Summary:

- The recent pullback in energy stocks presents several attractive buying opportunities for dividend investors.

- I compare two particularly attractive opportunities in DVN and PR.

- I share which of these two dividend growth and big buyback energy stocks is the better buy right now.

e-crow/iStock via Getty Images

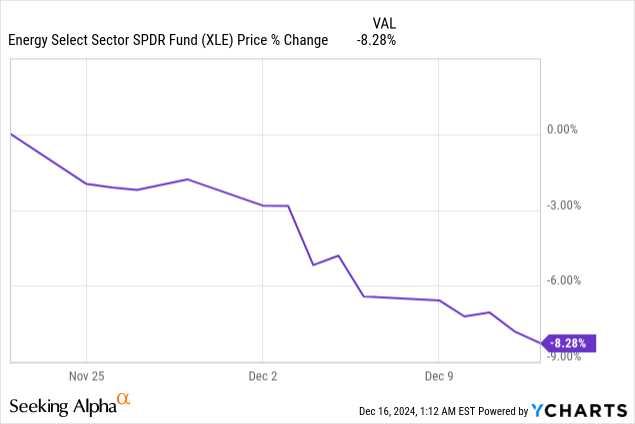

Several high-quality energy production stocks (XLE) have pulled back sharply recently due to reduced concerns about a major war breaking out in the Middle East, as well as the election of Donald Trump and his pro-energy production agenda, which could increase supply and thereby reduce prices.

That being said, Mr. Market often tends to overreact in both directions whenever markets turn bullish or bearish on a particular sector. As a result, there are several very high-quality energy companies with strong balance sheets that are gushing free cash flow and have very low WTI breakeven points and dividend sustainability points that are now trading at highly compelling valuations.

This is especially true given that, over the long term, energy demand is likely to soar due to the onset of the artificial intelligence boom. Therefore, even if there is a supply increase due to higher U.S. production and a lack of supply disruptions in the Middle East, there is likely to be significant demand growth from data centers that will absorb much, if not all, of this extra energy supply. With that in mind, in this article, I am going to compare two particularly attractively priced energy production companies, Devon Energy Corporation (NYSE:DVN) and Permian Resources Corporation (NYSE:PR), and share my thoughts on which one is the better buy right now.

PR Stock Vs DVN Stock: Business Models

One of the biggest differences between DVN and PR is that DVN is more diversified across multiple basins (the Delaware, Williston, Eagle Ford, Powder River, and Anadarko), whereas PR is fully focused on the Delaware Basin in the Permian Basin. This is not a clear advantage for either company, as some may prefer the diversification that DVN offers, while others may prefer PR’s concentration on the Delaware Basin, given that it has very low-cost production assets and the Permian Basin is considered one of the world’s premier drilling locations.

In addition, both are well diversified in terms of commodity exposure, as both have a healthy mixture of oil, gas, and NGLs exposure. As a result, both companies are positioned to potentially profit from various market conditions where certain commodities are more attractively priced than others. This also gives them exposure to future growth areas like NGL exports and AI-driven demand for natural gas.

PR Stock Vs DVN Stock: Balance Sheets

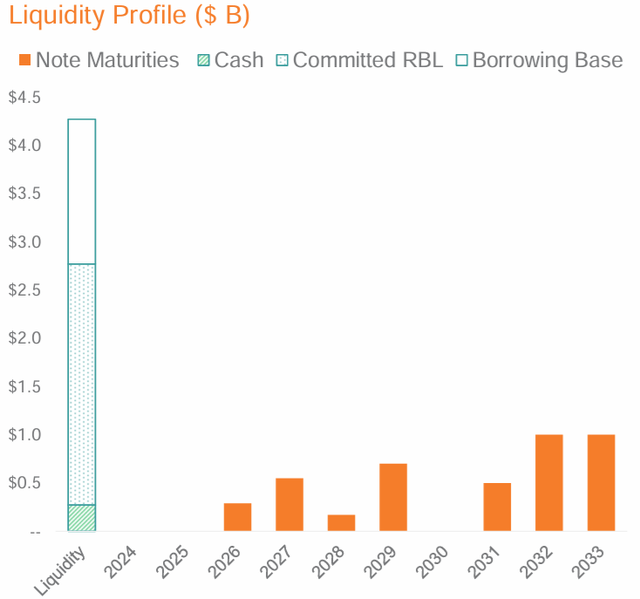

Their balance sheets are also both in strong shape. DVN is already investment grade, while PR is on the cusp of being upgraded to investment grade, with the company targeting an upgrade to investment grade status in 2025. Both companies also have leverage ratios of roughly 1x (1.1x for DVN and 1.0x for PR) and plan to maintain a leverage ratio of 1x or even lower moving forward. Their debt maturities are also well-laddered as PR does not have any debt due until 2026, and even then, its debt levels are quite low each year, stretching out to 2032 and 2033 when its maturities will come in at about $1 billion each.

PR Debt Maturities (Investor Presentation)

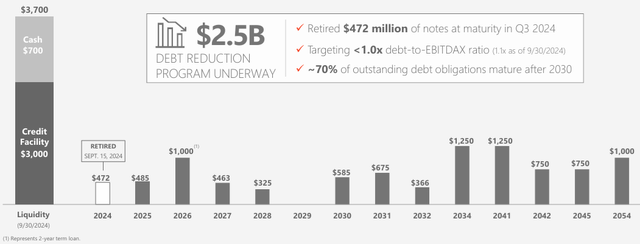

Meanwhile, DVN does have some debt due in 2025, 2026, 2027, and 2028, but each year the amount due is fairly moderate. Additionally, much of its debt is also termed out all the way to the 2030s, 2040s, and 2050s, with $1 billion not maturing until 2054.

DVN Debt Maturities (Investor Presentation)

PR also has $2 billion in liquidity, while DVN has $3.7 billion in liquidity. However, DVN also has more debt outstanding. Overall, both companies appear to be in very strong shape from a balance sheet perspective.

PR Stock Vs. DVN Stock: Capital Returns & Valuations

Both companies are also moving away from variable dividend payouts and are instead focusing on a fixed dividend payout, which they hope to grow over time while prioritizing excess cash toward reducing debt and buying back stock. PR has a $1 billion buyback program in place, which it plans to use opportunistically based on where the stock price goes, while also paying out an attractive dividend. Meanwhile, DVN is planning to buy back about $1.2 billion worth of stock each year.

Given that PR’s market cap is $10.3 billion and DVN’s is $22.3 billion, the ultimate impact of these buybacks will depend on how quickly PR executes its buyback plan. However, based on the size of the buybacks relative to its market cap, PR’s plan looks at least as favorable, if not more so, than DVN’s provided it can execute its full buyback authorization within 2 years or less.

The comparison becomes even more favorable for PR when looking at its next twelve-month dividend yield, which is expected to be 4.1% based on its base dividend. In contrast, DVN’s base dividend yield is expected to be only about 2.5%. This makes PR the higher-yielding stock, especially if it executes its buyback program with a heavy weighting toward this year. Both companies have also reiterated that they plan to grow their base dividends consistently and sustainably, which will be driven by a combination of share buybacks and improved production efficiencies thereby delivering earnings per share growth on a commodity price-neutral basis.

On top of that, PR’s price-to-free cash flow for 2025 is expected to be just 7x, whereas DVN’s is 8.3x, making PR the cheaper option on a free cash flow yield basis. As a result, PR is cheaper relative to DVN on both a free cash flow yield basis and a dividend-plus-buyback-yield basis.

PR Stock Vs. DVN Stock: Risks

Of course, no investment is risk-free, and PR and DVN are no exception. Both companies share similar macro risks in that both are highly sensitive to commodity price volatility as well as the operational risks that come with extracting energy commodities from the earth. That said, both companies have an excellent track record of doing so in an increasingly efficient and safe manner.

As for commodity price volatility, both companies have low costs of production and diversification across LNG, natural gas, and oil, so this enables them to opportunistically dial production up and down in each of these segments based on market conditions while they should also be able to remain profitable and support their dividends even in weaker energy market conditions. On top of that, they have strong balance sheets and substantial buyback authorizations in place, so if energy prices were to enter a prolonged period of weakness, they should be able to survive the storm and potentially even buy back a considerable amount of equity should their stock prices overreact to the negative macro environment.

A final note – that has been already discussed elsewhere – is that DVN has less operational risk given that it is diversified across numerous basins whereas PR is concentrated in a single basin.

PR Stock Vs. DVN Stock: Investor Takeaway

So which stock do we prefer right now? Both companies have very similar leverage ratios and similar exposure to oil, natural gas, and NGLs. The main reason to pick DVN over PR would be the fact that DVN’s market cap is about twice the size of PR’s and its portfolio is more diversified across multiple different basins, whereas PR is a Delaware Basin pure play. However, PR’s cheaper free cash flow valuation, significantly higher base dividend yield, slightly more attractive debt maturity profile, and slightly lower leverage ratio make it a more compelling buy, in our view.

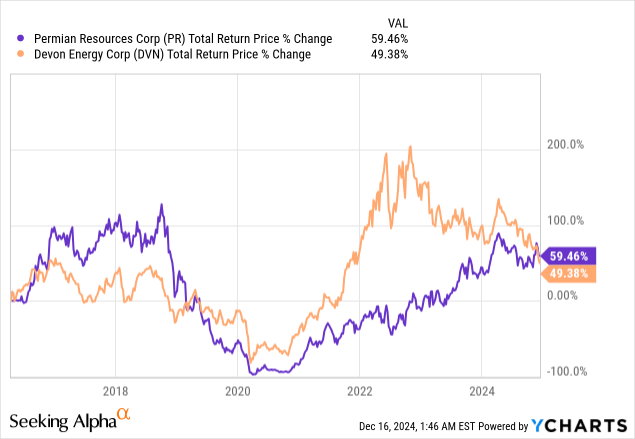

Additionally, though it is not a major factor in our consideration, it is worth noting that PR has outperformed DVN over the course of its existence as a publicly traded company:

As a result, while we rate both as attractive buys right now, we hold PR, along with several other high-yielding energy dividend growth opportunities, over DVN in our portfolios at High Yield Investor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want access to our Portfolios that have crushed the market since inception and all our current Top Picks, join us for a 2-week free trial at High Yield Investor.

We are the fastest growing high yield-seeking investment service on Seeking Alpha with a perfect 5/5 rating from 180 reviews.

Our members are profiting from our high-yielding strategies, and you can join them today at our lowest rate ever offered. You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!