Summary:

- BioNTech SE’s stock saw a spike in September due to positive data from Summit Therapeutics’ ivonescimab, which has a similar mechanism to BioNTech’s BNT327.

- BioNTech’s Q3 earnings showed improved revenues and profit, largely driven by its COVID-19 vaccine, Comirnaty, which remains a significant revenue source.

- Despite the potential in oncology, BNTX’s current valuation is high relative to its non-COVID revenue prospects, warranting a “Hold” rating.

- Future oncology success hinges on BNT327 and other assets, but substantial data validation is needed before significant gains can be expected.

Klaus Vedfelt

Investment Overview

I have been a little lukewarm on BioNTech SE (NASDAQ:BNTX), the Mainz, Germany-based Pharma, in previous notes on the company. These included covering Q2 earnings, discussing the company’s plans to secure ten different indication drug approvals in oncology by 2030, and analyzing potential earnings from the messenger-RNA COVID-19 vaccine BioNTech developed with Pfizer (PFE).

In summary, my last three posts on BioNTech have concluded with “Hold” recommendations, and the stock has generally trended slightly downward. After falling from its pandemic era high share price of ~$390 per share in 2021, to ~$175 per share at the end of 2022, shares reached a four-and-a-half year low value of ~$80 in August this year.

In September, however, BioNTech’s stock spiked to >$125 per share, although the catalyst for gains came from a source outside the company.

Summit Therapeutics (SMMT), a cancer drug developer focused on a single asset, ivonescimab, shared data from its Chinese Pharma partner Akeso Therapeutics, from a Phase 3 study of ivonescimab in first line patients with PD-L1 expressing, advanced non-small cell lung cancer (“NSCLC”).

The data compared results between patients treated with ivonescimab, and patients treated with US Merck’s (MRK) Keytruda, widely regarded as the most successful cancer drug to have been developed, standard of care in NSCLC, and a >$25bn revenue generating asset in 2023.

The data strongly favored ivonescimab, showing it “reduced the risk of disease progression or death by 49% compared to pembrolizumab monotherapy, with an objective response rate of 50%, compared to Keytruda’s 38%, and median progression free survival (“mPFS”) of >11 months, compared to Keytruda’s <6 months.”

Summit stock is now up nearly 700% year-to-date. It is preparing to launch a pivotal study of ivonescimab in the US. The reason BioNTech’s stock made gains is that the company is developing an asset – BNT327 – which has a very similar mechanism of action (“MoA”) to ivonescimab, being a dual blocker of PD-L1, and VEGF-A.

Both are clinically validated targets – Keytruda blocks PD-1 – but the additional blocking of VEGF may be a masterstroke that changes the cancer treatment landscape heading into the next decade. It opens up a double-digit billion revenues opportunity for any company that possesses such a drug candidate.

At present, only Summit/Akeso, a small biotech, Instil Bio (TIL), and BioNTech have a PD-1 or PD-L1 (I will explain the difference shortly) and VEGF blocking candidate in clinical studies.

This fact added a little extra spice to BioNTech’s Q3 earnings, which were reported on Monday, November 4th. In this review, I will discuss BNT327 in more detail, and BioNTech’s other cancer programs, as well as its COVID-19 vaccine. I will provide some objective guidance about how I see BioNTech’s stock performing in 2025, based on updates and earnings news provided Monday.

BioNTech – Q3 Earnings Overview By The Number & COVID-19 Vaccine News

Let’s first take a look at some headline figures:

In Q3, BioNTech reported “revenues of €1.2 billion, net profit of €198.1 million and diluted earnings per share of €0.81 ($0.89),” and ended the quarter with “€17.8 billion in cash and cash equivalents plus security investments.” Revenue and income performance was an improvement on Q3 2023, when the company earned €895m of revenues and €161 million of net income, or €0.66 per share.

BioNTech earned $21.6bn and $18.5bn of revenues in 2021 and 2022 (splitting revenues 50/50 with Pfizer) and net income, respectively, of $11.7bn, and $10.1bn, as the messenger-RNA based COVID-19 vaccine developed alongside Pfizer became the best-selling vaccine of the COVID era, hence the company’s exceptionally strong cash position.

It is highly unlikely that Comirnaty, as the COVID vaccine is known, would ever earn that level of revenues again. However, with COVID becoming endemic, a market is emerging for private, government, or health insurer sponsored vaccinations – especially for the elderly. Because BioNTech and Pfizer secured earlier approvals for their vaccine targeting this year’s strain of COVID (as decided by the Vaccines and Related Biological Products Advisory Committee, or “VRBPAC,” in the US, and by separate regulatory bodies in Europe, UK, and Japan), revenues in Q3 were notably higher than in the prior year.

On its Q3 earnings call, Özlem Türeci, BioNTech’s Chief Medical Officer & Co-Founder told analysts:

In Europe, less than three weeks after the regulatory authority recommended the use of a JN.1 spike antigen in the COVID-19 vaccine for the 2024-2025 season, we were able to submit our application to the European regulator and we began rolling out our updated vaccine shortly after approval in early July.

Anticipating the regional differences, we followed up with the development and submission for our KP.2-adapted vaccine. In the UK, the regulator approved our JN.1-adapted COVID-19 vaccine in July and our KP.2-adapted COVID-19 vaccine in early October.

In the United States and Canada, regulatory authorities recommended the use of KP.2 as a preferred lineage for the present season. Less than two weeks after recommendation, we initiated our rolling submission with the US FDA and received approval of our KP.2-adapted vaccine in August. In Japan, we received our JF.1 approval in early August.

Pfizer upgraded its revenues forecast for Comirnaty in 2024 to $5bn, and BioNTech’s 2024 guidance is for €2.5bn – €3bn of revenues in 2024, with R&D expenses of €2.4bn – €2,6bn, SG&A expenses of €600m – €700m, and capital expenditures of €300 – €400m.

In short, BioNTech will likely make a loss in 2024 (management advises revenues will likely be at the lower end of guidance), but it scarcely matters, as its high margin COVID vaccine business provides an excellent source of funding for its oncology programs.

Can BioNTech “Win” In Cancer Drug Development As It Did In COVID Vaccine Development With BNT327?

These are two different disciplines, clearly, but BioNTech began life as an oncology focused company, and oncology is where its long-term focused lies, and where it will deploy most of the funds from its COVID vaccine windfall.

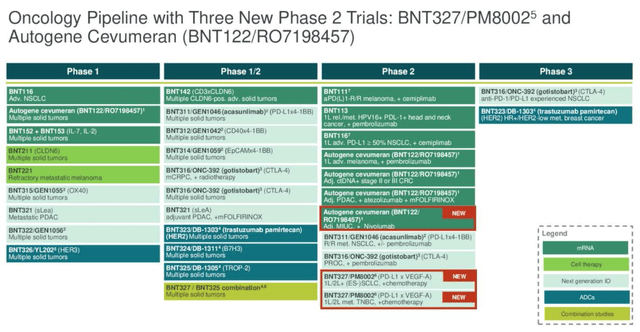

BioNTech oncology pipeline (Q3 earnings presentation)

As we can see above (slide taken from Q3 earnings presentation) BioNTech has a wide range of oncology-focused assets in its pipeline, albeit only two in Phase 3 studies (typically positive Phase data is required before a company can push for regulatory approval).

The most high profile is, as mentioned, BNT-327. Like Summit, BioNTech is partnering with a Chinese Pharma, Biotheus, over the development of its PD-L1 / VEGF blocking cancer drug.

BioNTech has acquired the rights to develop, manufacture and sell BNT-327 outside of China – according to a Biotheus press release from November 2023:

Under the terms of the agreement, Biotheus will receive an upfront payment of $55 million, and is eligible to receive additional development, regulatory and sales milestone payments potentially totalling over $1 billion as well as tiered royalties on potential future product sales. The transaction is expected to close in Q4 2023, subject to customary closing conditions, including clearance under the Hart-Scott-Rodino (“HSR”) Antitrust Improvements Act, and regulatory clearances.

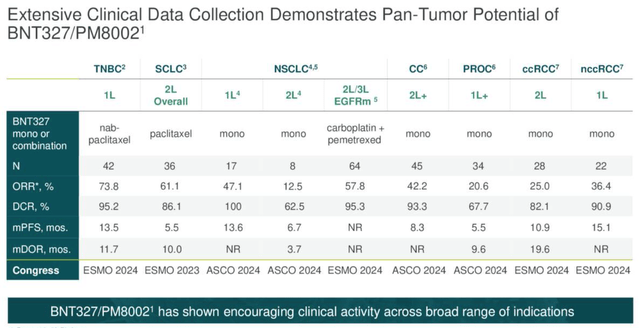

BNT-327 has not yet produced the kind of jaw-dropping data that ivonescimab has (although the onus is still on Summit to reproduce these results in US clinical studies). However, it says that it has treated 700 patients with its candidate to date. These are in first and second line lung cancer (both as a monotherapy and combo therapy), gynecological (mono only), breast (mono and combo), gastrointestinal, genitourinary and other cancers. As we can see below, some readouts look impressive and capable of challenging standards of care.

BNT327 data overview (earnings presentation)

For example, the antibody drug conjugate Elahere secured approval to treat ovarian cancer based on a pivotal study showing PFS of 5.6 months. This is a figure that BNT327 seems to have nearly matched, in a patient population of 34, although Elahere also achieved an ORR of 42%.

BioNTech says it is prioritizing development of BNT327 in triple negative breast cancer (“TNBC”), while a Phase 2 is ongoing in small cell lung cancer (“SCLC”). A Phase 2/3 in NSCLC and a Phase 3 in SCLC will initiate next year, and a Phase 3 in TNBC in 2025, BioNTech says. The company also hopes to combine BNT-327 with its antibody drug conjugate (“ADC”) candidates – the CMO told analysts on the Q3 earnings call:

we plan to evaluate BNT327 with our ADCs and some of these tumor types as additional key indications. The first exploratory trial evaluating novel BNT327 combination was started earlier this year with our proprietary TROP-2 ADC BNT325. These novel combinations may open up new areas of activity for BNT327. We plan to initiate additional trials evaluating novel proprietary combinations of BNT327 with ADCs before year-end and over the next 12 months.

In terms of the MoA of BNT327, it does not target PD-1 like Keytruda, or ivonescimab, but PD-L1 – a small but potentially significant difference. According to the American Lung Association:

PD-1 is a receptor often on the surface of immune cells. PD-L1 is a protein that has a broader presence, including on the tumor cells.

According to BioNTech’s CEO, speaking on Monday’s call with analysts, discussing the respective merits of BNT327 and ivonescimab:

BNT327 is directed against PD-L1, which comes with the potential advantage of being further enriched in the tumor microenvironment by binding to PD-1 or vice versa, enabling or adding to the binding of VEGF in the tumor microenvironment.

The data that we have so far, these are — there are some overlapping clinical trials, as you mentioned, look similar. And we have to see whether this potential mechanistic difference could translate into a better response rate and better durability, particularly in PD-L1 positive tumors. So, we have to see that there is a slight trend in this direction, but it’s too early to validate that.

In short, BNT327 is a potentially very exciting asset. However, the drug still has much to prove in later stage clinical studies. That is when its safety / efficacy will be truly put to the test in larger patient populations and against rival drug candidates which have set a high bar for efficacy.

Other Oncology Programs

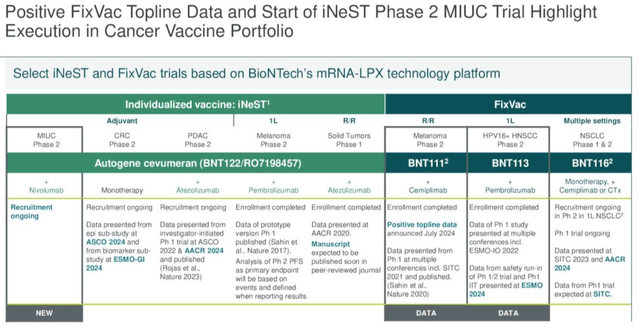

BioNTech is developing a number of cancer “vaccines,” as we can see below:

BioNTech cancer vaccine updates (earnings presentation)

BNT11 is being developed in collaboration with Regeneron’s (REGN) PD-1 inhibitor Libtayo, and BioNTech announced in July that a Phase 2 study of patients with relapsed or refractory stage III or IV melanoma:

met its primary efficacy outcome measure, demonstrating a statistically significant improvement in overall response rate (“ORR”) in patients treated with BNT111 in combination with cemiplimab as compared to an historical control in this indication and treatment setting. The ORR in the cemiplimab monotherapy arm was in line with the historical control of anti-PD-(L)1 or anti-CTLA-4 treatments in this patient group.

More data from the study is promised for next year. Meanwhile, BNT113, which encodes Human Papilloma Virus 16 (“HPV16”) antigens using mRNA, is being evaluated alongside Keytruda (pembrolizumab) and as a monotherapy in head and neck cancer. There is no timeline for data has been shared, and Autogene cevumeran – being developed alongside Genetech, Swiss Pharma Roche’s (OTCQX:RHHBY) drug development subsidiary is being evaluated as a monotherapy and alongside nivolumab – Bristol Myers Squibb’s (BMY) >$7bn per annum Keytruda rival Opdivo – in a Phase 2 study, while as we can see above, multiple other studies are planned. On the earnings call with analysts, the CMO observed:

We have two active randomized Phase 2 trials evaluating our individualized cancer vaccine in the adjuvant setting, namely in pancreatic ductal adenocarcinoma, or PDAC, and in colorectal cancer. The five-year survival rate in PDAC after resection is 10% and up to 75% of patients with PDAC relapsed even though they appear tumor-free within five years after adjuvant treatment. For high-risk colorectal cancer, about 35% of patients relapsed within five years after resection and adjuvant therapy.

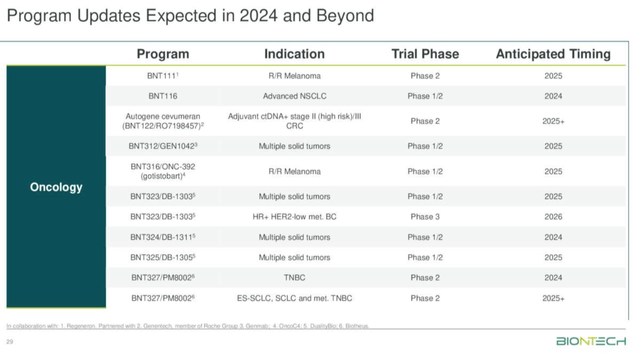

At long last, as illustrated below, study data is beginning to be shared, although I would call the upcoming readouts – shown below – a trickle, rather than a flood of data, and mostly earlier stage.

BioNTech – upcoming data catalysts (Q3 earnings)

Concluding Thoughts – After Q3 Updates, Is BioNTech Stock A “Buy,” “Sell,” Or A “Hold”

As mentioned in my intro, I have been quite skeptical in previous notes on whether BioNTech can deliver success from its oncology portfolio to mirror that which it achieved with its COVID vaccine.

BioNTech has initiated, and discarded, quite numerous projects over the past few years if my memory serves correctly. For example, there is not much mention in the latest earnings release of any cell therapy projects, or any mRNA vaccines such as for shingles, RSV, or HPV – these projects appear to have been quietly shelved.

On the Q3 earnings call, management was asked about a COVID / Influenza combo vaccine that had missed endpoints in its Phase 2 study. It responded that the program has the “full weight of Pfizer and BioNTech R&D teams behind it,” although did not provide any specific timelines or explanation of how the project might move forward.

Nevertheless, BioNTech is flush with cash thanks to the Comirnaty vaccine, and can therefore afford to take its time with each of its prioritized projects, under no pressure to rush out data updates and raise money, as many biotechs are.

The BNT327 asset can be considered genuinely exciting in my view. However, it’s unclear if even BioNTech itself knew what a valuable asset it had until Summit released its ivonescimab data in September. Only time will tell if BioNTech’s version of a PDL1 / VEGF dual inhibitor has a genuine shot at approval.

Similarly, the ADC assets and even the cancer vaccines require more data validation before we will truly know if they can genuinely challenge and outperform current standards of care. However, as management points out, the unmet need for better therapies is high across multiple target indications.

Since hitting highs of ~$125 per share in September, BioNTech stock has retreated in value to $105 at the time of writing, which gives the company a market cap valuation of ~$26bn.

All things considered, I’d be inclined to retain my “Hold” rating on BioNTech. This is simply because the company won’t generate any ex-COVID revenue for several more years, and therefore its current market cap – >10x revenues in 2024, with no guidance yet for 2025. It is still a little swollen by the success the company enjoyed in the pandemic era.

This year’s more positive revenues from the fall COVID vaccination seasons does seem to suggest Comirnaty can drive $3bn – $5bn in revenues for a few more years, perhaps even decades. This gives BioNTech a useful source of >$1bn per annum in revenues for the foreseeable future.

Moreover, across the upcoming years we will genuinely begin to understand the value of the oncology assets the company has been painstakingly developing, and on balance I see more positive signs than negative. These include as the promise of BNT327, the fact that Genentech is a partner, several ADC drugs in the pipeline – these drugs are expected to emerge as best-in-class candidates across the upcoming years and have been the subject of several double-digit billion biotech buyouts by Big Pharma recently – and the slow and steady progression and refinement of the cancer vaccine projects.

If I were a BioNTech shareholder, after Q3 updates, I think I’d feel relatively optimistic about the company’s progress over the next couple of years. I’d expect there to be share price volatility, but I’d be willing to hold for a few more years in the expectation that the company can secure several oncology drugs approval by 2028, say. Hopefully, its share price can hold firm over that period.

As for making significant gains, however, I don’t see that in BioNTech SE’s near-term future. I would be prepared to wait and see how the VEGF/PDL1 field of drug development pans out over six more months before buying into that potential. I’ll keep monitoring BioNTech and if the price drops below $80, let’s say, on no especially negative news-flow, I think I’d be tempted to buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RHHBF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.