Summary:

- 3M has experienced a recent rally, providing relief to investors after years of poor performance.

- The spinoff of the healthcare division as Solventum has created opportunities for value crystallization, and more clarity on litigation costs was provided.

- However, the company still faces challenges with struggling businesses, cash flow pressure from litigation payments, and limited ability to invest.

josefkubes

Companies that are undergoing changes via corporate restructuring and spin-offs often present good opportunities for value crystallization. I think 3M (NYSE:MMM) has experienced a similar dynamic with the recent rally, giving some relief to investors after three years of pain. More clarity on settlement costs has also helped give some visibility around big risk factors.

However, the benefits from these items are now likely priced in, and what’s left is a hodgepodge of struggling businesses that together can’t lift group revenue, and the prospects of large cash outflows further impair the business’ ability to invest in the next four or five years.

Spinoff and Structure Change

Spinoffs can create opportunities for value crystallization as well as investor confusion. 3M’s spinoff of the healthcare division as Solventum has changed the firm’s structure and might have created some opportunity for value crystallization, with the shares performing strongly in the past two months after several difficult years. This came together with more clarity on litigation costs for the two major lawsuits related to PFAS PWS and Combat Arms.

The business still retains 19.9% of Solventum, which will be monetized within five years following the spin-off, for a potential $2bn inflow at the current valuation. Management is going to adjust reported earnings by the change in the value of the Solventum stake.

As of Q1’24, the Health care division is reporting some organic volume growth (1% yoy) but is the lowest-margin division in the group (17.5% adjusted operating margin versus 21.9% for the group), and is experiencing margin compression (-40bps YoY in Q1’24).

What will be left is a group with relatively simplified consolidated operations comprising three core divisions instead of four, with the group reporting a higher margin because of the changed mix.

A Look at Recent Trends

Results have been poor for years and the stock has suffered as a consequence, reaching a compressed valuation at 8x earnings at the bottom. Recent trends have improved a bit, as 3M is reporting some slight organic sales growth (1%) and double-digit EPS growth as of Q1’24, backed by a 400bps operating margin expansion.

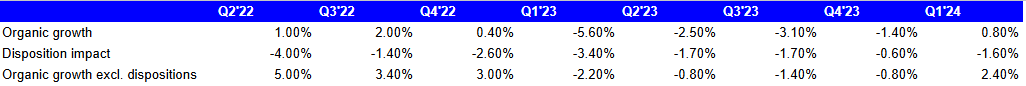

At the group level, the business had 2.4% percent organic growth if rationalization measures are excluded, such as small country closures, portfolio optimization, and disposable respirator comp. I am very cautious with adjusting the organic sales growth of businesses that are divesting stuff. There is generally the risk that companies whose top line is struggling exit declining/unprofitable divisions to show better top-line trends or profitability on an adjusted basis, while structural issues increasingly affect more divisions in a pattern of permanent gap between adjusted organic metrics and consolidated results. 3M has been divesting businesses for a while, such as the exits from less attractive geographies (e.g. Russia in 2022). While it does not adjust revenue metrics for this item, I think investors should be careful not to jump to bullish conclusions and confidently look at underlying revenue trends excluding the impact of the divested segments. 3M has been disposing of less attractive businesses for a while.

It surely helps to look at organic sales trends, both including and excluding the effect of these dispositions. As shown in the exhibit below, the trend is in both cases improving a bit, with YoY growth in Q1’24 (although with relatively easy comps in Q1’23). Yet we are still talking about sub-1 % growth.

Company Filings, Author

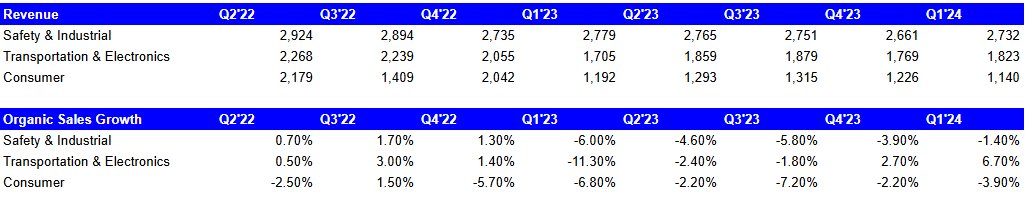

Revenue trends have been improving in Safety & Industrial and above all in Transportation & Electronics.

Company Filings, Author

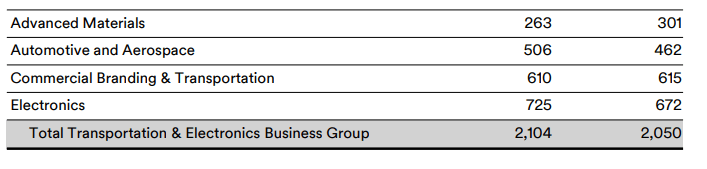

Transportation and electronics experienced strong organic volume growth in Q1’24 and is the highest margin division in the group with ~24.3% adjusted operating margin compared to 21.9% at the group level. Automotive and Aerospace, as well as Electronics, were the main drivers of growth in the division in Q1’24. Despite the strong start, it’s expected to report low single-digit adjusted organic sales growth in the full year.

Q1’24 Results

Safety & Industrial is expected to be flat to up low single digits, while Consumer is expected to contract low single digits. All in all, the business expects flat to +2% growth for adjusted organic sales growth at the group level, showing the business is still struggling to even get close to GDP growth.

Litigations and Cash Flow Pressure

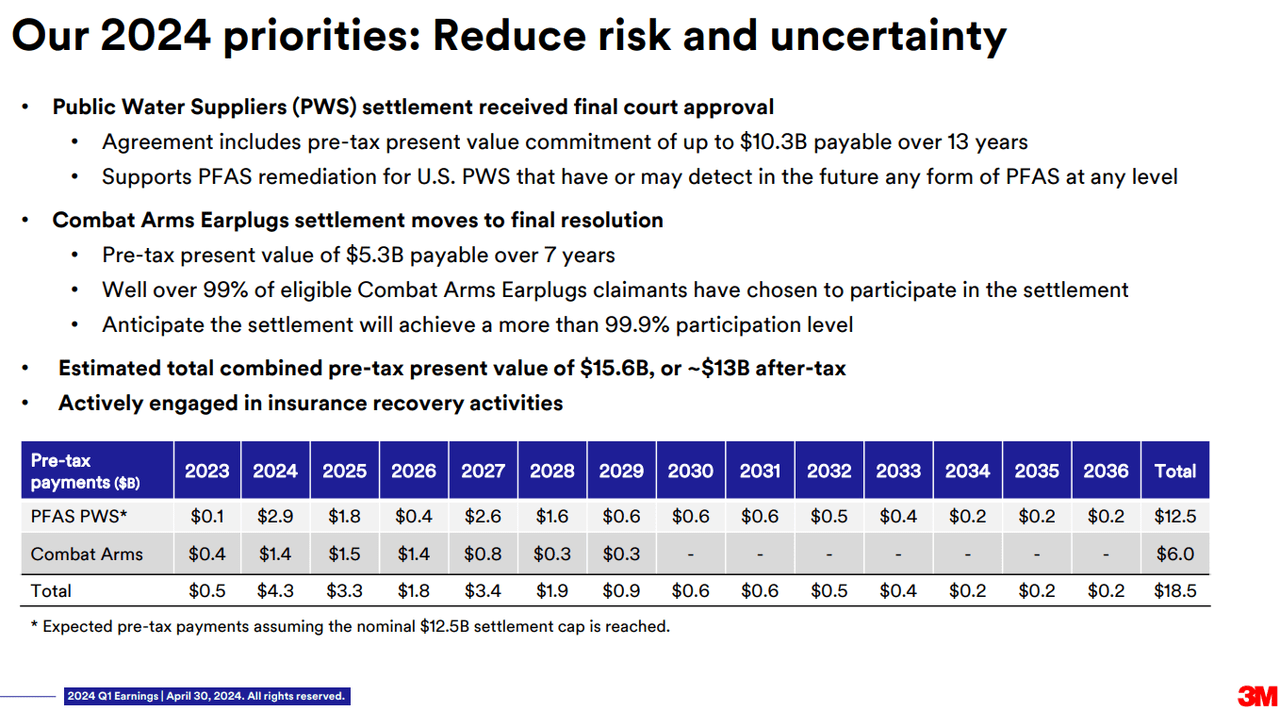

The big problem I see with 3M is the cash flow pressure coming from litigation payments. The total pre-tax cost of the Combat Arms Earplugs settlement is estimated to be $5.3bn over 7 years, and over 99% of eligible Combat Arms Earplugs claimants have chosen to participate in the settlement.

The even larger, PFAS PWS settlement is expected to cost $10.3bn pre-tax over the next 13 years, which could increase to $12.5bn based on additional PFAS contamination found.

The current state of the two litigations suggests a total pre-tax cash flow drain of $15.6bn in 13 years, with at least $1.8bn per year (and a peak of $4.3bn in 2024) for each year until 2028. A settlement cost that is quantified and that has received court approval has given some investors more clarity and an opportunity to chip in on 3M’s potential value story. However, even assuming the matter is finally closed (3M will still be producing PFAS until the end of 2025), there is an issue of structural cash burn that can severely limit the business’s ability to invest.

3M was generating an average of $4.9bn of yearly FCF in the 2021-2023 period. Excluding an estimated $1.4bn from Solventum (Q1’24 FCF of $340m annualized), the existing business could generate around $3.5 FCF per year assuming no further deterioration. According to the expected payment schedule disclosed in the table above, an average of $2.9bn per year will be paid in the next four years. Further pressure could come from high interest rates costs, as bond yields have been increasing, and the firm faces ~$6bn of debt maturities until 2028 that need to be refinanced. So there is a significant risk that the business will generate minimal FCF, if any, in this period.

It’s also worth mentioning that with the capex of 2021-23, the business faced declining revenues, and overall flat revenues in the past 6 years. This may indicate the business would need to invest more to generate some growth (assuming there is growth for its products in its markets), but FCF trends suggest not much availability of investable cash flows even with a full dividend cut (which was already cut from $1.51 per quarter to $0.70). The fact that the business intends to continue to pay dividends equal to ~40% of adjusted free cash flows (which excludes litigation payments) might indicate dividend distributions above the FCF generation, a choice that I generally consider a red flag for almost any business (let alone one that doesn’t seem to have growth capex) and a factor potentially contributing to further fundamental deterioration. Even assuming adjusted FCF reaches $4-4.5bn, a ~40% dividend distribution with $2.9bn yearly litigation payments still suggests distributions above FCF generation by $200-$500m per year.

Valuation is Not That Attractive

Adjusted P/E ratios using the midpoint of the company’s EPS guidance ($7.05) still reflect a valuation at 14x EPS, which I don’t consider a bargain. At an 11% discount rate, this multiple still assumes the prospects of perpetual growth at 4%, and the business got nowhere near there in the past five years. Moreover, I think it’s necessary to acknowledge the business is facing real cash flow pressure for the next five years, so adjusted EPS won’t translate into distributable cash flows anyway.

Conclusion

The Spin-Off of Solventum and more clarity on the litigation costs might have helped 3M stock in the short term, but structural challenges remain. The business is struggling to grow with revenue back to six years ago and organic sales growing at low single digits even with the recent improvements. Now the business faces further FCF pressures from litigation payments, and valuation implies structural improvements that are not warranted in my view. I believe the dividend remains at risk even after the recent cut, and if not, distributing in excess of FCF generation could lead to further fundamental deterioration for the business. I am always looking for good value among established companies, but I think this name is one to avoid in the current situation and at the current valuation.

I plan to continue to follow 3M and update my thinking around it.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.