Summary:

- Blink’s business model of selling charging hardware as well as operating its own charging network will allow it to benefit the most from a potential EV demand rebound this year.

- I expect EV demand to reaccelerate this year due to EV tax rebates being offered at the point of sale and NEVI installs picking up this year.

- Return-to-office policies will increase demand for EV charging stations to accommodate returning employees.

- Blink’s prudent cost management since Brendan Jones’ promotion to CEO could help it reach profitability in 2025.

- I believe Blink Charging stock is undervalued at current levels with a price target of $4.6.

Laser1987

2023 hasn’t been kind to EV charging stocks as waning EV demand caused equities in this sector to falter in 2023 as well as the first 2 months of 2024. One of those stocks is Blink Charging Co. (NASDAQ:BLNK) which has seen its shares decline 70% in 2023 and is currently 3.6% down YTD. That said, I believe Blink is fundamentally undervalued at its current share price as I expect it to benefit from a surge in EV charging demand this year for reasons that I’ll explain throughout this article.

Although the expected improvement in the EV industry’s outlook will benefit all charging companies, I believe Blink is the best stock in this sphere given its improving financial performance since promoting Brendan Jones to CEO in May last year. In fact, I expect Blink to reach profitability earlier than its peers ChargePoint Holdings, Inc. (CHPT) and EVgo, Inc. (EVGO), which is why I’m rating it as a buy with a price target of $4.6 per share.

Company Overview

Blink is an EV charging company that manufactures, owns, operates, and provides EV charging equipment and services. This means that Blink has multiple revenue streams since it sells the charging equipment, which is a low-margin business, in a similar fashion to ChargePoint, while also operating its own charging networks, a higher margin business, similar to EVGO. As such, the company combines both worlds, which makes its future outlook extremely bullish in my opinion as EV demand may be poised to reaccelerate in the US this year.

New Policy Will Boost EV Demand

On January 1st, 2024, EV tax rebates became at the point of sale as cash, a price discount, or a down payment. This means that all eligible EV buyers would get an upfront discount of up to $7500 for new EVs and $4000 for used EVs. In simple terms, a $60 thousand new EV immediately becomes $52,500 under the new policy.

In my opinion, this policy change is a game changer since, under the old policy, consumers had to wait until filing their annual tax returns during tax season to receive the tax credit. Therefore, the policy change makes the tax break easier to claim and more accessible to consumers in addition to making EVs cheaper for them. As such, a major concern for car buyers is solved, since according to the 2023 Deloitte Automotive Consumer Study, EVs’ cost was the most cited concern for 52% of new car buyers in the US.

NEVI Installs are a Major Tailwind

Another concern for potential EV buyers is charging infrastructure. A study conducted by Cox Automotive last June found that 32% of consumers who were considering an EV cited a lack of charging stations in their area as a barrier to purchase. Another study conducted by the Energy Policy Institute at the University of Chicago and the Associated Press-NORC Center for Public Affairs Research in April 2023, found that 47% of US adults are unlikely to buy an EV as their next car, with 80% citing a lack of charging stations as a factor.

With charging infrastructure clearly a major obstacle in increasing EV adoption, the ramp-up in opening EV charging stations funded by the NEVI Program comes at a perfect time to stimulate EV demand. While it’s been reported that no charging stations were constructed under the program in early December 2023, according to Associated Builders and Contractors, the first out of more than 500 thousand charging stations funded through the program opened outside Columbus, Ohio in mid-December.

Since then, the opening of new stations has ramped up significantly as the latest NEVI progress update stated that 33 states have released solicitations for the NEVI program, 16 of which are already awarding contracts and installing charging stations. In fact, 2 additional stations were opened in New York and Pennsylvania.

Although NEVI installs are still in their early stages, I expect more stations will open this year, especially as we approach the upcoming presidential election in November. This is a major catalyst for Blink since it is eligible to receive funding under the program. In fact, Blink is already in talks with officials at the DoE, DoT, and state departments of transportation who oversee their state’s NEVI program.

The advantage of this to Blink is that the program prioritizes having DC chargers along the highway corridors since they can charge a car over 80% in less than 45 minutes. However, the convenience of fast chargers comes at a cost since DC charging is 7-10 times more expensive than AC charging with the same performance.

Considering Blink’s business model, the company would be operating any charging stations it opens under the NEVI program, which would lead its service revenues, which have high margins, to increase substantially. As such, Blink would come closer to becoming profitable considering the improvements in its operating costs since Brendan Jones became CEO.

Although Blink is better known for its AC chargers, it’s already increasing its DC charging stations and was even awarded a $12.5 million grant to place 52 fast chargers along key highway corridors in Florida. With that in mind, Blink had 1,435 DC chargers contracted by the end of Q3 2023, a 45% sequential increase from 987 and a 378% increase compared to 300 in Q1 2023.

Return to Office Will Stimulate Charging Demand

Aside from DC chargers, it’s worth noting that AC chargers represent the bigger opportunity in the EV charging scene given that 80% to 90% of charging occurs overnight at home or during the day at work according to DoE estimates. Based on this, the anticipated implementation of return-to-office policies by most companies should stimulate demand for EV charging infrastructure. A survey conducted by Resume Builder found that 9 out of 10 companies with office space will have employees return to the office by the end of 2024.

The sheer amount of companies returning to office should lead to a spike in demand for EV charging equipment. This would be beneficial to both ChargePoint and Blink considering they are the 2 largest sellers of EV chargers. As is, a study conducted by ChargePoint found that 69% of EV drivers charge their vehicles at work, which highlights the significance of return-to-office policies for the EV charging sector.

A Clear Path to Profitability

Having discussed the potential tailwinds that could boost EV charging demand this year, I believe Blink is the more attractive stock in that industry compared to its peers ChargePoint and EVgo. This is mainly due to Blink’s superior margins and cost structure.

Since Q1 2022, Blink has had better gross margins compared to its peers as shown in the table below. It is worth noting that ChargePoint’s gross margins for Q2 and Q3 2023 exclude non-cash impairment charges of $28 million and $42 million respectively.

|

Gross Margin |

|||

|

Quarter |

BLNK |

CHPT |

EVGO |

|

Q1 22 |

16.18% |

14.83% |

-7.79% |

|

Q2 22 |

17.04% |

16.76% |

-8.20% |

|

Q3 22 |

27.72% |

18.10% |

-30.53% |

|

Q4 22 |

28.66% |

21.59% |

-4.03% |

|

Q1 23 |

20.97% |

23.48% |

0.16% |

|

Q2 23 |

37.42% |

19.35% |

10.94% |

|

Q3 23 |

29.47% |

16.37% |

1.72% |

*Author compilation from each company’s quarterly filings.

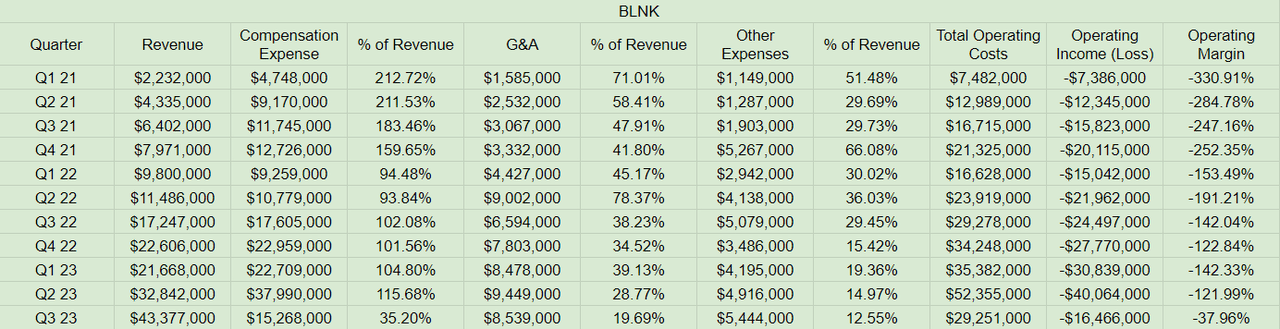

The reason why Blink boasts superior margins compared to its peers is a main result of its business model since it sells the charging hardware and operates its own charging network which mainly features AC charging stations. As a result, the high margins of the service business offset the low margins of the hardware business. The discrepancy in the margins of both segments can be shown in the following graph.

Blink’s Quarterly Filings

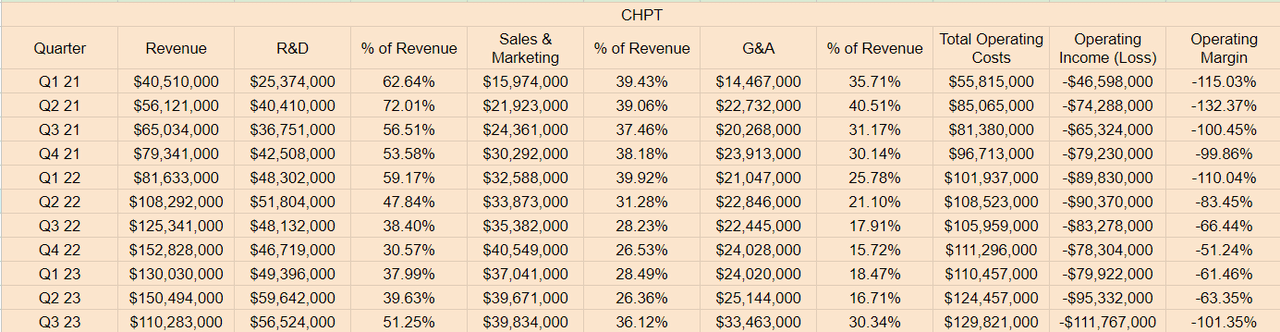

In comparison, ChargePoint sells charging equipment and generates additional revenues from the maintenance of the equipment. However, when looking at the margins of the hardware segments of both companies, Blink has substantially higher-margins as shown in the table below.

|

Hardware Gross Margin |

||

|

Quarter |

BLNK |

CHPT |

|

Q1 21 |

33.09% |

11.41% |

|

Q2 21 |

27.61% |

13.43% |

|

Q3 21 |

24.71% |

18.50% |

|

Q4 21 |

20.34% |

15.68% |

|

Q1 22 |

24.94% |

5.52% |

|

Q2 22 |

27.85% |

11.64% |

|

Q3 22 |

35.15% |

12.06% |

|

Q4 22 |

34.40% |

16.47% |

|

Q1 23 |

28.42% |

17.70% |

|

Q2 23 |

46.48% |

13.63% |

|

Q3 23 |

29.78% |

8.72% |

*Author compilation from each company’s quarterly filings.

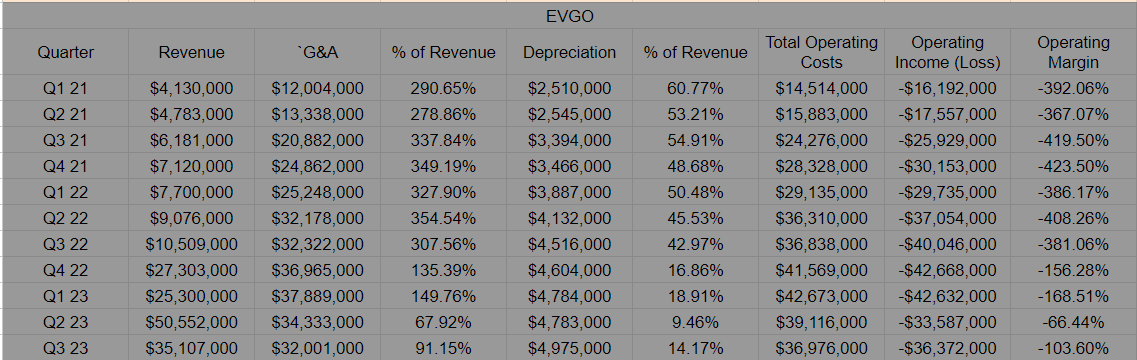

Blink’s business model also provides it with an edge over EVgo since the majority of its charging stations are AC stations, while EVgo’s network is exclusive to DC chargers. This edge is mainly due to DC chargers having higher installation and grid connection costs than their AC counterparts since they deliver more power to EVs, which requires more power from the grid. As such, Blink’s service segment has substantially higher margins than EVgo as shown in the table below.

|

Service Gross Margin |

||

|

Quarter |

BLNK |

EVGO |

|

Q1 21 |

72.53% |

-40.63% |

|

Q2 21 |

89.76% |

-35.00% |

|

Q3 21 |

77.97% |

-26.74% |

|

Q4 21 |

69.51% |

-25.63% |

|

Q1 22 |

52.76% |

-7.79% |

|

Q2 22 |

76.51% |

-8.20% |

|

Q3 22 |

81.29% |

-30.53% |

|

Q4 22 |

88.14% |

-4.03% |

|

Q1 23 |

69.25% |

0.16% |

|

Q2 23 |

82.99% |

10.94% |

|

Q3 23 |

85.33% |

1.72% |

*Author compilation from each company’s quarterly filings.

In my opinion, Blink’s solid margins could enable it to reach profitability earlier than its peers if its cost structure remains similar to Q3 2023. During that quarter, Blink’s operating expenses were flat YoY at $29.2 million, excluding a $94.2 million non-cash impairment charge, leading to a 17% YoY improvement in adjusted EBITDA. With that in mind, Blink’s management shared in the Q3 earnings call that they expect this trend to continue with more sales volume that would lead to better margins as well as realizing more cost savings through the improvement plan.

Given management’s forecast of reaching a positive adjusted EBITDA run rate by December 2024 in the Q3 earnings call, I expect Blink to reach profitability in 2025, especially if it’s selected to install stations under the NEVI program. I believe that is the case since the company showed impressive control over its operating costs in Q3 2023.

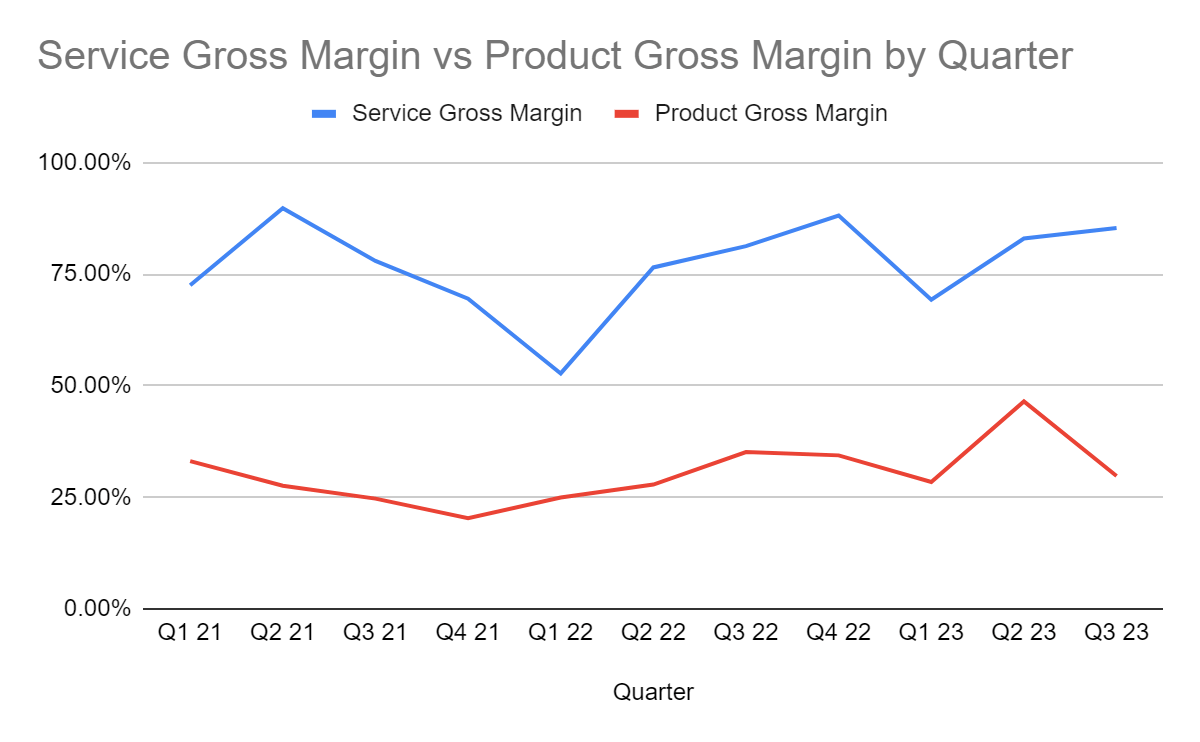

Blink’s operating margin during that quarter was -38% compared to -101.35% for ChargePoint and -103.60% for EVgo. This was a direct result of the company reducing its costs as a percentage of revenue as shown in the following table.

Meanwhile, ChargePoint and EVgo’s operating costs have been increasing as a percentage of revenue, which is problematic for ChargePoint specifically considering its declining sales.

ChargePoint’s Quarterly Filings EVgo’s Quarterly Filings

Valuation

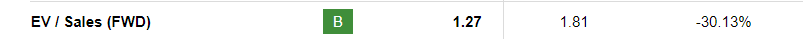

From a valuation standpoint, I believe Blink is undervalued at current levels considering the aforementioned EV charging tailwinds and its path to profitability. Currently, the company is trading at a forward EV/sales multiple of 1.27, lower than its peers ChargePoint at 1.58 and EVgo at 5.07. Blink’s EV/sales multiple is also lower than the sector median of 1.81, indicating a 30.13% undervaluation. Based on this, my price target for Blink is $4.6, representing a 42.4% upside from the current share price of $3.23.

Seeking Alpha

Risks

The biggest risk to my bullish thesis on Blink is dilution. Over the years, Blink has resorted to dilutive capital raises to fund its operations as it’s yet to reach profitability. This has caused significant dilution to shareholders as shown in the following table.

|

Quarter |

Outstanding Shares |

|

Q1 21 |

41,984,060 |

|

Q2 21 |

42,159,202 |

|

Q3 21 |

42,200,051 |

|

Q4 21 |

42,435,689 |

|

Q1 22 |

42,741,387 |

|

Q2 22 |

50,843,466 |

|

Q3 22 |

50,864,965 |

|

Q4 22 |

60,364,508 |

|

Q1 23 |

61,170,166 |

|

Q2 23 |

63,991,314 |

|

Q3 23 |

67,407,973 |

*Author compilation from quarterly filings.

With that in mind, Blink has an ongoing at-the-market offering where it can issue and sell up to $250 million. As of the end of Q3 2023, the company sold more than 6 million shares under the program representing gross proceeds of $36.5 million, per the Q3 report. As such, the company may raise an additional $213.4 million which would be equivalent to nearly 66.1 million new shares at the current share price of $3.23. This means that if Blink raises the maximum amount under the ATM program, its outstanding shares would nearly double.

Conclusion

In summary, I expect demand for EV charging infrastructure to increase this year due to EV tax rebates becoming available at the point of sale, the ramp-up in NEVI installs, and return-to-office policies. That said, I’m especially bullish on Blink given its impressive margins and cost structure, which gives it a clear path to profitability in 2025 in my opinion. As such, I’m rating Blink as a buy with a price target of $4.6, representing a 42.4% upside from current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.