Summary:

- Blink Charging’s stock price has been softening in recent months, in line with the lacklustre performance of the EV sector.

- Its revenue growth forecasts for 2024 aren’t encouraging either, though guidance can be upgraded after Q1’s performance, its own business developments and past history of upgrades.

- The company’s improved gross margins and shrinking adjusted EBITDA loss also work in its favour.

- However, the market multiples are unconvincing at a time when the EV market is softening in the US, making it a wait-and-watch situation.

Justin Paget

Since I last wrote about the EV charging solutions provider Blink Charging (NASDAQ:BLNK) in November last year, its price is down by ~28%. This compares poorly with even the S&P Kensho Electric Vehicles index, which has barely moved over this time in any case.

However, the trends improve when a narrower time frame, like year-to-date is observed. While BLNK is still down, by 5.9% (see chart below), it’s a slightly lesser decline than that for the index at 6.2%. This raises the question of whether Blink Charging can stand out in the industry now? Or whether investors can still expect it to remain weak?

Price Chart, YTD (Source: Seeking Alpha)

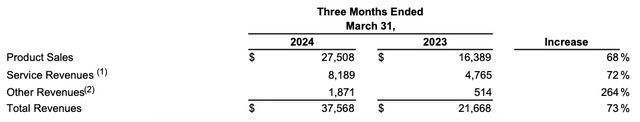

Revenue growth strong, but relatively softer

The first point of focus is the company’s revenue growth, it’s unique selling point, with a compounded annual growth rate (“CAGR”) of 126% over the past five year. While it’s growth remains robust as per the latest first quarter (Q1 2024) results, released earlier this month, at a 73% year-on-year increase, the figure is still a relative softening. Not just compared to the five-year CAGR but also the 130% increase seen in 2023 and even the 89% YoY rise seen in Q4 2023.

While some softening can be expected as the base figure expands, a look at the trends in the EV market are worth considering here too. It’s no coincidence that EV sales in the US slowed down in the past quarter. Sales grew by just 2.6% YoY compared to a 46.4% increase in Q1 2023.

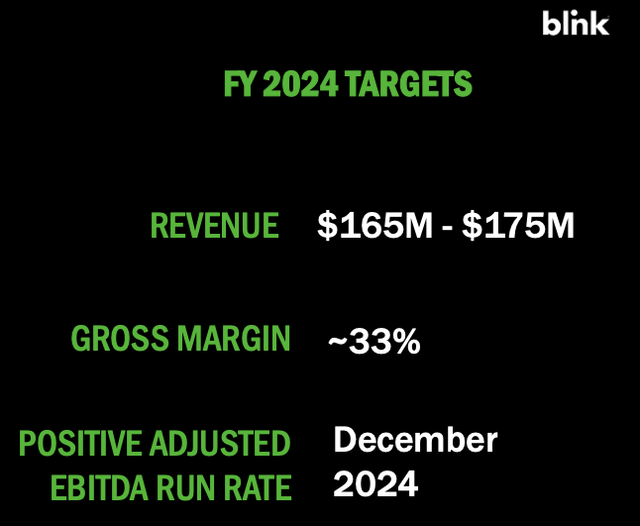

Guidance upgrade possible

Does this mean that Blink Charging is doomed to slowing growth from now on even as its yet to attain profitability? Going by its forecasts for 2024, it would certainly appear so. It expects revenues to range between $165-$175 million this year. At the midpoint, this is just 20% revenue increase. However, there are three reasons to expect that the actual outcome might be better.

#1. Past guidance exceeded

Even with the relative slowing down seen in Q1 2024, the company’s growth is far in excess of the target growth. This indicates that a guidance upgrade is possible further into the year, especially going by last year’s experience. The actual revenues of $140.6 million exceeded the midpoint of the initial guidance range by 34%. Blink Charging subsequently upgraded its 2023 target, but the actuals ended up higher than even the upper end of this revised guidance by ~6%.

#2. Business progress

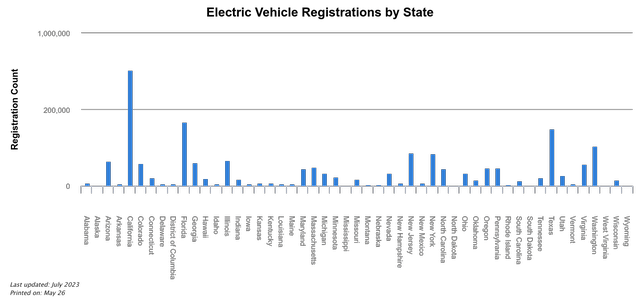

The company’s recent business developments certainly makes room for optimism. The most noteworthy of these is it being chosen as the official EV charging services provider for the State of New York, which had the sixth largest number of EV registrations among all US states as of July 2023 (see chart below). Other developments include its partnerships with the UK’s parcel delivery provider Evri, the City of Frederick, Maryland among others (see section on ‘Recent Quarter Highlights’ for details in its Q1 2024 earnings report).

Source: Alternative Fuels Data Center

#3. The Tesla (TSLA) drag

There’s also hope for improvement in the EV market moving forward. As the company pointed out in the latest earnings call, the drag is on account of a declining market share for Tesla. Of course this means that the demand for the company’s EVs hasn’t been absorbed by other manufacturers. This is a warning especially at a time when the US economy is seeing signs of a slowdown. However, there’s room for hope too considering:

- Nine EV manufacturers saw over 50% sales growth in Q1 2024, even if their absolute numbers are far smaller than those for Tesla.

- The company also points out to continued growth in Europe in its earnings call, especially in countries like Belgium, the Netherlands, and the UK, which can be a positive for it.

This said, it’s still likely that 2024 will be a slower year for Blink Charging. Even if actuals exceed guidance by the same margin a

Gross margin expands, for now

What the company now lacks in revenue growth, however, it makes up for in an expansion of the gross margin. In Q1 2024, it came in at 36%, a nice increase from the 29% for the full-year 2023 and 25% in Q1 2024.

It’s obvious that with slowing sales growth, the margin improvement comes from a smaller increase in of the cost of revenues. Indeed, the figure declined to 59.6% of revenues compared to 68.4% for 2023, and 71.9% even a quarter ago. This is essentially due to a softening in the pace of increase in the cost of its big product sales component to 41.5% compared to 131% for the full year 2023.

But investors need to brace for a softening in margin going forward, considering that the company targets a 33% level for the full year 2024. This would still be an improvement from last year.

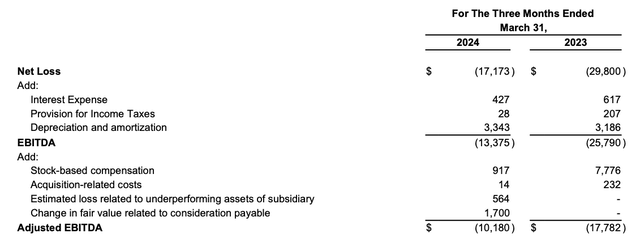

Getting closer to adjusted EBITDA profitability

Even then, the company is inching towards adjusted EBITDA profitability, which it hopes to achieve by the end of this year. It saw a pretty dramatic shrinking in the adjusted EBITDA loss by 43% to $10.2 million in Q1 2024, compared with just a 5.5% fall in 2023.

This follows from an almost 3x increase in the gross profits, but is also due to a decline of ~13% fall in operating expenses. As a result, the EBITDA levels are down by 48% (see table below).

Market multiples make unconvincing case

While BLNK’s trailing twelve months (“TTM”) price-to-sales ratio at 1.52x is improved since I last checked, when it was at 1.71x, the same can’t be said for the forward P/S. The figure is at 1.89x, a higher than the 1.58x ratio the last time.

Further, its ratios are also higher than those for its peer ChargePoint Holdings (CHPT) at 1.32x and 138x respectively. However, CHPT is in a very different place, with revenue contraction seen in the past two quarters and shrinking gross profits in two of the past three quarters, and a loss in the third.

In any case, CHPT’s performance is cautionary from a sectoral perspective. And coupled with the increase in BLNK’s forward P/E indicates a limited case for the stock.

What next?

This is particularly so going by slowing EV sales growth in the US. The company’s own revenue projections indicate its expectations of a cooling off in growth further into the year, even if the guidance is upgraded

Though, going by last year’s example and its business developments, the guidance may well be upgraded.

That it expects to show the first signs of adjusted EBITDA profitability by the end of the year is encouraging indeed, but even then, the gross margin is expected to soften in the coming quarters from the expansion seen in Q1 2024. Its market multiples don’t entirely indicate a price uptick ahead, and the EV industry as such isn’t exactly creating fireworks at the stock markets either.

The key takeaway here is that while BLNK has plenty of potential, there could be market weakness ahead that can drag the stock down. I’m retaining a Hold on it, until such time that there’s either a surprise in its financial performance or in the EV market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—