Summary:

- BioNTech SE reported Q2 2024 earnings yesterday, with a significant decrease in revenues from Comirnaty compared to previous years.

- The company reaffirmed guidance for 2024, for revenues of $2.7bn — $3.4bn, but is expecting a loss-making year due to increased costs.

- The cash position remains healthy at nearly $20bn, which helps to support a $19.5bn market cap valuation at the present times.

- BioNTech’s focus is shifting back to its oncology pipeline, with promising programs in development, but signs of genuine breakthrough progress seem to be absent.

- BioNTech is unlikely to secure an ex-COVID drug approval for another three years, therefore only very patient investors with great faith in the management team will likely be excited about investing in the business today.

Pyrosky/iStock via Getty Images

Investment Overview

BioNTech SE (NASDAQ:BNTX), the Mainz, Germany-based Pharma company that partnered with Pfizer (PFE) in creating the most successful vaccine of the COVID-19 era, Comirnaty, using a pioneering messenger-RNA (“MRNA”) approach, reported its Q2 2024 earnings yesterday.

I last covered BioNTech for Seeking Alpha in June, summarizing its recent fortunes as follows:

BioNTech launched its initial public offering (“IPO”) back in October 2019, raising $150m at $15 per share in October 2019 – at the height of its bull run, in 2021, the stock traded at over $375 per share, and the company was valued at close to a triple-digit billion sum. Not surprisingly, as revenues from Comirnaty tailed off in 2023, the stock price began to fall, and today it trades under $96, valuing the company at ~$23bn.

BioNTech earned $21.6bn of revenues in 2021, and $18.5bn in 2022, all thanks to Comirnaty (revenues and profits were split equally with Pfizer), but that figure fell to $4.2bn in 2023, and across the first six months of 2024, to $345m, down from $1.57bn in 2023 (all figures originally quoted in euros by BioNTech have been switched to dollar values throughout this post).

In Q2, BioNTech reported revenues of ~$140m, but due primarily to an R&D expenditure of ~$638m, and a further ~$291mm of one-off expenses related to internal reporting changes, an operating loss of ~$(1.05bn) was reported, a net loss of ~$(881m), and earnings per share of ~$(3.66).

In 2024, BioNTech reaffirmed its guidance yesterday for revenues of ~$2.72bn — $3.4bn, SG&A expenses of ~$764m — $872m, and capital expenditures of ~$437m — ~$546m. On its earnings call with analysts yesterday, Jens Holstein, Chief Financial Officer (“CFO”) also told analysts R&D expenses for the year would amount to ~$2.6 — ~$2.83bn, and confirmed that 2024 would be a loss-making year — the company’s first since 2019.

Fortunately, BioNTech also reported a cash position of ~$20bn, therefore, with total liabilities <$2.5bn. The company remains on an extremely sound financial footing, albeit with very little prospect of generating anything like the revenues achieved during the COVID era, in the near-to-medium-term, at least.

Comirnaty in 2024 — New Vaccine, Uncertain Market

Comirnaty remains BioNTech’s only commercial product, and the source of all of its revenues. This revenue is either through advance purchase agreements with governments — unlikely to be renewed unless there is an escalating threat of another pandemic caused by a different strain of COVID — or through sales into the new, private, endemic COVID vaccine market.

In this market, in the US each year, the FDA specifies a target strain of COVID it believes will be most prevalent. Vaccine developers then have the option to develop vaccines against that strain and, if approved, market and sell that shot in a private market, where each dose will likely cost close to $100.

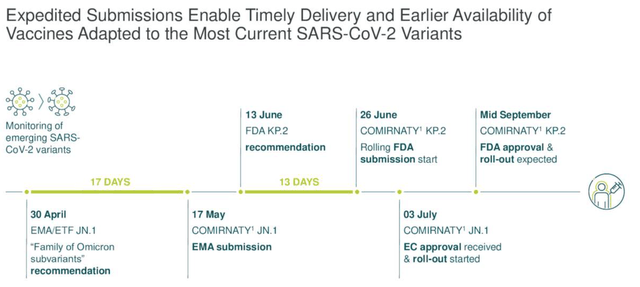

BioNTech COVID vaccine readiness (earnings presentation)

As we can see above (slide taken from the Q2 earnings presentation), the FDA’s Vaccines and Related Biological Products Advisory Committee (“VRBPAC”) specified the target strain in June, KP.2, and BioNTech has developed a vaccine that it hopes will secure approval by mid-September, ready for the fall vaccination season. The company has also secured approval in the EC for a vaccine targeting JN.1.

In Q4 last year, BioNTech earned $1.63bn of revenues, and in Q3, $947m, versus $183m in Q2. As such, we can expect Q2 in 2024 to also be BioNTech’s weakest quarter of the year, with the majority of its revenues earned during the fall vaccination season and reported in Q3 and Q4.

The key question is how demand for COVID vaccines will shape up in 2024. On the Q2 earnings call, BioNTech’s Chief Strategy Officer Ryan Richardson provided some colour on this matter, as follows:

COVID-19 vaccine demand continues to be globally distributed. We and our partner Pfizer are preparing to launch our variant-adapted COVID-19 vaccine in over 40 countries and regions worldwide. We expect approximately two-thirds of demand potential to reside outside the United States.

While some regions outside the US continue to be served by government contracts, we anticipate several newly established private markets to open up in regions like the UK and Japan. This could enable broader access to COVID-19 vaccines for individuals who may not qualify under local immunization recommendations, which tend to focus on the higher-risk population segments.

In addition, we have increased our supply of prefilled syringes, but we’ll continue to offer a mix of prefilled syringes, single-dose vials and multi-dose vials across regions. We believe the COMIRNATY franchise is well-positioned to maintain its leading position globally in the continued fight against COVID-19.

COVID vaccine developers, which includes Moderna (MRNA) and Novavax (NVAX) besides Pfizer / BioNTech, have speculated that the private market for COVID jabs could one day match the market for influenza. According to Eurostat, >50% of EU members over the age of 65 had a flu shot in 2021, and >20% of EU members are over 65, which implies, given the EU’s ~450m population, 45m shots per annum.

At $100 per dose, this could imply a market opportunity of $4.5bn in the EU, and I would “guesstimate” the opportunity would be of similar size in the US. Let’s say $10bn in total, and if we imagine Comirnaty claiming a 50% share in each market, the peak revenue opportunity could be $5bn, split equally between Pfizer and BioNTech, equals ~$2.5bn each — in an optimistic scenario.

Frankly, for a company with a market cap of $19.5bn at the time of writing, revenues of $2.5bn per annum may not be able to support such a high valuation long-term, and again it’s important to stress this is an optimistic scenario — in 2023, Moderna’s research suggests 11% of Americans opted for a COVID jab versus 44% of Americans who opted for a flu jab, which represents <40m Americans.

If the number falls again in 2024, the future earning power of Comirnaty, Moderna’s SpikeVax, and Novavax’ Nuvaxovid will be undermined further — for example a 30% share of a 80m patient market paying $100 per dose would see BioNTech struggle to drive >$1bn revenues per annum — and as we move further away from the pandemic era, patients may be less willing to spend >$100 on a COVID shot, and health insurers may be reluctant to provide reimbursement.

Of course, the flip side is that rising numbers of COVID-19 cases — which have been reported recently — and outbreaks of different strains could result in a higher demand for COVID jabs this year, and in subsequent years. However, buying BioNTech stock in the hope of growing COVID vaccine revenues can probably be best described as a hopeful investment strategy, and at worst, a fast way to lose money.

BioNTech’s Oncology Pipeline Must Begin To Deliver

As I wrote in June:

at the time of its IPO, BioNTech and its shareholders would likely never have imagined that shares would be up over 500% on a five year basis, and that there would be over $12bn in the bank.

It’s easy to forget, with BioNTech stock having lost 80% of its value on a 3-year basis, that long-term shareholders have made excellent gains thanks to Comirnaty. It is also easy to forget that BioNTech was set up primarily as an oncology focused Pharma, adapting its messenger-RNA technology to help partner Pfizer develop Comirnaty.

BioNTech’s husband and wife founding team, Ugur Sahin, CEO, and Özlem Türeci, Chief Medical Officer (“CMO”), have opted to return to oncology and make it the company’s primary focus and source of new revenues going forward — the company is still looking at developing other mRNA vaccines, for Shingles and HSV for example, but these are still at the Phase 1 study stage.

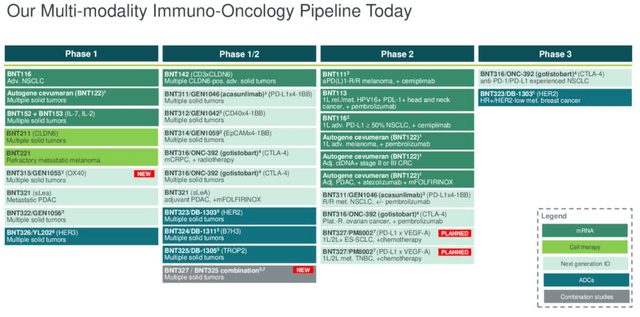

BioNTech – immuno-oncology pipeline (earnings presentation)

As we can see above, BioNTech has a busy and varied oncology pipeline, which CEO Sahin discussed as follows on the Q2 earnings call:

Today, we have an oncology toolkit featuring multiple modalities, including targeted therapies such as ADCs and immunomodulators IOs that open up new combination opportunities through synergistic mechanisms of action.

Having this diversity of assets in our pipeline enable us to pursue combination approaches that are proprietary and unique. This strategic advantage allows us to evaluate the activity of each individual compound and to determine those patient population for which monotherapy or synergistic combinations are best suited.

We believe that our strategy has the potential to address fundamental challenges of cancer and to drive meaningful improvement in the long-term survival rates for patients.

As I discussed in my last note on the company, however, despite promising to “increase the number of potential pivotal trials across our lead programs to 10 or more by year-end,” and to secure 10 approvals for oncology drugs in different indications by 2030, it’s difficult to point to “slam dunk” opportunities.

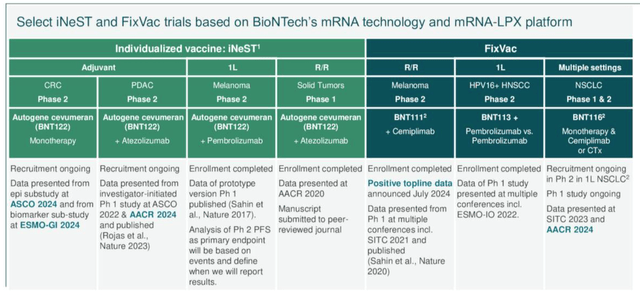

BioNTech is justifiably proud of its “cancer vaccine” programs, iNeST and FixVac, discussed by CMO Türeci as follows:

iNeST targets neoantigens derived from somatic mutations in cancer cells that are unique to an individual’s tumor. iNeST vaccines are manufactured on-demand and personalized to each individual patient. FixVac vaccines target multiple non-mutated antigens shared by a majority of patients with a given tumor type and are off-the-shelf.

There are six ongoing Phase 2 studies of “cancer vaccine” candidates, as we can see below:

Cancer Vaccine studies ongoing (earnings presentation)

In July, BioNTech was able to report positive data for candidate BNT111, which met its primary endpoint in a Phase 2 study in patients with melanoma. This was part of a combo therapy alongside New York Pharma giant Regeneron’s cemiplimab, a PD-1 inhibitor marketed and sold as Libtayo.

Türeci noted that the study achieved:

a statistically significant improvement of overall response rate in the BNT111 cemiplimab combination arm as compared to historical control of anti-PD-1 monotherapy in relapsed/refractory patients.

Whilst encouraging, we should probably contextualize the results because Moderna has produced a similar cancer vaccine. It has already succeeded in a pivotal stage study in patients with melanoma, in combo with Merck’s keytruda, the gold standard PD-1 inhibitor with revenues >$25bn per annum.

Moderna’s “vaccine” and Merck’s keytruda showed it could reduce the risk of recurrence or death by 49%. This puts it some way ahead of BNT111 in the race for approval, although as I discussed in a recent note on the company, Moderna has accused Merck of dragging its feet somewhat when close to the approval finish line.

For me, this underlines the fact that Moderna and BioNTech remain outsiders looking in at the commercial oncology treatment landscape. Other targets for the iNeST and FixVac programs include pancreatic and colorectal cancers. These are areas of high unmet need, but also areas being targeted by most major Pharma companies worldwide, and several dozen biotech firms, with no clear evidence that BioNTech has an edge in any MoA.

BioNTech’s other big hope in the oncology field besides “vaccines” is immuno-oncology, but in this field also it faces intense competition. BNT327/PM8002 is a “next generation immuno-oncology (“IO”) agent that combines two clinically validated mechanisms of action (“MoA”),” BioNTech says, which will target non-small-cell lung cancer (“NSCLC”), Small Cell Lung Cancer (“SCLC”) and triple negative breast cancer (“TNBC”).

These indications pit the VEGF-A / PD1 therapy against Merck’s almighty keytruda, AstraZeneca’s (AZN) Tagrisso, AbbVie’s exciting antibody drug conjugate (“ADC”) teliso-V, and many, many other drugs besides.

Phase 2 data from BNT327/PM8002 is expected to be reported at this year’s ASCO conference. However, unless that data makes a case for a best-in-class drug, which would be a stunning achievement, given the competition, BioNTech is playing catch up against some of the world’s most powerful and well resourced Pharma companies.

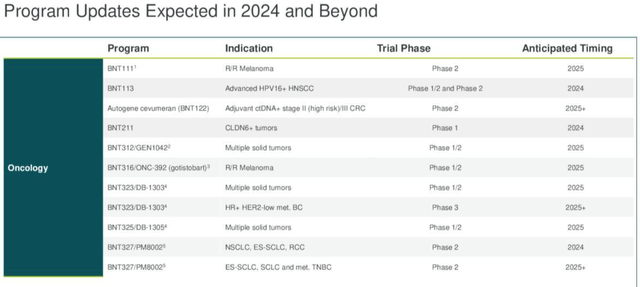

In 2024, BioNTech will report no Phase 3 data readouts, and although there may be 10 potentially registrational studies ongoing at the end of 2024, investors will have to be patient, as the best that BioNTech is promising is “potential launches” in 2026.

Concluding Thoughts — BioNTech Earnings Have Lost Their Wow Factor — A Fallow Period For Share Price Feels Inevitable

It’s not surprising that BioNTech’s earnings reports garner much less attention and market reaction today than in 2021 and 2022, when the company was reporting unexpected, and astronomical revenues and profits.

If we view the pandemic era as a “black swan” event, however, and look at BioNTech objectively today, we have a company valued at nearly $20bn promising <$3.5bn of revenues — a forward price to sales ratio of >5.5x — with no profits, and BioNTech is not a dividend payer, either.

With no prospect of any new drugs making a revenue contribution in 2024, or 2025, and most likely not in 2026, either, and highly uncertain private COVID market dynamics, BioNTech may be unlikely to grow revenues for many years to come.

When pushed on which drugs may be available in 2026 on the Q2 earnings call, management singled out “BNT323, our HER2 ADC,” which could win accelerated approval in “second and third line” endometrial cancer, management speculated, and “our BNT122 iNeST in adjuvant colorectal cancer.”

I would speculate that neither drug would be likely to achieve peak revenues of >$500m in its target indication if approved. There is presently little evidence to suggest that either has the best in-class potential required to carve out a niche in these indications.

As such, after reviewing BioNTech’s latest set of quarterly earnings, my conclusion would be that, from a share price and valuation perspective, the negatives outweigh the positives at present.

As mentioned, the dynamics of a private COVID market in both the US and EU are highly uncertain. If we look at Moderna downgrading its revenue guidance when announcing Q2 earnings last week, and its stock price falling >30% in the past week as a result, we may speculate the outlook is not promising for BioNTech, either.

Where Moderna has at least rolled out an RSV vaccine commercially, easing its reliance on its COVID vaccine for revenues in the process, BioNTech has no prospect of generating additional revenues within a 3-year period from any other source, its pipeline suggests.

As such, the prognosis for BioNTech’s share price and valuation is relatively gloomy. The saving grace is presently the promise of the oncology pipeline, although as I mentioned in my last article, arguably, there are biotechs out there with market cap valuations <$1bn with more evidently valuable pipelines than BioNTech’s.

The hope is that BioNTech’s painstaking approach, which is presently low on the types of positive clinical stage program data readouts shared by most pre-commercial biotechs, pays long-term dividends.

BioNTech – upcoming data catalysts (earnings presentation)

BioNTech is promising a “catalyst rich” 18 months or so, and has the opportunity to reward patient investors with a slew of positive data readouts, as we can see above. With my layman’s eye, however, I am struggling to spot an opportunity that genuinely marks BioNTech’s candidate out as having unique promise — in almost every indication, the evidence seems to suggest BioNTech is playing catch up.

As such, I wouldn’t recommend BioNTech as an investment opportunity to any investors looking to gain exposure to promising new cancer drugs. I can think of multiple companies in most indications targeted by BioNTech where I would rate the opportunity as more compelling, in terms of efficacy, safety, time to market, etc.

There will be BioNTech enthusiasts who will claim to have an in-depth understanding of the company’s methods, plus the patience to wait another three years for the various programs to come to fruition. Even these hardcore enthusiasts would probably concede BioNTech’s valuation is fair at this time, and unlikely to grow as there are no obvious upside catalysts in play, apart from non-pivotal study data.

Most other observers may conclude that, unless BioNTech is significantly underplaying its hand, and is positioning itself carefully for an incredible run of data, the business is significantly over-valued. Only time will tell, and I am remaining on the sidelines for the foreseeable future, although I am intrigued by what progress will materialize from BioNTech SE in the next 12 months, I just don’t know from which source.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.