Summary:

- Charging solutions provider Blink Charging’s declining stock price is explained by not just a weak EV industry trend but also by its own disappointing performance.

- Its revenue growth has dwindled to almost nothing in Q2 2024 and the outlook for 2024 has been downgraded too.

- While EV sales growth is expected to be healthy in the future, it’s best to wait and watch how BLNK performs over the next quarters before considering buying the stock.

Monty Rakusen

When I last wrote about the EV charging solutions provider Blink Charging (NASDAQ:BLNK) in May, I had anticipated an upgrade in the company’s revenue projections for 2024. I couldn’t have been more wrong.

The company’s numbers took a nosedive in the second quarter (Q2 2024) earlier this month, prompting a downgrade in the outlook for the year. Here, however, I explore whether there are any redeeming factors for the company for the remainder of the year and beyond based on the following:

- The details of its latest financials and outlook.

- The EV industry outlook and its competition.

Revenue: Outlook Downgrade on Weak Trend

As per Blink Charging’s latest guidance, it now expects revenues to fall in the range of USD 145-155 million for the full year 2024. This is a ~12% reduction at the midpoint from the earlier projected range of USD 165-175 million. It’s some comfort that revenues are still expected to grow. But the extent is a far smaller 6.7% at the midpoint of the guidance range, compared to an expected 20.9% rise seen earlier.

Sharp revenue growth contraction in Q2 2024

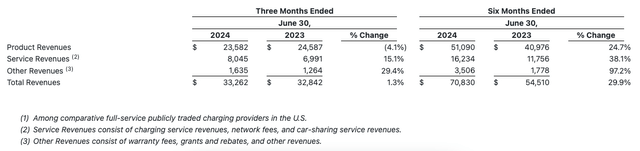

The guidance reduction follows exceptionally weak revenue performance in Q2 2024, which saw just 1.3% year-on-year (YoY) increase. The growth figure is small even on its own, but it’s ever more glaringly so when seen in perspective.

A year ago, in Q2 2023, revenues had risen by a massive 186% YoY. It would be tempting to chalk up the latest softening to a high base effect, but that’s not a convincing explanation. The company had seen robust growth in Q2 2023 even though revenues rose by almost 164% YoY in Q1 2022.

Further, even more recently, in Q1 2024, growth had been far healthier at 73.4% YoY. This even brings up the figure for the first six months of 2024 (H1 2024), to a far healthier 30% YoY.

Product revenues are worst affected

Product revenues, which are the biggest contributor, accounting for 72% of the total in H1 2024, were the worst impacted in the latest quarter. They saw a 4.1% YoY contraction in Q2 2024, dragging down overall growth even as the other segments saw double-digit growth. Even then, it’s worth noting that services and other revenues have also seen a growth come-off in Q2 2024. This is evident from the table below, which shows that their growth is much softer in the latest quarter compared to H1 2024.

Revenue expected to weaken further in H2 2024

The company ascribes the latest revenue decline to “the general short-term softening of EV demand”. Presumably, this is a lagged impact of weak EV sales in Q1 2024, when the number rose by just 2.6% YoY in the US before seeing some bounce back with an 11.3% YoY increase in Q2 2024.

But here’s the rub. Going by the latest guidance, the company doesn’t expect any growth improvements in H2 2024. On the contrary, assuming that the revenue comes in at the midpoint of the guidance, it will see an 8.1% YoY contraction during this time. This is a huge disappointment after the company saw a massive compounded annual growth rate [CAGR] in revenues of 124.4% over the past five years.

Profits: Mixed trends and outlook

With market weakness underway, Blink Charging has also moved its expectations for adjusted EBITDA profitability to 2025 now, from 2024 earlier. This follows an 8.9% YoY increase in adjusted EBITDA loss to USD 14.7 million, after it saw an encouraging 43% YoY contraction in loss in Q1 2024.

It’s some solace, though, that the company continues to expect the gross margin to come in at 33%, sustaining its earlier projections and the expectation of some improvement over the 31.6% level seen in 2023. This gross profit though has declined by 13% YoY in Q2 2024, in line with the softening in revenues, which isn’t a good sign considering that it has already moved the expectation of adjusted EBITDA profits to next year.

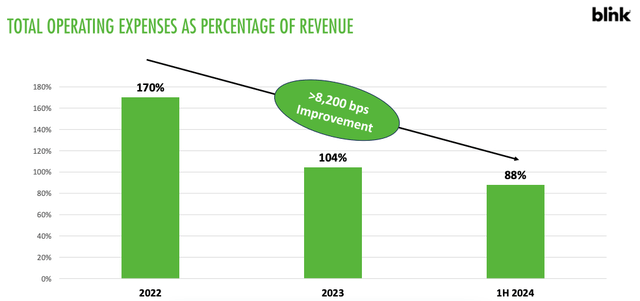

It does point out the reduction in operating expenses as a proportion of revenues (see chart above) since 2022, but this doesn’t give encouragement that it will become profitable anytime soon either. This is because the operating loss margin expanded to 62.1% in Q2 2024, from around 54% in H1 2024. The point being that much like the rest of the earnings report, the performance looks better because of a far healthier Q1 2024.

Charging solutions impacted significantly

With this as the background, it’s hardly surprising that the momentum is firmly against BLNK. The stock is down by a huge 53% since I first wrote on it in November last year. It’s hardly alone on this front, though Blink Charging’s closest competitor ChargePoint Holdings (CHPT) is down by 45% over this time as well.

To be fair, the sentiment towards the EV ecosystem has been negative over the past year. But it’s clear that the charging solutions segment has been particularly impacted, considering that the S&P Kensho Electric Vehicles Index is down by a far smaller 5.7% during this time.

De-emphasizing Market multiples

In an environment of weak performance and negative momentum, the market multiples have to be truly compelling to make a case for BLNK. This isn’t the case, even though they are better placed than CHPT. The stock’s trailing twelve-month [TTM] price-to-sales (P/S) ratio is at 1.13x compared to 1.53x for CHPT, the forward ratio is at 1.45x, compared to CHPT’s 1.52x.

Some premium over CHPT is justified too. The company has seen declining revenues for the past three quarters, after seeing just 8.2% growth in its last financial year ending January 2024. Still, it’s hard to ignore that BLNK’s forward P/S isn’t very different from the 1.47x for the industrials sector as such.

Can the longer term be better for BLNK?

There is hope for a better future, though. And not just in the longer term. Going by EV sales projections, H2 2024 may well throw up improvements for Blink Charging despite its sagging forecast. Consider the following:

- The biggest proportion of 60% of the company’s revenues come from the US market. In Q2 2024, the market has seen an improved growth. While there remains uncertainty about the US consumer economy for the remainder of 2024, if this recent improvement is sustained, there could be more buoyancy in revenues for Blink Charging than is currently factored in.

- The International Energy Agency expects global EV sales to grow by 20% this year. The company gets a substantial 40% of its sales from outside the US, so there’s a possibility that international demand can pull up its overall revenue.

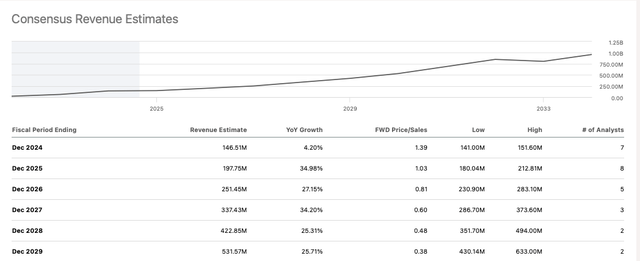

Even if Blink Charging’s revenues don’t quite surprise in H2 2024, there’s hope for the longer term. EV sales in the US alone are expected to grow at a CAGR of 18% between 2024-28, indicating sustained demand in the medium term. Analysts estimates on Seeking Alpha, too, are bullish on Blink Charging’s revenue growth from 2025 onwards, expecting double-digit increases in the years ahead (see graphic below).

However, projections can be subject to change based on evolving conditions. And there’s no real reason to believe that consumer demand will go from weak to booming anytime soon, in my opinion, with uncertainty in key consumer economies. So even if demand does regain speed, it might not necessarily be according to the forecasted timeline.

Investing takeaways

However, for now, it’s hard to overlook the sharp decline in Blink Charging’s revenue growth. Projections for EV sales and its presence in international markets suggests a possibility that H2 2024 might turn out better than anticipated now. But I’m not holding my breath, not after the recent results.

But there’s hope for the future, as evident in the industry and analysts’ revenue projections for Blink Charging. Whether or not demand bounces back in the projected timelines, though, remains to be seen. Especially when there’s still uncertainty on the consumer economy.

Right now, it would be a good idea to wait and watch before making an investment decision. I’m going with a Hold rating on Blink Charging.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you enjoyed this analysis, head over to Green Growth Giants which takes a deeper dive into the generational opportunity presented by the renewable energy transition underway. Community members have access rare stock articles, industry perspectives and investor takeaways. Consider a two-week free trial today!