Summary:

- BioNTech’s Q4 earnings shows a significant revenue drop and profitability concerns, with expectations of continued vaccine demand decline.

- Despite short-term challenges, BioNTech’s mRNA technology and pipeline, including COVID/flu vaccines and oncology, highlight long-term potential.

- Financials suggest a strong balance sheet, but projected R&D expenses indicate potential future cash burns.

- Investment recommendation: Buy BNTX stock, based on technology potential and cash reserves, despite current market skepticism and operational risks.

Eoneren

BioNTech: Financial Health And Market Sentiment Amidst Transition

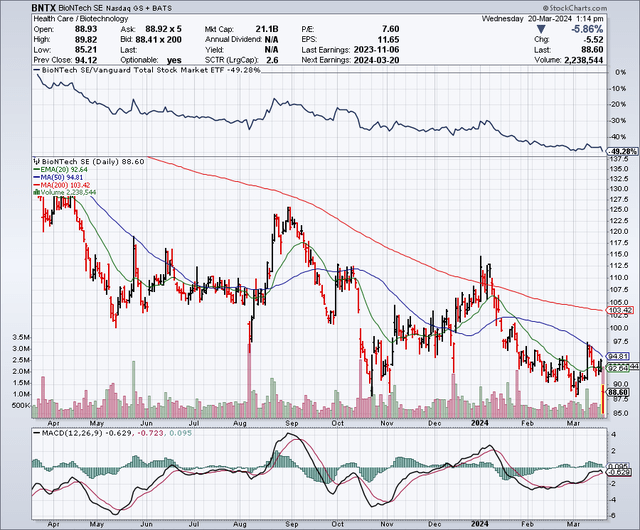

Since my December update on the company’s potential in oncology, BioNTech (NASDAQ:BNTX) is down another 17%. Due to COVID comparisons, revenue and profit had been on the decline at that time, but I reiterated BioNTech’s long-term growth potential. This Wednesday, its stock is trading lower after reporting Q4 earnings, even touching 52-week lows in intraday trading. The article below takes a look at any important changes.

Based on a currency rate of 1 Euro = 1.09 USD, total revenues for the quarter ending December 31 were $1,612.11 million, compared to $4,663.35 million for the prior year period. This was due to the continued drop in demand for BioNTech/Pfizer’s (PFE) COVID vaccine, Comirnaty. Moreover, BioNTech recorded $317 million of inventory write-downs in Q4. This is likely due to an overproduction of vaccines relative to demand (shelf life limitations) and is expected to persist in 2024. BioNTech remained profitable in Q4 with $499.11 million in net profit. Earnings per share [EPS] fell considerably short of the $2.64 that was expected: $2.04. For 2024, BioNTech projects between $2.725 billion and $3.379 billion in revenue. The Steet’s estimate, according to Seeking Alpha, was $3.3 billion. So, the company’s estimate is on the lower side of the market’s. BioNTech’s total maximum planned expenses (R&D, SG&A, and Capex) total $4.25 billion, so it appears the days of profitability are, at best, temporarily over. As of writing, BioNTech’s shares are off 6.61% after this update.

In my view, there’s nothing particularly surprising about the update. BioNTech continues to suffer from a “COVID hangover” that has impacted many companies, including their partner, Pfizer. I continue to believe that investors should remain focused on the long-term potential of BioNTech’s technology. Their ability to develop, partner with, and scale an innovative vaccine during a pandemic is not something to scoff at. Comirnaty is a testament to the potential of mRNA-based therapeutics, of which BioNTech is a leader in the field.

Regarding their pipeline, BioNTech continues to advance its influenza/COVID vaccine, which is currently in a Phase 3 clinical trial. There are just a few other players in this field, like Moderna (MRNA) and Novavax (NVAX). Considering COVID will likely be a seasonal nuisance, like influenza, these combination vaccines could become a standard practice in medicine. Per Fortune Business Insights, the global influenza market is expected to grow to over $17 billion by 2032.

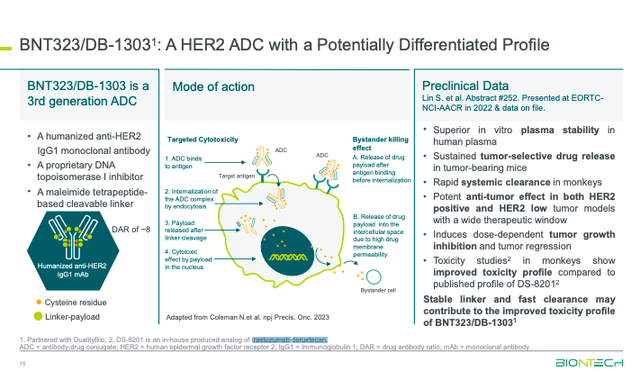

BioNTech also highlighted some developments within their oncology pipeline. BNT323/DB-1303, an ADC targeting HER2, is recruiting in a Phase 3 clinical trial for the treatment of breast cancer. The HER2 ADC is also being developed for endometrial cancer.

BioNTech is after Daiichi’s and AstraZeneca’s (AZN) HER2-directed therapy, Enhertu (trastuzumab deruxtecan), a blockbuster therapy. BNT323/DB-1303 is looking to improve upon Enhertu’s toxicity profile, which includes a boxed warning for interstitial lung disease [ILD] that can be potentially fatal. BioNTech’s combination, granted Breakthrough Therapy Designation in endometrial cancer, did not have any cases of ILD or TEAEs leading to treatment discontinuation in a Phase 1 clinical trial studying 32 patients.

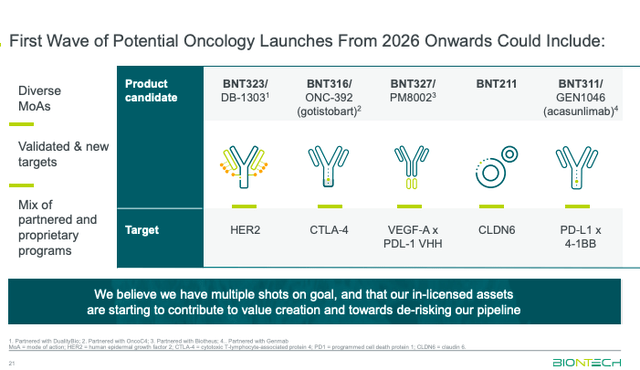

Beyond their HER2 therapy, BioNTech has several other candidates vying for market share.

BioNTech was recently in the news after announcing a $200 million investment to co-develop and commercialize CAR-T with Autolus Therapeutics (AUTL). The deal leverages Autolus’ manufacturing facilities to enhance BioNTech’s development of BNT211 targeting CLDN6 tumors. The company will also help support the planned launch of Autolus’ lead candidate, obe-cel, and be eligible to receive a small royalty on net sales. Obe-cel is anticipated by some analysts to procure up to $300 million in peak sales for acute lymphoblastic leukemia and potentially become a blockbuster therapy, assuming approval in other indications as well. Autolus submitted a BLA to the FDA last November and anticipates approval later this year.

This partnership makes sense for BioNTech as it expands their own development of cell therapies and exposes them to some upside from obe-cel, which I believe could reasonably exceed BioNTech’s initial investment in royalties within a few years.

Financial Health

Looking at BioNTech’s balance sheet, cash and cash equivalents total $12.71 billion. Total current assets are $21.28 billion. The other side of the balance sheet reveals just $3.01 billion in total liabilities. BioNTech has accumulated $21.54 billion in retained earnings.

Although the company was profitable in the last year, this is not expected to continue in 2024. Judging from the amount of current assets and the expected expenses reported by the company, it’s safe to say they’ll have plenty of funds to cover any losses for at least the next two or three years. The company’s balance sheet is healthy and supports continued investments in R&D.

BioNTech Stock – Market Sentiment

According to Seeking Alpha data, BioNTech’s market capitalization is near $21 billion. Earnings estimates have sales falling 26% in 2024 before finally stabilizing, year over year, in 2025. BioNTech’s stock has underperformed the broader market (SP500) as it is off 27% in the last year compared to the SP500 being up 32%.

Per Fintel, BioNTech’s short interest makes up 3.38% of its float, which is modest. Per Nasdaq, there is no data available on insider trading within the past year. Institutional ownership is at 16.81%. New positions (4.5 million shares) have outnumbered sold out positions (1.3 million) in recent months, signaling confidence among institutions. Key holders include Baillie Gifford & Co., Blackrock, and Primecap Management.

Overall, I’d qualify BioNTech’s market sentiment as leaning negative.

BNTX Stock – My Analysis and Recommendation

The market remains cautious of BioNTech as the difficult earnings comparisons progress. This is likely to evolve into 2025, when the picture will become a bit clearer. Judging by the market capitalization in light of its balance sheet, the market is notably pessimistic about BioNTech’s oncology prospects.

Remember, investing in BioNTech means investing in the net present value of future cash flows rather than current revenue. Their COVID/flu combination vaccine may boost their vaccine revenues once more in the future, but BioNTech is very much a speculative, clinical-stage company right now with COVID revenue, although considerably lower, offsetting some costs. Subsequently, the market, in its grand efficiency, has repriced the company accordingly.

However, I continue to like their technology and think this is worth holding onto as they advance their clinical assets. They have multiple shots on goal and a boatload of cash to reach them. Despite the stock’s weakness, BioNTech remains a Buy based on its long-term potential in oncology and infectious diseases, but beware of the risks here. Multiple shots on goal do not automatically translate to market success. Clinical trials may fail or the data may not be convincing enough to change treatment recommendations in their favor (e.g., endometrial and/or breast cancer). Moreover, cash levels remain robust for now, but BioNTech’s R&D expenses are significant and they figure to start burning cash this year. If their investments in R&D do not pay off within two or three years, they may find themselves looking for capital under unfavorable conditions (a lower market capitalization).

As always, investors are encouraged to maintain a diversified portfolio to decrease exposure to the idiosyncratic risks associated with BioNTech and the biotechnology sector.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.