Summary:

- Blink Charging Co. fails to impress with 2024 targets, highlighting struggles in the EV charging station sector.

- The company has limited service revenues and a reliance on volatile product revenue, with limited gross margins hindering growth.

- The stock isn’t appealing with the constant share dilution and lack of revenue growth going forward.

Laser1987

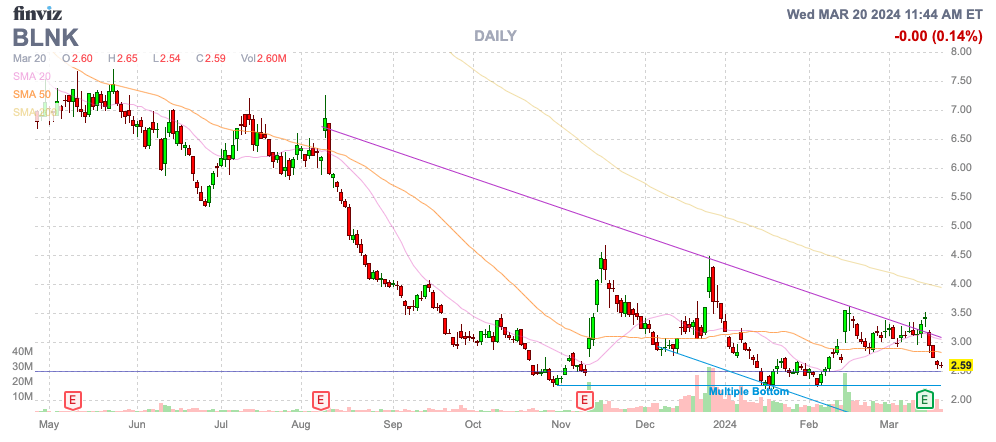

Just as the market was buying into the turnaround story for Blink Charging Co. (NASDAQ:BLNK), the EV charging station company failed to impress with 2024 targets. The whole sector has struggled to make the business models work and Blink Charging reinforced this issue again. My investment thesis remains Neutral on the stock, with the previous shift in the business not strong enough to warrant a Buy rating.

Source: Finviz

Limited Services Business

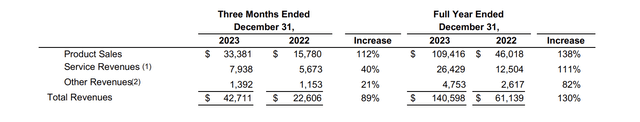

With a new CEO in place, Blink Charging made a remarkable turnaround in 2023. The EV charging station company grew revenues by 130% in the year to reach $140.6 million.

Unfortunately, the company ended the year on a sour note and the stock is back to the recent lows. Blink Charging ran into the same issue hitting all of the charging station stocks. The business is too reliant on volatile Product revenue with limited gross margins.

Source: Blink Charging Q4’23 earnings release

Service revenues only hit $7.9 million, though up 40% from $5.7 million last Q4. Total revenues for the quarter were only $42.7 million, down from $43.4 million in the prior quarter.

The company faces seasonality like any industry with holiday Product sales reduced and less EV driving during cold weather. Despite the dynamic industry with new EVs hitting the road each day, Blink Charging is no longer growing revenues.

The issue is that the company only produced a Q4 ’23 gross profit of $10.6 million. Blink Charging even cut the operating expenses to only $28.7 million, but the company still has a large operating loss, while revenue growth has stalled. This leaves a huge gap to resolve in 2024 without the benefit of much in the way of revenue growth.

The crazy part is that the adjusted EBITDA loss was mostly flat YoY at $14 million. The company nearly doubled revenues YoY in Q4 without any improvement to the loss picture.

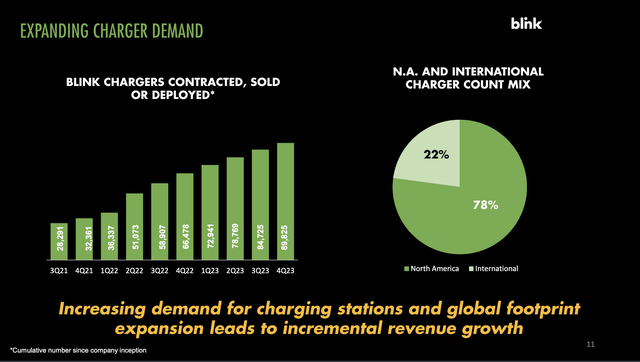

Blink Charging had demand for 5,100 chargers in the quarter with 23,347 chargers deployed or sold for 2023. The company has now sold or deployed nearly 90,000 EV chargers, yet the Service revenues are only hitting $7 million per quarter.

Source: Blink Charging Q4’23 presentation

Mackenzie apparently projects the U.S. needs 28 million chargers, 7x the 4 million installed today. The problem is that Blink Charging needs more than 25% CAGR through 20230 in order to generate a positive return for shareholders, especially considering the majority of EV chargers are forecast to be Level 2 chargers for homes. The whole industry made a vast mistake of not turning EV chargers into a profit machine due to these companies not really participating in the revenue split from actual charging, mostly done at home.

Growth Stalled

The market has constantly been told that EV charging station demand is off the charts with the need for millions of new chargers. Yet, Blink Charging and other EV charging station companies outside of Tesla (TSLA) SuperChargers regularly struggle to generate material revenues on services and software that include fees for customers using the chargers.

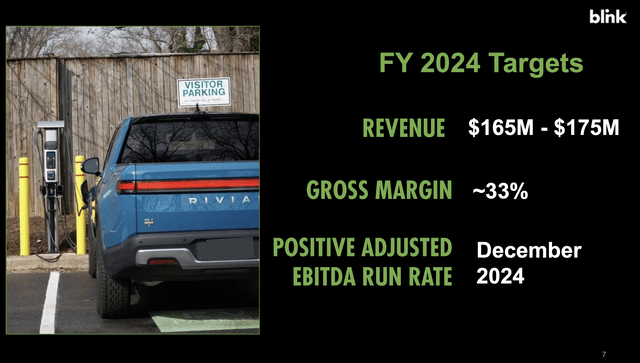

Blink Charging ended 2023 with 2H revenues of $86 million, yet the company only guided to 2024 revenues of $165 to $175 million. The stock market was already slapped with flat revenues during Q4, and the guidance for 2024 suggests sequential growth flatlines all year from the currently annual run rate of around $170 million.

Source: Blink Charging Q4’23 presentation

All of the positive goodwill generated by the new CEO during 2023 just evaporated. Blink Charging is back in the penalty box with limited margin of safety, while the company spent the Q4 ’23 earnings call promoting revenue growth in 2024, though the YoY focus doesn’t really address all the financials improving sequentially.

The guidance for 2024 offers up revenues flat with the 2H. All of the revenue growth is effectively due to the 1H’23 quarterly revenues averaging just $22 million before Blink Charging elevated sales to another level and growth stalled again.

Even worse, the company sold 30.9 million shares via the ATM in 2024 to raise $114 million with $88 million worth during Q4 ’23 and another 8.2 million shares for $25 million though February 12 of this year. Management suggested the shares were sold under favorable market conditions, though the average price was in the $3s with.

Blink Charging ended the year with a cash balance of $122 million and raised enough money in Q1 ’24 already to cover cash burn for the quarter. The issue is going forward and whether the company can indeed reach adjusted EBITDA profitable in December to cut off the cash burn considering the general view echoed on the earnings call appears too bullish on the current EV market.

The company reported an average Q4 diluted share count of 63 million with a diluted share count for Q1 of closer to 100 million. The stock has a market cap of just $260 million, at the current price.

Takeaway

The key investor takeaway is that the market wasn’t impressed with Blink Charging Co. guidance for only 20% growth in 2024. The target only amounts to roughly flat sales for the year with the 2H’23 numbers. Blink Charging just vastly diluted shareholders by raising $113 million in new equity when the stock price was relatively cheap and the guidance for reaching adjusted EBITDA positive in December doesn’t even appear logical with the limited sequential growth forecasted this year.

Investors should continue to watch Blink Charging from the sidelines with limited Services revenues to drive the business towards a profitable future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.