Summary:

- BioNTech is expected to report a significant decline in sales for the first quarter, mainly due to the decline in COVID vaccine revenues.

- The company’s earnings per share is also expected to be worse compared to the previous year.

- Investors should pay attention to the company’s operating expenses and progress in its drug development pipeline.

U. J. Alexander

Article Thesis

BioNTech SE (NASDAQ:BNTX) will report its quarterly earnings results on May 6. In this article, I will take a look at what investors can expect from the upcoming earnings release while also taking a look at BioNTech’s potential over the next couple of years.

Past Coverage

I have covered BioNTech once, in the spring of 2022. In that article, I gave the biotech company a neutral rating, arguing that there was some long-term opportunity but that the stock also was not low-risk at all due to the foreseeable decline in the COVID vaccine business. This has come true, as profits have declined since then, which has resulted in pressure on BioNTech’s share price. In today’s article, we will focus on the upcoming earnings release and the company’s pipeline.

BioNTech’s Upcoming Results

BioNTech will announce its first-quarter earnings results on May 6. The biotech company is forecasted to see its sales come under significant pressure, as Wall Street analysts have a consensus revenue estimate of a little more than $480 million. While that still pencils out to $2 billion on an annualized basis (note that revenues are uneven throughout the year, so the forecast for FY 2024 revenues is higher than $2 billion in total), the $480 million estimate would represent a huge 66% decline compared to the previous year’s quarter.

Of course, a revenue decline is not a surprise at all. After all, BioNTech has only had one major product on the market in its history, its COVID vaccine that was developed and commercialized together with Pfizer Inc. (PFE). The pandemic has waned down and the rate of vaccinations has declined substantially, which is why BioNTech and Pfizer, as well as competitors with COVID vaccines on the market, are seeing their revenues decline.

Over the last ten quarters, BioNTech has beaten revenue estimates seven times, while missing the analyst consensus estimate three times. One could thus argue that the chance of a revenue beat is higher than the chance of a revenue miss, but a revenue beat is far from guaranteed.

Analysts are forecasting that the biotech company’s loss per share will come in at around $1.14, which would be significantly worse compared to the previous year’s period when BioNTech still earned $2.26 per share. Even that was way below the peak profit of a little more than $15 per share that BioNTech generated in early 2022, however.

Biotech companies have high costs for developing new drugs, but proportional costs aren’t very high, as biotech companies generally operate with relatively high gross margins. That holds true for BioNTech as well, as the company’s gross margin stood at 80% to 90% in the recent past. This means that there is considerable operating leverage at work, due to low proportional but high fixed costs. When revenues rise, this can result in explosive profit growth, as we have seen during the peak of the pandemic. But when revenues decline, operating leverage works against the company, which explains the steep forecasted hit to BioNTech’s bottom line for the upcoming earnings report.

BioNTech has beaten earnings per share estimates seven times out of the last ten quarters, so, again, there is a reasonable chance for an earnings beat.

It is pretty clear that results for the first quarter of 2024 will be way worse than the results that BioNTech has generated during the previous year’s first quarter, but that doesn’t mean that BioNTech must be a bad investment. Instead, it has always been clear that the COVID vaccine would be a big source of profits and cash for a while but that this business would wane eventually. So investors should look for other items in the upcoming earnings report on top of the headline numbers that BioNTech will report.

One metric investors should look for is how BioNTech’s operating expenses are developing. Research and development expenses make up a significant portion of a biotech or pharma company’s operating expenses, and that is a good thing — R&D allows for the development of new drugs, which does not only help patients but which can also be a driver of future business growth for the company. Increased R&D efforts would thus not be a reason to worry, I believe. Higher administrative and general expenses, however, would bring up some questions. Ideally, BioNTech would continue to spend significant amounts of money on R&D while keeping other operating expenses in check.

The company has a very strong balance sheet for now, thanks primarily to the massive profits it has amassed during the pandemic. The company ended the fourth quarter with a cash position of $18.3 billion. Capital expenditures are comparatively small, coming in at around $300 million in 2023 — at that rate, BioNTech could thus pay for around 60 years of capital investments with its cash position. Of course, BioNTech also has to invest money that is not recorded in capital expenditures, e.g. its costs for employees in the R&D space. Cash outlays are thus higher than $300 million, but BioNTech’s massive cash hoard should still be enough to pay for the company’s cash needs in the foreseeable future.

Due to the declining share price, BioNTech has decided to return some cash to its owners via share repurchases. Those totaled $800 million in 2023 and $1 billion in 2022 — it will be interesting to see whether the company decided to return cash to its owners via buybacks during the first quarter of 2024 as well. The share price is down around 20% over the last year, thus buybacks would now be more opportune compared to twelve months ago, but management may have decided against additional buybacks if they want to focus on preserving cash, e.g. for potential takeovers.

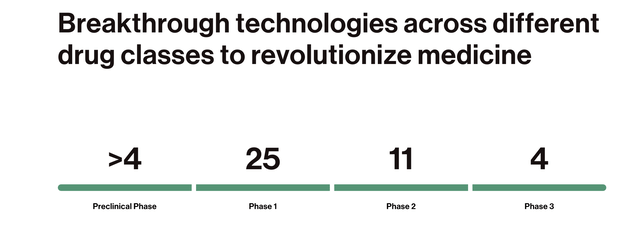

The company’s future share price performance will depend a lot on the company’s success — or lack thereof — when it comes to its drug development pipeline. Today, per BioNTech’s website, the company has a sizeable pipeline:

BioNTech pipeline (BioNTech website)

Not surprisingly, the number of drugs in phase I is the largest, with a high 25 candidates. There are fewer candidates in phase II and phase III, but considering BioNTech is a relatively young company, while also accounting for the fact that not all phase I candidates make it to phase II (and not all phase II candidates make it to phase III), BioNTech’s four phase III candidates are far from bad, I believe.

Two of the pipeline candidates that are closest to commercialization are two of BioNTech’s vaccine candidates, its BNT161 seasonal influenza shot and a combination of said influenza shot and its (already approved) COVID shot BNT162b2. The COVID shot was not fully owned but was commercialized in a partnership with Pfizer, and the same holds true for the phase III influenza vaccine candidate. This makes sense for both parties, I believe — Pfizer benefits from BioNTech’s MRNA expertise, while BioNTech benefits from Pfizer’s marketing and sales channels and experience in rolling out drugs on a global scale.

BioNTech’s oncology agents are potentially a lot more promising than the influenza vaccine, such as BioNTech’s multiple myeloma candidate BNT111 or its non-small cell lung cancer candidate BNT116. These candidates target indications with huge markets — the NSCLC market is forecasted to grow to more than $75 billion by 2031 — but there is more substantial execution risk here, relative to the vaccine. BNT111 is in phase II while BNT116 is only in phase I, versus a phase III status for the influenza vaccine. Also, BioNTech has already brought a preventive vaccine to the market successfully, so the company has more expertise there, relative to its approach when it comes to candidates such as BNT111. BNT111, for example, is a vaccine as well, but one that aims at treating an existing illness versus immunizing against potential harm, so it is not really comparable to BioNTech’s COVID or influenza vaccines.

Investors will be keen to see what management has to say about its progress when it comes to advancing its different pipeline candidates. BioNTech might share important news with investors about some of its pipeline candidates and how its different studies are progressing.

Summing Things Up

BioNTech’s tech is strong and potentially highly rewarding for both the company and the patients it wants to treat. But the COVID vaccine tailwinds are waning, and the Q1 report will likely show a net loss. BioNTech’s future depends a lot on the company’s success with current candidates such as its influenza vaccine and its oncology drugs and vaccines, making BioNTech an investment with upside potential in a bullish scenario, but BioNTech also is far from a low-risk investment, as we don’t know yet whether the company can replicate its COVID vaccine success in other areas.

With a market capitalization of $22 billion and $18 billion of cash on the balance sheet, one could argue that the downside risk is limited. But until we get additional positive news about the company’s pipeline, I will stay on the sidelines.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!