Summary:

- Blink Charging’s stock price has dropped by 64% YTD, reflecting the overall poor performance of the electric vehicle market this year.

- Its latest update however reflects robust growth of 154% YoY for 9M 2023, its revenue targets have also been upgraded.

- Its non-GAAP losses have narrowed and it aims to achieve a positive adjusted EBITDA run rate by the end of 2024 as well.

- But the path to profitability is a wait and watch, and in the meantime, the stock appears fairly valued.

PhonlamaiPhoto

EV charging solutions provider Blink Charging (NASDAQ:BLNK) has had a really bad year in the stock market, with its share price down by 64% year-to-date [YTD]. To be fair, electric vehicles [EV] as such haven’t done well either.

The S&P Kensho Electric Vehicles index, which measures the stock market performance of companies in the ecosystem, has dropped by 19% YTD. This compares unfavourably with the 17.5% rise in the S&P 500 (SP500) index during this time. But BLNK’s performance is far worse than that of even the EV index.

After its recent third quarter (Q3 2023) and nine-month (9M 2023) results last week, here I take a closer look at whether there’s now an opportunity for an uptick in the stock.

Sustained revenue growth

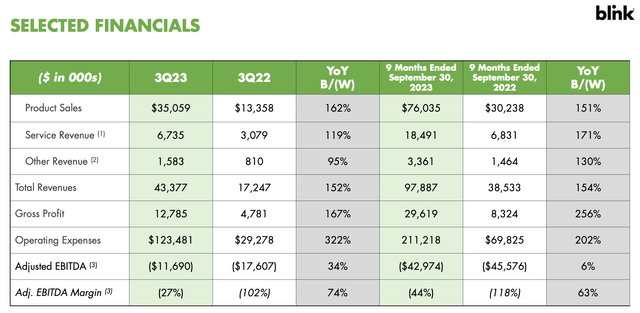

In line with fast growing EV demand, Blink Charging has seen a robust compounded annual growth rate [CAGR] of 90.2% over the past decade. Its recent results continue to reinforce its position as a bonafide growth stock. It grew by 154% year-on-year (YoY) for 9M 2023 and showed a sustained rise in the third quarter (Q3 2023) as well (see table below).

Source: Blink Charging

Much of this revenue growth comes from product sales, which have a 78% share in revenue as of 9M 2023. Product sales have seen a 151% increase, with the remaining coming from (1) service revenues, obtained from charging services revenues, network fees and ride sharing and (2) other revenue that includes warranties. Both categories have also seen sustained growth (see table above).

Margins largely strong

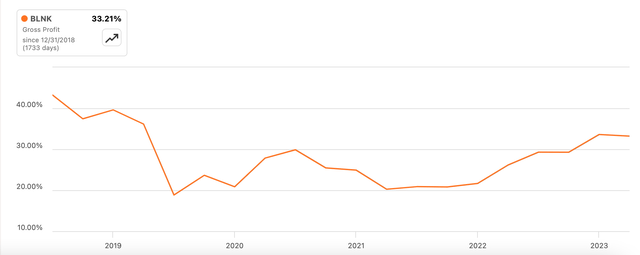

At 30.5% for 9M 2023, the gross margin is robust, though the number is softened for Q3 2023, coming in at 27.7%. I wouldn’t be too concerned with the correction in the latest quarter, though, looking at it in context.

First, the numbers for 2023 so far and also the latest quarter are ahead of the 24.2% margin for the full year 2022. In any case, Blink has a history of fluctuating margins (see chart below) and the figure for 9M 2023 is also higher than the five-year average of 28.4%.

Gross Margin (Source: Seeking Alpha)

Next, consider the margin compared to peers. Its closest peer, ChargePoint (CHPT) has a trailing twelve months [TTM] margin of 15.6%. Tesla (TSLA), which isn’t the perfect comparison but it is the biggest company in the EV ecosystem and also has interests in charging services, has a much lower TTM gross margin of 19.8% as well. These compare with a 33.2% TTM margin for Blink Charging.

Shrinking non-GAAP losses

There are also positive developments in the non-GAAP profit measures. The adjusted EBITDA loss has also improved after nearly doubling in 2022. For 9M 2023, the number came in at ~USD 43 million (9M 2022: USD 45.6 million). The trend is also visible for Q3 2023, for which the figure is at USD 11.7 million (Q3 2022: USD 17.6 million). The adjusted loss per share [EPS] also narrowed to USD 1.15 for 9M 2023 (9M 2022: USD 1.23, full year 2022: USD 1.65).

The non-GAAP figures are particularly encouraging in the context of ballooning in the GAAP operating and net losses for 9M 2023 by almost 3x YoY because of an impairment charge of USD 94.2 million. If it weren’t for the charge, both the operating and net losses would have still risen by ~45%, but that’s still a much lower increase than the present one.

Positive outlook

Even more encouragingly, as far as non-GAAP measures go, the company now targets a positive adjusted EBITDA run rate by the end of 2024. In other words, it’s getting closer to profitability, which has eluded it so far despite robust revenue growth.

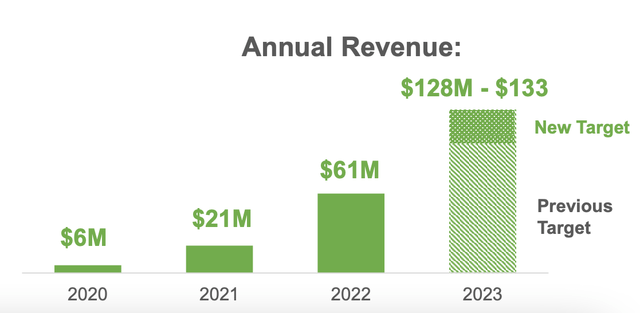

Further, it has also upgraded its revenue expectations from USD 110-120 million to USD 128-133 million for the full year 2023. At the midpoint of the revised range, the forecast translates into almost 114% growth compared to the initial expectation of an 88.5% increase. The rise expected for the full year is of course a softening from that seen so far this year, but it’s still higher than the past 10 years’ CAGR and in itself, it’s continued strong growth.

Revenue targets (Source: Blink Charging)

The question of liquidity

The company isn’t without its challenges, though. Having grown inorganically over time, the company’s cash position has widely been seen as a cause for concern. Its debt is low, with a debt-to-assets ratio of just 4.5%, but this is at the cost of its liquidity.

Its position is improving though, with cash and equivalents of USD 66.7 million at the end of Q3 2023, an 82% YoY increase. However, it has some way to go. With a cash burn of USD 17 million in the quarter, the company has enough cash for just four quarters.

The market multiples

The market multiples also indicate that it’s fairly valued. After the latest results, BLNK’s TTM price-to-sales (P/S) is at 1.71x, which is slightly ahead of that for CHPT at 1.68x, indicating that there’s really no upside to the stock. Similarly, the forward P/S at 1.58x is also fairly valued compared with CHPT’s forward P/S, also at 1.58x.

It’s worth noting though, that both the TTM and forward P/S ratios have corrected significantly from the past five years of 57.57x and 47.94x respectively. Normally, I’d consider the historical averages when determining the fair value of a stock. However, the EV industry is a special case, which has rallied on prospects that are indeed reflected to some extent in the financials but there’s far more maturity warranted right now. Until then, it’s better to compare the stock to peers than the past performance.

What next?

The Blink Charging story shows that while there are definite positives here, challenges persist too. The company’s fast growth, good gross margins, upgraded revenue forecasts and adjusted EBITDA profitability target, all go in its favour. However, its cash position is a concern and its market multiples indicate that it’s fairly valued for now.

I think the next key impetus for Blink can come in the form of adjusted EBITDA profits, which are expected soon enough. Until then I’d keep it on the investing watchlist and go with a Hold rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—