Summary:

- BioNTech and Pfizer’s COVID-19 vaccine, COMIRNATY, generated $36.8 billion in sales in 2021, making it the highest-selling pharmaceutical product in a single year.

- BioNTech’s stock has faced challenges due to competition and declining COVID-19 demand, leading to the stock dropping 29% this year.

- However, it has a promising pipeline of therapies in ongoing trials and the potential for recurring revenue from annual COVID-19 booster shots.

U. J. Alexander

BioNTech (NASDAQ:BNTX) was already starting to gain some recognition for its pioneering work in mRNA technology when it signed an agreement with Pfizer (PFE) to develop a mRNA-based vaccine to prevent the flu in 2018. However, few knew at the time that the relationship would pave the way for another collaboration that would go on to produce the highest-selling pharmaceutical product in a single year, with $36.8 billion in 2021 sales, the COVID-19 vaccine.

Pfizer describes how it and BioNTech collaborated to develop among the world’s most effective vaccine against COVID-19 in an interesting article that it posted on its website titled “Shot of a Lifetime: How Pfizer and BioNTech Developed and Manufactured a COVID-19 Vaccine in Record Time.” The vaccine, known by its scientific name BNT162b2, became the first to receive conditional approval, called an Emergency Use Authorization (“EUA”), in the U.S. on December 11, 2020. It also became the first COVID-19 vaccine fully approved by the Food and Drug Administration (“FDA”) on August 23, 2021. Pfizer and BioNTech renamed that vaccine COMIRNATY after the FDA approved it for marketing purposes.

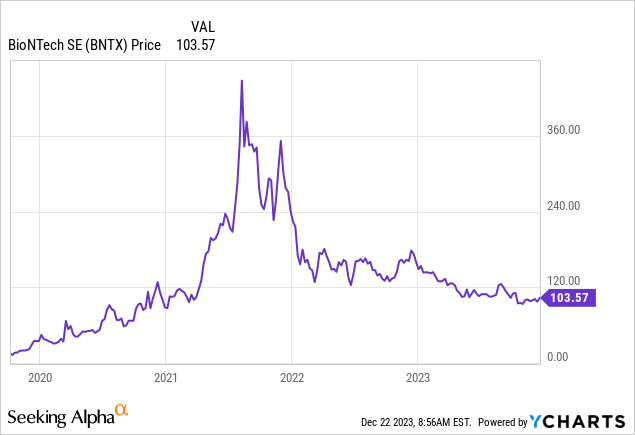

Since BioNTech only generates revenue from COMIRNATY, investors have always worried about sales dropping once the pandemic ends. The stock has fallen since hitting its all-time high of 441.35 on August 09, 2021, to December 21, 2023’s closing price of $103.57.

Some of the reasons the stock dropped might be because investors anticipated decreasing demand for the COVID-19 vaccine as emergency measures eventually wind down, competition increasing, and some people decide not to get booster shots. Moderna, Pfizer, and BioNTech have recently lowered COVID-19 sales forecasts as the government-backed market for COVID-19 vaccines shrunk. Increasingly, COVID-19 vaccine manufacturers will need to rely on the commercial market for sales as global organizations like COVAX, an international collaborative effort to provide access to COVID-19 vaccines, ceases operations at the end of 2023. The U.S. government ended emergency measures on May 11, 2023, and the World Health Organization and Europe are also planning for the post-pandemic period. It may take until 2025 for the market for the COVID-19 vaccine to reset to a commercially-driven market.

However, there are reasons for long-term investors to buy this stock at current prices. BioNTech has a promising pipeline of therapies focused on oncology and infectious diseases in ongoing phase 2 and 3 trials. These therapies hold considerable potential for diversification and long-term revenue growth. Additionally, the company has a strong balance sheet that it can use to bring some of these drugs to market.

This article will discuss how COVID-19 still benefits the company, its oncology therapy pipeline, its financial condition, and why aggressive growth investors should consider adding the stock to their portfolio. I rate the stock a buy.

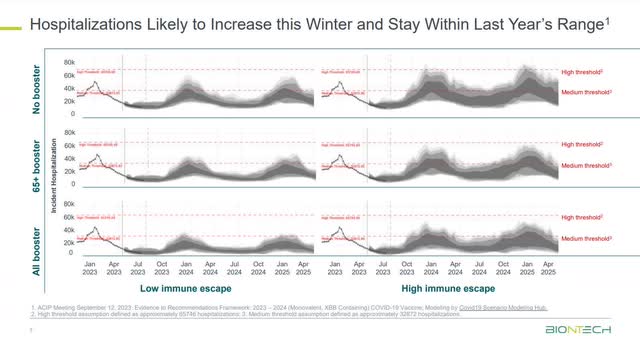

Why its COVID-19 franchise is still valuable

Despite some people’s perception that COVID-19 is not a threat because the World Health Organization (‘WHO”) and the U.S. Department of Health and Human Services declared an end to the Public Health Emergency in May, COVID-19 has not gone away as a public health menace. Only a week ago, ABC News reported that COVID-19 hospitalizations have increased in the U.S., with the highest rates among the oldest and youngest in the population. The Economic Times from India reports new infections from an Omicron sub-variant called JN.1 are spiking worldwide. Singapore, India, the U.K., and Germany are among the countries reporting rising cases. According to data shown by BioNTech in its third quarter 2023 earnings presentation, hospitalization will increase in the winter months and remain in last year’s range.

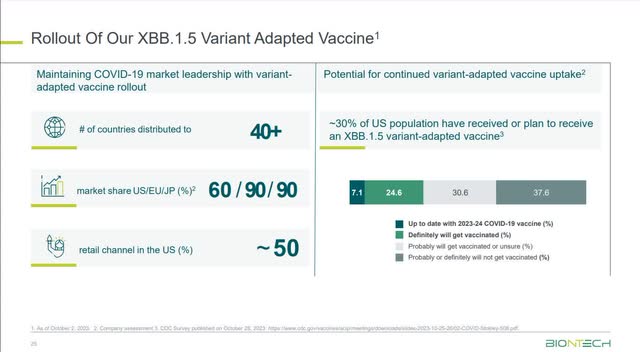

WHO still recommends that most people get vaccinated against COVID-19, and BioNTech and its partner Pfizer remain on the leading edge of creating vaccines designed to combat the latest variants. The partnership was first to market with a vaccine targeting the variant nicknamed the Kraken, Omicron sub-variant XBB.1.5, which emerged in late 2022. The EMA (European Medicines Agency) gave the Omicron XBB.1.5-adapted vaccine full marketing authorization in August 2023, quickly followed in September by the U.S. FDA awarding it an EUA for ages six months to 11 years in September 2023 and full approval for age 12. Regulators in the U.K., Japan, Canada, and South Korea quickly followed with approvals. Management indicated it has done well in Europe and Japan, capturing significant market share.

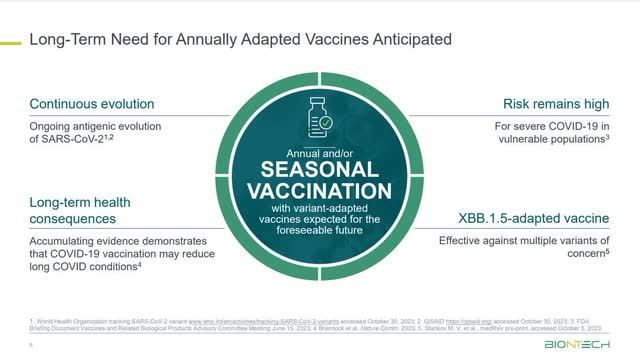

The U.S. FDA and Center for Disease Control (“CDC”) are still discussing whether an annual booster shot for COVID-19 is necessary. However, that hasn’t prevented vaccine companies from anticipating that a yearly booster shot, like the flu shot, will be essential to protect senior citizens and children against new variants.

BioNTech Chief Executive Officer (“CEO”) Ugur Sahin said on BioNTech’s third-quarter 2023 earnings call, “Given…our current understanding of COVID-19 seasonality and its burden on healthcare systems during autumn and winter season, we anticipate the need for annual adaptive vaccines to be a long-term feature of COVID-19 vaccination practices.” However, the ultimate authority on deciding whether annual vaccines are required rests with regulators worldwide, and they may disagree with assessments made by the vaccine makers.

If regulators in large markets like the U.S. or Europe eventually recommend annual vaccines, it could create a considerable recurring revenue stream for BioNTech and establish a solid baseline business. Its mRNA competitor Moderna (MRNA) stated in a press release recently where it sees this COVID-19 market eventually going:

The global influenza market volume is approximately 500-600 million doses annually with approximately 150 million doses administered in the United States. Moderna estimates the U.S. fall 2023 COVID-19 market size as likely to be 50 to 100 million doses, depending on vaccination rates. Over time, the Company anticipates the COVID-19 market will approach the influenza market in the U.S. given the burden of disease.

Source: Moderna

If Moderna is correct, the annual COVID-19 market size that Pfizer-BioNTech will eventually be competing over should be approximately 150 million doses in the U.S. and 500-600 million globally, a market worth billions of dollars of sales annually. BioNTech management gave a baseline projection for how much of the U.S. market it expects to capture. BioNTech Chief Strategy Officer Ryan Richardson said:

A recent national immunization survey in the U.S. by the CDC published last month, more than 30% of adults reported to have received or plan to receive an XBB.1.5 variant-adapted vaccine. We believe this data reflects the potential baseline demand for an annual vaccination.

Source: BioNTech Third Quarter 2023 Earnings Call.

Richardson was referring to the following chart when he made the above statement.

BioNTech Third Quarter 2023 Earnings Presentation

Since the U.S. adult population is 258.3 million as of the 2020 Census, 30% of that number is around 76 million. Using both companies’ estimations, the market for COVID-19 vaccines could settle in between 76 to 150 million doses. Kff.org stated in an article that Pfizer charges a commercial price of $115 for its COMIRNATY vaccine. Multiplying 76 and 150 million by $115 equals $8.76 to $17.25 billion. Morningstar estimates that Pfizer-BioNTech has a 55%-60% market share in the U.S. market. Assuming it can maintain that market share at the mid-point of 57.5% market share, the partnership could potentially split $5 billion to $9.9 billion in U.S. revenue annually once the COVID-19 market stabilizes. Of course, BioNTech only receives a 50% share of Pfizer’s gross profit as part of its agreement to share costs with Pfizer, so it can potentially receive between $2.5 to $5 billion in U.S. revenue every year. These estimates don’t include revenue from Europe and Japan.

However, take these estimates with a huge grain of salt, as many factors can throw these numbers off, especially competition. The COVID-19 vaccine market is quite competitive, and fresh players like Novavax (NVAX) have entered the market over the last several years, which could make it difficult for Pfizer-BioNTech to maintain market share.

In the near term, expect COVID-19 vaccine sales to drop in 2024. After BioNTech reported third quarter 2023 earnings on November 6, management projected full-year COMIRNATY revenue of approximately EUR4 billion ($4.4 billion), down from the EUR5 billion ($5.5 billion) it forecasted in March 2023. Wall Street estimates the company will report approximately EUR4.75 billion ($5.20 billion) in COVID-19 vaccine revenue in 2023. On December 13, Pfizer forecast that COMIRNATY and the Paxlovid treatment for COVID-19 would generate $8 billion in sales next year versus the approximately $12.5 billion it estimates for those products in 2023. Moderna also predicted slowing COVID-19 vaccine growth in 2024 but expects its COVID-19 franchise to return to growth in 2025.

Lastly, another valuable aspect of its COVID-19 vaccine that you should consider is that Pfizer-BioNTech has big plans to create combo vaccines, extending its core COVID-19 franchise into other markets like the flu. The partnership has already reported positive results in a Phase 1/2 study on October 26, 2023, for a COVID-19 and flu vaccine. The press release states:

“We are encouraged by these early results in our Phase 1/2 study of our combination vaccine candidates against influenza and COVID-19. This vaccine has the potential to lessen the impact of two respiratory diseases with a single injection and may simplify immunization practices for providers, patients, and healthcare systems all over the world,” said Annaliesa Anderson, Ph.D., FAAM, Senior Vice President and Head, Vaccine Research and Development at Pfizer. “mRNA-based vaccines have demonstrated their ability to induce robust antibody and T-cell responses, and we look forward to starting Phase 3 clinical development. Today’s results are an important achievement towards our ambition of providing a broad portfolio of respiratory combination vaccines.”

Source: Pfizer

BioNTech’s COVID-19 franchise could serve as a launching point for a broad pipeline of therapies.

It has the financial resources to build its drug pipeline

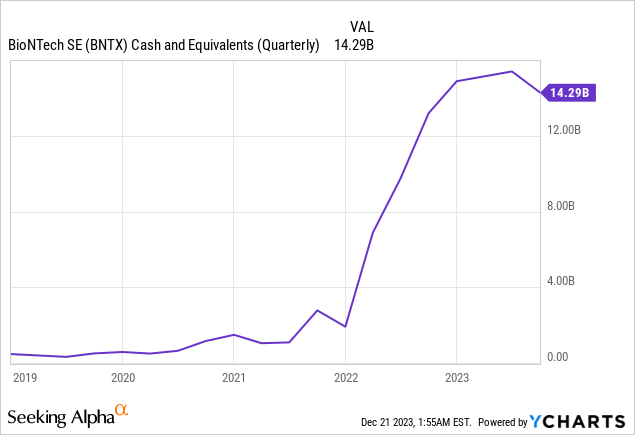

The following chart shows how much COMIRNATY’s success helped it build a massive cash stockpile. BioNTech started 2023 with EUR13.9 billion ($15.22 billion) of cash and cash equivalents on its balance sheet and ended the third quarter of 2023 with EUR13.5 billion ($14.78 billion at current exchange rates). The number on the chart is slightly different because my exchange rate calculation may differ slightly from when YCharts calculated the exchange rate. It also has an additional EUR2.2 billion ($2.41 billion) in short-term investments.

The company’s Chief Financial Officer (“CFO”) Jens Holstein said on the third quarter 2023 earnings call:

Our strong financial position is strategic advantage. These days where financial stability is key for companies in this industry, the cash surplus is a tremendous asset. Our cash position offers us opportunities to invest in capabilities and assets to build a highly innovative later stage R&D pipeline.

Source: BioNTech Third Quarter 2023 Earnings Call.

The following chart shows BioNTech’s Free Cash Flow (“FCF”) on a trailing 12-month basis from 2020 to the end of the third quarter of 2023. These numbers might be slightly different depending on which exchange rates people use. I sourced the following numbers from Macrotrends.

| End of Quarter Date | FCF ($ billions) |

| 2023-09-30 | $4.739 |

| 2023-06-30 | $3.922 |

| 2023-03-31 | -$0.775 |

| 2022-12-31 | $13.958 |

| 2022-09-30 | $12.646 |

| 2022-06-30 | $8.358 |

| 2022-03-31 | 4,495.65 |

| 2021-12-31 | 905.78 |

| 2021-09-30 | 1,182.15 |

| 2021-06-30 | -551.84 |

| 2021-03-31 | -400.38 |

| 2020-12-31 | -89.40 |

| 2020-09-30 | -354.67 |

| 2020-06-30 | -100.86 |

| 2020-03-31 | -67.27 |

Source: Macrotrends

This company has a solid financial base to support building out an innovative drug platform. BioNTech is currently developing therapies for various disease categories, with a strong focus on cancer and infectious diseases like HIV and Tuberculosis. This article will discuss the Oncology pipeline. I will discuss the company’s battle against infectious diseases and potential new categories like Cardiovascular diseases, Neurodegenerative diseases, and Autoimmune diseases in a future article.

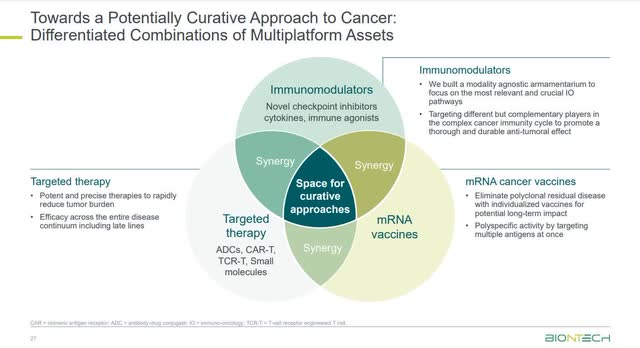

The Oncology therapy pipeline

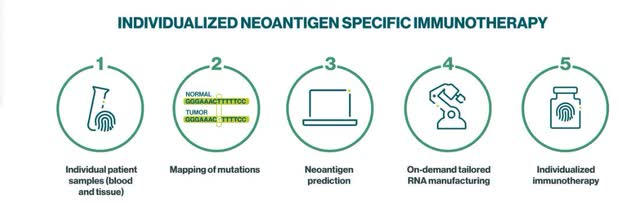

The company is taking a multi-pronged approach to cancer. Although its mRNA platform has gained attention outside the medical community because of its success with the COVID-19 vaccine, the company was already well-established as an innovator in using mRNA to fight cancer. In addition, BioNTech has several other platforms it’s developing outside of mRNA to fight cancer, including Cell and Gene Therapies, Small Molecules, and Protein-based therapies. The following image shows its approach to treating cancer.

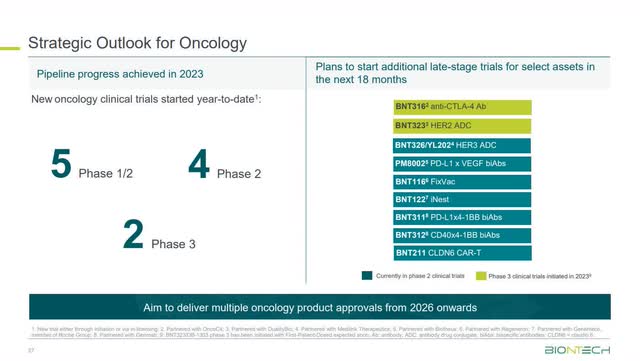

When it comes to Oncology, the company has already shown enough early progress to start attracting attention. BioNTech signed a Memorandum of Understanding with the U.K. in January 2023 to accelerate clinical trials for its personalized mRNA immunotherapies. The company aims to treat up to 10,000 patients with personalized cancer therapy by the end of 2030 through clinical trials or approved treatments.

The image below shows a few therapies in its current oncology pipeline, with BNT316 anti-CTLA-4 Ab and BNT323 HER2 ADC in phase 3 testing and the nearest to commercialization.

In March 2023, BioNTech partnered with OncoC4, a clinical-stage biopharmaceutical company, to develop and commercialize BNT316/ONC-392 to fight multiple advanced solid tumors. By June 2023, the two companies had announced that they had started treating their first patient in a phase three trial for non-small cell lung cancer. This program had already received a Fast Track Designation from the U.S. FDA in 2022, which means that it has already shown preliminary clinical evidence that the drug could produce a substantial improvement over current therapies.

It partnered with DualityBio in April 2023 to develop a therapy against various cancers. The first product from this collaboration to reach phase 3 trials is the BNT323 HER2 ADC, a therapy designed to fight advanced endometrial or uterine cancer in plain English. The company received big news from the FDA on December 21, 2023, that BNT323 HER2 ADC has achieved breakthrough therapy designation. A breakthrough therapy designation speeds up the development and FDA review process — a great sign. BioNTech investors should monitor the progress of these two drugs, as they are the most likely to be the first to reach the finish line and get commercialized.

Another area for investors to watch is BioNTech’s progress in developing its two platforms, FixVax and iNest.

When BioNTech started a Phase 1 clinical trial in melanoma in 2012, using the precursor technology to what is today known as the FixVac platform, it may have been among the first companies ever to administer an mRNA-based cancer therapy. FixVac, short for Fixed Vaccine, offers an off-the-shelf vaccine designed to fight solid tumors, including melanoma, prostate cancer, HPV16+, head and neck cancer, ovarian cancer, and non-small cell lung cancer. The advantage of using FixVax for patients is that it costs less and is a faster treatment option than personalized vaccines. You can find a more technical explanation of FixVac on the company’s website. If you look at the above chart, you will see that BNT116 is a FixVac vaccine. BioNTech has partnered with Regeneron (REGN) to develop BNT116 against non-small cell lung cancer.

The Individualized Neoantigen Specific Immunotherapy (iNeST) platform is BioNTech’s development effort for personalized mRNA cancer vaccines. Management claims on its website that “We have developed a first-in-kind, on-demand manufacturing process for mRNA vaccines designed to target mutations that are unique to the patient’s specific cancer, so-called tumor neoantigens.” Nature.com defines neoantigens as “foreign proteins that are absent in normal tissues, but can arise from tumors through various mechanisms, such as genomic mutation, aberrant transcriptomic variants, post-translational modifications (PTMs), and viral ORFs.” The iNeST platform works best against solid tumors, including Melanoma and Colorectal cancer.

BioNTech started collaborating with Genentech, part of the Roche Group (OTCQX:RHHBY), as far back as 2016 to develop iNeST. One cancer therapy that comes from the BioNTech-Genentech partnership is BNT122, which is in phase 2 trials for resected (a solid tumor removed through surgery) pancreatic ductal adenocarcinoma (PDAC). According to the company, the fatality rate for this type of cancer is bleak, with a survival rate of only 8-10% within five years after surgery and chemotherapy. The partnership also has BNT122 in phase 2 trials for surgically resected colorectal cancer, a phase 2 proof-of-concept study of BNT122 combined with pembrolizumab in the first-line treatment of advanced melanoma, and a Phase 1a/b trial in locally advanced or metastatic tumors.

BioNTech has 20 oncology programs in 30 clinical trials as of November 2023. It plans to launch multiple oncology products from 2026 onwards.

Innovation in manufacturing

The technology behind building innovative drugs goes nowhere without manufacturing competence. Pfizer provided BioNTech the scale needed to manufacture enough doses to satisfy global demand for COMIRNATY. Still, for BioNTech to develop drugs independently, it must build its own infrastructure. Its first step was to purchase a manufacturing facility from Novartis in Marburg, Germany, in 2020. Since then, the company created new plant capabilities and now has an annual capacity of 1.6 billion mRNA doses, one of the largest mRNA manufacturing facilities in the world. CEO Sahin said the following about Marburg in a news release in February of 2023:

“Since we acquired our manufacturing site in Marburg in the fall of 2020, we have continuously invested in the site to expand our manufacturing capacities and capabilities. Plasmid manufacturing is an exciting and important part of mRNA manufacturing that we expect to be able to cover in-house soon,” said Prof. Ugur Sahin, M.D., Chief Executive Officer and Co-Founder of BioNTech. “We plan to manufacture mRNA-based products for a broad range of clinical trial candidates at our Marburg site while we are preparing production measures for the commercial manufacturing of personalized oncology therapeutics.” The new manufacturing facility comprises two plants covering both clinical (“small scale”) and commercial (“large scale”) plasmid DNA manufacturing. The clinical-scale plant has been operational since August 2022. In this plant, BioNTech is currently manufacturing plasmids for the Company’s FixVac platform product candidates, such as BNT111.

Source: BioNTech

During the 2023 Innovation Day, a BioNTech representative said that its mRNA manufacturing platform allowed the company to be a “digitized manufacturer of vaccines.” This article by Pfizer describes digitized vaccine manufacturing and how it ramped up the production of COMIRNATY so rapidly.

Lastly, BioNTech wants to democratize mRNA technology through mobile mRNA manufacturing units named the BioNTainer. According to a press release, the company shipped six BioNTainers to Rwanda in 2022. The press release states:

BioNTech continues to develop and build its state-of-the-art manufacturing facility in Kigali, Rwanda, following the groundbreaking in June 2022. The facility will be housing the first BioNTainers and is expected to become a node in a decentralized and robust end-to-end manufacturing network in Africa. BioNTech also expects to ship BioNTainers to Senegal and potentially South Africa in close coordination with each respective country and the African Union. Vaccines to be manufactured in this Africa-wide network will be dedicated to people residing in member states of the African Union, with the aim to support access to novel medicines.

Source: BioNTech

The BioNTainers help avoid spending hundreds of millions of dollars and three to four years to build one massive facility. BioNTainers are the size of a standard container, allowing the company to set up the portable manufacturing unit wherever needed.

Risks

Although the company has worked on developing mRNA-based oncology products for over a decade, it has yet to receive approval from regulators for any of its therapies outside of COVID-19. Investing in BioNTech requires faith in management, and that the company has the tools to get multiple drugs approved in its pipeline.

BioNTech also has very stiff competition in building a pipeline of mRNA-based products from multiple companies, including its COVID-19 partner Pfizer, which is building out its own mRNA platform with products that could compete against BioNTech’s products. Additionally, some competitors have taken things from competing in the lab to competing in the court over intellectual property rights. Moderna has sued BioNTech in European and U.S. courts over patents and has asked for damages. BioNTech recently won one European case against Moderna and won a lawsuit against it from CureVac (CVAC). There are billions of dollars involved. So, expect lawsuits to continue over mRNA patents, which may muddy the waters. Investing in BioNTech involves accepting the risks associated with a company with a pipeline still mainly in the development phase.

Should you buy it?

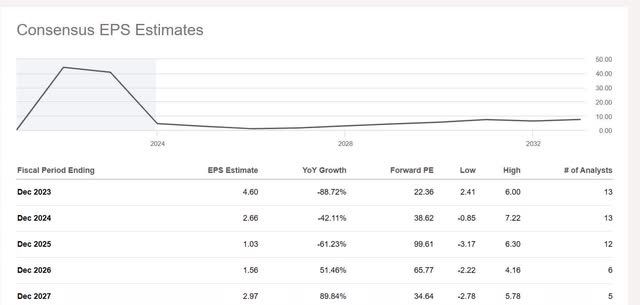

The company has a price-to-earnings (P/E) ratio of 8.98 as of December 20, 2023. The average P/E ratio for the S&P 500 is 26.16, and the average P/E ratio for the biotechnology and pharmaceutical industry is 19.33. BioNTech looks woefully underpriced until you see that earnings-per-share (“EPS”) estimates are declining annually to 2025.

Investing in BioNTech requires a long-term mindset, as an investor may not see the fruits of their investments for several years. Still, I believe the market undervalues the stock relative to the biotechnology and pharmaceutical industry, considering the company’s growth prospects look above average several years from now as it potentially starts getting therapies approved in its pipeline. I didn’t discuss its infectious diseases pipeline in this article, but I did discuss its oncology products. If everything goes well and it gets several of the products in its oncology pipeline approved in 2026, EPS growth should be solid in 2026, which is what the above EPS estimates on the image suggest, with 51.46% year-over-year growth. The stock deserves to trade at least in the range of a P/E of between 15 and 16, which translates to a stock price of between $173 and $184.

If you are an aggressive growth investor willing to speculate that the company has what it takes to get multiple therapies approved in its pipeline, buy a few shares as a stocking stuffer for your portfolio. I rate the stock a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MRNA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.