Summary:

- BioNTech is diversifying its portfolio beyond its COVID-19 vaccine, focusing on antibody-drug conjugates (ADCs) and novel vaccines.

- The company has acquired MediLink Therapeutics’ ADC technology and is targeting HER3 protein-related tumors in cancer treatment.

- Despite a decline in revenue and profit, BioNTech remains financially robust with strong cash reserves and a solid current ratio.

- BioNTech’s attractive valuation, high profit margins, and promising pipeline offer long-term growth potential despite current skepticism. BioNTech is a “buy,” but patience may be key.

Marcin Klapczynski/iStock via Getty Images

At a Glance

In my previous analysis of Germany-based BioNTech (NASDAQ:BNTX), I underscored its potential for growth in immunotherapy and the importance of its oncology-focused initiatives. Since then, while their COVID-19 vaccine sales have declined further, the company has made notable progress in diversifying its portfolio. This is evident in their strategic expansion into antibody-drug conjugates (ADCs) and the acquisition of MediLink Therapeutics’ ADC technology. The promising advancements in their endometrial cancer drug, BNT323/DB-1303, further highlight BioNTech’s commitment to cancer therapy innovation. Financially, they remain robust with strong cash reserves and a solid current ratio, supporting continued R&D investment. However, the revenue decline and a cautious market outlook necessitate a prudent investment approach. This evolving landscape shapes my updated analysis, balancing BioNTech’s attractive valuation and profit margins against market skepticism and growth challenges.

HER3’s the Charm: BioNTech’s Bold Cancer Conquest

BioNTech, famous for its COVID-19 vaccine in collaboration with Pfizer (PFE), is branching out. ADCs and novel vaccines are currently the center of attention. This move aligns with wider pharma trends, marked by recent acquisitions involving Seagen (SGEN), Icosavax (ICVX), and ImmunoGen (IMGN).

BioNTech made its own splash in the ADC world. They acquired the rights to a MediLink Therapeutics ADC. This ADC targets HER3 protein-related tumors. The deal cost $70 million upfront. It shows BioNTech’s push into cancer treatment, especially ADCs. HER3 is linked to several cancers, like lung and breast cancer.

Earlier this month, BioNTech’s BNT323/DB-1303 ADC, targeting HER2, received FDA’s breakthrough designation. It’s meant for advanced endometrial cancer. This follows promising trial results that revealed an overall response rate (unconfirmed) of 58% in heavily pretreated patients.

On the vaccine front, BioNTech remains busy in 2023. They’re testing mRNA vaccines for herpes and shingles with Pfizer. They’re also eyeing trials for a malaria vaccine, BNT165, and a tuberculosis vaccine, BNT164.

BioNTech’s cancer vaccine lineup is packed. They have at least a dozen candidates in clinical trials. These include vaccines for melanoma, HPV16-positive cancers, and pancreatic cancer.

In short, BioNTech is diversifying well beyond its COVID-19 vaccine fame. Their focus on ADCs and vaccines puts them in an interesting spot in the biotech world.

Q3 Performance

BioNTech’s latest earnings report for the quarter ending September 30, 2023, shows major changes. Revenues fell from €3,461.2M ($3,842.1M) to €895.3M ($994.8M). The main hit was in commercial revenues (COVID-19 vaccine), down from €3,394.8M ($3,768.4M) to €893.7M ($992.0M). Research funds also dipped from €66.4M ($73.7M) to just €1.6M ($1.8M). Operating income and profit plunged too. Operating income dropped from €2,387.5M ($2,650.1M) to €73.1M ($81.1M). Profit fell from €1,784.9M ($1,981.8M) to €160.6M ($178.3M). EPS nosedived from €7.43 and €6.98 to €0.67 ($0.74).

Financial Health

BioNTech’s assets are strong, totaling €15.75 billion ($17.48 billion). Cash makes up €13.50 billion ($14.99 billion) of this. When examining liabilities, BioNTech has a varied debt portfolio, including short-term and long-term debts. The current ratio is solid at 10.36, showing good short-term health.

In nine months, BioNTech’s operating activities brought in €4.52 billion ($5.02 billion), equating to €502 million ($557.2 million) per month. Subsequently, the chances of needing new financing soon appear low.

In short, BioNTech’s financial state is robust. The current ratio is healthy, and there’s positive cash flow. Long-term, the company looks stable, with ample reserves and good cash generation.

Market Sentiment

The company’s market capitalization of $24.90B, with a significant decrease in both EPS and sales Y/Y, signals market doubt. This skepticism is reflected in its growth grade (F), highlighting negative revenue trends and a substantial EPS drop. Comparatively, the stock underperforms against SPY across all timeframes.

Per Seeking Alpha, the short interest stands at a moderate 3.58% with 3.01 million shares short, suggesting a balanced view among investors. Institutional ownership is relatively low at 15.32%, with a marginal difference between new (722,439 shares) and sold-out positions (819,099 shares). Notable institutions like Baillie Gifford & Co. and UBS Asset Management Americas show mixed changes in their holdings. There doesn’t appear to be any recent insider trades to note.

Considering these factors, the company’s market sentiment is best described as “fragile.”

Peer Comparison

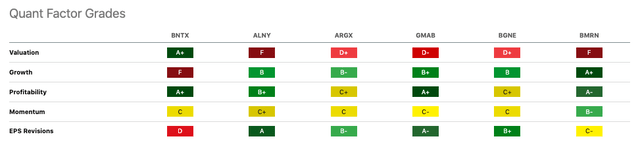

According to Seeking Alpha’s Quant Factor Grades, BioNTech (BNTX) stands out in the biotech world with its top-notch valuation, scoring an A+. This outshines peers like Alnylam Pharmaceuticals (ALNY) and BioMarin (BMRN). Yet, BNTX is lagging in growth, earning an F due to challenging post-pandemic comps. This contrasts with BMRN’s excellent A+ in the same area.

Profit-wise, BNTX matches the best, like Genmab (GMAB) and BMRN, with an A+. They boast a 90.87% gross profit margin and a 41.57% net income margin [TTM]. But BNTX falls short in momentum (C grade) and EPS revisions (D grade). This suggests weaker market trends and earnings prospects, especially against ALNY’s higher EPS revisions grade.

BNTX’s revenue growth Y/Y plummeted by 64.35%. This is a sharp contrast to its peers’ positive trends. This decline is key for investors, given BNTX’s otherwise strong profit numbers.

In essence, BNTX stands out in terms of valuation and profit. However, its growth hurdles and uncertain EPS future paint a complex picture for investors. This marks a clear difference from its more evenly performing biotech counterparts.

My Analysis and Recommendation

BioNTech’s market stance is clear-cut. Their move towards ADCs is strategic, notably with the MediLink Therapeutics acquisition. This places them at cancer therapy’s cutting edge. Moreover, their vaccine pipeline targets diseases like herpes, shingles, malaria, and tuberculosis, highlighting their global health commitment.

The company has sound financial standing. Despite lower sales of the COVID-19 vaccine, they still have sizable cash reserves and a solid current ratio. Even though COVID revenue has significantly diminished and is now largely seasonal, I predict it will wane to $3–4 billion in the upcoming years, giving BioNTech respectable cash flow. This offers a reliable foundation for further R&D efforts. Its recent proposal to repurchase stock demonstrates its financial stability and development prospects.

Investors, however, should also be wary. BioNTech’s revenue and profit have dipped, and the market is cautious, as seen in their growth grade and lagging stock performance. The Y/Y decline in EPS and sales suggests prudence is needed. In my view, BioNTech still suffers from a “COVID hangover” that limits its valuation. Risk reduction involves watching BioNTech’s pipeline progress, especially the impending phase 3 trial initiation of their COVID/flu vaccine. This could be a significant growth driver.

My “Buy” recommendation is backed by BioNTech’s low valuation, high profit margins, and promising pipeline, offering long-term growth potential despite current skepticism. This one may take a while to play out, so patience may be key. Moreover, investors must watch for changes in biotech, regulatory actions, and BioNTech’s success in diversifying and marketing its pipeline. Contrary indications could include clinical trial setbacks, regulatory challenges, or unforeseen biotech market shifts.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.