Summary:

- BioNTech is a biotech company with a strong cash position and a commercial program generating cash flow, making it a promising investment opportunity.

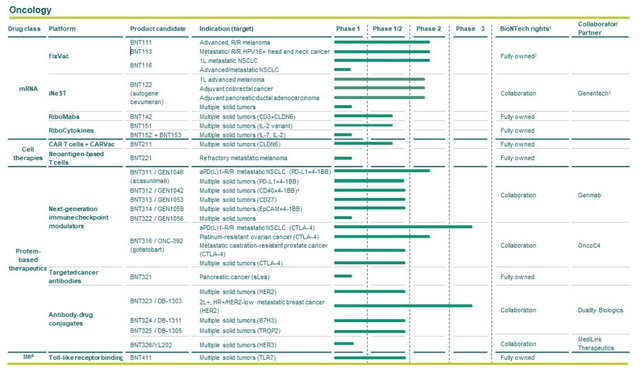

- The company’s pipeline includes programs targeting cancer, respiratory infections, and other diseases, utilizing various platforms such as mRNA therapies and CAR-T therapies.

- While there are risks, such as the potential decline in revenue from the COVID vaccine, BioNTech’s potential to launch new programs and grow its revenues could lead to significant returns.

U. J. Alexander

I have been researching the biotech sector for a while now, and that experience has allowed me to recognize several patterns that successful companies exhibit that set them apart from unsuccessful ventures. One of those features is the simultaneous presence of a meaningful war chest and sustained cash-flow from a commercial line of products that allows them to finance new projects as they go through the lengthy process of development and approval for commercialization.

Possessing these two attributes simultaneously goes a long way in making a biotech company successful. A company in this position can always get licensing or even buy any given biotech startup of interest if they need it for one of their projects. However, a biotech whose only meaningful asset is a big cash position and that still has years to go until their first program can hit the market, will inevitably bleed cash.

Therefore, a good candidate for a promising investment in this sector is any company that enjoys good liquidity, while owning a commercial program that already generates cash-flow. BioNTech SE (NASDAQ:BNTX) fits this description. In the following paragraphs, we shall test the thesis that this company is a good vehicle to get exposure to the biotech field without the liquidity risk stemming from the usual cash-burn profile of the startups in this sector.

A primer on BioNTech

The company was among the first pack of companies to develop mRNA vaccines for the COVID pandemic. At the time, they were still a small company, and therefore they teamed up with Pfizer to develop, manufacture and distribute the vaccine.

In 2020, Pfizer invested $113 million in BioNTech stock, while also making an upfront payment of $72 million. Part of the deal was further milestone-dependent payments of up to $563 million. The deal implied sharing the gross profits evenly, while also sharing the development costs. Pfizer has the option to terminate the deal without cause, but it would have to provide one year’s notice.

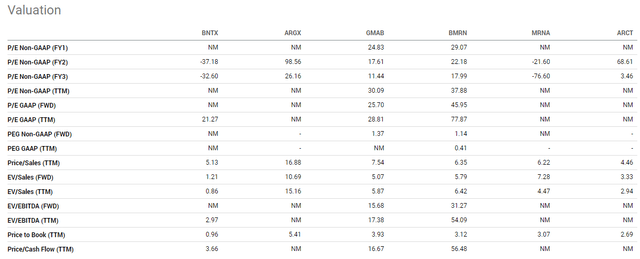

It goes without saying that this resulted in an overnight growth burst for the company. Now, as the pandemic fades, the demand for COVID-19 boosters is normalizing, and it is only natural that the company’s revenues recede.

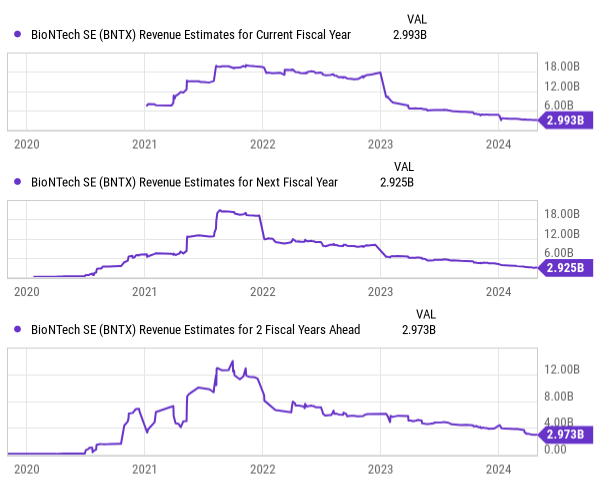

YCharts

The critical aspect of BioNTech as a long-term investment opportunity lies in evaluating what will be left in their cash-flow generating business as demand normalizes. Current revenue estimates point towards a $3 billion annual revenue.

YCharts

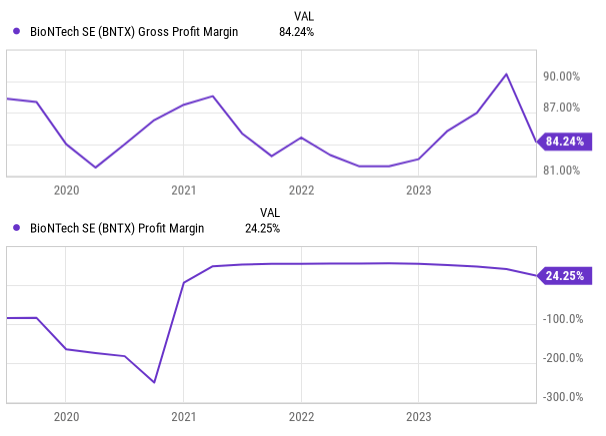

If these estimates stand, the company will most likely keep deriving enough cash-flow to support its activities, which includes a prolific pipeline of R&D. The current business derives very healthy margins, and the company’s OpEx can be adjusted to accommodate the drop in the revenue level to $3 billion. The OpEx stood at $3.1 billion in 2023, which includes COGS, SG&A, and R&D. This is a manageable overhead in our view, reinforced by the fact that the company holds more than $16 billion in cash and cash equivalents.

Strategy

The company was established with the vision to use the immune system to combat diseases like cancer. The COVID pandemic opened an unexpected opportunity to build a proof-of-concept program. This should open an avenue for further COVID-related vaccines, but also to more general respiratory infections like the influenza virus. However, the company intends to keep developing precision therapies for cancer.

YCharts

The company’s pipeline currently includes 20 oncology programs, but also programs targeting Shingles, Tuberculosis and Mpox.

It is important to note that the company is not simply betting on mRNA therapies. As the pipeline reflects, the company is also actively researching Antibody-Drug Conjugates, Immuno-Oncology Antibodies, and CAR-T therapies. There are synergistic effects stemming from having all these platforms. For instance, the combination of these platforms like CAR-T therapies and mRNA vaccines can enhance the effectiveness of treatment responses in cancer treatments.

In its 4Q23 earnings call, the company highlighted the BNT-211 CAR-T cell therapy as one of the most promising in its pipeline. The therapy is designed to attack cancer cells that express the Claudin-6 protein. To enhance the engraftment and longevity of the CAR-T cells, BioNTech developed CARVac, a CAR-T cell amplifying RNA vaccine. The combination of BNT-211 with periodic administrations of CARVac aims to improve the persistence of the CAR-T cells in the body. Recent clinical trials have shown promising results.

Risks to thesis

The main risk to our thesis is that the COMIRNATY asset loses steam faster than anticipated, and that might indeed be the case, as the company has guided revenues of $2.7 to $3.3 billion (EUR/USD rate of 1.07). In that scenario, it is quite plausible that the company would fall into break-even cash-flow levels or even experience negative cash-flow.

This would be a major concern for this thesis, which relies on the COMIRNATY program to continue to provide funds to finance the other programs, effectively making BioNTech a low theta decay option within a prolific biotech pipeline.

Nevertheless, we think there are mitigating factors at play here. As you can see in the pipeline the company is developing influenza and COVID 19/influenza combination vaccines. The availability date is uncertain, but it might not be far away, in the 4Q23 earnings call, the executives talked about fall 2025, if trials are successful. Additionally, the company intends to progress over 10 potentially registrational clinical trials, with a possible oncology launch in 2026. The flip side is that we should also expect increases in R&D and SG&A expenses until then.

Valuation

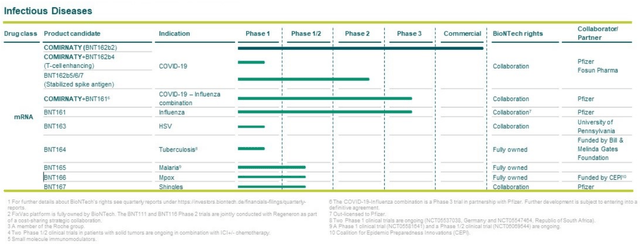

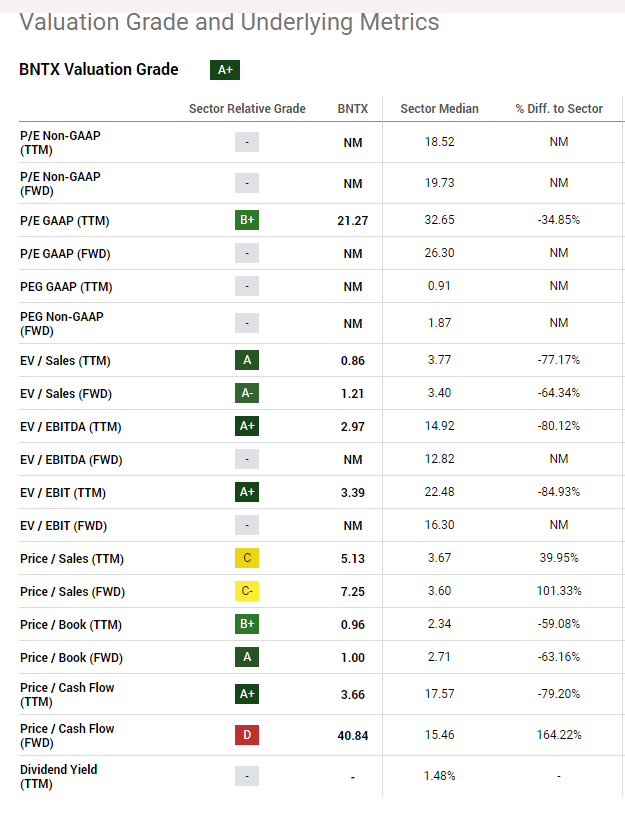

A look at valuation tells us that BioNTech is relatively cheap relative to its sector median on most metrics. However, know that this is in part due to the market discounting the loss of revenue and profits from the COVID vaccine business.

Seeking Alpha

A closer look at peers in the mRNA arena striving to launch new programs, Moderna (MRNA) and Arcturus (ARCT), reveals that the P/S ratio is in line with them, while the P/BV ratio is significantly lower.

The valuation reinforces my view that BioNTech should be treated as a slow theta decay option on an innovative biotech pipeline with the potential to create a new multi-billion dollar business segment. Given that the alternatives in the sector consist of cash-burning companies with no commercial product (in essence fast theta decay), and traditional Pharma companies that have committed to some biotech projects, but that will hardly move the needle in terms of revenue if successful, then I think that BioNTech has something to offer to risk-takers.

Obviously, there are risks that we have covered in the previous paragraphs, but I think BioNTech is an interesting opportunity to add a small company with significant return opportunities to a balanced portfolio.

As things stand, the company seems capable of successfully launching both influenza and an influenza/COVID combination vaccine that helps stabilize its respiratory infection business. This alone could go a long way to conserve the company’s cash while financing the rest of the pipeline. If one of the other projects in the pipeline is successful and helps grow its revenues to $10 billion by the end of the decade, we can see this company valued at 10 times sales. In that case, the company could be valued at close to $100 billion, equating to a 25% annual return from the current value. While this is not a price prediction, it illustrates the potential for this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This text expresses the views of the author as of the date indicated, and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit, there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.