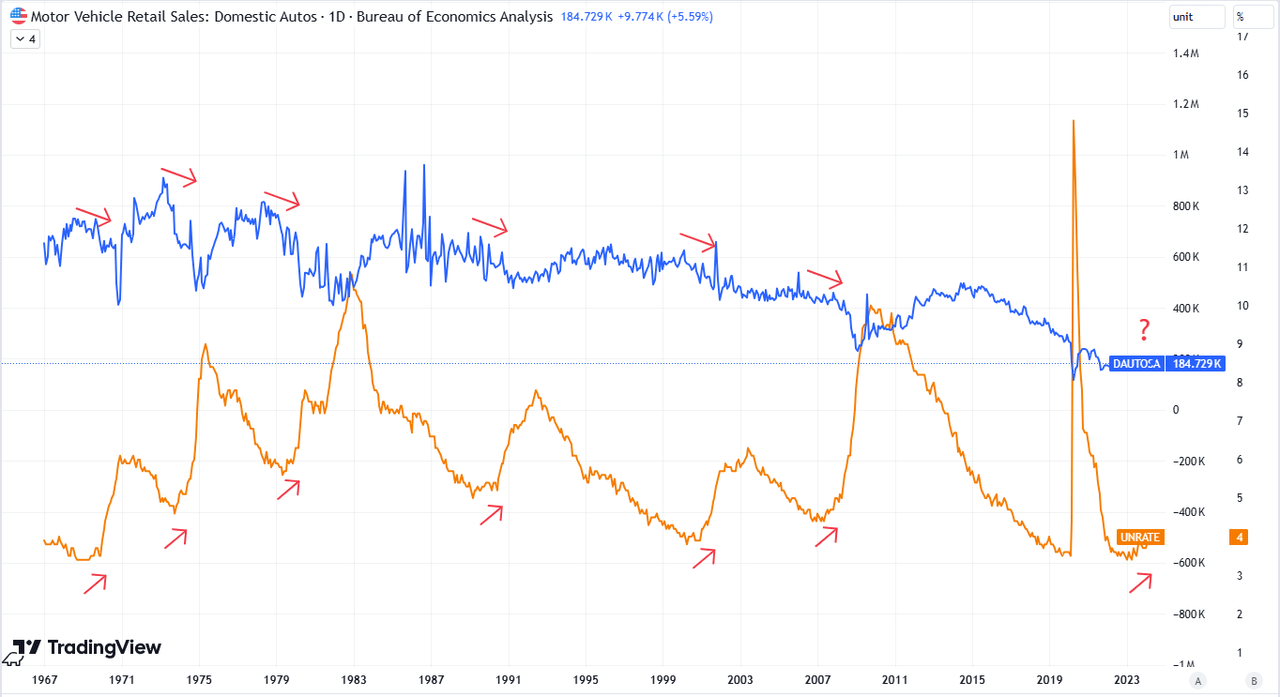

Are Auto Sales Going to Improve From Here?

To buy GM here, I believe investors should have a positive view of US auto sales trends. I have my concerns. A rising unemployment rate similar to what was seen recently is generally a precursor of recessions and not a positive development for US Auto sales.

A word on Balance Sheet, Cash Flows, and Financial Segment

GM’s balance sheet for the automotive part of the business remains relatively healthy, with cash and liquid instruments totaling $19.7bn and above total automotive debt of $16.3bn. Yet investors are buying the business in its entirety, with the Financial division adding complexity and leverage at the group level, with $105bn financial debt (up from ~$97bn in Q1’23), ~58% of which is unsecured.

There are obviously strategic reasons to have a Financial business to support the automotive one, such as the potential to generate incremental sales by offering a comprehensive portfolio of financing products. However, investors should keep in mind that this is a cyclical business whose revenue and cost remain dependent on trends in interest rates charged and paid, as well as the level of delinquencies. I have a bearish view on interest rates that I shared in some recent analyses here on Seeking Alpha. GM Financial revenue had a boost from rising interest rates that continued in Q1’24 with a 14% YoY revenue growth. However, the ~$0.4bn expansion primarily driven by the increase in effective yield and a large portfolio was more than offset by ~$0.4m higher interest costs and a ~$0.1bn increase in provision for losses with higher delinquencies. While the impact of changing interest rates appears to be broadly neutral, the trend of rising auto loan delinquencies (also highlighted by the Federal Reserve Bank of New York) is having a negative impact on GM Financial EBT and should be monitored. Provisions for loan losses at GM Financial tripled between 2021 ($248m) and 2023 ($826m), with an annualized level of $816m as of Q1’24.

GM’s cash flow use should also be monitored. In 2023, the cash used for dividends and buybacks surpassed the FCF generated by the business by ~$1.8bn. This continued in Q1’24 at a slower pace of $109m and GM has recently announced another round of accelerated share repurchases worth $6bn and a 33% increase in dividends. GM’s use of cash might contribute to reducing the health of the balance sheet if dividends and buybacks continue in excess of FCF.

GM stated that the investments made in its brands and product portfolio over the last several years, and the company’s operating discipline, are delivering consistently strong revenue growth, margins and free cash flow, allowing the business to return cash to shareholders. Yet the business keeps losing market share and was not able to deliver operating profit growth in the past two years.

Valuation and Technicals

Investors are attracted by the optically cheap P/E multiple of ~6x and ~5x forward earnings. While this can look like an attractive valuation for a struggling business with improving fundamentals, GM continues to lose market share and experienced declining EBIT in a period of strong volume growth and favorable pricing conditions. Investors should also keep in mind that cyclical capital-intensive businesses generally trade at low multiples, and the market might continue to apply a big discount to GM shares due to an increasingly leveraged balance sheet driven by the growing financial business. It also has a complex structure and reports large and frequent adjustments to profitability metrics, which can further contribute to a discounted valuation.

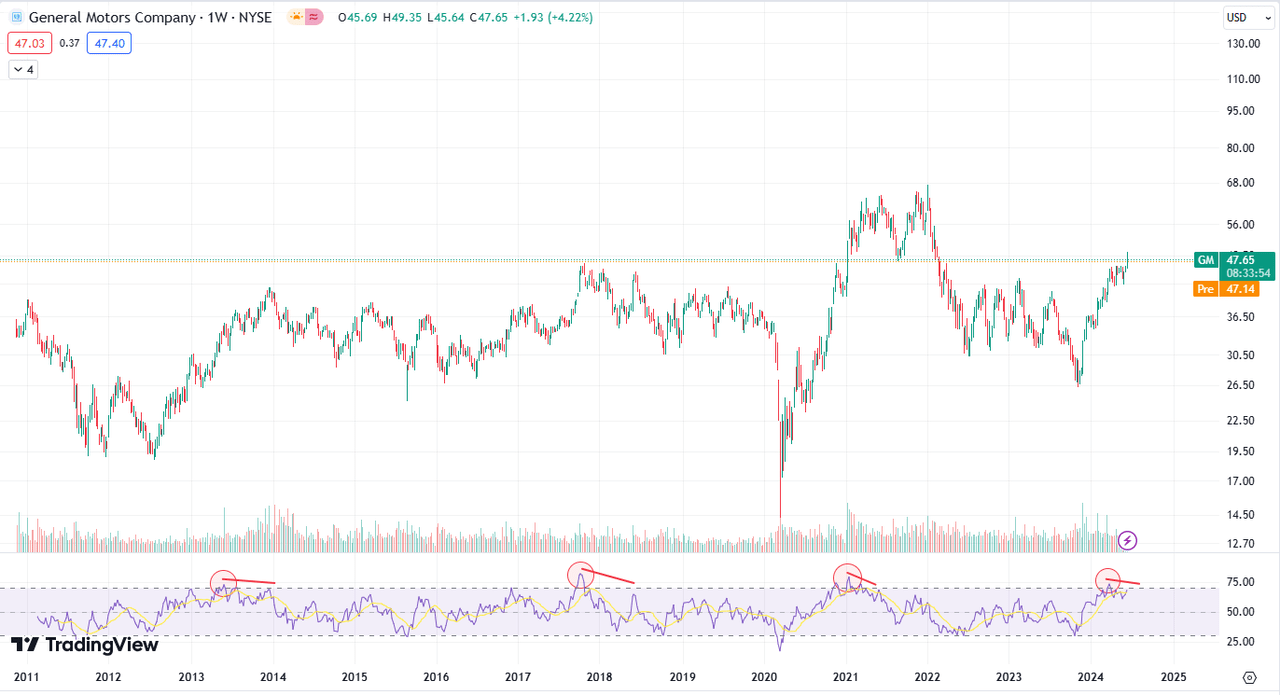

GM shares look overextended and recently went into overbought territory on the weekly chart. Analogies with similar technical setups in the past fourteen years show these have never been good entry points for a position in GM.

Although I think resources could be better invested to improve competitive position instead of repurchasing shares, I think aggressive buybacks, as well as short-term outperformance, are helping give some support to the shares, yet the rest of the auto industry has already started a significant decline.

Conclusion

GM attracts value-oriented investors due to the optically cheap valuation. Although the buyback can give some support, I believe conditions are not favorable. GM is still structurally losing market share in a stagnating market and has failed to report meaningful EBIT growth since 2016. Timing an investment well is the only way, in my view to make money on this stock. Unfortunately, I believe macro trends and peer performance are not encouraging for the industry, while growing leverage from the Financial business and increasing delinquencies on auto loans suggest caution. I believe that conditions are not favorable enough to buy GM at these levels, and technicals resemble previous tops in the shares.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.