Summary:

- BioNTech’s oncology assets, including BNT327/PM8002, show promising results, with a notable 39.3% ORR in PD-L1-negative EGFR-mutated NSCLC patients.

- BioNTech’s stock has risen by 24% since March, outperforming the S&P 500, driven by optimism in their oncology pipeline.

- Despite a partial FDA hold on BNT316/ONC-392 for NSCLC, other trials and treatments remain unaffected, signaling potential for resolution.

- BioNTech’s cash reserves and multiple promising oncology candidates support a positive investment outlook, despite recent regulatory challenges.

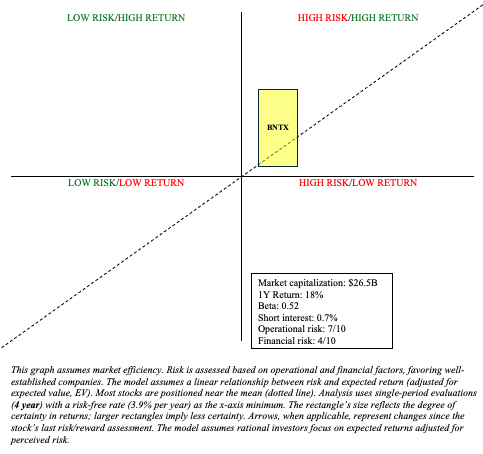

- BioNTech remains a high-risk, high-reward investment due to the potential of their oncology pipeline, but clinical breakthroughs are essential for future market performance.

Klaus Vedfelt

Introduction

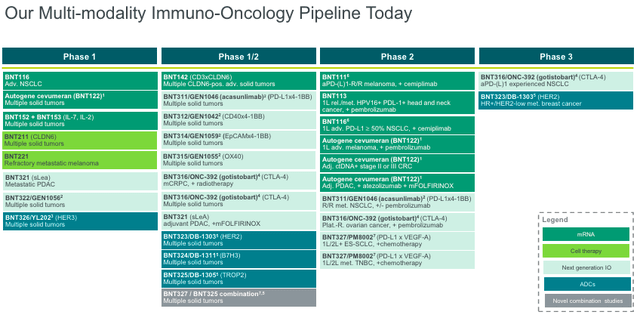

I last covered the German biopharma, BioNTech (NASDAQ:BNTX), in March. The company, known for its efforts in developing a COVID vaccine with Pfizer (PFE), is making progress in oncology. Recall that, in a recent slide deck, BioNTech highlighted a few oncology assets, like BNT323/DB-1303 (HER2), BNT316/ONC-392 (CTLA-4), BNT327/PM8002 (VEGF-A x PDL-1 VHH), BNT211 (CLDN6), and BNT311/GEN1046 (PD-L1 x 4-1BB). Based on BioNTech’s valuation, I believed the market was notably pessimistic about their R&D efforts, particularly in oncology, but this was largely unfounded. I rated BioNTech as a “buy,” citing their “boatload of cash” and “multiple shots on goal.” Since then, BioNTech’s stock has risen by 24%, nearly doubling the S&P 500.

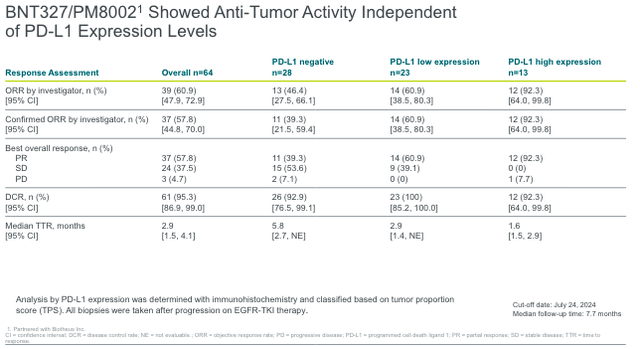

BioNTech’s BNT327 Targets Resistant EGFR-Mutated NSCLC with Impressive Results

BNT327/PM8002 has recently garnered a lot of attention after Summit Therapeutics‘ (SMMT) ivonescimab (PD-1/VEGF bispecific antibody) demonstrated PFS superiority over Merck’s (MRK) Keytruda in a China-based Phase 3 trial in first-line NSCLC with PD-L1 expression ≥1%. This is the first time a bispecific antibiody has outperformed Keytruda in a head-to-head study, with findings indicating clinical benefit across multiple subgroups. However, FDA approval will hinge on further demonstration of survival benefits in broader, non-China-based trials. BioNTech’s, in partnership with Biotheus, BNT327/PM8002 had demonstrated promising antitumor activity in Phase 2 trials. At ESMO 2024, BioNTech presented data on EGFR-mutated NSCLC progression following EGFR-TKI. In this difficult-to-treat population, the ORR for PD-L1-negative patients was 39.3% (n=28). As is common, responses increased in proportion to PD-L1 expression. This figure is especially significant in PD-L1-negative patients, as many therapies in this field have poor efficacy in this population.

The number of new EGFR-mutated NSCLC cases in the United States is estimated to be between 20,000 and 30,000 per year. Up to 25% of these patients will develop resistance to first-line EGFR-targeted therapies such as TKIs (e.g., Tagrisso), making a new therapy like BNT327/PM8002 particularly appealing.

BioNTech’s Lung Cancer Trial: A Partial Hold but Not a Full Stop

Last week, it was announced that the FDA slapped a partial clinical hold on one of their two Phase 3 candidates, BNT316/ONC-392, in the treatment of NSCLC.

The trial’s independent data monitoring board noticed “varying results” between the squamous and non-squamous NSCLC patient population, raising concerns regarding the treatment’s efficacy or safety. Partial holds pause the enrollment of new patients but allow existing patients to continue receiving treatment. So, whatever the issue is, it appears that it doesn’t pose immediate harm but, rather, requires further clarification. This could be the result of the inherent biological differences between these populations. They can respond differently to drugs. Moreover, other trials involving BNT316/ONC-392, like in ovarian and prostate cancers, are unaffected. Investors should watch for some kind of resolution to the partial hold within the next few months before jumping to conclusions. These events are commonplace in drug development. In fact, the FDA just lifted a partial hold on one of BioNTech’s Phase 1 ADC, BNT326/YL202. Meanwhile, the news caused minor weakness in BioNTech stock (closed down 2% or more), disrupting some of the momentum BNTX had gained since the beginning of September.

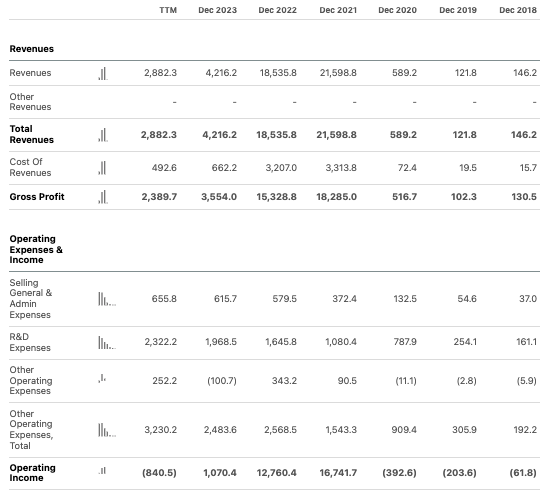

Financial Health

In Q2, BioNTech reported €128.7 million in revenues. The cost of sales was €59.8 million. R&D expenses were €584.6 million, compared to just €373.4 million in the same period last year. S&M and G&A expenses were €12.9 million and €170.9 million, respectively. The net loss for Q2 was €807.8 million or $878.2 million. These are significant figures and highlight the need for clinical breakthroughs.

Turning to their balance sheet, as of June 30, BioNTech had €10.376 billion in cash and cash equivalents. Current security investments were €6.916 billion. Total current assets were €18.281 billion, while total current liabilities were just €2.425 billion. This suggests a current ratio comfortably over 2, which indicates BioNTech can easily cover short-term obligations.

Although BioNTech generated €1.627 billion from operating activities in Q2, this figure cannot reasonably be utilized to estimate for cash runway. The company is, after all, unprofitable and makes major investments in R&D. For purposes of estimating cash runway, although unconventional, I will utilize the net loss figure for the first six months of 2024, which was €1.122 billion. This is equivalent to a cash burn of approximately €203 million every month. If we divide their cash and securities by this figure, it suggests a cash runway of over 7 years.

Recall that BioNTech made a killing during the pandemic, and this has allowed them to ramp up R&D efforts in oncology.

Seeking Alpha

Note: Cash runway and burn estimates are based on historical data and my analysis and should be viewed as estimates only. The term “cash burn” can encompass various factors beyond cash flow, making these estimates somewhat subjective. If companies provide forward-looking estimates in their earnings releases, I will include them to supplement my analysis.

BNTX Stock: Risk/Reward Analysis and Investment Recommendation

BioNTech continues to make progress in its oncology pipeline, which is key for diversification beyond COVID-related revenues. Although crowded, their work in PD-1/VEGF may pay dividends, particularly in more niche areas like EGFR-mutated NSCLC that could still procure a major blockbuster. Meanwhile, setbacks like partial holds exemplify the risks inherent in drug development. Although BioNTech’s technology holds water in their moat, the future is highly uncertain. COVID provided significant revenues, but this has since waned considerably. Their efforts in a COVID/flu combo shot, which could reasonably replace much of the $8 billion global flu vaccine market, may have suffered a setback as well, after the Phase 3 trial met only one of the two primary endpoints.

Author

Still, I have to side with the mRNA technology that quickly developed a vaccine for a novel disease that ended up saving tens of millions of lives. BNTX is a Quadrant 1 investment (high risk/high reward) that merits a place in a barbell portfolio (maintain “buy“). However, their lucrative R&D spend will necessitate a clinical breakthrough within a couple of years to outperform the market. Judging by the recent updates, I’m willing to continue to give them the benefit of the doubt.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.