Summary:

- BioNTech’s revenue soared during the COVID era, but the company faces uncertainty with declining vaccine sales and plans for new oncology-focused products.

- The company is shifting focus to oncology programs, aiming for multiple late-stage trials and regulatory submissions, and ten indication approvals by 2030.

- BioNTech’s pipeline includes various oncology drugs targeting different proteins in cancer cells, with potential for 10 indication approvals by 2030.

- In this post I provide a whistle-stop tour of the current pipeline and opportunities relative to where the industry is.

- I am not especially encouraged, but with COVID funds and management’s track record, BioNTech can afford to move at its own pace.

Darwin Brandis/iStock via Getty Images

Investment Overview

BioNTech (NASDAQ:BNTX), the Mainz, Germany based biotech company founded by the husband and wife team Professor Ugur Sahin and Dr. Özlem Türeci, will forever be associated with the COVID pandemic, and the messenger-RNA vaccine against SARS-Cov-2 the company developed alongside the Pharma giant Pfizer (PFE). The vaccine, Comirnaty, was the most widely used vaccine of the COVID era, and netted BioNTech revenues of $21.6bn in 2021, and $18.5bn in 2022. In these two years, the company reported operating income of $16.74bn, and $12.76bn.

BioNTech launched its initial public offering (“IPO”) back in October 2019, raising $150m at $15 per share in October 2019 – at the height of its bull run, the stock traded at over $375 per share, and the company was valued at close to a triple-digit billion sum. Not surprisingly, as revenues from Comirnaty tailed off in 2023, the stock price began to fall, and today it trades under $96, valuing the company at ~$23bn

The company reported revenues of $4.22bn last year, operating income of $1bn, and a cash position of $12.9bn. Although, by COVID era standards, the revenue figures may seem small, at the time of its IPO, BioNTech and its shareholders would likely never have imagined that shares would be up over 500% on a five year basis, and that there would be over $12bn in the bank.

The question is what BioNTech does next. The company was primarily research-based at the time of its IPO, and Comirnaty remains its only commercial product. A new version of its vaccine is being prepared in advance of a fall vaccine season, and is also developing a combination influenza/COVID vaccine. BioNTech is guiding for total revenues of ~$2.7bn-$3.3bn in the full year 2024, however, with R&D expenses forecast to be ~$2.7bn, SG&A expenses ~$800m, and capital expenditures ~$485m, it is likely the company will be loss making in 2024 to the tune of ~$1bn (data taken from company Q1 2024 earnings presentation).

With the demand for COVID vaccinations in a private market highly uncertain, in which shots will cost over $100, as opposed to the ~$25 per shot fee charged to governments during the pandemic, the outlook for revenues from this source is equally uncertain. However, BioNTech has always regarded itself first and foremost as an oncology focused company, and is embarking on a new phase in its development.

BioNTech’s Migration From Early Stage Experiments, to Late Stage Promise In Oncology

Speaking on the earnings call with analysts for Q1 2024, Co-Founder and CEO Ugur Sahin spoke about the shift in emphasis the company is undergoing in terms of its oncology programs, as follows:

In the years following our establishment, we developed various therapeutic platforms to demonstrate the safety and clinical effectiveness of various drug candidates in early clinical trials. The period from now to 2030 is about progressing this candidate into late-stage development and registrational trials to become a multi-product company with the first product to be delivered by our late-stage oncology pipeline.

In 2024, we are aiming to increase the number of potential pivotal trials across our lead programs to 10 or more by year end.

Starting in 2025 and continuing into the following years, we expect to enter a period where pivotal data, if positive, could support regulatory submissions for marketing authorization across our pipeline.

We have begun building a fully integrated oncology organization to support our transition into a global multi-product company. This process will be accelerated this year as we bring our new Chief Commercial Officer on Board. Ultimately, we are building our organization to support multiple oncology launches beginning in 2026.

In short, BioNTech seems confident that its groundwork is done, and its differentiated pipeline projects are ready to be tested in late stage studies, and push for regulatory approval and commercial revenues.

With the cash injection from Comirnaty sales over the past three years, the company has a strong competitive advantage over many of its rivals, who do not have the funding to run as many studies, or submit so many regulatory submissions.

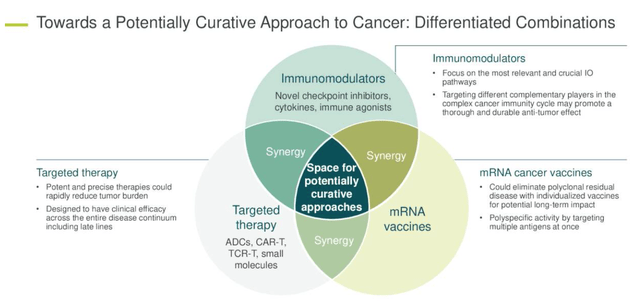

BioNTech has three different categories of oncology focused drugs – immunomodulators, targeted therapies, and individualised and off-the-shelf messenger-RNA vaccines – as we can see below, BioNTech believes there are plenty of synergistic opportunities between the three approaches.

BioNTech’s three pronged approach to cancer treatment (Q1 earnings presentation)

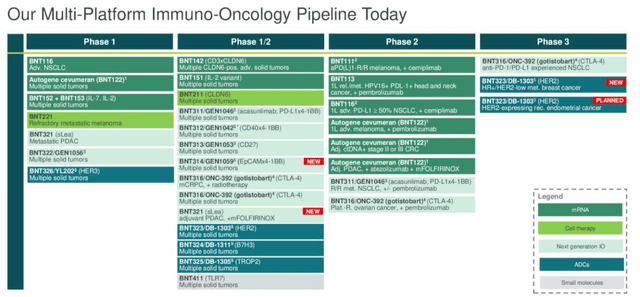

Breaking these down into individual programs/drug candidates, BioNTech has shared the following graphic:

oncology pipeline breakdown (Q1 earnings presentation)

There is clearly a lot to unpack here – I break things down as follows: there are three antibody drug conjugate (“ADC”) candidates, with one, BNT323, targeting HER2, in Phase 3 studies for breast and endometrial cancer. The remaining two, BNT324, targeting B7H3, and BNT325, targeting TROP2, are being tested in multiple solid tumors at the Phase 1/2 study stage.

To explain, HER2, B7H3, and TROP2 are all types of protein found expressed in cancerous cells, that can help drug products target and attack them. HER2 and TROP2 are popular targets, therefore BioNTech will need to show its candidates can have greater efficacy and safety profiles, and perhaps also longer duration than existing drugs with the same targets, such as Swiss Pharma Roche’s (OTCQX:RHHBY) Herceptin, which earned ~$1.5bn of revenues last year, or, in the ADC space, Anglo/Swedish Pharma AstraZeneca (AZN) and Japan based Daiichi Sankyo’s Enhertu – ~$2.6bn revenues in 2023.

In the immuno-oncology space, BNT316, or gotisobart, which targets CTLA-4, is in a Phase 3 study in non-small cell lung cancer, the largest cancer drug market, and, in combo with Merck’s Keytruda, the world’s best selling drug, with over $25bn in revenues recorded last year, in a Phase 2 study in ovarian cancer.

BNT311, which appears to target the PD-1 ligand as Keytruda does, is in a Phase 2 study in NSCLC, while BNT312, targeting CD40, and BNT313, targeting CD27, are in Phase 1/2 studies in solid tumor cancers. BNT321 and BNT322 sit even further back, development wise, in Phase 1 studies.

Finally there are the mRNA therapies, BNT111, BNT113, BNT116 and BNT122, or autogene cevumeran, which target melanoma, head and neck cancer, NSCLC, and for BNT122, studies are ongoing in melanoma, colorectal cancer, and pancreatic cancer. Omitted from the charts above is BNT327, being developed alongside partner Biotheus. This drug is a bispecific antibody that targets VEGF-A, and PD-L1, which has shown an 80% objective response rate in triple-negative breast cancer studies.

BioNTech says it hopes to have 10 indication approvals in oncology by 2030 – not necessarily 10 different drugs, but 10 separate indications, meaning some drugs will target approvals in several different cancer types, which is normal practice for any company with a potentially strong drug candidate.

Homing In On Programs With Promise

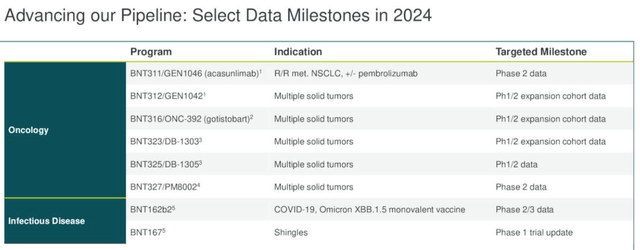

Now let’s look at some of the milestones that are arriving in 2024:

Upcoming data milestones (Earnings presentation)

Probably the first thing to note is that there is no Phase 3/pivotal study data arriving this year, other than for the COVID vaccine update, so while valuable, none of the data is likely to be used to support a push for regulatory approval, unless an “accelerated approval” is being sought, when the Food and Drug Agency (“FDA”) may approve a drug based on a surrogate endpoint that is suggestive of efficacy, and approved to meet a significant unmet treatment need. I am not sure if any of BioNTech’s candidates fit the accelerated approval profile.

Management communicated on the Q1 2024 earnings call that:

With BNT323, we are also planning to start a confirmatory Phase-3 trial this year in patients with metastatic endometrial cancer that will complement our ongoing single-arm trial in this indication.

Perhaps stung by criticism from outside (or perhaps simply following its own prespecified path) that its programs have been advancing at a slow pace, BioNTech has also been keen to stress that it has been enrolling more and more patients in its studies, noting an increase of 400% since the first quarter of 2022.

Picking out programs to watch going forward, on its recent earnings call, Chief Medical Officer Tureci highlighted several. BioNTech is proud of its work in the cancer “vaccine” space, interestingly, a space in which another mRNA giant, Moderna, has had success, with a melanoma therapy used in combo with Merck’s (MRK) Keytruda, which mid-stage studies show reduce the risk of death by half.

BioNTech’s “Fixvac” and “iNeST” candidates are explained as follows by the CMO:

Our FixVac vaccines use sets of multiple antigens shared by patients across one tumor type. iNeST, our individualized vaccine program, partnered with Genentech identifies neoantigens derived from cancer mutations that are unique to an individual’s tumor. While iNeST and FixVac target different types of cancer cell antigens, they are based on the same mRNA and delivery technology, namely our uridine mRNA-lipoplex platform.

This is a smart, albeit complex and painstaking approach. Autogene cevumeran appears the most advanced, and as well as a combo with Keytruda in melanoma, putting it in direct competition with Moderna’s drugs, two studies, in pancreatic and relapsed solid tumor cancers, are being conducted in combo with Roche’s Tecentriq, which has a similar mechanism of action (“MoA”) to Keytruda.

It has to be said, however, that the kind of data that is usually obtainable from clinical studies is thin on the ground, with (so far as I can see), no overall response data, progression free survival, duration of response data having been collected, seemingly.

BioNTech does share some pancreatic data suggesting median relapse-free survival was not reached after three year follow-up in pancreatic patients, which seems encouraging, but the kind of data that drives share price gains seems to be largely absent from BioNTech’s studies to date, so far as I can see at least.

Nevertheless, mRNA therapy BNT116 is in studies in collaboration with Regeneron (REGN), the New York based Pharma powerhouse that has had great commercial success with the likes of Eylea, the eye-disease drug, and Dupixent, developed alongside French Pharma Sanofi (SNY), so it may be that patience is key to unlocking the true value of BioNTech’s pipeline. The target is lung cancer. Six mRNAs encode tumor-associated antigens, which is impressive from a technical perspective, although researching study results online, seemingly, initial studies have not produced especially compelling data.

There is also some promise in BNT211, a CAR-T cell therapy – according to the CMO:

We plan to initiate a potentially registrational trial in patients with germ cell tumors. At ASCO, we will present real-world evidence of overall survival and treatment patterns of this patient population in the U.S. that will inform the trial design for our Phase 2 trial.

Again, we will have to wait for share price needle moving data.

Concluding Thoughts – A Review Of BioNTech’s Pipeline Arguably Throws Up More Questions Than Answers

BioNTech mentioned on its earnings call that it has now appointed a General Manager in the US, focused on building out commercial operations, but unlike its rival Moderna, which secured FDA approval for its second commercial drug, an RSV vaccine, last month, BioNTech’s prospects of securing approvals this year or next look remote.

In fact, my review of the current pipeline would suggest that 2026 may be too soon for a first oncology approval, as there seem to be so many hurdles still to overcome across most programs – it is hard to select a candidate that looks like a “slam dunk” for approval.

In the markets where BioNTech is focused, competition is also fierce. ADCs are about the hottest property in oncology at present, and rival Pharmas such as AstraZeneca, Pfizer, and AbbVie (ABBV) have invested close to $100bn in the space, and boast six approved drugs between them. Moderna is arguably ahead in the cancer “vaccine” race – a space that lacks real-world validation, and there are multiple approved CAR-T and other types of cell therapy, yet BioNTech has no such assets in a pivotal/registrational study yet.

With all that said, I doubt this is a time for BioNTech shareholders to start panicking. With ~$12bn of cash in the bank, and a “blockbuster” (over $1bn revenues per annum) commercial product with a few more years of life in it, at least, BioNTech has the luxury of developing its programs at the pace it chooses, and management does not need a rising share price to secure fresh funding, so it can afford to keep its cards close to its chest.

Personally speaking, when I look at the ranges of targets, mechanisms of action, stages of development, I struggle to identify where BioNTech may find its ten indication approvals by 2030, and therefore would probably not invest in the company at this stage, but I am at least intrigued to see how the development paths pan out, which assets end up in registrational studies, and what data may be required to secure a commercial approval.

Although BioNTech is not renowned for the pace of its pipeline development, it seems management may have jumped the gun slightly by promising to deliver commercial success this decade. I’d be interested to know what readers think.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.