Summary:

- Billionaire Ray Dalio’s principles provide valuable lessons for investors seeking to cultivate financial success.

- Companies with mountains of Free Cash Flow generation are trading at dirt-cheap valuations – I am seizing the opportunity.

- Discover top picks with up to 9% yields that Bridgewater Associates is loading up on.

Eugene Gologursky/Getty Images Entertainment

Co-authored with “Hidden Opportunities”

Ray Dalio is an American billionaire investor and hedge fund manager who founded and served as co-chief investment officer of the world’s largest hedge fund, Bridgewater Associates, since 1985. Mr. Dalio is known to conduct his business based on a series of “principles” that he has written down, and his teachings over the years emphasize that everyone should write down theirs and use them in their own decision-making processes, especially when it comes to making investments.

“Think about how you can make all of your decisions well, in a systematic, repeatable way, and then being able to describe the process so clearly and precisely that anyone else can make the same quality decisions under the same circumstances.” – Ray Dalio

The three most important takeaways from Mr. Dalio’s investment principles and related teachings are:

1. Know your investments: Investing in the financial markets carries many known and unknown risks. Mr. Dalio mentions that one of the easiest ways to make investing less risky is to opt for the sectors that you are well-acquainted with.

2. Avoid reacting to market sentiment: Many investors make investment decisions based on the market trajectory. While the idea of buying rising stocks and selling dropping ones might sound appealing, market timing is challenging even for the most experienced traders. For the average investor who doesn’t want to stare at charts all day, success is not as repeatable as you think.

Companies with low stock prices could present meaningful long-term opportunities if their business fundamentals remain sound.

3. Risk Reduction through diversification: Mr. Dalio has repeatedly emphasized that successful investing boils down to one central principle – diversification. It is a powerful risk-minimization technique because, let’s face it, you don’t know everything about the company you have invested in and maintain no influence over their decision-making.

Let us look at two excellent dividend-payers that Mr. Dalio’s Bridgewater Associates is buying at discounted prices.

Pick #1: AT&T – Yield 6.7%

AT&T (NYSE:T) is the largest telecom company in the U.S. by number of consumers. The telecom giant provides a wide range of communications services, including data/broadband internet services, local and long-distance telephone services, wireless communications, and managed networking services.

In recent years, the company has been heavy on capital expenditure, with 5G and fiber deployment. Now, the company is reaping the benefits through massive subscriber growth and the launch of value-added services. AT&T’s fiber footprint expanded by about 12% YoY, leading the telecom industry in increased fiber locations.

The company also launched the “Internet Air” offering, allowing customers to utilize 5G wireless for their Fixed Wireless needs. The company also recently launched affordable in-car wifi add-ons, boasting the widest coverage across U.S. interstates, highways, and other main roads.

Another notable development for the company was the massive increase in its 5G upload and download speeds following the loosening of the restriction around the 5G C-Band spectrum due to FAA concerns. AT&T can now utilize the full potential of its expensive purchase to provide what the next-generation wireless technology can offer.

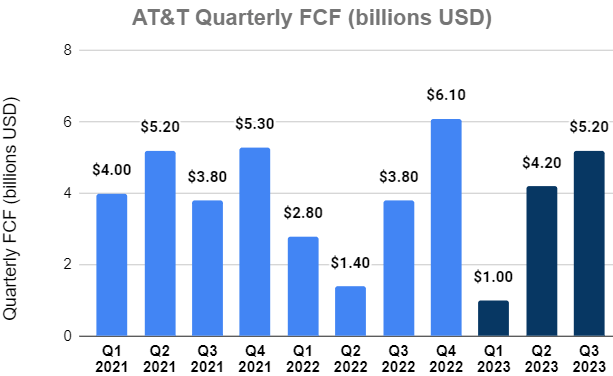

Similar to the expenditures undertaken by the telecom industry during the 3G and 4G era, we have been explaining over several articles that AT&T will see CapEx peak and reduce. This CapEx reduction will directly influence shareholder returns through higher FCF (Free Cash Flow), improved dividend coverage, debt paydown, and eventual dividend raises. The company’s Q3 performance was a trailer for what investors will see in the upcoming quarters.

Author’s Calculations

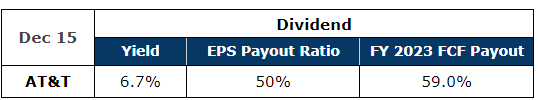

The market was in disbelief that AT&T would hit its $16 billion FCF guidance for FY 2023, but the company did better by raising that guidance to $16.5 billion. Overall, this improves dividend safety by keeping the payout ratio at modest levels by adj. EPS and by FCF metrics.

Author’s Calculations

AT&T ended Q3 with over $9 billion of cash equivalents and interest-bearing deposits on hand. More than 95% of the company’s long-term debt is fixed at an average rate of 4.2% and a weighted average maturity of 16 years. The company reduced its debt by $3 billion during the quarter and remains on track to achieve the net debt-to-adjusted EBITDA target of 2.5x range by 1H 2025. Reducing interest expense is a net positive for shareholders as it improves dividend safety and improves the prospects of a raise.

With an EV to EBITDA of 6.6x and a forward Price-to-Earnings ratio of 6.7x, AT&T is relatively undervalued and still presents an attractive 6.7% qualified yield to lock in while it lasts. The company will continue to churn growing FCF in the coming quarters, and the stock is well-positioned to see price appreciation.

Pick #2: MO – Yield 9.3%

Smoking was huge in the 80s, and Hollywood was one of the leading platforms for Tobacco companies to drive sales by getting as much screen time as possible for their brands. And who can forget the iconic Marlboro Man all over billboards and advertisements in some of the most popular locations in the country?

Today, combustible smoking has a very negative social perception and is on a steady decline in the United States. Yet, a different product from the same companies exhibits tremendous popularity among today’s youth, occupying the same billboards, advertisements, and social media platforms.

Altria Group, Inc. (NYSE:MO) is a leading American corporation that manufactures popular brands – Marlboro, Copenhagen, Skoal, and Black & Mild. In recent years, MO has been investing heavily in non-combustibles, with the core brands like On!, SWIC, Ploom, and NJOY.

Despite combustibles being on a steady decline in recent decades, companies like MO have used combustibles as their cash cow to fuel investments into growth segments. And they have done so while growing their dividends and repurchasing their discounted shares. In the past five years, MO has paid over $30 billion in dividends and purchased shares worth $6 billion. MO recently made a 4.3% raise to its quarterly dividend, and its annualized dividend rate of $3.92/share represents a 9.3% yield. MO’s recent dividend raise marks the 54th year of annual payment increases, a feat very few companies can boast.

Along with growing dividends, MO has been repurchasing its cheaply-valued shares. The company repurchased $260 million worth of shares during Q3, bringing their YTD 2023 total repurchases to $732 million. MO has another $268 million available in its share repurchase program and intends to utilize it by December 31.

Altria’s $2.75 billion all-cash acquisition of NJOY in July is already bearing results after a full quarter of ownership. NJOY ACE is the only pod-based e-vapor product with FDA approval for marketing, and MO grew its distribution to ~42,000 stores, including all the top 25 convenience store chains by e-vapor sales volumes.

For FY 2023, MO has narrowed its adjusted diluted EPS guidance to be between $4.91 – $4.98 (a 1.5% – 3% YoY growth), providing 126% coverage to the dividend.

MO maintains a modest debt profile, with a debt-to-EBITDA of 2.1x at the end of Q2. The company’s balance sheet carries investment-grade ‘BBB’ ratings, with adequate liquidity to propel its “Moving Beyond Smoking” strategy. MO’s enterprise goals for 2028 outline an OCI (Operating Companies Income) margin of 60% or higher in the next five years. This would continue to produce the cash flows needed for expansion and market penetration in non-combustibles.

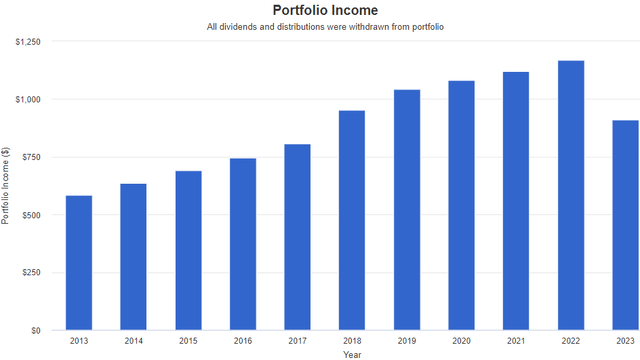

A $10,000 investment in MO in 2013 would currently be worth $13,372 and would have produced $9,735 in dividends! This is the power of income: when you buy high-yield dividend growers, you secure a high current income, and it snowballs rapidly. Source

Portfolio Visualizer

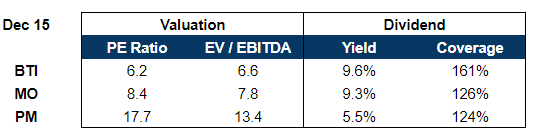

MO trades at a dirt-cheap valuation compared to peers, making it an excellent bargain for long-term income investors.

Author’s Calculations

Big Tobacco, akin to a resilient cockroach, not only endures the challenges of social stigma, regulatory fines, penalties, and headaches but remarkably thrives, consistently returning with highly sought-after products.

Conclusion

We’ve established clear principles to guide our decision-making in portfolio management, ensuring a consistent, repeatable, and scalable approach to meeting our income needs. Inspired by successful and principled investors like Mr. Ray Dalio, our Income Method is put into action through our well-diversified model portfolio, which comprises +45 securities from dividend-focused industry sectors, targeting an overall yield of +9%.

Mr. Dalio’s successful hedge fund is loading up on AT&T and Altria while they are massively discounted. Both firms are generating billions in free cash flows, capable of funding their dividend, managing debt, and making opportunistic investments toward growth.

Our Investing Group doesn’t let price trends and sentiments dissuade our pursuit of sound businesses with predictable cash flows. Our principles are helping us grow our passive income in this market. Have you defined yours yet?

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, PendragonY, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities.

Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Model Portfolio and our current Top Picks, join us at High Dividend Opportunities for a 2-week free trial.

We are the largest income investor and retiree community on Seeking Alpha with +6000 members actively working together to make amazing retirements happen. With over 45 picks and a +9% overall yield, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale for 28% off your first year. Get started!

Start Your 2-Week Free Trial Today!