Summary:

- Reliable connectivity forms the basis of the digital revolution.

- It pays big dividends to own wide-moat telecom.

- We compare and contrast the fundamentals of two telecoms, AT&T and Verizon.

- Whose dividend is higher, safer, and backed by a better balance sheet?

Jaiz Anuar

Co-produced with “Hidden Opportunities”

Remote work, virtual school, and social-distancing measures have accelerated the need for improved digital connectivity. Accessible, affordable, and reliable telecom services are evermore essential today and have completely transformed how we study, work, and interact. This has resulted in the telecom sector’s unprecedented “pandemic-accelerated” transformation.

Telecom is an attractive business with a terrific competitive advantage. We are very dependent on our smart devices, and their number in our household keeps increasing yearly. The Big Three U.S. telecom companies – AT&T (NYSE:T), Verizon (NYSE:VZ), and T-Mobile (TMUS) maintain almost 98% market share.

Recognizing the importance of digital connectivity in modern society, the Biden Administration recently passed a federal infrastructure act, delivering a historic $65 billion for broadband infrastructure deployment. Much capital inflows into this sector, which is vital for nations to be leaders in the digital revolution.

Today, we will look at two U.S. telecom giants that are well-positioned to benefit in the years to come from the generational transformation in the industry; AT&T and Verizon.

The Business Opportunity

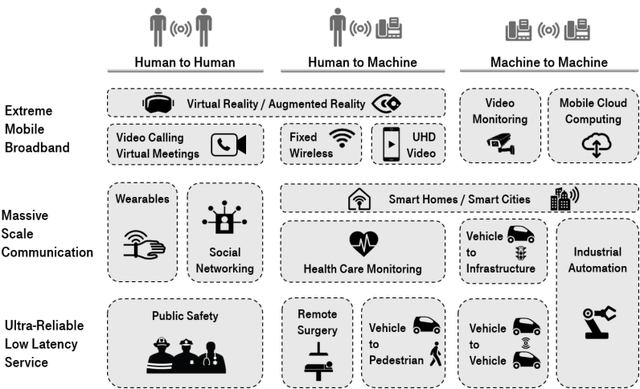

5G and fiber rollout are significant transformations in the communication industry. They have substantial applications that touch upon consumer needs and B2B advancements. Yes, companies like Meta (META) are building a massive business out of Augmented Reality, but I prefer investing in the infrastructure backbone that empowers all this innovation.

As a child, Warren Buffett was fascinated by cars moving on the streets and was quoted to have lamented that he couldn’t make money from their movement.

All that traffic, what a shame you aren’t making money from the people going by.” – Warren Buffett as a child

In this digital world, I want to make money from terabytes and petabytes of data traffic, and telecom provides me with that opportunity. Source

The Juniper Research into 5G monetization predicts that the global revenue from 5G services will reach $600 billion by 2026. AT&T and Verizon are both partnering with several businesses to enable digital transformation. VZ is notably diving deep into modernizing government agencies and industry 4.0, whereas AT&T is expanding into connected cars and Internet-of-Things (‘IoT’). This is only the beginning.

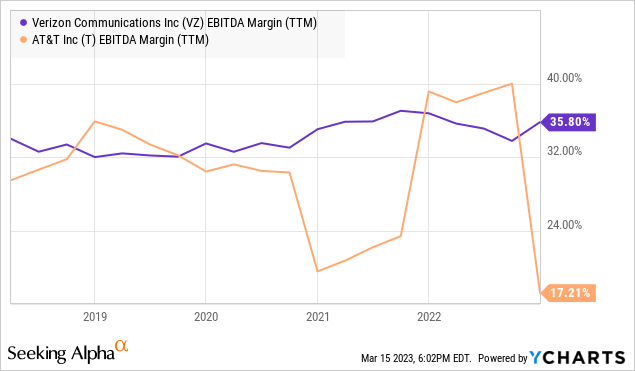

Comparing the two companies, AT&T has better coverage and offers lower-priced plans to consumers. VZ, on the other hand, has better 5G reliability and offers additional perks to customers in the form of subscriptions to streaming services like Disney+. VZ’s increased focus on more premium plans has ensured consistently better profit margins in the U.S. telecom industry.

We’re focused on attracting and retaining high-quality consumers, those willing to pay for its higher-priced unlimited data plans. About 81% of Verizon’s consumer customers were on unlimited plans as of the end of Q3.” – Hans Vestberg, CEO of Verizon

While VZ has maintained a strong track record of profitability, consumers tend to get price-conscious in a challenging economy. As such, AT&T’s lower-priced connectivity options may offer better value for bargain hunters, positioning the company better for a recessionary environment.

Capital Expenditure and 2023 Outlook

5G and Fiber automatically have investors speak about billions of dollars in expenditure. In many ways, 2023 was the year of peak 5G expenditure for U.S. telecom companies as carriers raced to win customers by offering the fastest and most reliable coverage.

We expect [that] the 5G train acts more like a 100-car freighter and not a high-speed bullet; it started slowly and will ramp over the years, but it may be unstoppable.” – Raymond James Analysts

VZ’s expenditure for the full-year 2022 came in at a sizable $23.1 billion; this total was up by $2.8 billion from 2021. The company expects its 5G C-band deployment to continue in 2023 but with less intensity, and management has affirmed that 2022 was the year for peak 5G expenditure. The company projects $18.25-$19.25 billion in capital expenditure for FY 2023.

AT&T, on the other hand, spent $24 billion in FY 2022, including 5G rollout and massive fiber deployment projects. AT&T’s CFO Pascal Desroches said that the company will have a similar capex spend in 2023 and begin to fall below $20 billion levels in 2024 as the company tapers off its 5G network investments.

While VZ comes out ahead in peak 5G expenditure, AT&T is still in a better position to reward shareholders from a priority and a cash flow standpoint. Let’s take a deeper look at those differences.

Balance Sheet Strength and Debt Levels

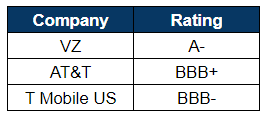

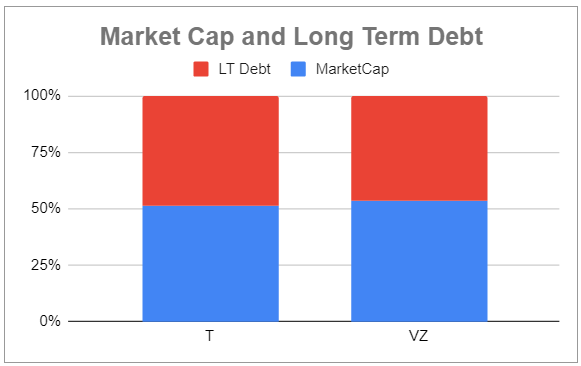

Verizon boasts a strong balance sheet and excellent credit ratings. Team Red exited 2022 with a net unsecured debt to adjusted EBITDA ratio of 2.7x. The company carries an effective interest rate on debt of 3.7% at the end of FY 2022.

Telecom Credit Ratings

AT&T lags behind VZ in debt levels, projecting to reach a healthy 2.5x leverage ratio only by 2025. However, AT&T has a tad bit lower debt as a percentage of the market cap than VZ. Notably, AT&T has been aggressively focusing on debt reduction, paying off almost $24 billion in 2022 and reducing its interest expense by $700 million during the year. At the end of FY 2022, Team Blue had a weighted average interest rate on its long-term debt portfolio (including credit agreement borrowings and the impact of derivatives) of 4.1%.

Author’s calculations

Verizon comes out ahead with a lower leverage ratio, debt expenditure, and a slightly stronger balance sheet rating. However, AT&T is catching up quickly, and its aggressive debt paydown will reward shareholders in the long run.

The Dividend

As income investors, dividends are the prize for owning the stock. The yield on our investment and dividend safety are critical metrics to evaluate to ensure the consistency of this prize.

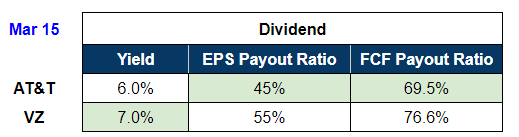

Author’s Calculation

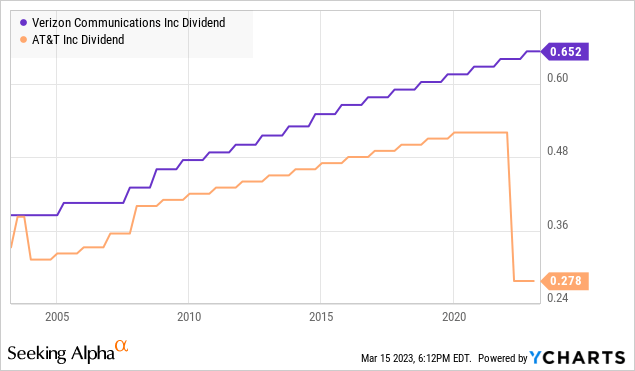

Verizon boasts a solid track record of shareholder returns with 16 consecutive years of dividend increases. The company’s $0.6525 quarterly dividend calculates to a 7.0% annualized yield.

Looking backward at 2022 Free Cash Flow (‘FCF’), VZ generated $14.1 billion and spent $10.8 billion towards common dividends. This calculates to a modest 76.6% FCF payout ratio. Based on VZ’s 2023 projected EPS between $4.55-$4.85, this dividend comes at a healthy 53-57% payout ratio.

Note: Analysts project VZ to generate $17 billion in FCF, which adequately covers the common dividend payment.

AT&T has a somewhat controversial history of dividends. The company lost the coveted dividend aristocrat status in 2021 following its decision to freeze the dividend that year following the announcement of the spinoff of Warner Bros. Discovery (WBD). AT&T subsequently adjusted its dividend to base its payment on the new AT&T’s earnings. This new AT&T pays $0.2775 every quarter, a 6.0% annualized yield. For FY 2022, the company generated $14.1 billion in FCF, which covered its annual $9.8 billion dividend at a 69.5% payout ratio. We expect the company to hold this dividend steady and use the FCF in the upcoming quarters to pay down debt. AT&T’s adj. EPS guidance for 2023 ($2.35 – $2.45) indicates a 45-47% payout ratio.

Note: AT&T reduced its dividend in 2022 and expects to spend $8 billion on dividend payments in 2023. This enjoys 2x coverage by the projected FY 2023 FCF of +$16 billion.

While VZ sports a higher yield at current prices, AT&T’s dividend appears to enjoy better safety on a forward-looking basis.

Valuation

Investors are rushing to “safer,” government-guaranteed securities in this rising rate environment. As such, battle-tested and recession-resistant businesses are trading at low prices, sporting big yields.

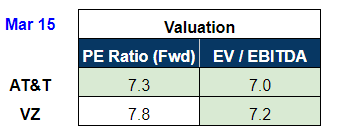

Author’s Calculations

Both AT&T and VZ are neck and neck when it comes to valuation and offers almost equal value for the price you pay.

This round is a tie!

Conclusion

2G established the gateway to digital communications; with 3G came real wireless access to the internet. Our phones became computers with the power of 4G, and today, 5G opens the door to a whole new world of massive possibilities. This communication infrastructure forms the backbone of our digital tomorrow and is critical for empowering the workforce of the future. Whether we like it or not, more components of our household will be connected to the internet in the coming years. Recession or not, job seekers will be more glued to social media for their next opportunity, and we will be consuming more data than ever before.

Telecom is a defensive industry with a significant moat, and the industry is a passive income seeker’s delight. Both AT&T and Verizon are excellent dividend stewards with a strong track record of sharing their profits with shareholders. You won’t go wrong picking either name (or both) in your portfolio. Currently, the ‘High Dividend Opportunities’ model portfolio includes AT&T among +40 other high-yielding stocks to ensure quality and diversification. This model portfolio yields +9% today!

This article outlines salient strengths in several categories for each company for investors to review and utilize to inform their decision-making. The company you choose to invest in must be one that you understand better and that lets you sleep well at night. Which among AT&T or VZ do you like better? We would love to hear your perspective!

Disclosure: I/we have a beneficial long position in the shares of AT&T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Treading Softly, Beyond Saving, PendragonY, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities.

Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

If you want full access to our Model Portfolio and our current Top Picks, join us for a 2-week free trial at High Dividend Opportunities (*Free trial only valid for first-time subscribers).

We are the largest income investor and retiree community on Seeking Alpha with over 6100 members actively working together to make amazing retirements happen. With over 40 individual picks yielding +9%, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale get 22% off your first year!

Start Your 2-Week Free Trial Today!