Summary:

- Historical data is very clear. When the dividend is cut, it’s time to sell.

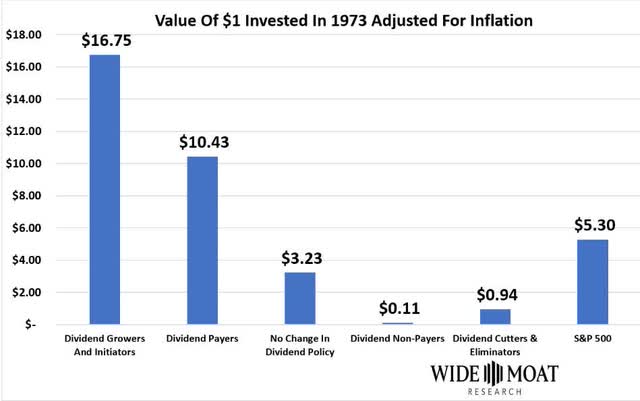

- Dividend growth stocks have outperformed dividend cutters 18 times over the last 50 years. It’s the difference between $1 becoming $17 adjusted for inflation, or $0.94.

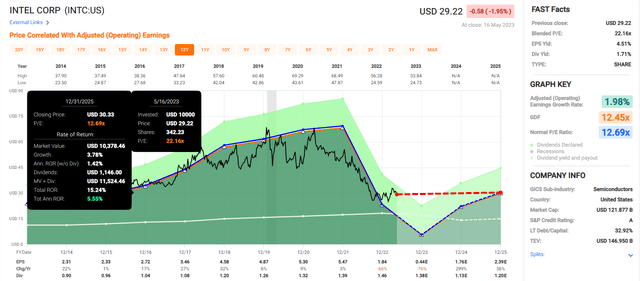

- Intel Corporation has been struggling for years with its turnaround efforts and is now on its 2nd attempt in as many years.

- Intel slashed its dividend by 66%, and analysts expect -$25 billion in free cash flow through 2025 to cause it to cut the dividend twice more, a total of 24%.

- Intel’s turnaround is expected to succeed, but analysts expect only bond-like 5% long-term total returns. In fact, bonds have outperformed Intel for the last 20 years. And Intel has underperformed the chip sector for 22 years. It’s time to bid farewell to Intel and buy two high-yield dividend aristocrat bargains before the recession hammers Intel even more.

JuSun

This article was published on Dividend Kings on Wed, May 17th.

—————————————————————————————

U.S. companies rarely cut their dividends, only as a last resort.

DK Research Terminal

When it comes to dividends, we’re a nation of Rockefellers.

Do you know the only thing that gives me pleasure?” he once asked. “It’s to see my dividends coming in.” – John D. Rockefeller.

And personally, I won’t own companies that cut their dividends.

Why? Because short-term stock prices are vanity, cash flow is sanity, and dividends are reality.

Earnings can be manipulated; cash flow is much harder to fake. But dividends have to be paid out of cold, hard cash.

If a company cuts its dividend, its management is effectively admitting the wheels have fallen off the bus.

If an aristocrat or dividend king cuts? It means the company’s fundamentals are the worst in decades or more than half a century.

A dividend cut is the ultimate confirmation of a broken thesis stock, and here’s why.

When The Dividend Is Cut, It’s Time To Sell

A dividend cut is often followed by a very short, sometimes just a few hours rally. And then typically, the stock begins to fall…and keeps falling, sometimes for years.

Over the last 50 years, dividend cutters have lost investors 6% adjusted for inflation-an entire investing lifetime with nothing to show for it.

Half a century of anguish that’s the price of refusing to admit an investment thesis has broken.

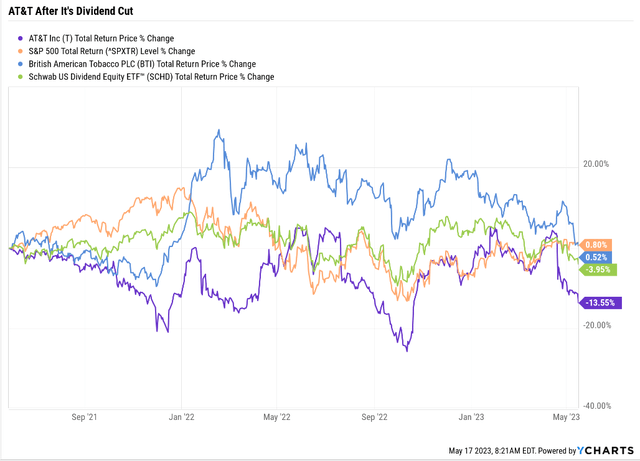

When AT&T Inc. (T) announced it would cut its dividend in the following year on May 28th, 2021, I immediately sold and recommended Dividend Kings Members sell and buy British American Tobacco p.l.c. (BTI).

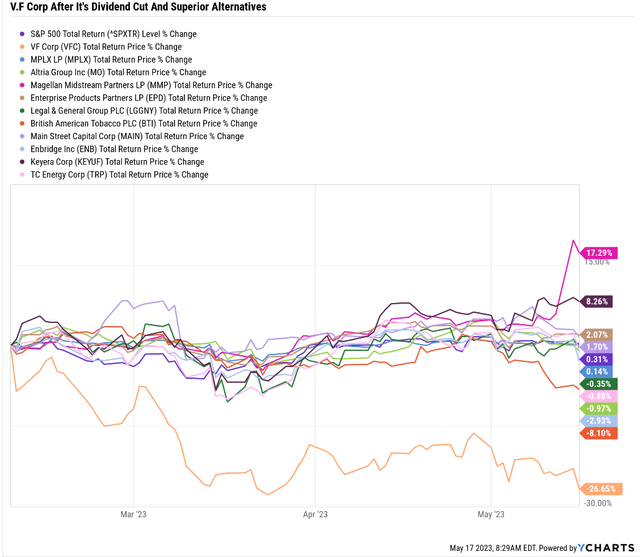

When V.F, Corp (VFC), just three months after raising its dividend for the 52nd consecutive year, slashed its dividend by 40% and admitted the worst company fundamentals since 1971, I sold and recommended DK members buy 15 superior alternatives.

Not every alternative to VFC is up since February 8th, but compared to the dumpster fire that is this failed dividend king, they are rock stars.

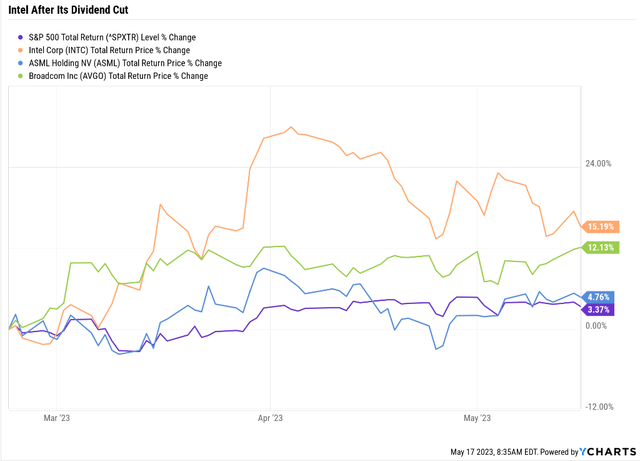

Intel Corporation (NASDAQ:INTC) has so far bucked the dividend cut curse, though it’s been losing steam for weeks.

It’s still beating my superior alternatives, ASML Holding N.V. (ASML) and Broadcom Inc. (AVGO), but that’s not likely to hold long-term.

Let me show you why Intel’s much lower dividend is still not safe and why almost anything makes a better long-term investment than Intel.

In fact, I’ll give you some high-yield aristocrat alternatives so you can sleep extra well at night in these troubled times.

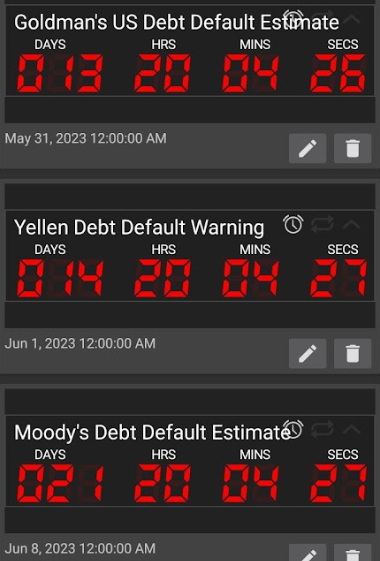

Goldman Sachs, Moody’s, US Treasury

Why Intel’s Dividend-Cutting Days Might Not Be Over

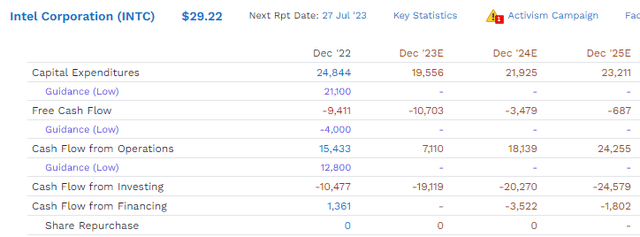

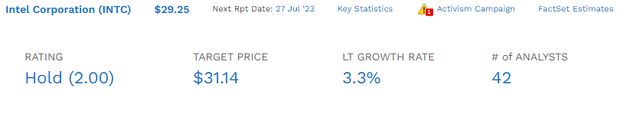

The consensus among all 42 analysts covering Intel is that it will follow up its 2023 dividend cut with 24% more cuts over the next two years.

Why are analysts so bearish on Intel’s dividend safety when U.S. corporations are loath to cut even once, much less three years in a row?

What could possibly justify analysts’ forecasts that Intel will cut its annual dividend not once, not twice, but thrice?

Intel’s new turnaround plan, its second in the last few years, is to turn itself into an outsource fab solution along the lines of Taiwan Semiconductor Manufacturing Company Limited (TSM). In other words, rather than just design and make its own chips to sell in things like laptops and smartphones, it wants to become a chip factory for its rivals.

It plans to spend $20 billion to build two factories in Arizona, part of the $50 billion Chips Act, which partially funds those fabs.

That high capex is expected to last until 2025, at least. Resulting in negative free cash flow for four consecutive years.

Analysts think Intel will need to borrow $25 billion to build its new factories and continue improving its chips as it struggles to keep up with superior rivals like Advanced Micro Devices, Inc. (AMD) and Nvidia Corporation (NVDA).

But wait, it gets worse. $25 billion is what Intel is expected to have to borrow to build its new manufacturing facilities.

It still pays a modest dividend costing it $2.1 billion annually.

So if Intel wants to keep that dividend intact, it will have to borrow $33 billion.

But wait, it gets worse.

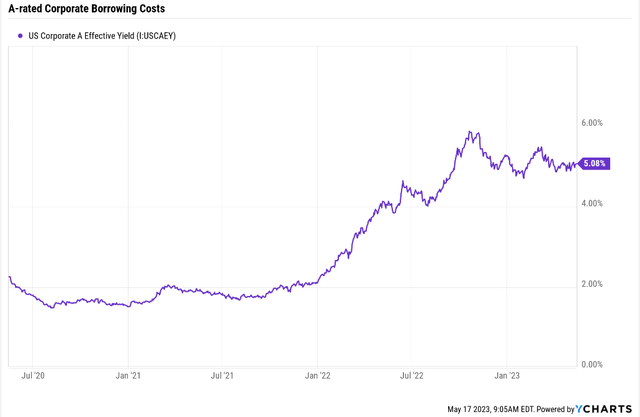

The 10-year borrowing costs for A-rated companies are 5.1%, matching the Fed funds rate. Intel’s 10-year bonds are currently trading at 5.2%.

But wait, it gets worse.

In recessions, corporate borrowing costs generally rise by 1% to 2%.

That means if the Fed makes good on its promise/threat to hold rates at 5% all year, even if we’re in a recession (President Bostic of Boston this week), then Intel’s borrowing costs could rise from 6% to 7%.

Intel’s average borrowing costs on $50 billion in current debt are 1.67% or $835 million per year.

Assuming it was smart enough to borrow all $11 billion in deficit spending this year (that’s what negative free cash flow is) at 5% before the recession causes corporate bond spreads to blow out, then its interest costs will rise by $572 million to a total of just over $1 billion per year.

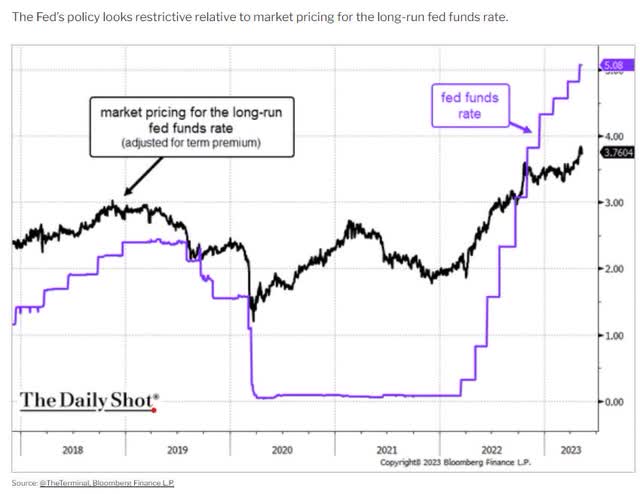

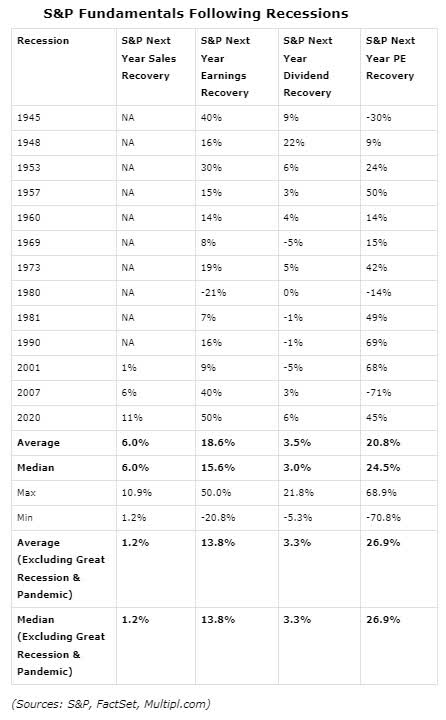

The good news is that, on average, the Fed cuts rates by 5% in recessions.

The bad news is that we’re not actually going back to zero.

The bond market currently thinks the Fed is going to have to stay at 3.75% long-term.

That’s twice Intel’s current average borrowing costs.

Remember that A-rated bond yields are basically tracking the Fed funds rate over time.

And Intel has a negative outlook on its A-rated, meaning a 33% chance of a downgrade which would mean even higher borrowing costs.

Let’s assume the Fed cuts aggressively in 2024 due to the recession.

And let’s assume that Intel’s remaining $14 billion in borrowing to construct its new fabs is borrowed at 3.75%.

- $835 million in current interest costs

- $572 million in additional interest from 2023

- $525 million additional interest from 2024 to 2025

- $1.932 billion in potential annual interest costs

- compared to the $418 million pre-Fed hiking crusade.

That’s a potential 400% increase in interest costs.

But wait! It gets worse!

We haven’t even factored in the $8.4 billion it would cost Intel in new debt to fund its 66% smaller dividend.

- 2023 dividend borrowing: $109 million additional annual interest expense

- 2024 through 2025 dividend borrowing: $236 million additional annual interest expense

- $345 million per year in annual interest expense

- $2.277 billion in total annual interest expense by 2025

- potential 450% increase in interest costs.

Now do you see why analysts expect Intel to cut its dividend to once, not twice, but thrice?

If I were on Intel’s board, I would recommend Intel eliminate the dividend entirely, saving itself $8.4 billion over four years, which it obviously needs for its turnaround plan.

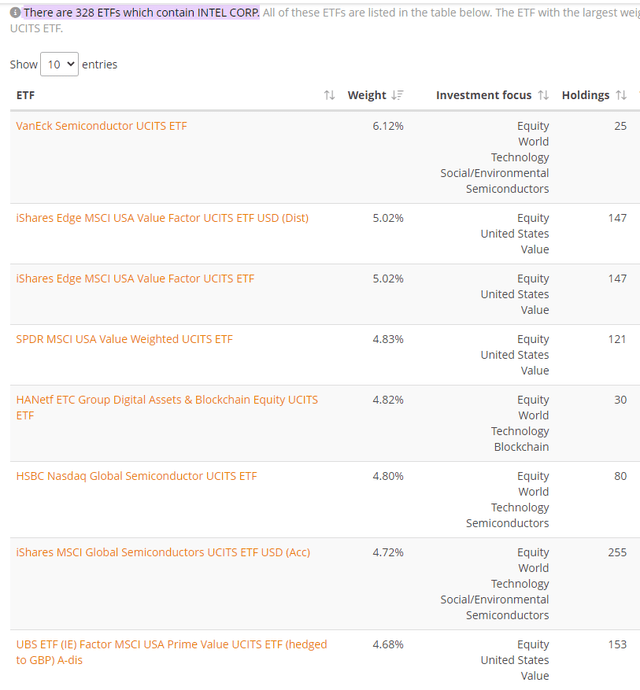

How much more selling could dividend mutual funds and exchange-traded funds (“ETFs”) do? INTC has already been removed from the most popular dividend growth ETFs such as SCHD, VIG, and VYM.

328 ETFs still own it, and most of its ETF shares are in chip ETFs and value ETFs.

Cutting the dividend to zero isn’t going to cause a mass exodus. True income investors have already abandoned INTC after its first 66% dividend cut.

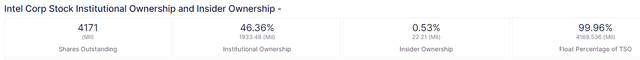

Ok, but maybe insiders own a lot of INTC, so they are still paying that 1.7% yield.

Sure, if the CEO owned 1% of shares, then that would be $21 million in annual dividends, which might explain why Intel is still a dividend stock.

Management owns 0.53% of Intel, 22.21 million shares paying $11.1 million per year in dividends.

That sounds like a lot, and to you and me, it’s a fortune. To Intel’s executives, it’s a drop in the bucket.

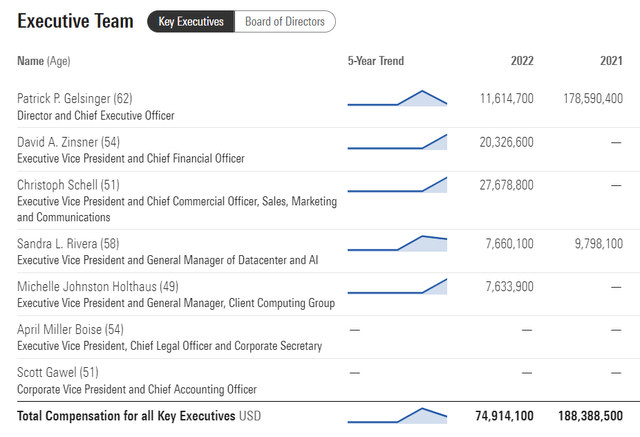

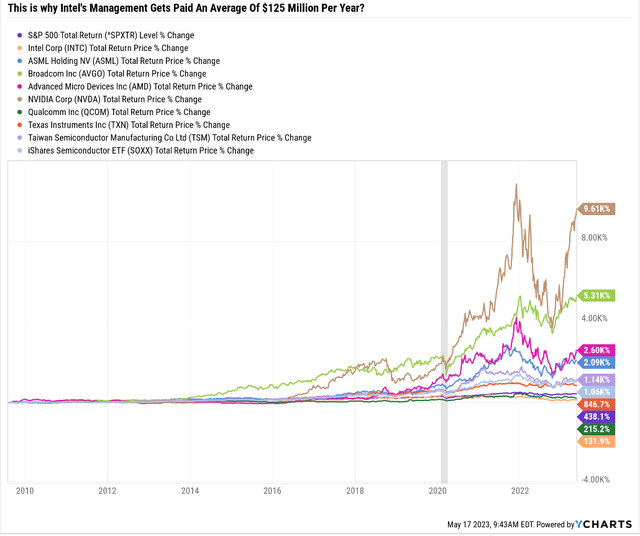

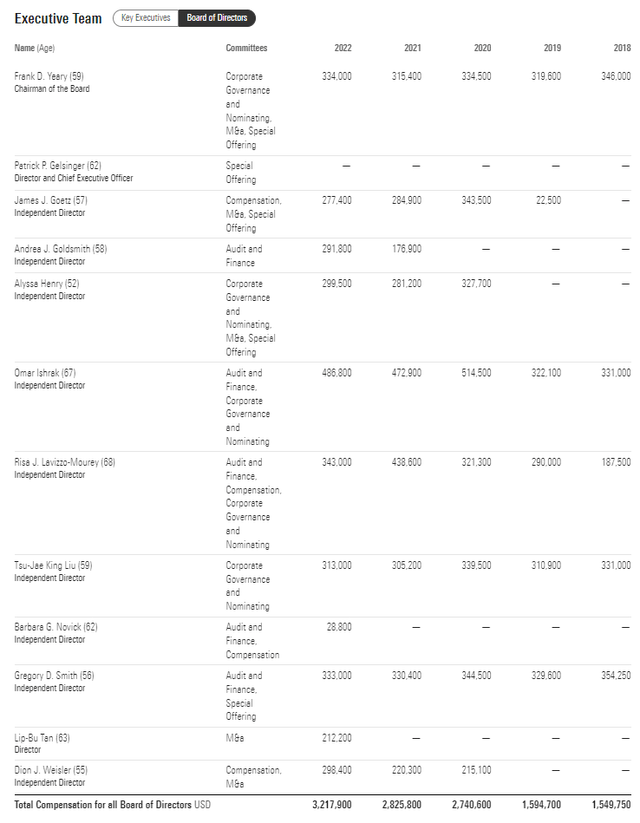

In 2022, a year when Intel was cut in half, management paid itself $75 million.

Intel’s CEO made $12 million in 2022, which is more than management gets from dividends.

Why is Intel paying its executives so lavishly when its returns have been terrible?

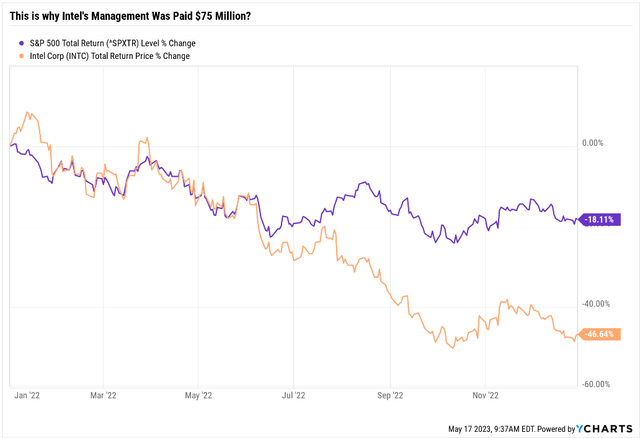

Here’s what $125 million per year is buying Intel shareholders.

It’s getting crushed by every major peer. In fact, its performance over the last 12 years is 88% worse than the sector.

Why is Intel paying itself so much for returns that are so bad?

Intel’s dumpster fire has been burning for years, but every year, the board, including the highly overpaid CEO, votes to pay itself more.

In fact, since 2018, the board, which is supposed to hold management to account for the benefit of shareholders, has been raising its annual pay by 20% annually.

- Buffett’s 58-year returns are 20% annually.

Intel’s board is giving itself Buffett’s like returns in income…for distinctly non-Buffett-like results in fundamentals and share price.

So…why is Intel still paying the dividend? The only reason I can think of is that management wants that $11 million per year in dividends. It’s a 10% average increase in pay for a c-Suite that we’ve already seen doesn’t believe that pay should be based on performance.

Intel’s Future Prospects Don’t Look Much Better

Believe it or not, analysts do believe that Intel’s turnaround will succeed. They think the new “take on TSCM and be a manufacturer for other companies” plan will work…kind of.

So what kind of returns can Intel investors currently expect after the four years of $25 billion in deficit spending are over?

A return to Intel’s historical 7% growth rate over the last 20 years? The bad news is that even if Intel didn’t cut its dividend, 7% growth would lead to 8.7% long-term returns.

- Verizon like returns

- but with 1/4th the yield.

But wait, it gets worse!

Analysts don’t think Intel will be able to return to its historically humdrum growth rates.

Forty-two analysts crunching the numbers after Intel’s most recent earnings and conference call, and their median long-term growth estimate is 3.3%.

Long-Term Return Potential That’s…Almost Bond Like

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

| ZEUS Income Growth (My family hedge fund) | 4.2% | 10.0% | 14.2% | 9.9% |

| Vanguard Dividend Appreciation ETF | 2.0% | 11.3% | 13.2% | 9.3% |

| Nasdaq | 0.8% | 11.2% | 12.0% | 8.4% |

| Schwab US Dividend Equity ETF | 3.6% | 7.6% | 11.2% | 7.8% |

| REITs | 3.9% | 7.0% | 10.9% | 7.6% |

| Dividend Champions | 2.6% | 8.1% | 10.7% | 7.5% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% |

| 60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% | 5.0% |

| 6-Month Treasury Bonds | 5.2% | 0% | 5.2% | 3.6% |

| Intel | 1.7% | 3.3% | 5.0% | 3.5% |

(Source: DK Research Terminal, FactSet, Morningstar.)

What’s a potentially better investment idea than Intel? Just about anything, including risk-free U.S. treasury bonds at the moment.

OK, so Intel’s consensus long-term growth prospects might suck. But what’s the range on those forecasts?

- -8% to 10%.

In other words, the most bullish analyst out of 42 professionals who study Intel for a living thinks it might grow at 10% over time.

- 11.7% long-term returns.

The most pessimistic thinks its earnings will be 50% lower in a decade.

OK, so Intel isn’t a good growth stock or a good dividend stock, but maybe it’s a good value stock?

After all, it’s now primarily owned by value funds, right?

Intel Isn’t A Value Stock Either

5% long-term returns…and 5% short-term returns, despite 443% earnings growth from the 2023 trough.

A trough that might get a lot deeper because of the 2023 recession!

So let me get this straight. Intel isn’t a growth stock; it’s not a dividend growth stock; it’s not a high-yield stock or a value stock.

And despite a heck of a turnaround, with 443% expected earnings growth through 2025, shareholders can expect to earn bond-like returns, half the returns of the S&P.

So basically, you’ll be paying management about $375 million + about $25 million in dividends, for a total of $400 million to keep disappointing you.

- just like the last decade.

OR…you can buy these faster-growing, high-yield dividend aristocrats instead.

Bid Farwell To Intel, It’s Time To Buy Proven Winners Instead

It’s not hard to beat Intel’s yield, valuation, growth rate, return potential, safety, or quality.

Here are two solid high-yield aristocrat choices to consider.

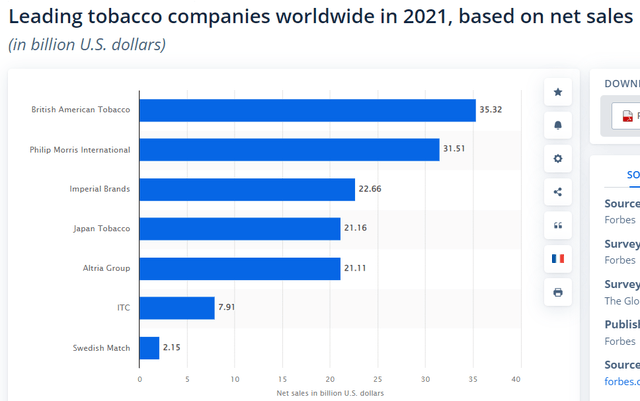

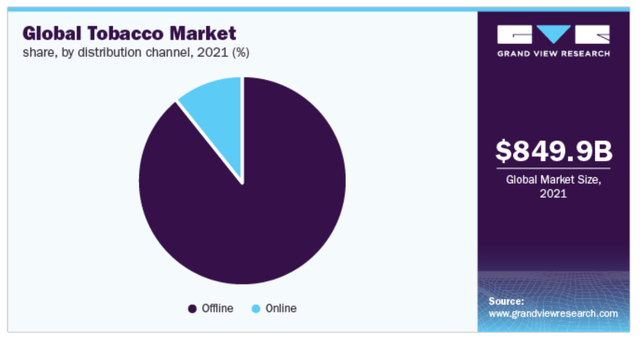

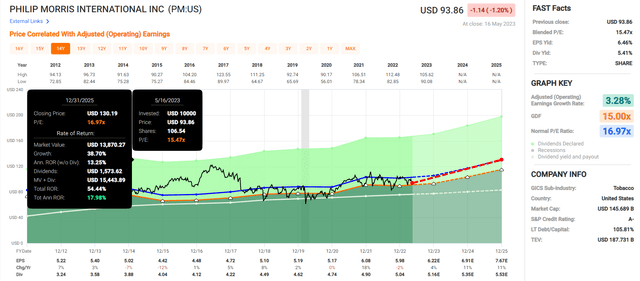

Philip Morris International (PM): The Growth King Of Tobacco Owns The Smoke-Free Future

Further Reading

After acquiring Swedish Match, PM is neck and neck with BTI as the world’s #1 tobacco company.

More importantly, it’s the reduced-risk product or RRP leader, with 40% of sales from heat sticks and oral nicotine pouches.

And thanks to pioneering heat sticks starting in 2013, it’s now earning slightly higher gross margins on iQos than traditional cigarettes.

That’s why PM is the growth king of its industry, as well as the top balance sheet, the only A-rated tobacco company you can buy.

Oh, and it’s a dividend king with a 53-year growth streak to its credit. A streak that it won’t kill with a cut like Intel did, thanks to a highly stable and recession-resistant business.

Outside of China, where foreign companies aren’t allowed, tobacco (including RRPs) is a $680 billion industry growing at about 3% annually through 2030.

It’s not a dying industry, at least not nicotine, which has always been popular and likely will remain so for as long as humans walk the earth.

Fundamental Summary

- DK quality score: 98% very low risk 13/13 Ultra SWAN dividend king

- DK safety score: 100% very safe dividend (1.0% dividend cut risk in severe recession)

- Historical fair value: $108.69

- Current price: $93.65

- Discount to fair value: 14%

- DK rating: potential good buy

- Yield: 5.4%

- Long-term growth consensus: 8.8%

- Consensus long-term return potential: 14.2%.

PM’s yield alone is more than Intel’s entire long-term return consensus.

PM offers over 3X the yield of Intel, a much safer yield at that. It also offers more than 3X the short-term return potential and 3X the long-term return potential.

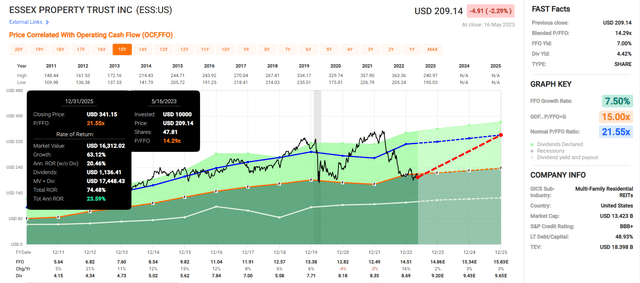

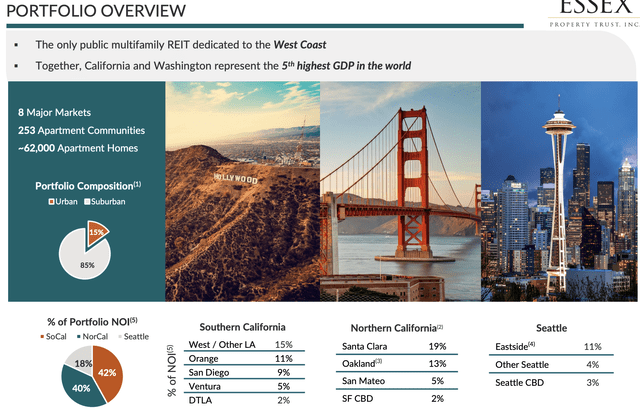

Essex Property Trust, Inc. (ESS): An Ultra SWAN Way To Profit From The Housing Crisis

Further Reading

Guess where some of the most expensive housing in the world is? The West Coast.

That’s due to NIMBYism and local cities blocking new home construction to keep home prices elevated.

Is that bad economic policy? Yes.

Is it economically unethical? Yes, it increases homelessness and hurts the poor.

Is it politically hypocritical in the oh-so-liberal state of California? You bet it is.

But it’s also reality. So why not profit from California’s dysfunction by cashing in on the housing crisis?

Why ESS Is A Very Strong Buy Today

investor presentation

Essex Property Trust is an apartment REIT that is well run, and it was one of just 17 REITs in America that didn’t cut its dividend in the Financial Crisis.

Even if we default on our debt and plunge into a Great Recession 2.0, ESS is very likely to keep growing its dividend every year and extend its 29-year dividend growth streak.

Oh, and if you want to feel good about your investments, then how about the fact that ESS’s average rent-to-income ratio is 23.5% (33% or less is considered affordable)?

ESS is cashing in on a crisis, helping California’s put a roof over their head, and making income investors rich, all at the same time!

God bless America!

Fundamental Summary

- DK quality score: 95% low risk 13/13 Ultra SWAN dividend aristocrat

- DK safety score: 95% very safe dividend (1.25% dividend cut risk in severe recession)

- Historical fair value: $321.99

- Current price: $210.42

- Discount to fair value: 35%

- DK rating: potential Ultra Value buy

- Yield: 4.4%

- Long-term growth consensus: 6.2%

- Consensus long-term return potential: 10.6%.

ESS’s long-term return potential is more than twice that of Intel.

Buffett-like return potential from a table-pounding high-yield aristocrat bargain hiding in plain sight.

Bottom Line: Bid Farwell To Intel, And Buy These High-Yield Dividend Aristocrats Instead

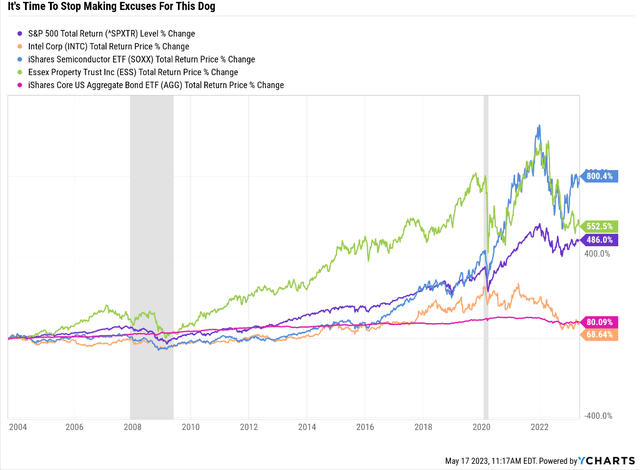

Intel bulls defend the company by arguing that its terrible results over the last decade are a function of bad luck.

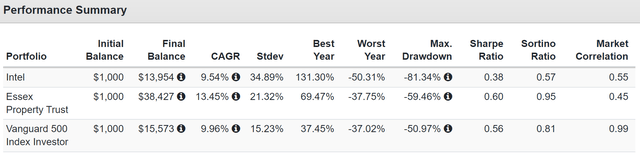

Intel has been losing to U.S. bonds for 20 years.

It’s been losing to the chip sector for 22 years.

It’s been losing to Ultra SWAN quality aristocrats like Essex for three decades.

Total Returns Since 1994

When a company does poorly for 20 years, there is a 91% statistical chance it’s a bad company.

When a company underperforms a high-quality investment for 30 years, there is a 97% statistical chance it will keep doing so.

Intel has had a few great months, and it gives income investors who have clung to the hope of a better exit price exactly that.

The economic data say a recession approximately twice as bad as economists expected last week is now possibly 4.5 weeks away.

Let me ask you, what would you rather own in a recession that’s slightly worse than average and lasts slightly longer?

- -1.8% GDP contraction

- 9-month recession

- Also what Bank of America (BAC) CEO Brian Moynihan expects to start in July.

Would you want a cyclical chip maker that’s hemorrhaging free cash flow and expected to keep doing so until 2026?

Would you want a company that just slashed its dividend by 66% and that analysts think will cut another 24% over the next two years?

Or would you want two recession-resistant dividend aristocrats and kings led by battle-tested shareholder-friendly management?

Companies that are proven market-beaters and run by management that’s worth their generous but not outrageous pay packages?

I think the answer is clear.

It’s time to bid farewell to intel and buy these high-yield aristocrats instead.

That’s how you’ll sleep well at night on your dividend blanketed bed.

No matter what the economy or stock market might soon bring, I’m highly confident that these world-beater blue-chips with joy will make your heart sing;)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Intel's dividend is expected to be cut another 24% in the next two years. It's long-term return potential is 5%, less than bonds, which it has underperformed for the last 20 years.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.