Summary:

- Blink faces challenges from slow charging infrastructure growth and strong competition, impacting EV adoption and its market position.

- Strategic acquisitions offer potential, but slow EV uptake and automaker hesitancy create uncertainty for Blink’s growth outlook.

- Investment risks and current valuation metrics suggest a Hold rating, with a target price of around $2.3-$2.4.

3alexd

Introduction

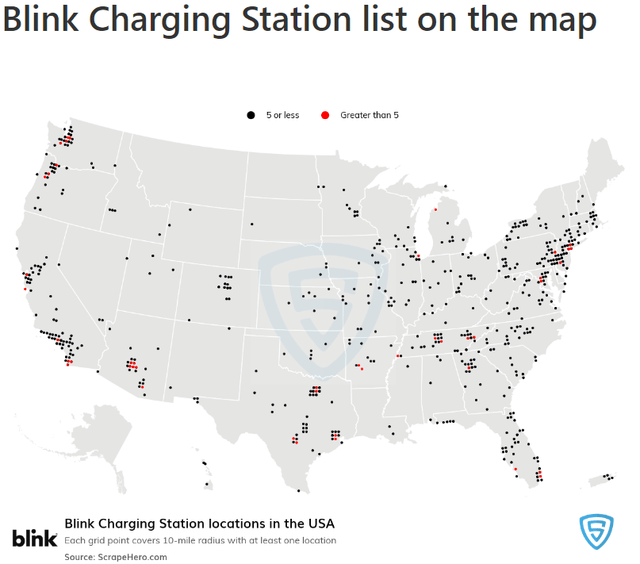

As one of the top charging station networks in terms of station size in operation, Blink Charging Co. (NASDAQ:BLNK) consistently develops charging products to accelerate the growth of EV usage. Blink currently owns 90,000 chargers globally, which is a significant player with strong growth potential given the rising carbon-free narrative and EV manufacturers.

Most importantly, the CEO, Brendan Jones, in the Q2 2024 announcement, affirms that the management is committed to positioning Blink for long-term growth and value to its shareholders. The company continues to lean towards advancing energy transition and expanding charging points globally through its continuous innovative charging technology.

However, the EV industry, on which the charging sector is dependent, is also facing a lot of problems, such as slower sales and problems with infrastructure. As such, in this analysis, we are going to dive into different risks for the company and think that it will continue to impact Blink for the next few years. Therefore, we rate Blink as a Hold.

Latest earnings update: Q2 2024

The company recorded a number of positives, but there were no key strong positives as the stock went bearish by 7.5% to $2.34 immediately after reporting Q2 2024.

Most of the analysts’ expectations fell short, with revenues recording $33.26 million over analysts’ forecast of $38.97 million, which is a miss of 14.6%.

EPS (non-GAAP) recorded -$0.18 over analysts’ forecast of -$0.13, which is a loss of $0.67 per share. Considering these Q2 2024 results, BLNK remains a solid business. The increase in operating margin shows the company is improving on efficiency, and it is strongly on its way to full recovery with the currency trading price. However, as the analysis title suggests, the company is still facing some difficulties in the industry.

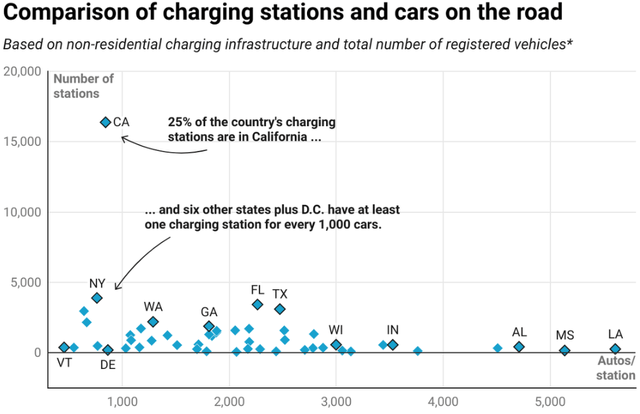

Unmatched supply of charging points with high EV sales

According to McKinsey research, EV sales exceeded ten million units in 2022 and increased by 50% from 2021. However, the increase in EV sales is not equally matched by the installation of private and public chargers. By 2022, the United States recorded 2.6 million charging ports, but the increase in EV sales every year creates an approximate demand of 9.5 million ports by 2025 and 28.0 million chargers by 2030. The demand for charger points continues to increase, but the charging ports are slowing consumer adoption due to convenience matters such as range and accessibility. Inconvenience is creating a reduced demand for EVs, whose ripple effect on Blink stocks is a decline in demand for charging stations.

Inconvenience created by uneven charging installations

Modesto Bee

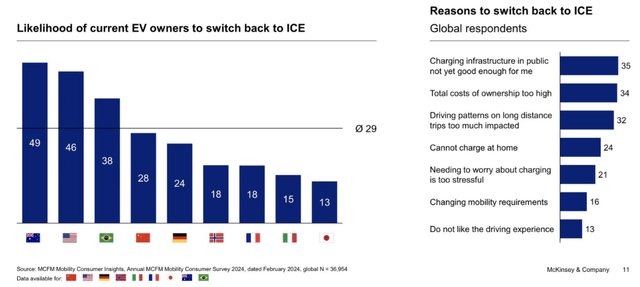

Therefore, slower consumer demand for EVs

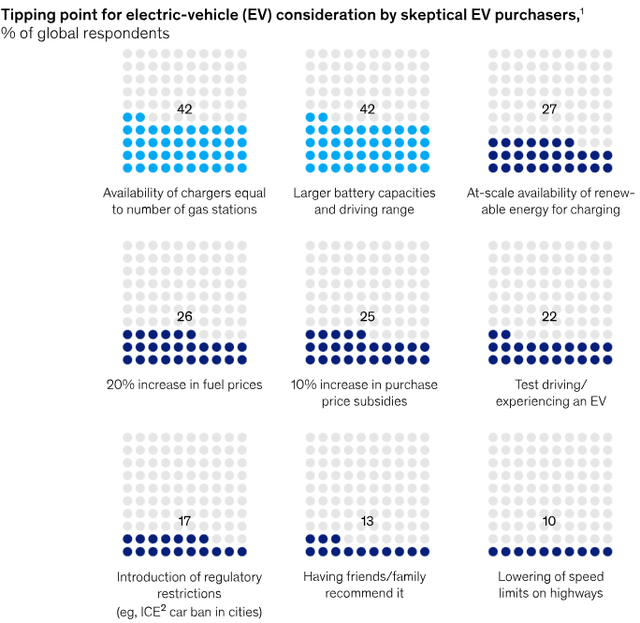

Charging providers such as Blink have failed to offer convenience in charger accessibility and range. Users of EVs do not experience a similar convenience as users of internal combustion engines (ICE). Consider the survey conducted by McKinsey, where respondents prefer buying an alternative traditional ICE car before transitioning to EVs. 40% of respondents consider charging ports the main hindrance to EV purchase as they are not equivalent to gas station installations. Therefore, the stability and growth of Blink chargers is pegged on the company’s ability to meet the customers’ expectation

29% of EV owners are actively shifting back to ICE because of port charging difficulties

Teslarati

Charging ports inconvenience driving consumers’ unwillingness to transition to EVs

Mckinsey

Ultimately, manufacturers scaling down production

There is a decrease in consumer demand due to inconvenient charging ports as the demand for EVs continues to decline. However, there is a forecasted increase in sales in the future. Auto manufacturers such as General Motors, Mercedes-Benz, Jaguar, Aston Martin, Land Rover, and Volkswagen have started to scale down and delay EV manufacturing plans. Even Tesla, the U.S. leader in EV manufacturing and charger points, through its CEO Elon Musk, announced plans to lower its growth rate. While this positively impacted Blink charging stock, it emerged as a deceleration of its usefulness in the long term.

EVHUB

Competitive landscape

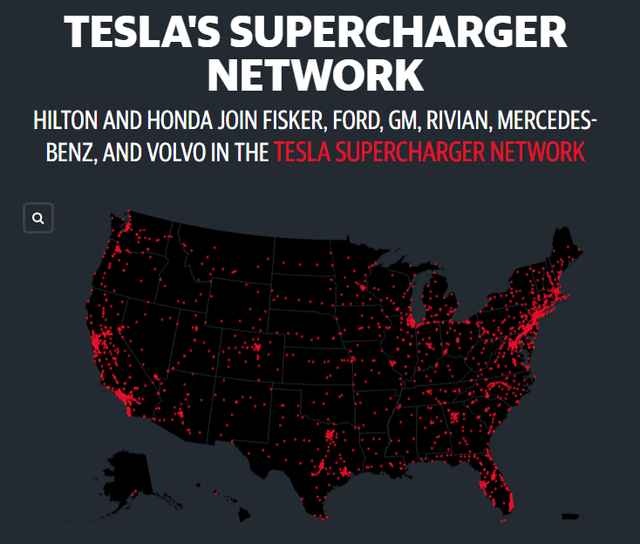

Admittedly, Blink is not the most competitive rival in the EV charging sector, in terms of coverage and speed of charging. Some competitors, such as Tesla Inc., are far ahead of Blink regarding efficient superchargers

Blink faces competition from its peers, such as Tesla, whose CEO, Elon Musk, announced its intention to invest $500 million in new superchargers. Tesla, Inc. (TSLA) is a strong competitor to Blink’s business because it can produce the most efficient and fast charging points.

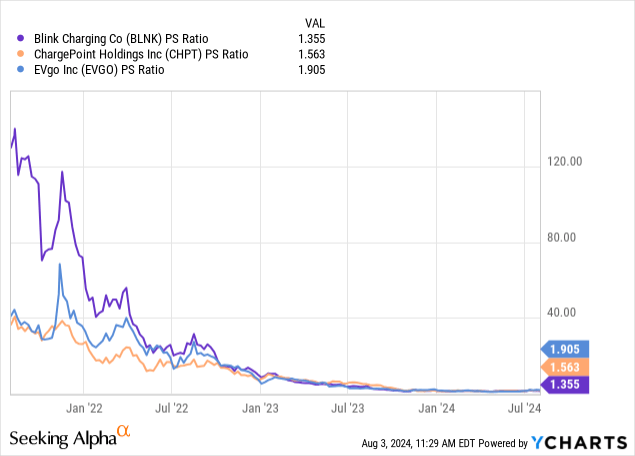

ChargePoint Holdings, Inc. (CHPT) is also a notable competitor of Blink, with a market capitalization of $1.79 billion compared with Blink’s $190 million. Despite Blink Charging’s size, it still faces competition from Tesla’s Supercharger network, which is compatible with multiple EV automakers. On the other hand, EVgo, Inc. (EVGO) has the edge over Blink Charging in fast charging capability.

Blink’s competitive edge is in 60kW—360kW D.C. fast chargers designed as an all-in-one charging point for serviceability and speed. However, in June 2023, Blink announced its intent to make 240 kW Fast Chargers accessible to most users of Blink chargers. This reveals that Blink is facing unfavorable competition in the market.

BLNK’s future strategic positioning

Blink is increasing investor confidence following its strategic decision to acquire SemaConnect, an EV infrastructure company that manufactures EV charging infrastructure in Maryland. In scaling its network, Blink is now manufacturing, owning, and operating its charging points, a positive indicator for investors.

Implications of owning network operation instead of selling

Blink has attained a vantage point in acquiring SemaConnet, which is its research and development while manufacturing and operating its EV chargers. This is an opportunity for Blink to accelerate and fully control its supply chain to speed up EV adoption. This is a strategic plan to scale the production of 50,000 chargers yearly from the current production of 10,000 EV chargers at reduced costs. With the Q2 2024 announcement, the Blink report on charging points sold, deployed, and contracted to be 4,106, indicating a risk of failing to achieve its forecasted 50,000 charging points per year.

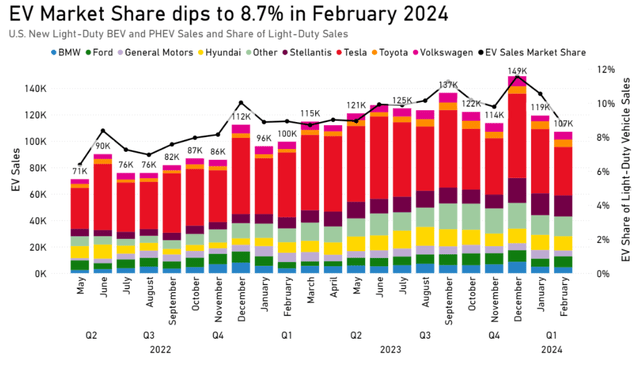

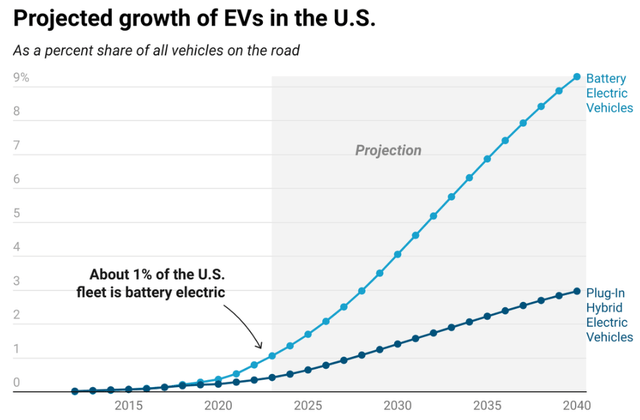

Future demand for charging ports

The transition towards electric mobility is gaining a slow momentum, with minimal research on how battery-powered vehicles will overtake ICE convenience. The projection of EV sends a warning to Blink investors with 1% EV on U.S. roads and expected 9% by 2040. This is an indication that Blink charging investors may not realize profits any time soon. With the Q2 2024 announcement, the Blink report on charging points sold, deployed, and contracted to be 4,106, indicating a risk of failing to achieve its forecasted 50,000 charging points per year.

Motointegrator

When investing in Blink, investors should observe key events going forward, such as a significant increase in charging infrastructure. With 4,106 charging point installations, this is an opportunity for Investors to earn more. Installations of significant charging points and reduction of costs will position Blink towards steady growth in the EV transition.

Valuation

In terms of valuation multiples, its listed peers all share similar ratios and trends – P/S ratio bottomed at the range of 1.5 – 1.6x. I forecast that the ratio will not change substantially and will remain at a similar level since the sector is going to be troubled by the EV / ICE car debate and trend in the next 2 – 3 years, especially since the economy is in a downtrend and EVs are generally more expensive.

Despite Blink growing its revenues by 130% in 2023, at $140.6 million, the company’s stock is still at record lows. Blink stock reacts to myriad events, among them declining product sales during cold weather when EV use is low and over-reliance on certain product revenue. The consensus revenue growth in the next 3 years is generally at 20%, which translates into around $170 million and $200 million in revenue in 2024 and 2025 respectively.

Therefore, the target price based on the comparable multiple and revenue forecast for 2024 is around the $2.3 – $2.4 range, which is a Hold for me.

Investment risks

- Intense competition: The EV charging points face competition from alternative fuels, rapidly evolving chargers, ever-changing technologies, and new entrants. These competitions threaten Blinks’ stock performance. Therefore, Blink will have to conduct more research and development on charging technology.

- Technological and regulatory revolution: Developments such as Tesla’s fast charging technology pose a significant risk to Blink charging points. The most innovative technologies could replace the current charging solutions, rendering Blink charging points obsolete. Also, the government is evolving regulations to maintain industry standards.

- Demand dependence on the EV industry: The demand for EV cars sold determines the charging point performance. This means that overreliance on the EV market poses a significant risk to investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.