Summary:

- Blackwell GPU, priced at $30-40k, could drive annual revenue of more than $50 billion, pushing computing boundaries with advanced tech.

- Despite strong financial performance, Nvidia’s slowing revenue growth and declining margins indicate substantial profit growth risks.

- Nvidia’s valuation demands doubling past five-year growth in the next eight years to match S&P 500 returns, posing a high growth bar.

- Nvidia has incredibly concentrated customers given the cost of its GPUs, which presents a massive risk to its ability to continue future growth.

JHVEPhoto

Nvidia (NASDAQ: NASDAQ:NVDA) share price went up mid single digits last week after the CEO announced strong demand for Blackwell. Despite that, as we’ll see throughout this article, strong immediate demand doesn’t give the company a path to justifying its valuations, making it a poor investment today.

Blackwell Demand

Nvidia has announced “insane” demand for Blackwell, its next generation GPU that’s expected to cost $30-40k per unit.

Blackwell Nvidia

Blackwell is expected to allow multi-trillion parameter models to be created. For perspective, Chat GPTs latest models have potentially 1.8 trillion parameters. Blackwell has more than 200 billion transistors, with 2 GPU dies tied together through a 10 TB/s link. It’s indicated that the design issue with Blackwell GPUs have been fixed and 4Q production could be 450k.

This indicates annualized revenue potentially topping $50 billion (1.8 million annual units x 30k min price). The GPU is significant and Nvidia has indicated an interest in an annual GPU cadence each several times as good as the last as it continues to push the boundaries of computing. One other note that we want to highlight here is that Nvidia GPUs are being built on TSMC’s n4p process, the latest iteration of its 5 nm process.

Nvidia Valuation

Nvidia has a lofty valuation backed up by the company’s continued growth levels.

Nvidia Valuation

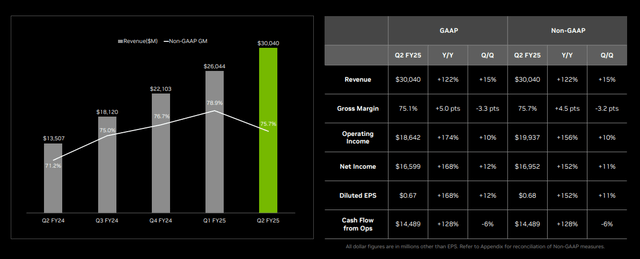

The company crossed $30 billion in revenue in the most recent quarter. That was $4 billion in revenue growth vs. the prior quarter, and for the last four quarters, the company has seen more than $4 billion revenue growth each quarter vs. the prior quarter. The company had a more than 75% gross margin, down more than 3% QoQ.

The company’s diluted EPS of $0.67 saw 12% QoQ growth, down from 15% QoQ revenue growth as the company’s margins have slowed down. The company’s annualized EPS is $2.6 / share, which puts the company’s P/E at just under 50x, a valuation that expects substantial future growth. That combines with the need to match S&P 500 growth at minimum.

That’s the floor to be a worthwhile investment going forward given the concentration risk vs. the S&P 500. The company’s outlook for the current quarter is $32.5 billion, the first quarter in the last four that the company is not seeing $4+ billion in QoQ revenue growth. The company expects 74.4% gross GAAP margins, another decrease QoQ.

Declining margins combined with slowing down revenue growth is a strong indication that the company’s profit growth will be slowing down substantially. The company has Blackwell, which is impressive, and will help in the fourth quarter, and it’s tough to predict those numbers. However, that’s still a substantial risk.

Nvidia Financial Performance

Nvidia has had incredibly strong financial performance with 26x returns over the last five years.

Nvidia Stock

The company’s returns have taken it from a company with a market capitalization of less than $120 billion to one worth almost $3.1 trillion. That financial performance is incredibly impressive and the company has built up a loyal portfolio of investors as a result.

However, when we invest, we’re looking at the question about evaluating the company as an investment today. Despite the company’s strong recent strength, the question is whether it can outperform the S&P 500 going forward. Average S&P 500 annual returns are more than 10%, so our benchmark is whether Nvidia can continue driving 10% returns going forward.

To hit that benchmark, given compounding, the company needs to double in size over the next eight years. That means all of the massive success the company has had recently, it needs to double that. That’s a high bar of growth that the company needs to achieve to justify its valuation.

Eight years from now, assuming a halted growth scenario, the company needs to be earning $500-plus billion in annual profit to justify its valuation versus the market. That’s because the S&P 500 generates 10% annual returns, and if you’re no longer growing you need 10% annual profit to generate 10% annual shareholder returns.

Nvidia Concentrated Customers

Nvidia continues to have the risk that its customers are heavily concentrated among a few mega caps chasing artificial intelligence.

Nvidia GPU Shipments

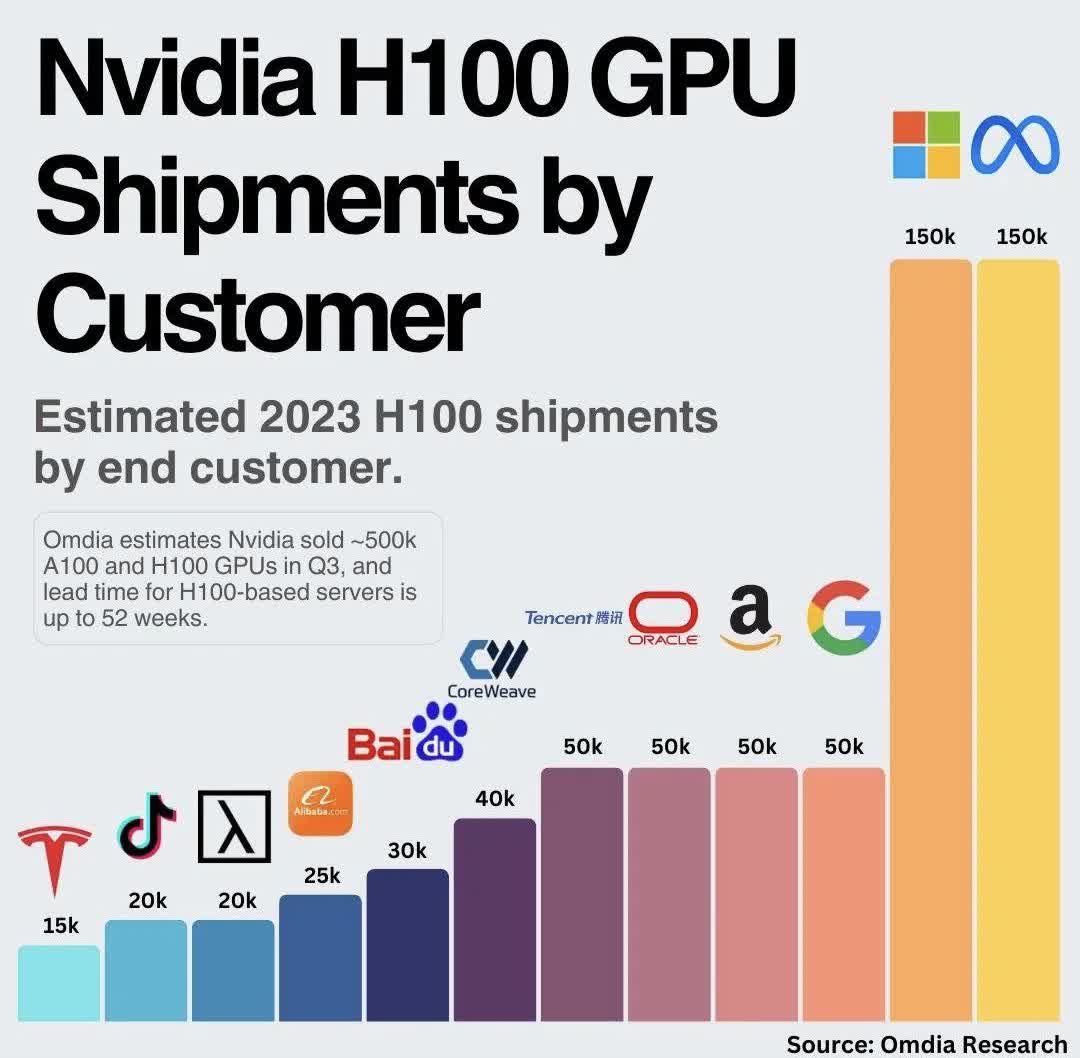

The company’s largest customers are Meta (META) and Microsoft (MSFT), which each bought ~150K H100s. That’s billions of dollars spent on the next generation GPUs. Oracle (ORCL), Tencent (OTCPK:TCEHY), Amazon (AMZN), and Google (GOOG) were the next four largest customers with roughly 50k units each. Putting this all together and the vast majority of Nvidia GPUs are sold to a handful of mega cap tech companies.

This is a concentrated risk because, as we discussed above, Nvidia needs to continue its growth in order to justify its valuation. If you have five customers driving your business, and you need 4x the revenue to justify your valuation and match the S&P 500, unless new mega cap tech companies show up with the same opinion, those customers need to order 4x as much.

Whether that happens remains to be seen.

Nvidia Wealthy Competition

Nvidia has incredibly wealthy competition, competitors that are well versed in the GPU industry. At the same time as these companies are buying Nvidia GPUs, they’d prefer not to pay Nvidia 75% margins and billions in profits and they have the assets to counteract that.

GPU Inference

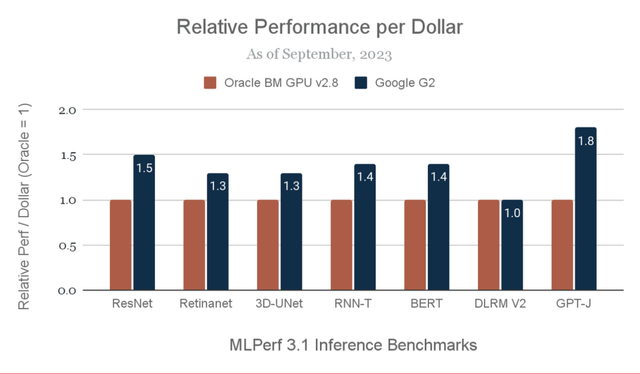

(Oracle bM GPU v2.8 instance uses a A100 vs Google G2 using a Google TPU)

There’s no denying that Nvidia has strong GPUs and a strong market it has built with CUDA. However, when your customers are massive, buying hundreds of thousands of GPUs, they have the ability to build their own GPUs. That’s exactly what Google has done with the TPUs, building them to a high enough quality that Apple (AAPL) used them for Apple Intelligence.

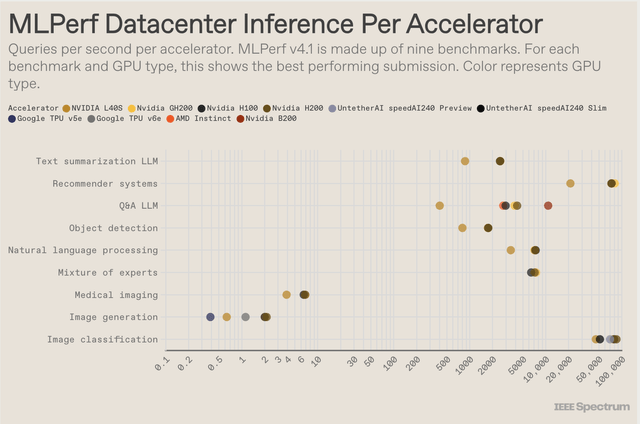

GPU Performance IEEE

Some benchmarks submitted with these TPUs are indicated in the chart above. Of course, Google benchmarks haven’t been universally submitted, but where the gray TPU v6e exists, i.e. for image generation, it’s worth noting it’s roughly half the speed of an Nvidia GPU. That might sound far behind, but at a 75% margin that means it’s cheaper for Google to use TPUs.

It’s worth noting that Google is also a leader in AI software, having created software such as Tensorflow. The company also operates its own cloud infrastructure, two moats that Nvidia doesn’t have, that could enable it to lift up TPUs. There are other risks from wealthy customers. For example, as we discussed above, Nvidia’s Blackwell is being released on TSMC’s n4p node.

Meanwhile, it’s already been five months since Apple introduced its M4 chip, on TSMCs 3nm node, not surprising given earlier rumors that Apple had booked out TSMC’s entire 3nm node. Nvidia can have cutting edge silicon but if it can’t afford to compete with companies like Apple for cutting edge nodes, it’s going to be starting 10% behind on performance, which is a big risk as competitors catch up.

Major customers Microsoft and Meta are also building their own AI accelerator chips. Microsoft recently had a standby on Nvidia attempting to have customers use its server racks, something that Nvidia backed down on. We expect this to continue.

Thesis Risk

The largest risk to our thesis is that Nvidia is currently producing the shovels in a global economy that’s being disrupted by mining. The largest companies in the world are chasing the company’s metaphorical shovels and willing to pay $10s of billions for them. As artificial intelligence grows that could enable Nvidia to outperform the market.

Our View

When we recommend against investing in Nvidia, we’re not saying that Nvidia isn’t a great company that hasn’t changed the face of the world, and we’re not saying that the company will fail to make money.

However, we’re saying that the company can’t just rest at its present size, and it needs to continue generating annual returns matching the S&P 500 to be worthy of an investment. That’s especially true given the concentration risk of such an investment. We see a number of catalysts that could hurt the company going forward.

(1) Lack of returns. Major financial analysts such as Goldman Sachs are saying the return for AI likely won’t justify the GPU cost, and we agree. LLMs are impressive but they aren’t true AI, and as that lack of returns become more clear we expect companies to cut investments.

(2) AI is expensive. ChatGPT is expected to spend more than $1 billion on GPT5. There’s only a handful of companies that can build these models and this explains the concentration of Nvidia’s customers.

(3) The side effect of 1/2 is that companies will look to cut Nvidia’s 75% margins, either through cutting orders without negotiations, as they question the costs. Even executives at Meta and Alphabet have admitted they might be spending too much but are concerned about being left out of the arms race. These companies are building their own silicon to save on costs as well.

Blackwell demand is high, which is expected, it’s a hefty benchmark improvement, and GPU demand remains high. However, Nvidia needs strong growth to justify its valuation and Blackwell can’t provide it forever. As the tech of customers catches up and they realized returns are lower than expected, Nvidia too will suffer making it a poor investment.

Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.