Summary:

- Block, Inc. trades in sympathy with Bitcoin but hasn’t matched Bitcoin’s recent gains, reflecting its minimal profit from Bitcoin-related activities.

- Despite past unprofitability, Block’s gross profits and adjusted EBITDA have shown consistent growth, with a 20% YoY increase in gross profits.

- Risks include competition from larger fintech firms like PayPal and Visa, and potential overvaluation relative to recent market performance.

shuang paul wang/iStock via Getty Images

Introduction

Block, Inc. (NYSE:SQ), which most people known only by the name of its flagship products Square and Cash App, is a fintech giant founded by Twitter-founder Jack Dorsey. Dorsey is still the CEO, and has been since SQ’s founding in 2009. Block has an interesting stock price chart, with a massive whiplash that followed a crypto frenzy so frothy that Block changed its name from Square as a nod to cryptocurrencies and the blockchain.

Sympathy with Bitcoin

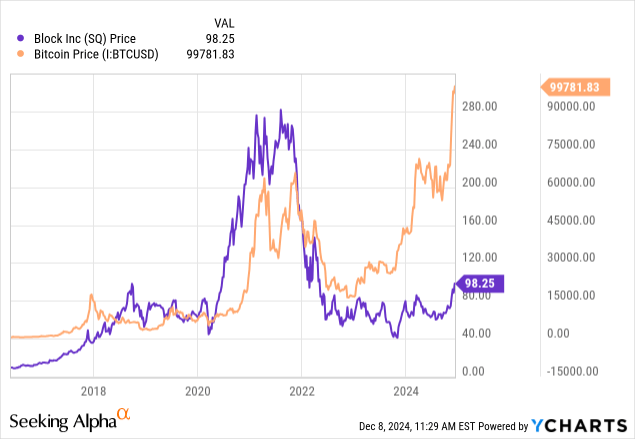

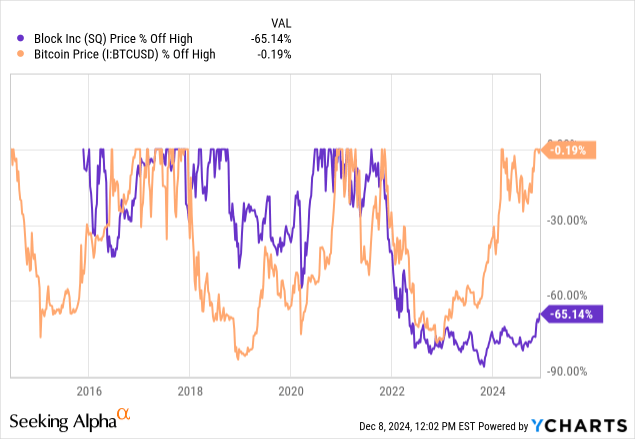

However, since Bitcoin’s (BTC-USD) return to prominence this year, Block hasn’t quite kept up.

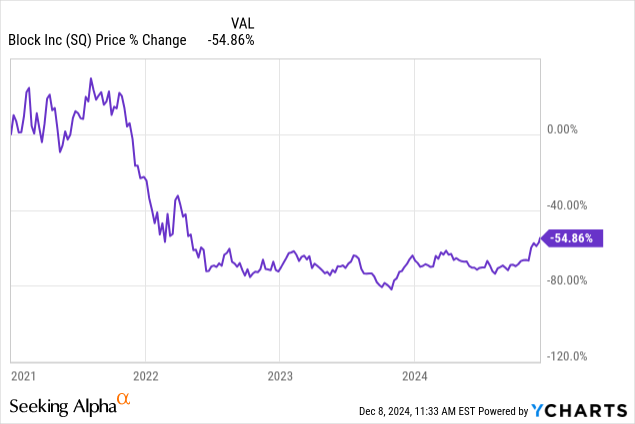

Block was one of the most adversely hit tech companies during 2022 as it trades not only in sympathy with small businesses (due to Square), but also Bitcoin itself, as shown by the chart above. So when stagflation hit, interest rates rose to 5%, and both small caps and crypto were crushed, SQ fell hard. From 1/1/21 to now, Block is down almost 55%.

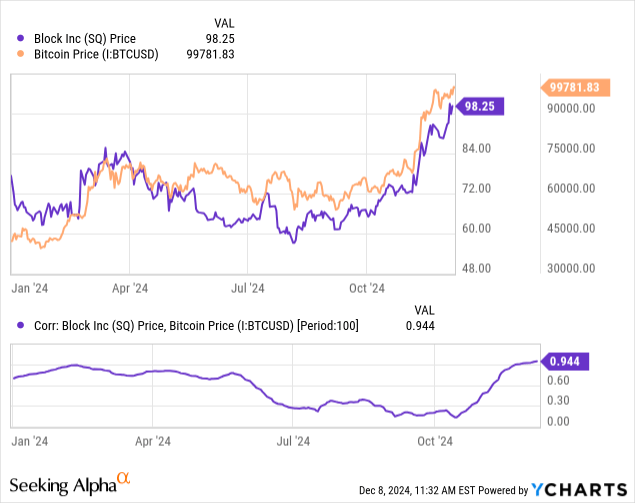

YTD, we’ve seen a continuation of some crypto sympathy, with a detangling of the correlation through Q3 and a return to near-perfect correlation last month. This is an interesting pattern to follow, as SQ really does seem to trade in line with Bitcoin when you overlay their charts like this.

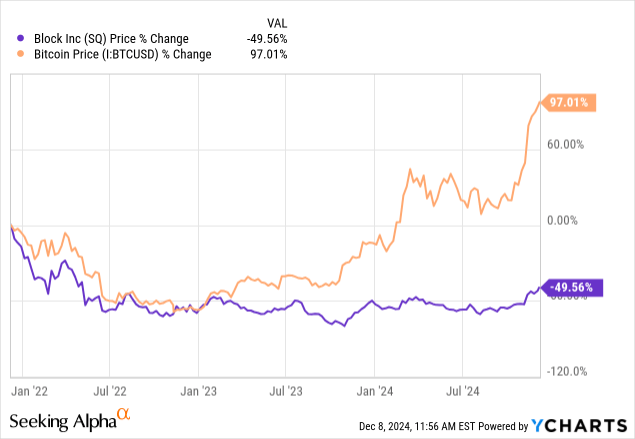

But Bitcoin isn’t down 55% over the last few years, SQ is. Bitcoin is at all-time highs, in fact. Looking back at end of ’21 and beginning of 2022 when the crushing began, Block is still far below that, while BTC is far above and now at all-time highs.

It seems that even though Block trades in sympathy with Bitcoin, it does so at such a low rate that it isn’t benefitting from the violent upswings in the cryptocurrency. The disparity began with this last bull run, one that is still ongoing for crypto.

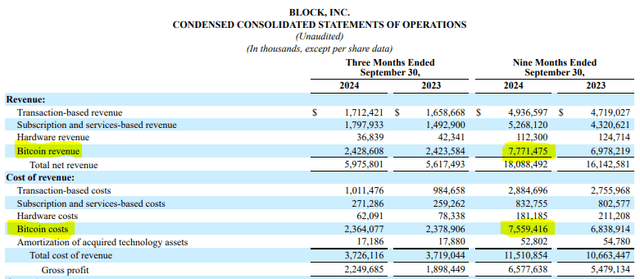

Here’s the rub: Bitcoin isn’t that profitable for Block.

Block, Inc.

Looking at their latest financial statements, we can see that up through the end of Q3, they did close to $7.8B in Bitcoin revenue, incurring almost $7.6B in Bitcoin expenses. Their profit from Bitcoin-related business was about 2.8% of revenue left after costs. That is a pitiful amount compared to their transaction-based revenue margins, which is over 52%. The actual profit left over is also about 1/10th of the profit from transactions.

Bitcoin not being a big profit generator for Block resonates with why it hasn’t taken off as fast as Bitcoin has. Square has fallen off this last big run-up due to its surprisingly small reliance on Bitcoin for any source of value. Its transaction volume is still the vast majority of its revenue.

They have so little to do with cryptocurrencies and Bitcoin in particular that it nor the Blockchain or any cryptocurrency are mentioned in the Q3 investor presentation. They did mention AI, though.

It’s also unclear how much Bitcoin operability influences Cash App users’ decision to use the platform.

The Financials

So what about the business itself? If Bitcoin isn’t seeming to help pull this back up to all-time highs, then investors will need to help that Block itself will create value for shareholders themselves.

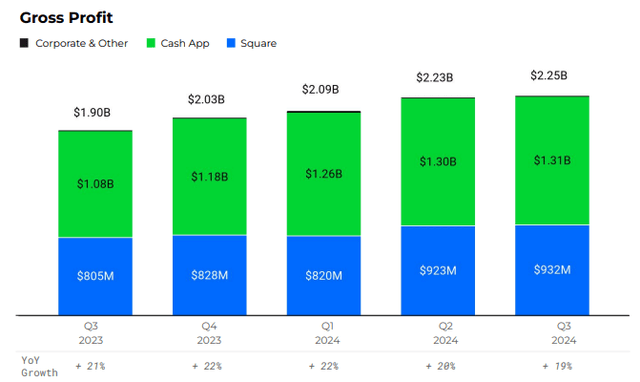

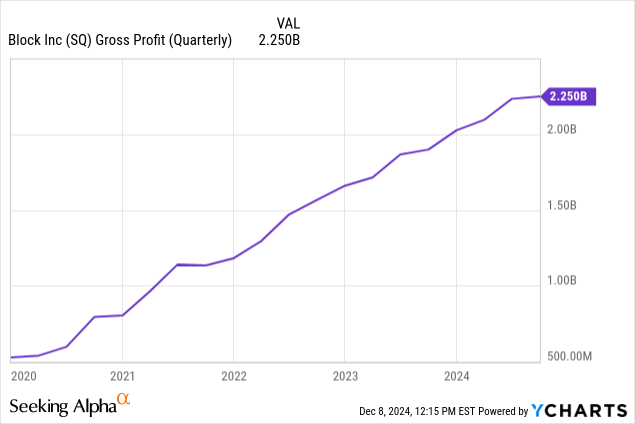

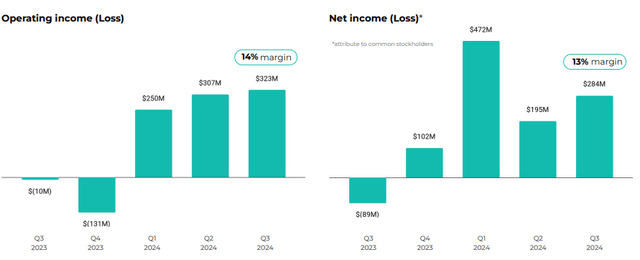

This is where Block impressed me. In their Q3 investor presentation, they focused on a few things, but the biggest one was improving profitability. Gross profits are up, and have been consistently growing quarterly around 20% YoY for the last year.

Block, Inc.

This comes on the heels of several years of this kind of growth, something that has impressed shareholders, but not enough to move the stock back to the frothy highs it was at in 2022.

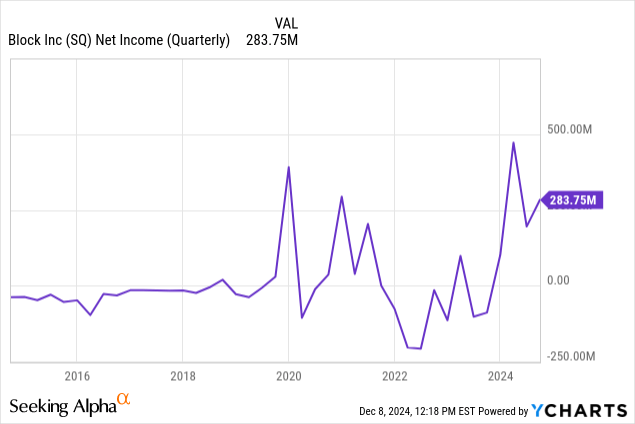

Recovering from unprofitability is difficult, and SQ has managed it decently. While their net income is varied over this past year, they have had several profitable quarters in a row, which gives me confidence as a potential investor.

I have a rule about not investing in unprofitable companies, with few exceptions.

Block, Inc.

This trend is new, as Block, Inc. mostly has a history of losses, so it’s unclear if this profitability will last. It could continue on, or fall again as it has in the past after very profitable seasons.

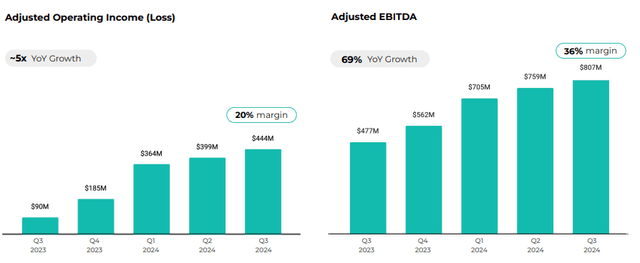

Adjusted income is a very good-looking chart from an investor perspective. Almost 70% YoY growth in adjusted EBITDA is a great success for Block, especially one that is still 65% off its all-time highs.

Block, Inc.

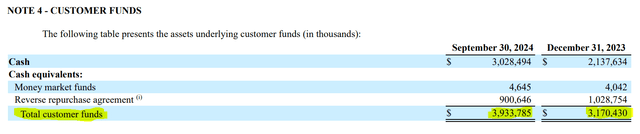

Customer funds have also increased substantially YoY, with a 21% increase.

Block, Inc.

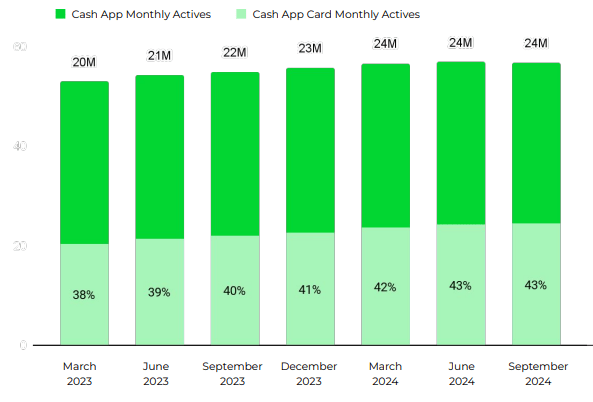

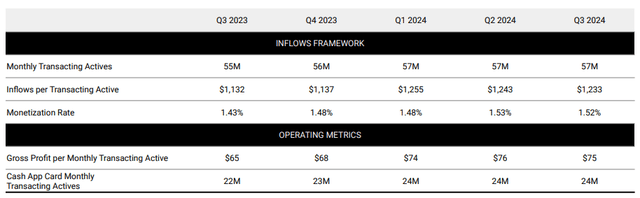

Put that together with growing monthly actives in both Cash App and Square, Block’s flagship products, and you can see why there is a narrative here that Block could swing back up to its former highs.

Block, Inc.

I particularly like to see the inflow per transacting active climbing, showing us that users are bringing more to the platform than before, a YoY increase of 8.5%.

Block, Inc.

Risks

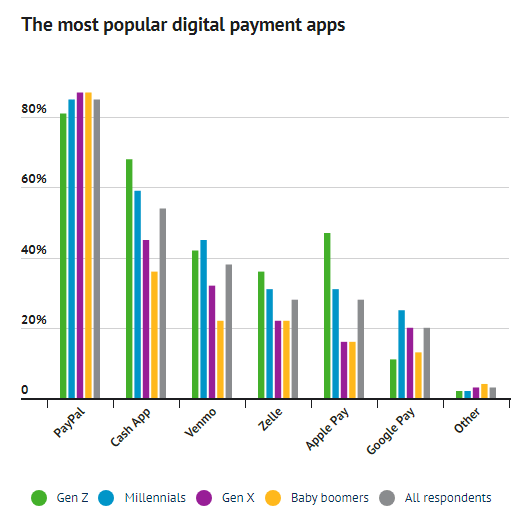

There are some holes to poke here. The first is that Block’s flagship products have to compete with larger firms like PayPal (PYPL) and Visa (V). They could lose market share in the future, even if they are one of the favorites of the younger generation. They are not the most monetizable audience in the fintech space. PayPal, by contrast, carries more favor with basically all age groups and also has its own crypto-buying program to compete with Block on top of the P2P payment system.

Infogram

There is also a problem with operability, since Cash App doesn’t have the same kind of partnerships with banks that Zelle does, or the monopoly-like grip of Apple Pay (which is on the rise!).

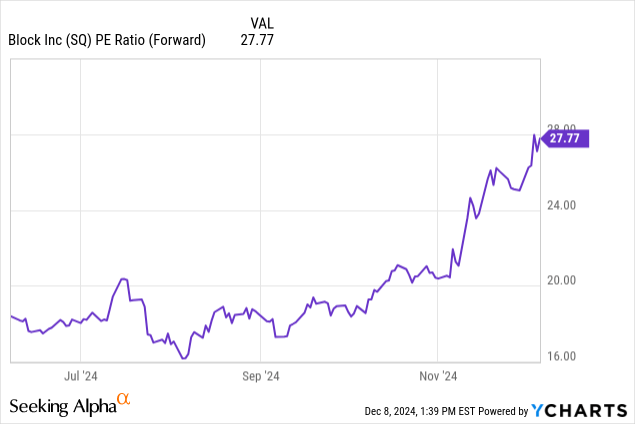

There is also the risk of a heightened valuation, which SQ has even if it’s far below its frothy peaks in 2021.

While there was certainly value to be had under 20, but now we are above the market average. This is still less than the sector-specific average, but risks remain with it elevated so much relative to the last six months.

The Trump Trade could run its course, continuing the SQ run up due to the potential for less fintech regulation that affects both SQ itself and BTC, which we’ve established SQ trades in sympathy with.

If this trade goes sour, SQ is likely to be hit and brought back down below the 20 mark. This is a critical juncture that investors must consider when buying SQ stock.

Conclusion

Ultimately, it’s been interesting to see how BTC and SQ decoupled in the severity of their correlation, even if it still remains somewhat intact. Block, Inc. is benefitting from the current market run-up following the election in Bitcoin and fintech stocks somewhat broadly, but may be entering heightened levels that it can’t sustain. This comes even as it grows its business, both in terms of monthly actives and in revenue and profit, at a 20% YoY rate.

The business fundamentals make SQ attractive, but it’s unclear how much of that plays into its share price, given that it trades in sympathy with BTC so consistently. This means that there are risks even if the underlying business looks like quality.

I am rating SQ a hold for now, and encourage those bullish on fintech to consider Block, Inc. in their portfolio, but only for aggressive investors, and only up to a 2% allocation in an all-equities portfolio. This is a position that could catch back up to where it used to be, but it is also one that could stay depressed despite positive signs for the business, especially if Bitcoin crashes following its breach of the $100K mark.

Thanks for reading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.